So, you’re a startup that’s just raised its first serious round of funding and you have your roadmap planned out in front of you. Hire, build, raise more money, repeat.

But then you hit a snag. How do you track ownership changes as new investors come on board? How do you track valuation changes? And what about that investor who gave you a convertible loan note several years ago and wants their cash converted to equity now you’re raising again? That's where your cap table comes in handy — but you need to have a strong grasp on what it all means too. Sifted spoke to founders and investors who have seen dozens of them to bring you the vital info on cap tables.

What is a cap table?

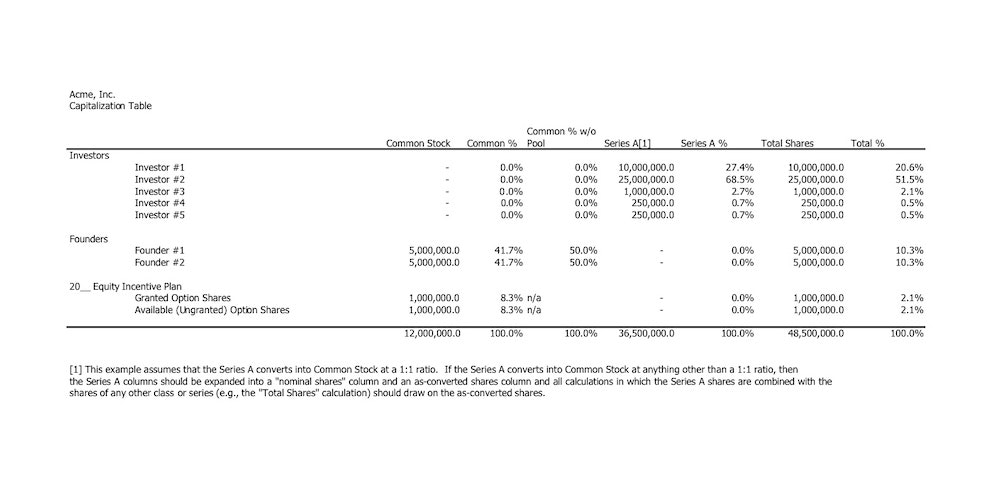

A cap table is a record of company ownership. At the earliest stage, a cap table will just include the founders and the percentage of the company they own.

When it comes to fundraising and you bring investors on board, cap tables become more complicated. They need to include the name of the investors, the number of shares they have and at what price, and what percentage of your company they own (total percentage of shares).

“It's a tool that tells you about the shareholding of the company — who holds what,” Yair Reem, partner at Extantia Capital, explains.

Other details to add to your cap table include:

- Equity dilution, which is the decrease in existing shareholders’ ownership when the company issues new shares;

- A breakdown of the types of shares people own, such as:

- Ordinary/common shares, which are typically issued to original founders, employees and investors and come with company voting rights;

- Preferred shares, which come with no voting rights but put those shareholders first in line for dividends payments or payments in the event of liquidation;

- The post-money valuation of your company after outside funding has been added.

In later stages, your cap table can be updated to include details of any mergers and acquisitions, what would happen in the event of an exit and your company’s valuation over time.

Why do you need a cap table?

- To keep track of who owns what in your company.

- To track how ownership of shares has changed over time and the breakdown of shares between founders, employees and investors.

- To perform scenario calculations — for example, what happens if the company exits at different valuations? How much would each person get? If you need a majority to get something passed at a board meeting, then whose vote do you need?

- A mechanism to show your investors how you’re incentivising your top talent to stay — your C-suite, for example, could have 2% share options that they only receive if they stay for at the company for a minimum amount of time.

- To plan for your next funding round — for example, you can use it to calculate the company’s ownership split when new investors are brought on board.

- To forecast what the ownership of the company would look like when things like convertible loan notes (CLNs) are converted into shares after a raise.

How to make a cap table

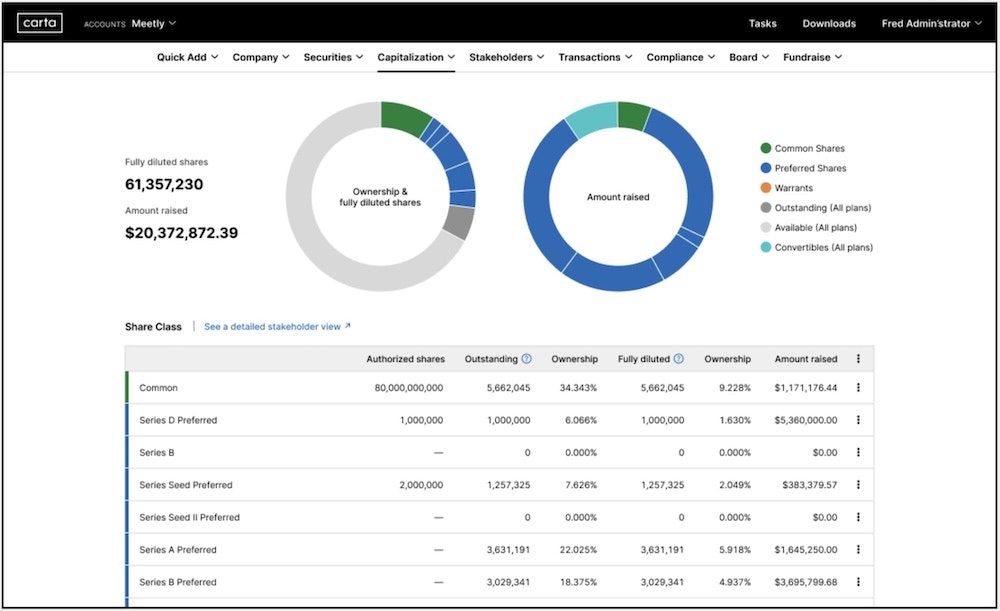

Cap tables, especially in the early stages, can be a simple Excel sheet. As your company becomes more mature, you might want to consider other programmes such as Seedlegals.

You might want to structure your cap table into columns that represent different types of raises — for example, SAFE notes, CLNs, equity and debt.

“The rows will show you the different participants in the cap table, then the columns will show you first, how much money they put in, for how many shares and at what price," says Andreas Mjelde, the CEO of buy now, pay later platform Two. “Then later on, every new event when someone comes in becomes a different column.”

Andreas Aepli, CFO at Climeworks, a Swiss direct-air carbon capture startup, explains that “while we have switched to a software solution in the meantime, we still maintain our original Excel cap table going back to 2009 when the company was founded. Having comments on transactions dating back 10 years has been very helpful in many situations.”

Reem suggests making the cap table into an easy-to-read story of the company that reflects its development. “We use colour-coding to separate the founders, employees and investors so it's easy to read,” he says.

Within that Excel sheet or note, you can provide a more detailed breakdown of who the shareholders are, including information such as “who was first, who was second, when did they arrive, were they there from the beginning, how much money did they invest, how many shares they got, did they first invest in a SAFE and CLA and was this converted later,” says Reem.

To make the cap table more visually interesting, some founders choose to include pie charts showing ownership and and voting rights of each person or entity on the cap table.

Things to consider when deciding who is on your captable

Cancer diagnostics startup Mursla has TA Ventures along with a number of undisclosed investors on its cap table, according to data platform Dealroom. At the early stages founder and CEO Pierre Arsène suggests looking for “smart money — not only will the investor give you money, but they’ll help you along the way with their expertise and their time”.

In his experience, he says a lot of founders tend to rush. “Of course, it's tempting if there's a big cheque and a good brand,” he says, but advises thinking carefully about your cap table first, as the investors you choose will “have an influence on your life and they are here for a long time”.

Sifted has previously covered how to find investors at pre-seed and seed and what to look for.

Climeworks is a spinout from ETH Zurich and has a combination of investment from accelerators like EIT Climate-KIC, as well as from private equity firm Partners Group, VCs like Global Founders Capital and the Swiss bank Zürcher Kantonalbank.

When deciding who to have on your cap table, Aepli says, “you want to think early about why they invest and what is their long-term motivation. Is it a purely financial motivation? Is it another motivation? What's their timeline? Will they pressure you for an exit in a couple of years? Or are they more interested in company growth?”

He says you also need to “think if things don’t go well, what do you think this investor will do — will they try to sell? And how do you protect yourself against them selling to someone you might not want in your cap table?

“It's difficult to predict, but it's good if you start making these decisions early and invest in good tax and legal advice. While expensive in the early stage, this can prevent many headaches later."

Two is backed mainly by VC investors such as Sequoia, LocalGlobe and Day One Ventures, as well as company builder Antler.

“The first thing we thought about, and it's something I’d recommend to others, is to always think about how to get employees involved”, says Mjelde. “You provide this option for two reasons: to create a connection between the person and the business and to provide a financial upside."

“You could over-analyse and try to strategise who you have on your cap table”, but what matters most, Mjelde says, is finding “a small group that you enjoy talking to and meeting and that you’re aligned with in terms of what it takes to be successful in the business you’re building”.