Seed fundraising feels like a rollercoaster when you’re in it. It feels like it’s going on forever, it’s tempting to let it gobble up all of your time and attention, and you’re never sure whether it’ll be who you know or what you know that will make you stand out in front of investors.

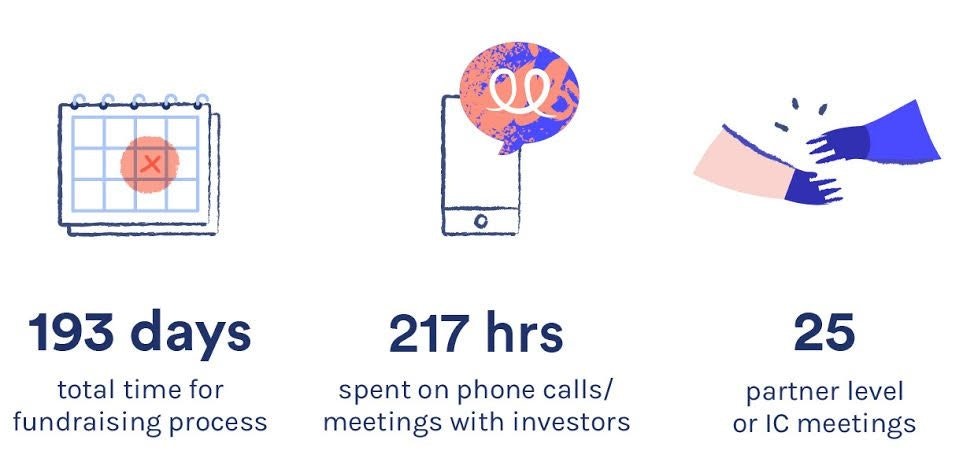

Fresh out (I raised a seed round earlier this year), I wondered whether our data could give a good picture of what fundraising ‘wisdom’ to pay attention to — and what to ignore. So, 193 days, 217 hours of calls and 886 emails later, here goes...

Reality: Fundraising takes a really, really long time! Accept it, prepare well, and have contingency plans

It’s true what they say — you do need 6-9 months to do a fundraise.

As the old adage goes, time = money. You need to make sure you have enough funds to tide you over for the long haul.

This was our timeframe:

My cofounder and I logged over 90 introductory Zoom calls with potential investors… and both had recurring dreams about ‘telling our story’ — the first question any VC asks, and perhaps the only consistent question we had.

Myth 1: You must perfect and tailor your pitch to each individual investor

Tailor your pitch to each investor, some say. You only get one shot at each investor, so you want to get it right.

But ‘Be Prepared’ doesn't mean ‘Be Perfect’. I’d advocate treating the process like you’re building a business a la the “Lean Startup” (Test, Iterate, Repeat).

We used broadly the same deck for every investor — personalising each deck was not worth it. Your deck only exists to pique investor interest for a meeting.

We never ‘presented’ the deck on any of our investor calls. But we used the questions asked — which although always differently worded, focused on core themes e.g. product, competition, revenue model and go-to-market — to refine our deck and improve our answers as we went along.

As to tailoring your pitch — yes, it is good to emphasise your fit with the investor’s focus. But don’t pitch a different business to each investor. Why? Investors talk, so may get confused and put off if they can’t compare apples for apples.

You want your investors to believe in your vision for the company, not the vision you think they want you to have. Otherwise, get ready for a rocky ride in your post-closing board meetings...

Myth 2: Only approach/speak to the investors who seem like a 'good fit' on paper

The general consensus is that you should do your homework and only talk to investors that’ll be the right fit for your business.

On the very good advice of one of our angel investors, Jens Lapinski, we did a fair amount of research and approached the most appropriate potential investors (in reverse order, so we had time to iterate).

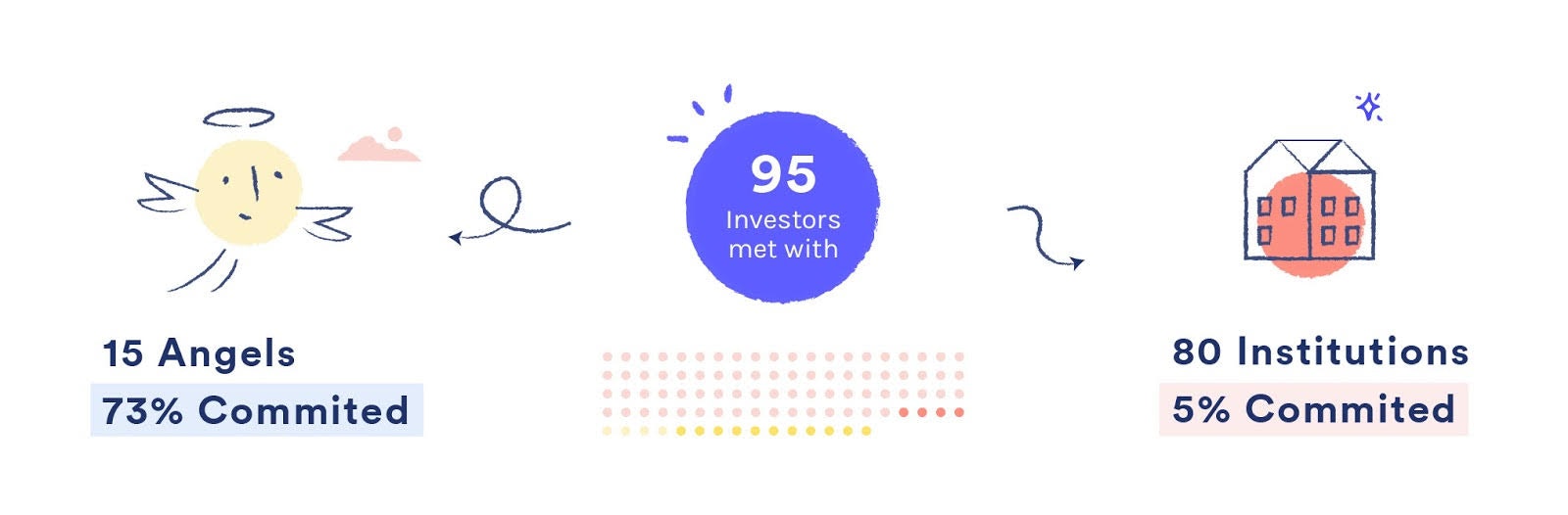

But, we still ended up speaking to over 90 investors. Why?

At seed, you can’t say no to an introductory conversation. The seed investor community is small, and they talk. You don’t want to be that company that’s too arrogant to take an intro call.

Most funds see around 1,500 decks yet only make 10-15 investments a year.

And conversion rates at the seed stage are pretty low. Most funds see around 1,500 decks yet only make 10-15 investments a year (a 1% hit rate). That’s a lot of frogs you need to kiss before you find your prince.

Our experience was that whilst a fund may look like a perfect fit on paper, this doesn’t always play out IRL. Seed-stage investing is more to do with conviction than a specific investment area or thesis.

So you can’t rule out any inbound or unsolicited intro — speak to them all.

Myth 3: Warm intros are the only way to secure VC investment

As the old adage goes, “it’s who you know, not what you know” and the investing community tend to agree.

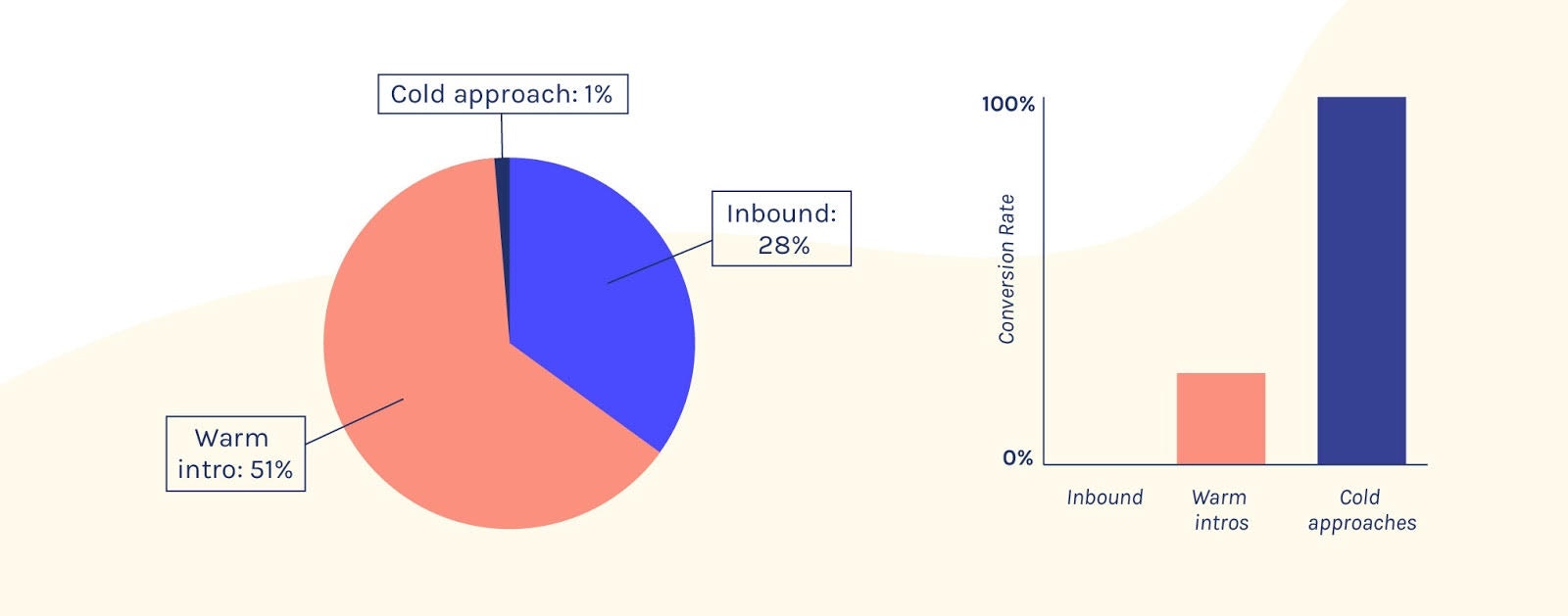

We were lucky to have some great existing investors who facilitated warm introductions. The key here of course, though, is the conversion rate.

Our biggest takeaways were:

(1) Inbound investor enquiries don’t have the highest conversion rate, but may be key for future-proofing. A number of inbound leads are later-stage investors who want to start the conversation now ahead of your next round. Don’t ignore these — they should form the basis of good relationships for your future rounds.

(2) Don’t write-off a cold approach. If there’s a good fit, it can work! The conversion rate for our cold approach with investors was 100%. Our lead investor, Crane, was the result of a cold approach — I attended a (public) event Crane was co-hosting, and wouldn’t leave them alone until they’d heard all about our business and its exciting traction. Persistence can pay off.

Myth 4: The term sheet is king — once you've got one, you're at the finish line

The biggest surprise for us was the time lag between signing a term sheet and closing. The delay was for two reasons.

First, a lead investor does not usually offer 100% of the round, even though they bring interest from co-investors. So you still have to find and close the rest of the round.

Be ready for curve balls.

Second, the unexpected (almost always) happens in processes like this. For example, a minority investor could dig their heels in on details in docs despite an agreed term sheet, or you could have an opportunity to bring in a brilliant angel investor that delays closing as you get them up to speed.

Also, who knew that all investors, even angels, needed to be fully KYC’ed before closing? Cue a hasty round of Facetime calls for ID certifications (I knew my being a lawyer would be useful someday). Be ready for curve balls.

Myth 5: Fundraising and progressing the business are mutually exclusive

Established wisdom (or a common complaint) is that while you fundraise, you won’t be progressing your business.

I disagree. Yes, there is less time to focus on revenue generating activities. But you can mitigate this.

Divide and conquer. Even in our six-person team, it was possible to divide responsibilities to allow for continued business development.

The fundraising process is like a six-month-long test of your product with feedback on all aspects of your business.

The fundraising process is like a six-month-long test of your product with feedback on all aspects of your business. Investor feedback and subsequent soul-searching led us to change our pricing model, prompting greater certainty of revenue, and to adjust our go-to-market strategy, focusing our sales prospecting and processes.

Take the advantages you can during fundraising — use and build on the insights the feedback loop provides.