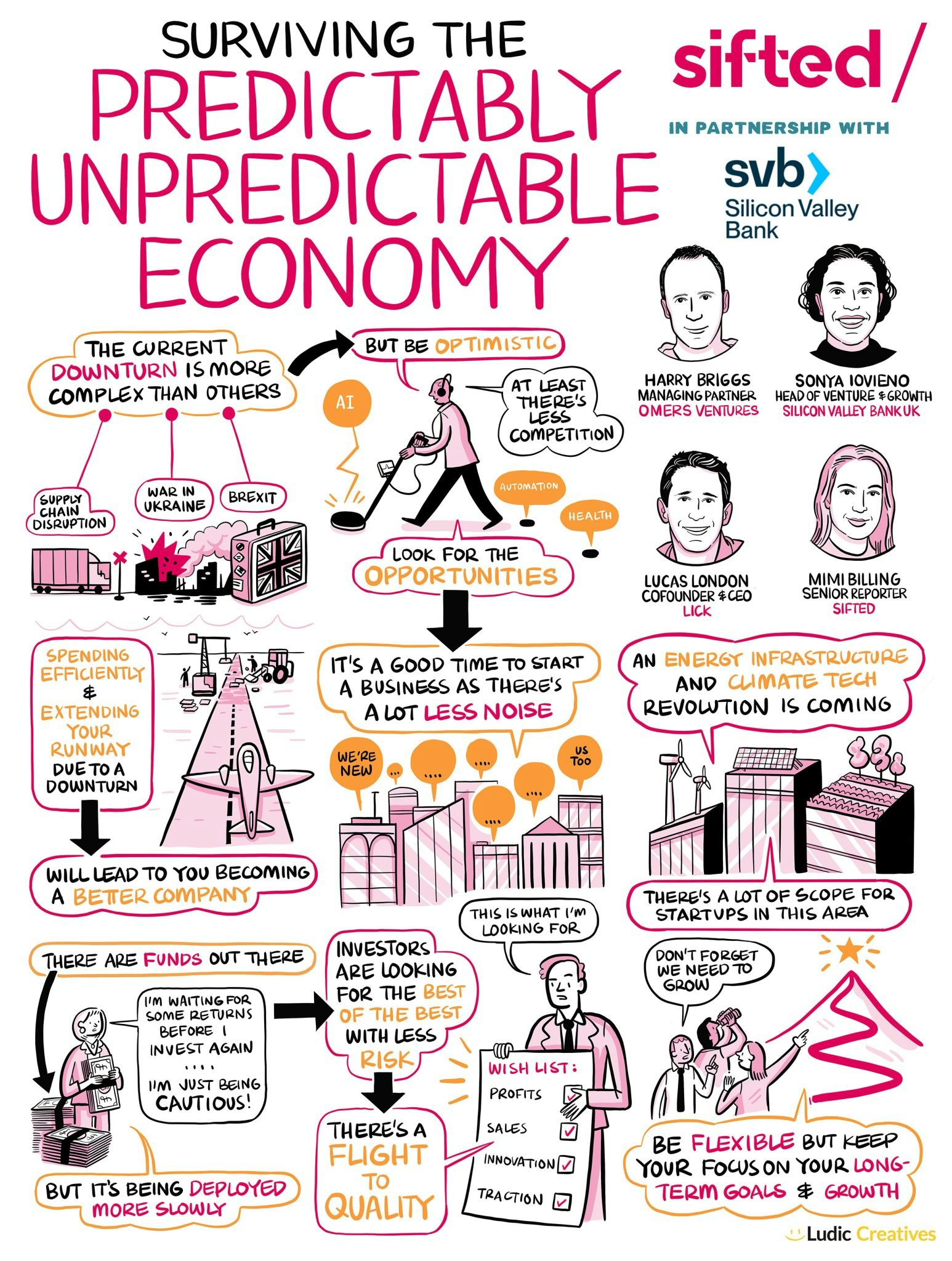

Following the escalation of the climate crisis after the hottest summer on record, and the rapid rise of fuel costs following Russia’s invasion of Ukraine, many startups have seen their valuations drop.

These global events were less predictable, while other things such as supply chain issues from Covid and Brexit have been known influencers on the economy for some time.

But what does an unpredictable economy mean for venture capitalists and startups going forward? We asked our panel of experts for their top tips on managing the current downturn.

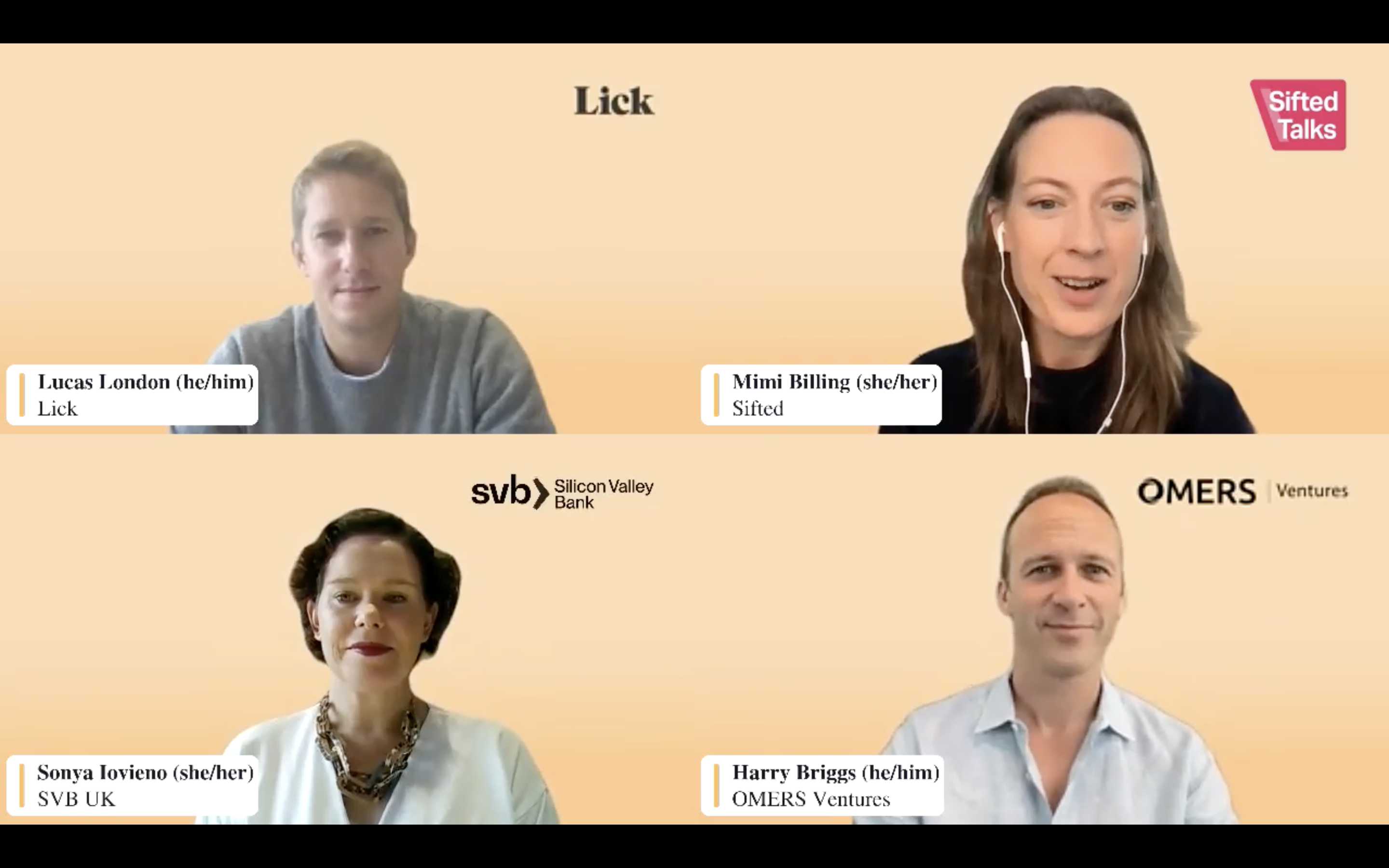

Our speakers were:

- Sonya Iovieno, head of venture & growth banking at Silicon Valley Bank UK

- Lucas London, CEO and cofounder of interior design startup Lick

- Harry Briggs, managing partner at OMERS Ventures

1/ The coming downturn will persist, but there are still opportunities

All three of our panellists agreed the looming recession might be felt across Europe for some time.

Iovieno listed as many as “12 to 15 factors” that are having a cooling effect on the continent’s economy. She believes it could take as long as two years for the markets to rebound, which Briggs suggested would produce a “very tough funding environment” for startups.

However, both of the VCs insisted there are plenty of opportunities for startups. Briggs said: “In every downturn there are opportunities to be found.”

My view is that it is going to take at least two years, certainly over 12 months to come out of the current environment into an upturn… [but] that doesn’t mean everything is looking negative in this environment” — Sonya Iovieno, Silicon Valley Bank UK

2/ VCs will have to return to key principles

Briggs said that while the amount of capital VCs will be willing to invest would likely slow, there would still be activity in the market.

This means rather than VCs exposing themselves to a wide portfolio of startups (as they have over the past few years), they will more likely look for businesses that can clearly demonstrate a sustainable and profitable model.

The core tenets of venture were being forgotten. There will be a flight to quality and some companies will continue to be able to raise funding at good valuations, but a lot will find it harder” — Harry Briggs, OMERS Ventures

3/ VCs will look for early-stage investments

Despite their warnings about VCs tightening the purse strings both Briggs and Iovieno said they believed early-stage startups would be able to raise funds relatively smoothly.

For instance, Iovieno reported there’s still a lot of takeup on accelerator programmes.

Briggs also expects smaller funds to prioritise startups from pre-seed to Series A over the coming 24 months. Our panel attributed this to early-stage businesses not being burdened with inflated valuations, and a willingness to still work with passionate and capable founding teams.

Because they’re such early businesses, they don't suffer from the valuation overhang that later stage businesses have… There's still that faith and that enthusiasm for really good quality founders with ideas where there's good market fit" — Iovieno

4/ Startups will have to show a road to profitability…

For post-Series A startups, investors will likely want to see that clear path to profitability in the next few years to consider investment.

London said his startup Lick has seen rapid short-term growth over the past few years, but that it will now focus on other performance indicators as they presented a picture of profitability to investors that could then stimulate growth further down the line.

Our strategy has shifted to a number of things: making sure we're focused on delivering ROI, remaining invested in what will drive medium and long term growth” — Lucas London, Lick

5/ …but be transparent on runway

Iovieno said managing runway should be a high priority for all startups and businesses should be as transparent as possible with investors.

Lick is tightening its belt in a few ways including: optimising marketing in its key channels rather than looking to expand reach aggressively, freezing new hires for the next six months and reducing expenditure across the operation wherever possible.

London said Lick must strike the balance between frugality and spending to stimulate growth.

[We’re] looking at every aspect of the business in order to optimise and extend your runway and reduce burn, while also continuing to invest in growth. I think if we were too drastic with our measures, we'd get ourselves into trouble when we go to raise money in the future” — London

6/ Founders — don’t let a valuation define your worth

Of course, some companies have seen their bullish valuations fall. But Briggs warned founders not to become too attached to a number that he describes as “an equation of how much your investors are willing to put in against the business’s potential”.

He said some founders can become too enamoured with that figure and can attach their identity to it. This can stop them from wanting to announce a downround, although all three of our panel agreed that sometimes you just have to swallow that pill.

Some founders would probably prefer to maintain a valuation. Partly out of ego, possibly, but partly because they don't want to upset their employees… A downround is painful, because you're going to get diluted. At least you know where you stand” — Briggs

Like this and want more? Watch the full Sifted Talks here: