The rest of your friendship group are pursuing stable careers at large corporations with cushy salaries and benefits packages. You, meanwhile, are considering joining a startup without a proven product or clear route to profitability. It could go bust in a year or two if things don’t go well, and resources are too tight to pay as well as bigger companies.

This is where equity comes in — a way to incentivise employees of young businesses, by giving workers a direct stake in the success of the company. In this article we’ll explain what getting equity in an early-stage startup means, how much you should expect and some of the possible pitfalls that employees should be looking out for.

What is equity in a business?

Having equity in a business essentially means that you own a small portion of that company. It’s typically given out in the form of stock options (we’ll unpack that term later) and, while it might not be worth much when you’re given it, if the company does well you could be in for a chunky payout.

Employees at scaleups like Klarna and Revolut have seen the value of their equity climb into the millions of euros as their employers’ valuations have soared. These employees are known as “paper millionaires” because while their stock options might be worth €1m or more, they’re not yet able to cash them out easily — because the businesses are still privately owned.

Employees are typically able to cash out their equity in two ways:

- When a business is bought by another business (an acquisition);

- Through a public listing (where a company lists and sells shares on a public stock exchange).

These are known as “exits” or “liquidity events” and they represent the moment that startup employees are rewarded for their hard work, and for taking on the risk of joining a young business. Even if you just own a fraction of a percentage of the business in equity, it can mean a seven-figure payout if you joined the right company in its earliest stages.

👉 Read: Pre-seed funding: What founders need to know to raise from VCs

How does startup equity work?

When a founder or cofounders of a startup start planning how to divide the ownership of their company, there are three main buckets they need to consider: the founders, the employees and the investors.

“The cofounders might have 30% of the company each and then they've got some investors who’ll often be mates of theirs who are punters,” says David Reuben, director of London-based law firm Postlethwaite Partners. “And then you have what’s called ‘the employee pool’ and that will be a number of shares that are basically reserved for employees.”

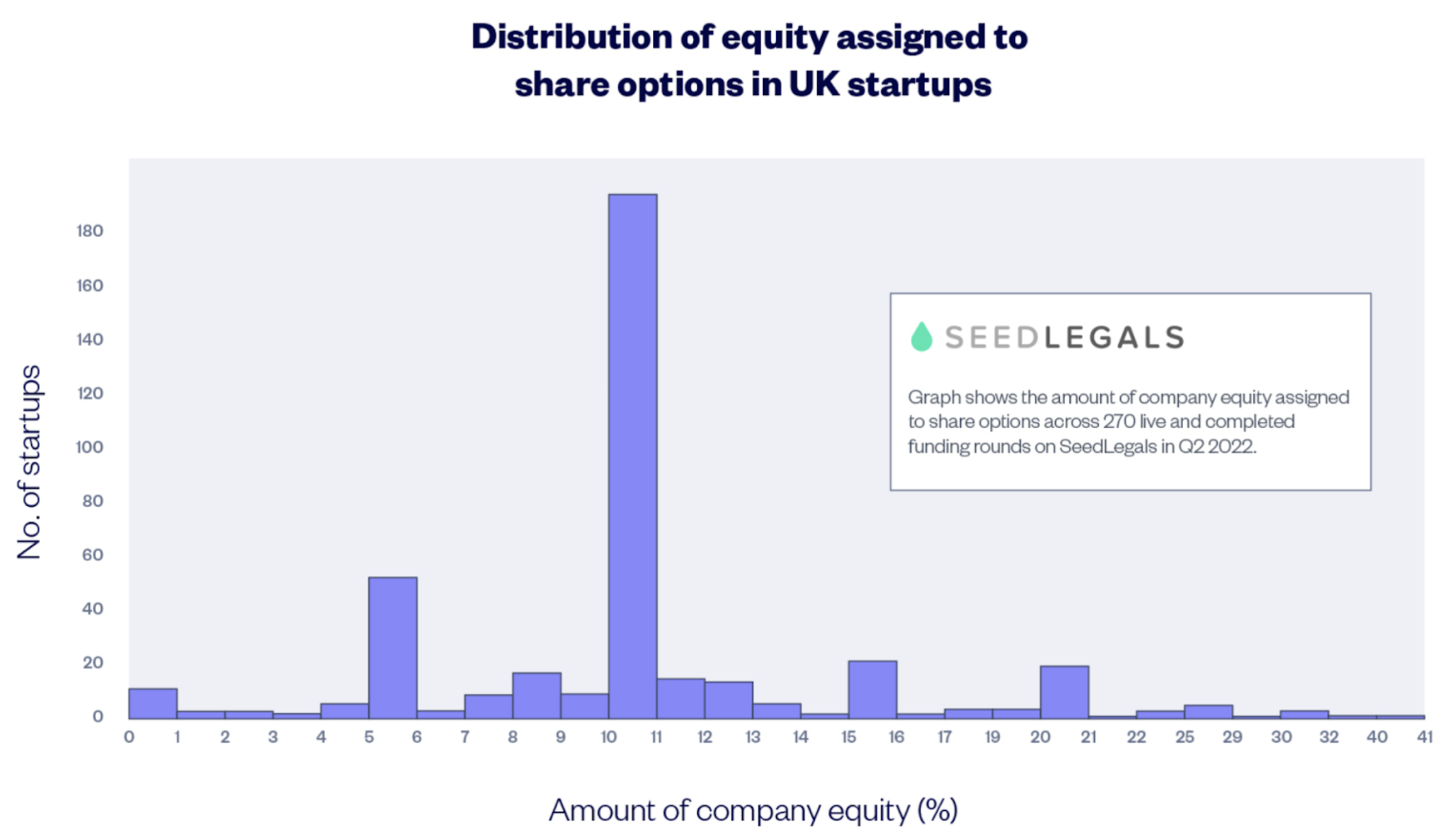

Reuben says that it’s typical for employee stock option pools to account for 10 to 15% of the company’s overall available equity — though in some cases it can be as high as 20%.

Data from SeedLegals, a UK platform for seed and pre-seed stage founders and investors, shows that the vast majority of startups in the UK reserve between 10 and 11% of equity for their employee pool.

What percentage equity should you expect?

The amount of equity you’ll be given as an employee of an early-stage startup will depend on how senior you are when you join.

Hugo Fdez. Mardomingo, co-managing partner at Bilbao-based VC firm All Iron Ventures, lays out what he sees as a standard offer for startup employees.

“Let's say 1% for non-founder C-suite roles, 0.5 % for senior VP roles and from then on it comes down to the profile of the candidate and their experience,” he says.

Luckily for employees today, a good amount of benchmarking data is available to show how much equity you should expect from an early-stage startup. One of those comes from London-based VC firm Index Ventures, which has published an equity calculator that shows what founders should be offering.

Erin Nixon, VP of strategy at workplace mental health company Oliva, says that this was the go-to tool she used for working out her company’s option allocation package when she joined the company.

“There's a lot of good benchmarks out there so I don't think that it's something that founders or employees need to figure out on their own,” she says. “When I came in and was like, ‘Alright, let's sort this out’, [the Index Ventures calculator] is what I used to gut check what we already had, and there's a few others that you can also use to click around and triangulate.”

Index’s calculator lays out the different equity expectations that employees of seed-stage companies should have, as a percentage of salary, seniority and type of job role (technical hires typically receive more equity).

To help widen the database, SeedLegals has collated data from Index and Balderton, another London-based VC, to show the typical percentages of equity that employees can expect from early-stage startups (those with up to 50 employees).

Typical equity percentages that employees can expect

- C-suite — 0.8%-2.5%

- VP — 0.3%-2%

- Directors — 0.5%-1%

- Managers — 0.2%-0.7%

- Other employees — 0.0%-0.2%

Reuben adds that early-stage startup employees should be prepared for their stock options’ equity to be diluted as the company goes on to raise more money at subsequent VC rounds. This essentially means that you own a smaller percentage of the company because more equity has been made available to new investors — but the value of that stake increases alongside the valuation of the startup.

“Let's say the employee owns 1% of the company, then there’s an investment which will bring money into the company. But it also means that instead of having, let’s say, a million shares in issue, there’d be 1.5 million,” he explains. “The holder of 1% now has 0.6%, but it's of a bigger pie. And as long as that investment has come in at a higher valuation, then the value of the employee’s equity will increase.”

The questions to ask before you accept a job offer

Job offers won’t always contain all of the information about the equity deal you’d be getting upon joining. Sometimes they’ll just share the value of the stock options being offered, without saying what percentage of the company’s value that represents.

Yoko Spirig is founder and CEO of Ledgy, an equity management platform for startups, and says that employees should ask for transparency from potential employers.

“As an employee, I would really encourage you to ask 'what share of the company that would be?' 'What is their value today, based on the valuation that came from the latest fundraising round?'” she says.

It’s unlikely that a startup will be making many hires before an angel or pre-seed round, but employees coming in pre-valuation should still ask what percentage of the company their equity offer represents, and check that it’s in line with industry benchmarks.

And, while more senior employees will naturally get more equity than their more junior counterparts, Mardomingo says that less experienced employees should push for performance and promotion-related equity top-ups.

“For less experienced candidates, it’s going to be hard to get a lot of equity up front. The key thing is to ask how that will be re-evaluated in the mid-to-long term,” he says.

Another key question for employees to ask, according to Reuben, is whether the stock options are tax optimised. This article from Stock Based Comp has a useful breakdown of tax conditions for stock options in different European countries.

The key startup equity terms you need to know

When it comes to fully understanding your employment contract and what stock-based compensation actually looks like in practice, there are a whole raft of terms and conditions that you need to know.

- The difference between shares and stock options. Owning shares in a company means that you actually own a percentage of the value of that business. Stock options are different to shares in that they don’t actually mean a company is giving out a share of the company now. Stock options give the employee the option to buy that equity at a fixed price (known at the “strike price”) later down the line. If all goes well with the startup, your stock options will have greatly increased in value from the strike price by the time you’re able to turn them into real shares.

- The process of turning stock options into shares is called “exercising your options”. To exercise their options, the employee will have to buy them from the company at the strike price.

- The next term to know is “vesting”, which refers to the process of an employee earning their equity offer gradually, as they spend more time at the company. A startup isn’t going to give you your 1% equity on the day you join — you’ll receive a fraction of it each month, typically over a four-year period, which is known as a “vesting schedule”/

- The next term to know is the “cliff” — this refers to the minimum time period that an employee must be working at the company to get any equity at all. The standard cliff for European startups is one year.

Startup equity: What could go wrong?

There’s one stock option term employees should be aware of, Spirig says, which can leave them with few options for turning their equity into cash.

“I was [recently] chatting with an employee of a well-known European scaleup. The person received stock options but now he's thinking about leaving,” she says. “But the company only offers three months for the employee to actually exercise his stock options. And now the employee is in a situation where he actually needs to pay about €100k to buy them.”

This time period is called the “exercise window”, which refers to the amount of time you have to exercise your options after leaving the company. In the example that Spirig gives, the employee is being forced to pay for their equity very quickly, and perhaps years before they might become worth anything at a liquidity event.

Spirig says that startups should really give an exercise window of at least five years, to allow employees the best chance of being able to get value out of their stock options.

Another potential pitfall that employees of early-stage startups need to look out for is something called “buyback rights”, which allow companies to buy equity back from employees without their say so.

“Sometimes there are cases where companies have a right to buy back shares, which is not great at all,” says Spirig. “I would really pay attention to these buyback rights as an employee and I would want to understand: what is the thinking behind those kinds of clauses?”

Why understanding employee equity matters

As Europe’s startup sector matures, stock option standards and benchmarks are now being established. But Oliva’s Nixon — who started her career in Silicon Valley — says that European tech workers tend to be less aware of the importance of their equity package than US workers.

“My understanding is that a lot of people, particularly if they're more junior, don't even ask questions about it in Europe,” she says. “I would strongly advise people to get their benchmarks because, like I said, this is the best way to really be a part of the huge value creation for these fast-moving startups.”

Spirig agrees that employee equity literacy in Europe is fairly low, but says the task is made harder by the fact that norms are less well established than in the States.

“These kinds of policies are not yet as standardised in the European ecosystem than, for example, the US, where these kinds of things are just much more standard,” she says.

For Nixon, the importance of giving a good stock option package to employees is hard to overstate: “For us it’s about saying, ‘You matter a lot to us, you're building a tonne of value with this company, we want you to have every option to have a life-changing financial event with us'.”

What happens to startup equity if you're laid off?

When it became clear in 2022 that we were heading into a downturn, many investors advised the CEOs in their portfolios to rescue their runway by making cuts, fast. That's led to several waves of layoffs across European tech in 2022.

From knowing how much of your equity has vested to whether you should exercise your options, here's what you need to know about equity if you're laid off.