The tech downturn has left startups grappling with the decision of whether to scale back operations or invest in growth. As VCs hold onto their wallets, funding is expected to drop from $83bn in 2022 to $51bn in 2023, which will likely worsen the situation for startups.

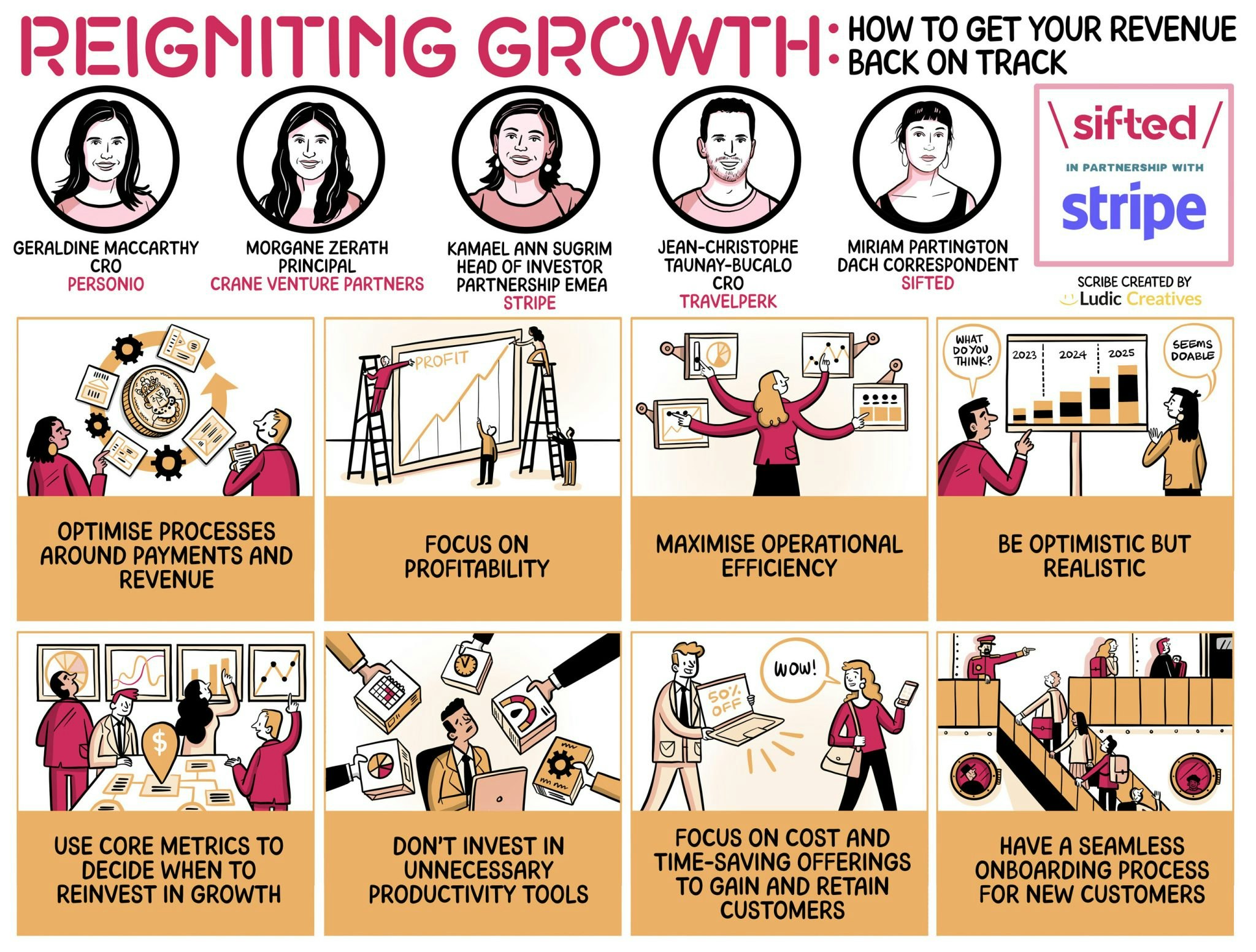

In our latest session of Sifted Talks, experts shared their thoughts and experiences on what companies should be prioritising in a tough market to get their revenue to a good place.

Our experts were:

- Kamael Ann Sugrim, head of investor partnerships EMEA at Stripe, a payment processing platform

- Morgane Zerath, principal at VC firm Crane Venture Partners

- Geraldine MacCarthy, chief revenue officer at HR software service Personio

- Jean-Christophe Taunay-Bucalo, chief revenue officer at TravelPerk, a travel platform

Watch this Sifted Talks here or read about what we learnt:

1/ Optimise processes around payments and revenue

In a recent Stripe survey of startup founders, 86% said their businesses were actively looking for new sources of revenue. Sugrim said that early-stage startups shouldn't get caught up in just product development and should test receiving payments for their products and figure out what the right pricing is early on.

For later-stage companies, she said recommended they optimise processes around revenue collection such as looking at fraud or consistency of payments. It’s also key for companies to adapt their revenue and business models for more stability — which could mean, for instance, pivoting to B2B from B2C.

Sugrim added that the costs of software development have dropped over the years, so going into a new business stream or exploring a new revenue stream is a lot cheaper, and therefore, the decision to focus on revenue is a lot easier now. For example, startups can use tech such as Stripe's Payment Link to test out new markets and pricing for new products.

“This gives founders a really nice space to really be imaginative: in a time where you might usually be thinking in a contracting way, you can think in an expansive way because the costs have come down so much” — Kamael Ann Sugrim, Stripe

2/ Focus on profitability

Zerath said that along with capturing market share, it’s important for early-stage startups to think about sustainable growth and the path to profitability. If a startup has high customer acquisition costs, they need high revenue per customer to be profitable.

She emphasised that investors always looked at customer acquisition costs and the value that your customers bring in — both now and in the future of the relationship with the customer. For instance, subscription-based business models can potentially maintain revenue and keep customers close.

Investors also always look at the gross margin, which is a company's gross profit compared to its revenue or sales, while making investment decisions, Zareth said.

“We’ve seen companies where to be able to grow, you need to have a physical presence in different countries. But how sustainable is it to grow geographically if you need to have a physical presence?” — Morgane Zerath, principal at Crane Venture Partners

3/ Maximise operational efficiency

MacCarthy said that a Personio survey of European C-suite and HR executives found that 69% wanted to be more operationally efficient — and of that, 48% said that they didn't know or didn't have a strategy for how to become more efficient.

Giving examples from Personio, MacCarthy said that they’d implemented strategies such as “Winning Wednesdays”, where nobody schedules any meetings on Wednesdays so they can focus on their core work, which has helped improve productivity. They’ve also implemented “Momentum Mojo” to help people identify old processes or ways of working that are no longer serving the company.

To this, Sugrim added that companies had to identify their revenue leaks such as fraudulent customers or in managing invoicing and billing customers, and plug these gaps to increase efficiency.

“There is definitely a need in our customer base and across all businesses in Europe to become more efficient — and there are quick wins that businesses can implement for this” — Geraldine MacCarthy, Personio

4/ Be optimistic but realistic

MacCarthy said that it was key to be realistic with your team about the challenges that come with operating in a difficult market — but downturns are also good for businesses as they become more efficient and sustainable in the long term.

Taunay-Bucalo spoke about the time TravelPerk’s revenue dropped to zero in a week during the pandemic, and how they had to manage the crisis. He said that it was key to not create a sense of panic in the team — it should instead be a conversation about what the way out is and how to work towards it.

He added that if it’s a deep crisis, you’ll have to rethink your business model, unit economics, target market and so on, whereas if it’s just a bump in the road, you can ride it out and wait for the next wave. It’s also crucial to be honest and transparent with your team about what you know and don’t know, he said.

“When times are hard, the team will look at you to find a way out — and it might be painful, but there is a path forward. Then it's a call to arms, like are you with me or are you not?” — Jean-Christophe Taunay-Bucalo, TravelPerk

5/ Use core metrics to decide when to reinvest in growth

Taunay-Bucalo said that companies should look at core metrics such as pipeline conversion ratio and revenue generated to decide when to reinvest in growth after a slowdown or crisis.

He said that reinvesting into growth should be done at the right time to accelerate the business before competitors do, which is what led to TravelPerk’s recovery and boom after the pandemic slump.

MacCarthy added that companies that continue to invest during a downtrend come out much stronger. She said it’s key to focus on training your talent even when the going gets tough as this will help them drive growth at a fast pace when the market is ready.

“If you do it too early, you die along the way, and that's not a great output. But if you wait too late, you’ll miss the opportunity to take over the market when everybody else is terrified to invest” — Taunay-Bucalo