Barely halfway through 2021, Europe has already broken the record for annual investment into fintechs.

So far this year, European fintechs have raised €10.4bn, trumping the €9.3bn raised across the whole of 2019 — the previous highest year on record according to Dealroom data.

It’s also a marked recovery from 2020 when, in the midst of Covid-19, European fintechs raised a total of €8.4bn. The fintech sector looked vulnerable at the start of last year, hitting a three year low as governments shut down and investors took stock.

Now, the sector appears to have bounced back, buoyed by a shift to digital as well as banks’ growing interest in fresh infrastructure. With six months of the year still to go, it's looking like a bonanza 2021 for fintech.

2021’s figures have been dominated by megarounds by Klarna (a trifling $639m), Trade Republic and SaltPay.

In addition, European fintechs have attracted an influx of cash from both US and Chinese investors, drawn in by the mounting success of first-generation fintechs.

That’s also had a knock-on effect on valuations, meaning there are now more than 30 fintech unicorns in Europe, and several more soon slated to reach the $1bn milestone.

Fintech also looks set to maintain its position as the most funded area in European tech.

Crypto and DeFi

One subsector of fintech that has had a particularly strong year so far is cryptocurrency and decentralised finance (DeFi).

Funding into crypto startups in Europe has already hit €1.2bn this year, a 300% jump from 2019.

This has been allocated through a sprinkling of smaller raises (including Poland’s Ramp and London's Copper) as well as large rounds from Ledger, Bitpanda and Blockchain.com.

Bitcoin has continued its rollercoaster price ride this year, and attracted intrigue from institutions — big and small — which may have played a part.

The boost in funding could mark a changing tide in Europe. Last year, Sifted wrote about investors' hesitation when it came to blockchain-based finance. One such investor was Edith Yeung, a general partner at San Francisco’s Race Capital.

“I’m a little bit jaded… A lot of the founders are very religious and I’m like ‘no, if you want consumers to use it, you have to be flexible,’” she told Sifted, noting that Race Capital “care about crypto a lot” but have been reticent to invest.

Moreover, Yeung highlighted that DeFi startups have been slow to take off and often can’t answer key queries about revenue and returns.

Yet investors now slowly seem to be showing an interest in understanding the sector, and backing Europe's blockchain startup ecosystem.

Another crypto-focused firm set to raise this year is Elliptic, a leading blockchain analytics firm.

Insurtech’s moment

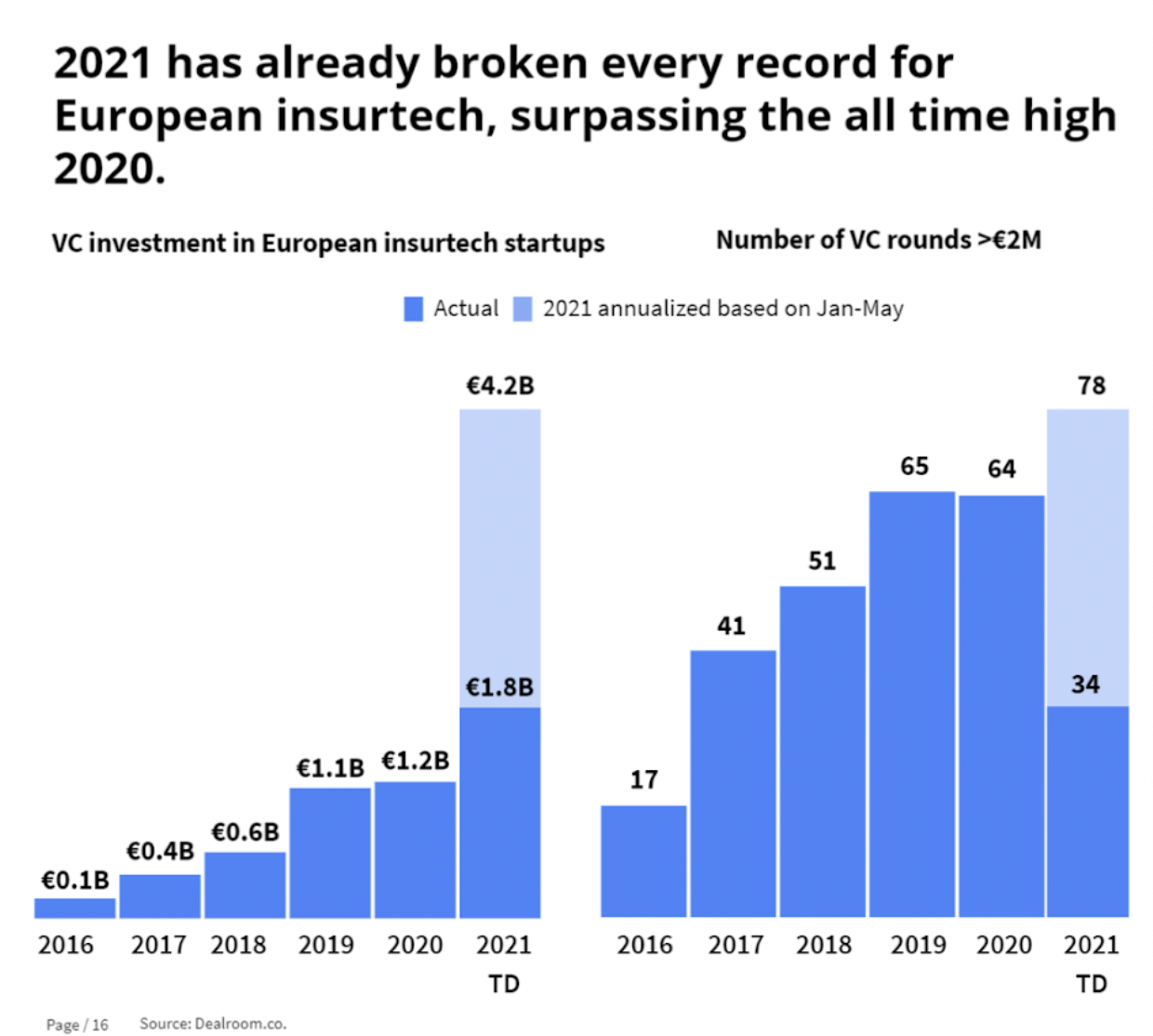

Despite not receiving much mainstream attention, insurtech has been another decent contributor to surging fundraising volumes in Europe.

Dealroom data shows that insurtech investment on the continent has already reached €1.8bn this year, a 13x increase compared to 2016. That includes two megaraises in the space from Wefox and Bought By Many.

Crucially, the European insurtech sector now has a combined valuation of €23bn, more than five times its collective value in 2016. And more broadly, European insurtech has been on a tear since 2020, when funding reached an all-time high.

The ongoing funding boom suggests the insurance space is maturing. Startups in this area are looking to slowly outpace this ageing industry using digital infrastructure, although it could take decades.

By 2024, the insurtech market is predicted to be worth over $1.6tn.

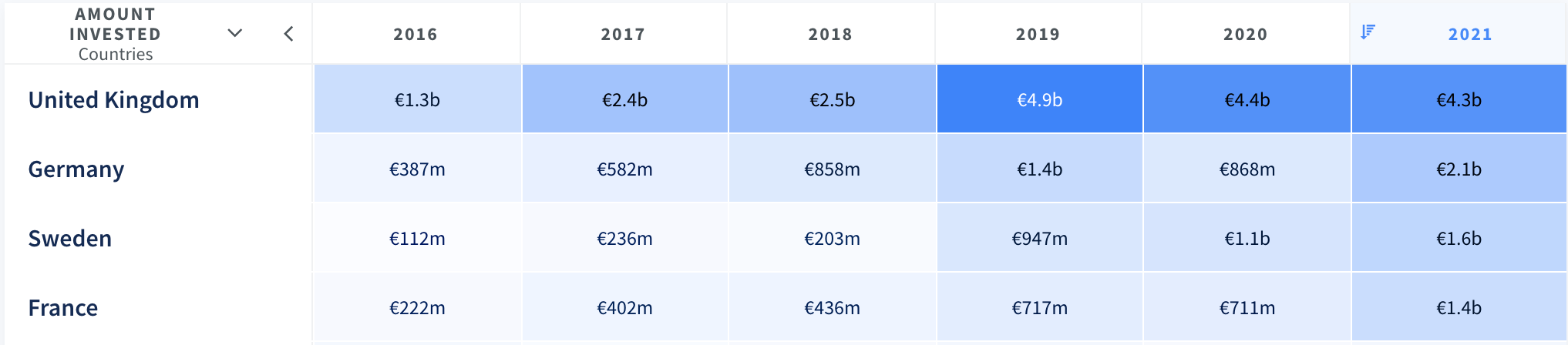

The UK has competition

The UK has long dominated fintech funding in Europe and indeed globally. The UK is second only to the US in terms of investment in the space, with UK fintechs getting another small boost from the UK Government's Future Fund scheme last year.

Nonetheless, the UK's lead in Europe has narrowed in 2021. Germany, Sweden, and France have all seen a record year so far, and are now gaining on the UK, according to Dealroom data (as shown below).

All three countries have seen much larger increases in funding than the UK so far in 2021.

Moreover, whereas the UK made up 53% of Europe's fintech funding in 2019, so far this year, it's made up 41%.

The European continent is certainly becoming a more attractive fintech hub — big players like Sequoia have invested in France for the first time this year, for instance.