Offering employees a share of the business, or equity, is one leg up many startups have in attracting talent over bigger companies.

Letting employees share in the upside is also important for spurring growth in local tech ecosystems, as Europe has seen with employees from successful companies like Klarna, Deliveroo and TransferWise, who have taken their hard-earned cash and started new ventures.

But with anything good, there’s usually a catch. And in Europe, it's taxes. In many European countries, options are taxed when they are exercised i.e. buying and selling shares. So, which European countries are the best for employee stock option taxation?

Estonian-based startup Salto X, a platform offering end-to-end solutions for company incentive programmes, has taken a look at 15 countries across Europe — from Austria to the UK.

The Baltics, the UK and the Nordics top the list

According to Tanya Chaikovska, cofounder of Salto X, the Baltics, the UK and the Nordics are the most favourable when it comes to taxation for employee stock option plans (ESOPs) and let employees take home more cash than, for example, France, Germany and Spain.

“What we see is that it is connected to how many successful companies that a country has had, and how progressive those countries are in making new laws,” Chaikovska says.

This is also in line with a report Index Ventures published earlier this summer, which lists the policies in Belgium, Germany and Spain as the most burdensome in Europe.

Chaikovska says that German startups in the past have not been keen to offer ESOPs because of the stringent regulations for shareholders, which means the companies want to keep their numbers of owners low. Instead, companies have often offered so-called VSOPs — virtual stock options — which are taxed differently and more than ESOPs.

At the beginning of 2023, Ireland, Spain and the Netherlands all updated their stock option policies. Latvia and Lithuania have also made some amendments recently. France made its laws more startup-friendly three years ago. However, it’s not one of the 15 countries Salto X has looked into yet.

Where is it best to be based for stock option tax reasons in Europe?

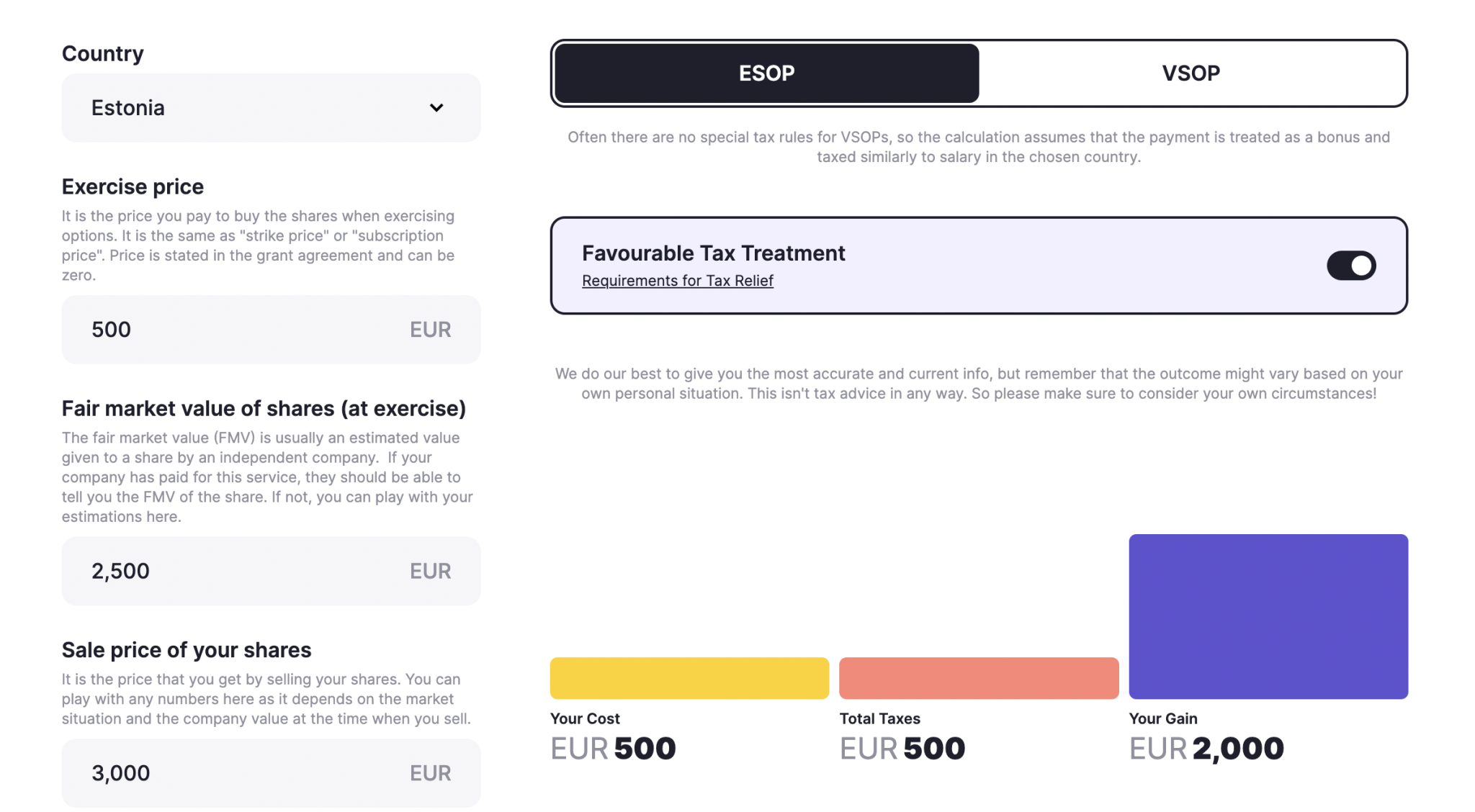

The reality of stock option taxation is more complicated when you take into account factors such as the employee’s country of tax residence, the strike price and the estimated sale price, as well as an employee’s cash salary.

The tax bill can also increase due to social security contributions or how much of a cash salary the individual is earning, among other things.

Let’s take an example.

Imagine an employee at Estonian mobility giant Bolt — which employs across Europe — was offered options with a value of €500 in 2018 when Bolt was valued at €1bn. The employee then exercised the options in 2022, when the valuation of Bolt had risen to €7.4bn. But with every fundraise the existing shareholders get diluted and, taking that into account, let’s say the fair value of those shares was five times the initial offer, €2,500. The employee then sells those shares for €3,000 a couple of years later — if the valuation of the company increases over that time.

If the employee’s tax residence was Estonia, they would be entitled to favourable tax treatment and would only pay tax on the capital gains of €2,500 when they sold the shares (€3,000 minus €500), which equals a tax bill of €500. In Estonia, there are no additional social contribution fees and the tax rate is 20% on the capital gain, so the employee would be €2,000 richer.

In Germany, the tax bill would increase to €1,425, including a social contribution fee of €800 paid at the time of exercise in 2022. Net, the employee would end up €1,075 richer — a bit more than half of what they would gain if a resident in Estonia.

Estonia is however trumped by Lithuania, where the same employee would only have to pay €375 in taxes on capital gains.

“The Baltics are the most tax favourable, not just because of low tax, but also because it’s simple and with very few rules. While in the UK can end up with the best results tax-wise, it also has many more rules you have to follow to achieve this, so it gets quite complicated,” Chaikovska says.

UK employees, with the EMI tax incentive introduced in 2000 instead of the more internationally common ESOP, have the lowest taxes on share options. For the Bolt employee who is a resident in the UK, the only cost (apart from exercising the shares) would be a 10% capital gains tax charged when the shares were sold. That would equate to a €250 tax bill, and €2,250 for the employee.