Digital bank startups aren’t just coming for personal current accounts. They’re after the business banking market too.

Why? Because there’s big money to be made — £14bn in the UK alone — and what’s on offer from traditional banks is universally acknowledged to be a right pain in the ass. It’s slow, it’s expensive, and it’s way behind on digitalisation.

Enter the startups. In the UK, the main contenders are Tide (focused solely on SMEs, small or medium-sized companies) and Starling (which has retail accounts as well). In France, the big player is Qonto. In Germany, there’s Penta and Hufsy (which is actually based in Denmark). In Norway, Aprila. For “micro-businesses” of 1-10 people, there's Holvi in Finland, Coconut, Anna and CountingUp in the UK, and Shine in France.

Sifted looks into the numbers behind the leading players, asks who is winning the race to disrupt business banking and discovers how much the incumbent banks really have to fear.

Which are the startups in the race?

Business bank startups are growing fast.

There is a lot of space for growth because the European market — with 24.5m SMEs — is still dominated by the big lenders. In the UK, for example, the four big banks currently have 90% share of SME banking. That’s one chunky oligopoly — and a host of startups are raring to break it up.

The UK's Tide now claims over 1.4% of the UK’s SMEs as clients (up from 1% in December), and is gunning for 8% market share by 2023, aided by a £60m UK government grant.

Meanwhile, Starling currently has 46,000 SME members, up from 30,000 in March, with £100m in the kitty from the same government grant to develop its business banking offering.

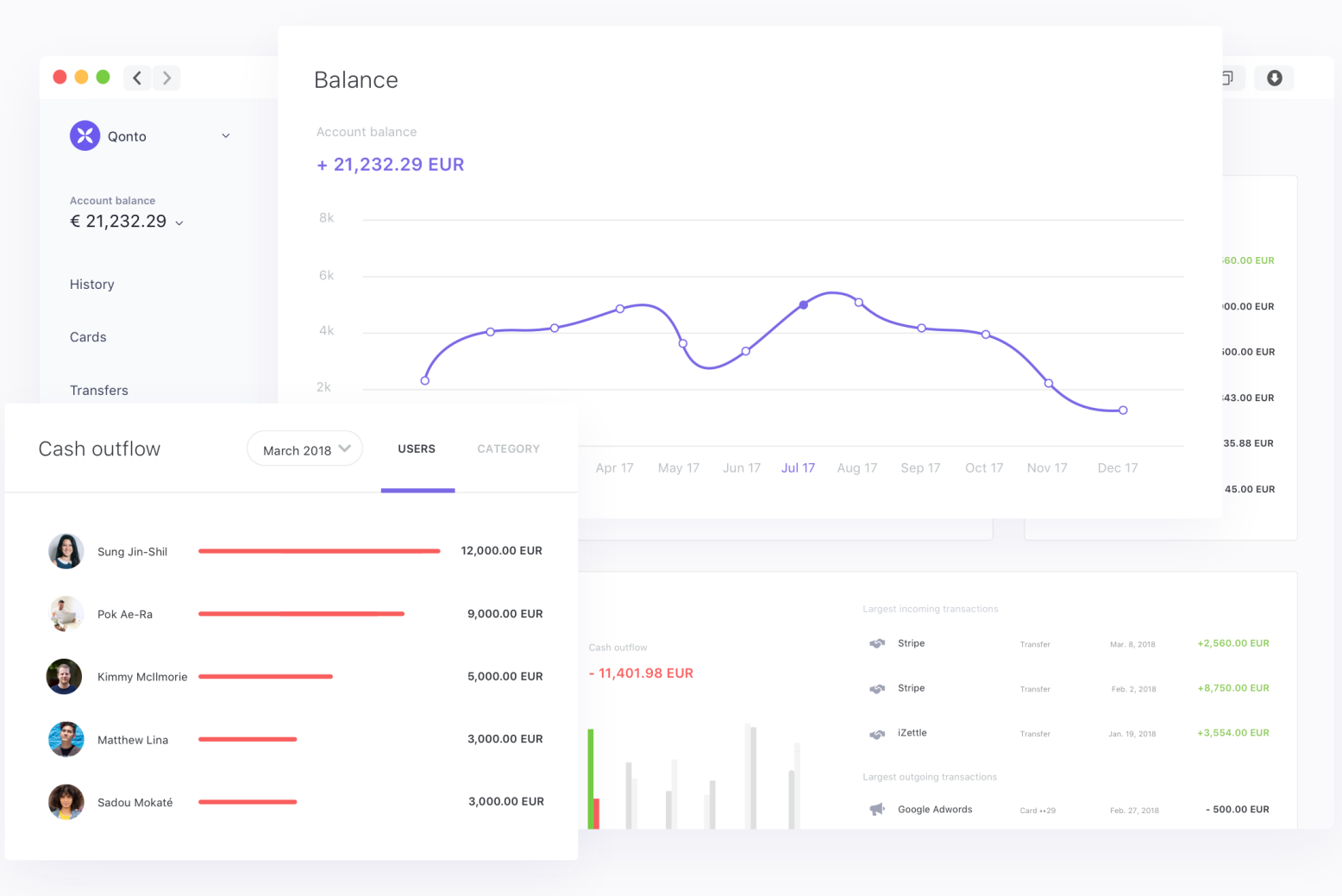

Qonto in France has grown from 15,000 small business customers to 40,000 in the past year, and is expanding into Germany, Spain and Italy this year. Finnish startup Holvi, which was bought by Spanish bank BBVA in 2016, claims 150,000 customers and is expanding into France, Italy, the Netherlands, Ireland and Belgium.

Fortunately, they're well funded too.

Continuing that growth will not be so easy, however.

The big banks are fighting back, starting their own digital-focused business banks as well to compete. In November, NatWest announced the launch of Mettle. Santander’s “startup” small business bank, Asto, also began development in the UK late last year. Meanwhile, HSBC is building its own small business bank startup, known internally as Project Iceberg.

How do they make money?

Nearly all the companies targeting this market begin with offering basic bookkeeping and payments features suitable for the very smallest of companies — sole traders, the self-employed or founders of companies that employ less than 10 people, and have an annual turnover of less than £2m.

The sell is an easy one: we save you time and money. These startups offer accounts which take minutes (not weeks) to open, integrate with the kind of accounting and payments software their customers are probably already using (such as Xero and iZettle), and help them keep track of their finances in the user-friendly manner now common with consumer digital banks.

But the bigger opportunities for the challenger banks are with the bigger customers: companies with more staff, more stakeholders, more turnover.

Qonto offers several pricing plans, ranging from €9 per month to €299, to cater for companies with up to 500 employees, but founder Alexandre Prot says the average size of business is probably around 10 people.

Starling says just over a third of its customers are one-person bands, while 85% of Holvi customers are “solo-preneurs or freelancers”.

Enticing larger companies to switch from their existing bank (most SMEs only have one business bank) takes a larger carrot. And so the challenger banks are steadily rolling out new features — from cash deposits to batch money transfers — to make their apps the one-stop-shop for all of a company’s banking and admin needs. Some of these features they’re building in-house, but for many, they’re looking to specialists.

“We want to be the operating system of an SME, not the application layer,” says Oliver Prill, chief executive of Tide.

Why are they partnering with other fintechs?

In a bid to turn themselves into a one-stop-shop for SME banking, the challenger business banks are hopping into bed with other fintechs even faster than the digital consumer banks.

Along with accounting and payments software, most also offer (or plan to offer) their customers foreign exchange, loans, insurance and help with tax, provided by third parties. Tide also plans to introduce a payroll service later this year (either white-labelled, or with a partner), while Qonto has integration with Apple and Android Pay in its pipeline.

Starling plans to build a comprehensive marketplace, filled with both its own and others’ tools — some of which will compete. “We will have lending products in our marketplace, and we have our own lending products,” says Anne Boden, founder of Starling. “That keeps us on our toes.”

For the challenger banks, working with partners also helps them bring features to market faster. “If something is ready on the market and we can integrate it, we’re happy to use it — if we feel like that partner has a similar DNA to us,” says Alexandre Prot, chief executive and founder of Qonto.

“We're not trying to build everything ourselves: there's too much to do,” Prot adds. “Our intention is not at all to reinvent everything or rebuild everything from scratch.”

We're not trying to build everything ourselves: there's too much to do.

For Qonto, partnerships are also a useful means to acquire new customers. A third of its customers are incorporating companies, and a third of those companies come to Qonto via LegalStart, a platform which helps people incorporate a company online.

Tide seems to have taken note. This year, it plans to offer new customers the option to incorporate their business at the same time as opening a Tide account. This so-called “Starting-Out Proposition” will be funded by the £60m government grant.

“In the UK, the controls we have to do to onboard you are such that we might as well register your company [at the same time],” says Prill. “So we will allow people to not only open an account with us, but also say, ‘We can register your domain, we can register your company, register you for tax if you want to’.”

Accountants are big fans of the digital business banks, because they generally make it easier for them to access their clients’ data and oversee accounts. Qonto says accounting firms are a big source of referrals — and is, as a result, working on some new integrations with accounting software to improve the service for accountants. (So far, features have included customisable labels and access to original invoices and receipts.) Last week, UK startup Coconut, a current account for the self-employed and small business owners, also launched a portal for accountants.

What about a more personalised service?

Both Starling and Tide are planning to expand their customer service to offer more specialist support, for a fee.

“We are going to start having a range of people, with sector expertise, who you will be able to meet virtually on your app,” says Boden. “Somebody who knows about being a freelancer or who knows about a construction agency business. It's not possible for the big banks to have those in every single branch — but we can have it if we make it virtual.”

It's not possible for the big banks to have [sector experts] in every single branch — but we can if we make it virtual.

Tide is currently running a ‘Plus’ membership (£8.99 per month) trial with around 200 customers, and plans to also launch a ‘Premium’ membership later in the year, which will offer customers a relationship manager who “will know your business inside out” to do “proper, 24/7, quality phone support”. With the standard free account, that level of personalisation is not possible, says Prill; but plenty of customers are asking for it.

Qonto, which offers customer support via email and social networks during business hours, has found the opposite to be true, says Prot: customers would rather receive a quick answer, than an answer from someone they’ve dealt with before.

Why have the big banks been so negligent for so long?

Challenger banks say they're already streaks ahead of the traditional offering.

“Traditional banks were not offering a good — not even an average — service,” says Qonto's Prot.

He's right - the average banking industry NPS [Net Promoter Score] is negative.

“In a way, you could just say that being positive will do,” adds Prot, who says Qonto is aiming for (and currently achieving) an NPS of more than 60.

So why do traditional banks offer such a terrible service to SME customers?

“A lot of these small businesses are unprofitable for the big banks,” says Tim Levene, partner at London-based fintech VC Augmentum, and an investor in Tide. “They don’t have the infrastructure to serve them in a cost efficient way, so the service offering, from a digital point of view, left a lot to be desired.”

“A lot of big banks club all small businesses into one; that doesn’t work for all small businesses,” says Jordan Shwide, who is developing UK challenger bank Monzo’s business banking offering (currently on trial with 100 users). The SME bracket covers a huge range of business types, with widely varying requirements — and yet the big banks have tried to get away with retro-fitting their mass-market consumer banking offering for SMEs.

“When you look at SMEs they’re actually very diverse,” says Prill. “Some are cash intensive, others have to write invoices, some of them have employees, some of them don’t, some of them do international trade, some of them don’t. And what makes it even harder is that an SME goes through stages of development.”

“To deal with this diversity, you cannot really do it on the side,” says Prill, who believes that Tide’s laser focus on SMEs sets it apart from other banks like Monzo and Starling also growing on the consumer side. Prot makes a similar argument: “We believe that to serve SME you need to be focused on SMEs and to SME all day long — and all night long.”

But what happens when the big banks sort themselves out?

The big banks haven't put up much resistance, so far; although Santander’s small business app Asto recently added invoice financing and this week announced a partnership with eBay to offer SMEs loans via the app.

Investor Tim Levene reckons they have an uphill struggle to win back customer trust. “If they had to build new brands rather than use ones built over hundreds of years [to attract small business customers], that tells you everything you need to know,” he says.

Meanwhile, in mainland Europe, the race is on between the startups. Qonto is expanding into Germany (3.6m SMEs), Italy (4.4m SMEs) and Spain (2.5m SMEs); the three largest economies in the Eurozone, along with France (3.7m SMEs). Holvi, which has been active in Finland, Germany and Austria for the past three years, now has the rest of the Eurozone in its sights.

“There’s one currency and one payments system [SEPA - Single Euro Payments Area], which makes it much easier, technically, to offer our product across these four countries,” says Prot. 80-90% of the product will remain the same, he adds; a few technical features, such as the algorithm which extracts VAT from invoices, will need to be tweaked to understand formatting and linguistic quirks of each country.

“We want to be the leading business banking solution in Europe,” says Prot. “Maybe even further.”