Berlin-based digital bank N26 lit up London the night it launched in the UK in October 2018, with a stunt projecting the company logo onto several landmarks across the capital.

In the following months, the fintech — which has raised $670m to date — hired around 25 local employees and launched a lavish advertising campaign that sprawled across London’s tube network; hoping to take on local competitors Monzo and Revolut.

But just over a year later, in February 2020, N26 announced it was leaving the UK and closing hundreds of thousands of accounts, blaming the country’s official departure from the European Union. The bank said it would be "unable to operate in the UK with its European banking licence".

However, a joint investigation by Sifted and Germany’s Finance Forward has found that N26’s UK division took a series of blows in the months prior to the announcement, including a run-in with the UK's Financial Conduct Authority (FCA), a series of high-level resignations and low user engagement.

Insiders say that — while Brexit indeed complicated the landscape for N26 — it was, in fact, these issues that collectively triggered the end for N26’s high-profile foray into the UK.

Questions from the FCA

In late 2019, N26 premium users in the UK received an email stating that their pay-to-use membership was under review and the company required more personal information.

The email — seen by Finance Forward and Sifted — warned that customers who failed to respond would have their premium membership withdrawn.

“There is some important information that we should have asked you when you opened your N26 account,” the support team explained on Twitter at the time.

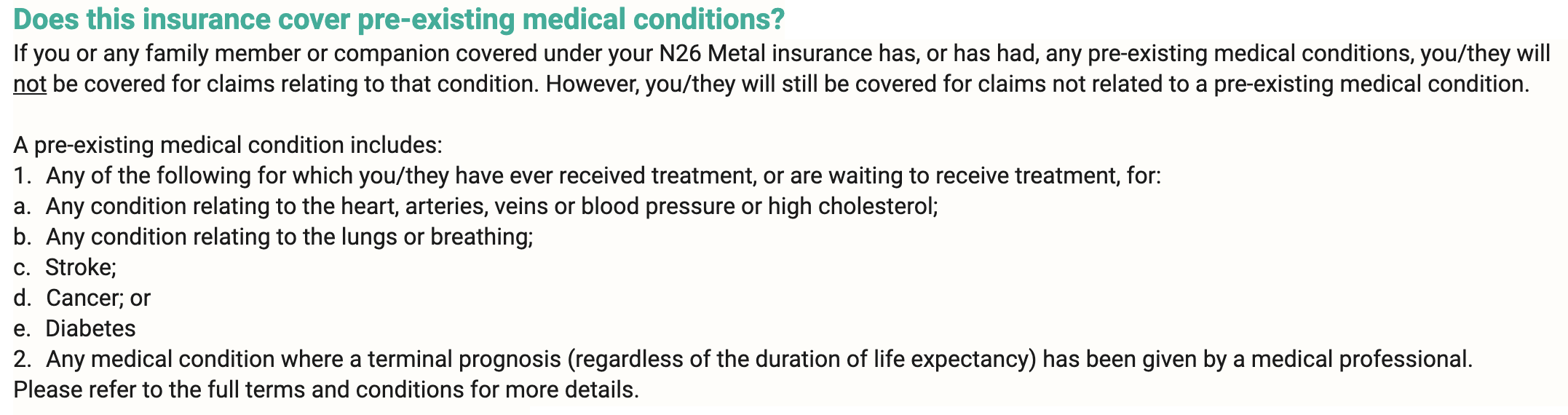

Behind the scenes, N26 UK was handling claims they may have unintentionally mis-sold travel insurance; included as a feature of the £14.90 a month “Metal” card, launched nearly a year earlier.

UK regulation and ‘customer best interest’ rules state that consumers must be eligible for the insurance they are being sold, which puts the onus on the sellers of insurance to gather information from customers

Yet — as N26 acknowledged in their email — the bank had failed to ask key health questions to determine if the policy was “appropriate” for all its UK customers.

The absence of medical scrutiny means that premium users with certain pre-existing conditions could have bought travel insurance (provided by German insurer Allianz) that they were actually ineligible for. That means, for instance, that if they'd had a health complication on holiday, they would not have been able to claim for the policy they’d paid to cover them.

When approached for comment, N26 confirmed that several UK customers had bought Metal membership despite being ineligible, putting the bank in breach and forcing them to refund them during Q3 last year.

“While the majority of customers were not affected, those that were have been issued a full refund,” N26 told Sifted and Finance Forward in a statement.

N26 would not comment on the total number of users affected, but it's understood they refunded all customers who failed to reply by the deadline, as well as those who failed to meet the health conditions (listed in the screenshot above).

They also confirmed that the Metal product was flagged by the FCA, the UK’s regulatory body.

“As part of this review, we introduced a more detailed sign-up process to capture additional information about each customer,” they wrote.

There is no evidence that the FCA actually fined N26 UK, which was led by chief executive Nick Kennett and head of compliance Tomas Hazleton. N26 are believed to have first discussed the issue - which is surprisingly common among insurers - during an in-person meeting with the regulator.

Still, one insurance expert, who asked for anonymity, noted that N26 was ultimately responsible for how the policy was sold as a licensed distributor, adding that the policy — issued by Allianz — had a larger-than-normal number of exclusions by British standards.

The FCA and Allianz both declined to comment.

A loss of optimism

N26, which is backed by big names such as the US and Hong Kong billionaires Peter Thiel and Li Ka-shing, says the regulatory “review” did not influence their decision to leave the UK.

“This review only affected UK customers, was resolved months ago and had no bearing on our decision to exit the UK market,” they said in a statement.

In fairness, the financial cost of this regulatory dilemma was seemingly manageable (“sub £1m,” according to one executive).

But multiple sources told Sifted and Finance Forward that the investigation from the FCA contributed to a loss of confidence in the UK among N26’s Berlin bosses.

“There was no way to justify this to the leadership,” said one former N26 executive.

Another executive added that the mishap also highlighted the depths of the UK’s “regulatory minefield”; something N26 would need to get to grips with if they were to survive and acquire a UK bank licence, post-Brexit.

Crucially, the FCA run-in also added to the general sense of fragmentation that those same people say shrouded the UK operation. Soon after the compliance issue was resolved, at least two senior UK team members handed in their resignations. This was separate to the series of high-level departures in the German office last year.

N26 argue the resignations officially came "after the decision to leave the UK was formalised internally.”

Tough at the top(line)

Finally, the refund saga should be analysed in light of N26's overall performance in the UK.

While the specifics are still inconclusive, the following data clearly illustrates N26 UK had both low user engagement and a tough road to monetisation; making small set-backs even more critical.

Firstly, analysis by Priori Data suggests that N26 had a total of 418,500 downloads by the time of its withdrawal announcement, 18 months after launching.

Assuming this figure is accurate, it's not bad in isolation. By comparison, Monzo had 401,000 downloads after 18 months according to App Annie, Tandem Bank claims it had 500,000 after 12 months, and children’s spending app gohenry (fee-based) took five years to get 350,000 active members.

Nonetheless, N26’s downloads do not equate to users or engagement; the bank’s key metric.

Indeed, data compiled by Sifted in December suggested that among British fintechs, N26 ranked far behind its local peers like Monzo and Revolut by monthly active users (MAUs), coming in 19th place.

This is particularly disappointing in the context of an intensive advertising campaign across London tubes last summer.

Arguably, this disengagement came down to limited appetite amid tough competition. Some users complained that, unlike its peers, N26 had overseas ATM fees for its standard offering and forced users to withdraw cash just to activate their card. Despite a strong business account proposition and desktop access, N26 seemingly wasn’t enough.

Moreover, beyond drawing in the masses, the company’s priority was to get its customer base to pay for itself through premium subscriptions. This included both Metal (now available in over 20 countries) and its cheaper UK version, the £4.90 “Black/You” card for regular travellers (without insurance).

In a statement to Sifted and Finance Forward, N26 said that “premium account uptake in the UK [was] on the high end of what we typically see across our markets globally”, which it has previously quoted as 30% of its total user base.

Nonetheless, one former N26 exec said it was tough going.

“It was harder than expected to monetise,” the executive said, noting that the company was dealing with small proportions all round.

“They didn’t have a proper plan in the UK,” another executive, who has also since left N26, explained.

Moreover, refunding handfuls of customers after the FCA review won’t have helped the rate of Metal signups, N26’s main revenue stream.

Now, with fellow bank Monzo gearing up to relaunch its premium card, we’ll see if the UK becomes another graveyard for paid account offerings.

This piece was updated to clarify N26 first discussed the compliance issue with the FCA in person rather than in writing.