Pre-seed funding is the first formal funding round for a startup, the earliest stage of funding that many VCs operate in. It’s the first round of real cash injection for most startups, and though overall funding levels have dropped in the downturn, pre-seed funding remains largely unscathed.

In our latest Sifted Talks, experts shared their insights and experiences on whether pre-seed funding has been hit by the slowdown at all — and what startup founders should think about before raising a pre-seed round in a tough market. Our panel included:

- Maria Rotilu, principal at VC firm Octopus Ventures

- Jannat Shah Rajan, VC and operator

- Kira Unger, cofounder of Pocketlaw, a platform that helps companies with their legal needs

- Tayga Baltacioglu, cofounder of Debite, a payments platform for startups

Here’s what we learnt:

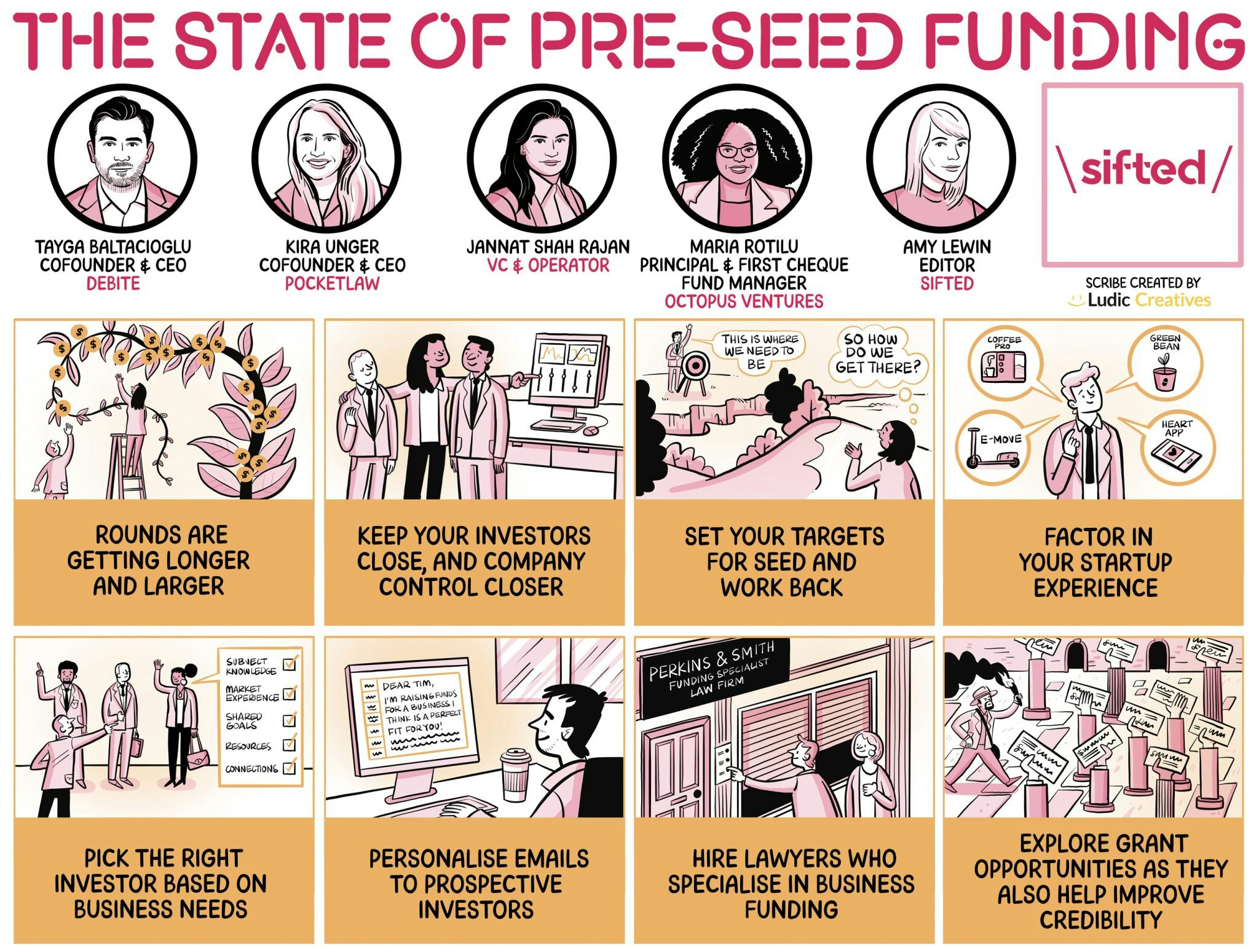

1/ Rounds are getting longer and larger

Many founders start looking for pre-seed investors before they even launch their businesses, and/or raise a pre-seed round within six months of incorporating the company. Rotilu said that even though founders were still raising competitive pre-seed rounds, there’s a shift to larger rounds with investors focusing on cash runway.

She added that the overall market shift to focusing on quality is also true of pre-seed rounds — and VCs are doing more due diligence too. She recommended keeping round sizes at a minimum of $500k, as anything below that would make it difficult to attract institutional investors.

Baltacioglu said that founders should raise as much as possible at the pre-seed round as knowing the right size for other rounds is difficult in current market conditions. Rajan added that it's key not to have a messy cap table for future rounds by giving away too much equity to your earliest investors.

Rajan also said you should budget around three months to close a pre-seed round — far from the highs of the 10 to 15-day deal closing of 2021.

“If you’re using a very small round and you’re trying to get an institutional VC investor on board, there might be some concern that you just wouldn't have the runway to hit the milestones that you need for the next round” — Maria Rotilu, principal at Octopus Ventures

2/ Keep your investors close, and company control closer

Unger said that along with not giving away too much equity at the pre-seed stage, it’s also key to carefully consider other terms in the agreement such as who controls the board. Needing a majority of the board’s votes to approve raises can be especially tricky.

Baltacioglu said that startups should give away no more than 20% of their equity at pre-seed, to which Rajan added that the best pre-seed rounds might only dilute 5-10%. The experts all agreed that the term sheet should be studied carefully during negotiations.

“I suggest people do introductory meetings with different investors all around the world because investor approaches in the UK versus EU or US or Middle East, or APAC are completely different” — Tayga Baltacioglu, cofounder of Debite

3/ Set your targets for seed and work back

Rotilu said that founders should speak to investor friends to get a sense of the pulse of the market — and be “exploratory about your valuation” at the pre-seed stage. But you also need to set the tone for what you’re going to do between pre-seed and seed using the funds raised, and that plan is what investors are buying into, said Rajan.

Founders should plan if by seed they would have monetised their product and to what extent, and set realistic expectations, she said.

Rotilu added that in their pitch deck, founders should give a sense of what metrics they’re trying to hit, a thesis that they’ll prove in the market (and evidence) and data to show that you’re building something with market opportunity, or how many customers you will have by the seed stage.

“Normally it's at Series A that you'll have a financial model you use for prospect investors, but now increasingly you see at the earlier stages and it’s a factor of the current market” — Jannat Shah Rajan, VC

4/ Factor in your startup experience

Baltacioglu said that if you were a serial founder, you could raise pre-seed with just a core team, a product idea and success metric — but you'd also need to be able to show them something tangible like an MVP or a small product that works, he added.

But as a first-time founder, you may face more scrutiny, said Unger. She added that transparency is key here, and founders should be genuine and have a way of talking about their background and why they’re the best person, along with their cofounders, to solve the problem they’re trying to address.

“Make sure that you come across as someone who is really honest, transparent, resilient and determined to this vision and this mission that you're on” — Kira Unger, cofounder of Pocketlaw

5/ Pick the right investor based on business needs

If you’re looking for expertise in a specific area such as product, go for an investor who has experience in product, said Baltacioglu.

Unger agreed, adding that it’s important to think about who you’re bringing on board as they're likely to be there for a long time. She said that it’s key to think about the knowledge as well as financial benefits that they bring to the table.

Rotilu said that connecting with other founders and investors can help you understand whether a fund is a generalist or specialist fund and what sectors they invest in. Investors who’re relevant to your specific area will also add credibility and work as a strong signal in subsequent fundraising rounds, she added.

She further said that using your existing investor network to connect with other investors is key — so treat every connection as a pitch to your next investor connection.