The UK has set a new record for investment into financial technology startups, drawing in over $4.9bn last year and putting it at the top of the European leaderboard in spite of uncertainty over the UK leaving the European Union on Friday.

Overall, European fintechs raised $8.5bn, meaning the UK contributed to over half of all the continent's investment in the space, according to new research by Innovate Finance. Indeed, seven of the 10 biggest European fintech raises last year were by British companies.

That puts the UK in second place for investment globally behind the US (which raised $16.3bn in 2019) and ahead of India and China, which saw a 93% decrease in funding since 2018.

The UK meanwhile saw a 38% boost in fintech investments since last year. Its closest European peer was Germany, which raked in $1.3bn, followed by Sweden with $778m.

The global scene

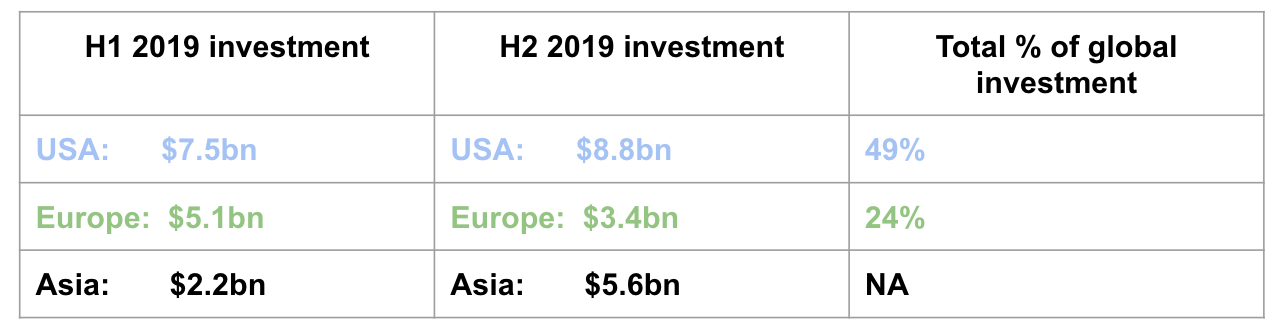

Nonetheless, fintech investment in Europe slowed in the second half of 2019. European fintechs brought in $3.4bn in last six months of the year versus the $5.1bn in the first six months.

As a continent, Europe also still lags behind North America. The US and Canada made up 49% of the total $35.7bn invested globally in fintech last year, while Europe made up 24% of that figure.

2020 is also set to be another big year of funding for Europe, with UK digital banks Monzo and Revolut both rumoured to be raising large rounds to the tune of £100m.

Moreover, while fintech has been Europe's standout sector by way of venture capital funding, overall funding for startups on the continent was at its highest ever in 2019 too.