Losses at digital health scaleup Kry rose in 2022 as the business adjusted to tricky economic headwinds, laying off hundreds of employees and pulling out of two markets — but the company says it’s on track to hit profitability by the end of 2024.

Pre-tax losses hit €155m in the year to December 31 2022, increasing from €97m in 2021, according to Kry’s latest annual report, which is due to be filed next week.

At the same time, revenue in the UK nearly doubled to €21m and nearly tripled in France to €17m. Sales in its home market, Sweden, also increased in 2022, rising from €106m to €128m.

“We have been doing this major refocus, but we are growing more than 30% year on year,” says COO Kalle Conneryd-Lundgren. “It’s been a difficult year in some ways, but that’s now behind us and it's in our hands when we’ll turn into a profitable company.”

'Major readjustments'

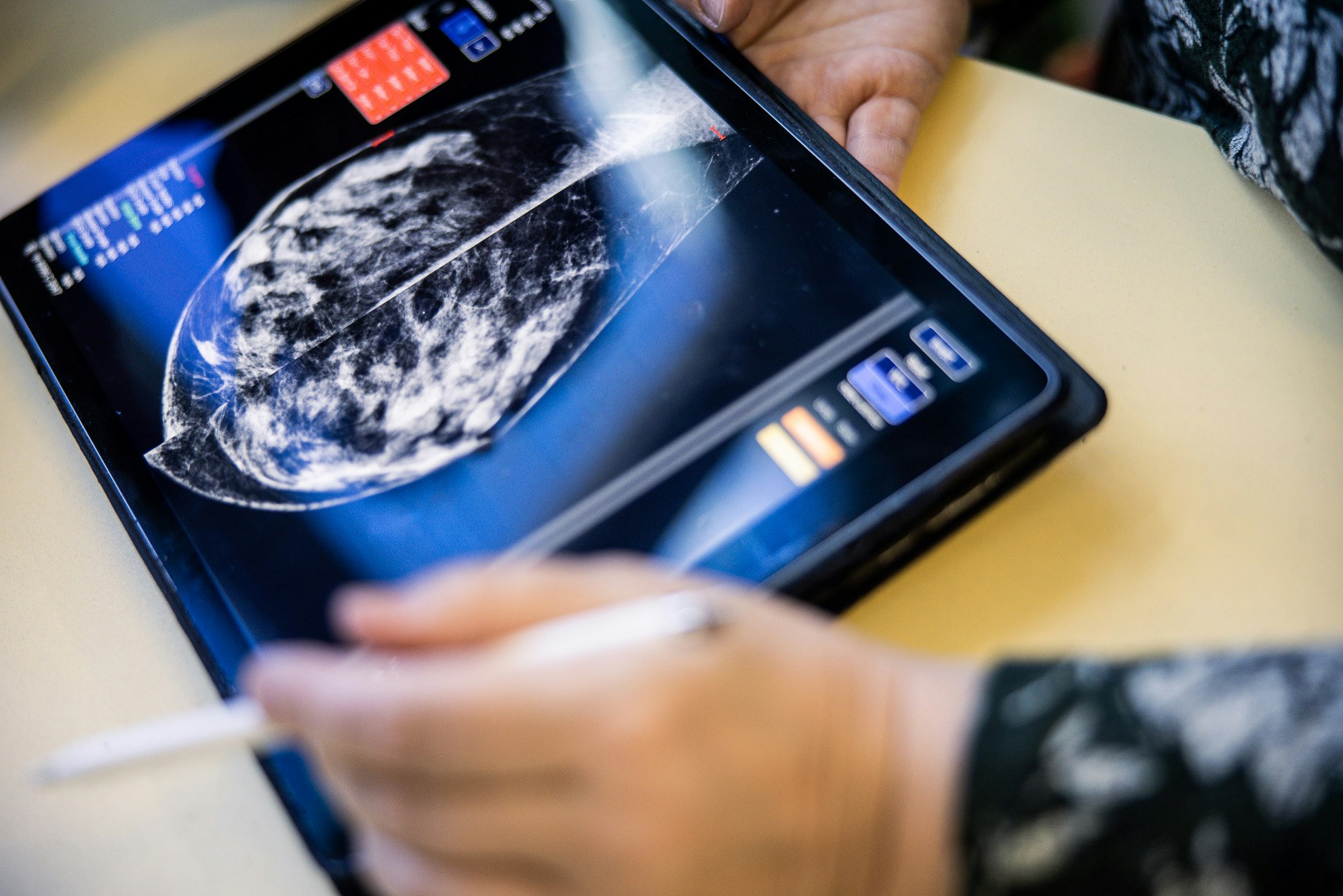

Stockholm-based Kry provides a digital healthcare platform and runs physical clinics for both primary and specialist care. It’s raised $753m since launching in 2014, including a $160m Series D extension in July 2022 — made up of a convertible loan and debt financing — of which Kry has spent about half. A further formerly unannounced €30m was raised from the Healthcare of Ontario Pension Plan in February 2023.

After a boom in customer numbers during the pandemic, 2022 was a year of “major readjustments” for Kry, says Conneryd-Lundgren.

It let go of about 400 staff across two rounds of layoffs, and announced it was pulling out of one of its five markets, Germany. It also put the brakes on a planned expansion to Italy.

“We decided in early 2022 to turn around how we operate as a company, which meant a lot of colleagues working on exploratory stuff and expansion had to be laid off,” says Conneryd-Lundgren.

Severance pay to laid-off employees and “goodwill payments” — money spent on pulling out of markets — led to the sharp increase in losses in 2022, he adds, although Kry expects total losses for 2023 will be far lower.

“We think we made the right strategic decisions, and we are now in a completely different situation in 2023 — with a much lower burn rate.”

The picture in 2023

Kry’s Ebitda (earnings before interest, taxes, depreciation and amortisation) was up around 60% in Q1 2023 compared with Q1 2022, according to Conneryd-Lundgren. For all of 2022, its Ebitda was -€109m.

The business now hopes to reach profitability by 2024. Conneryd-Lundgren says it’s already there in Sweden and Norway — although Kry doesn’t include company-wide costs, like some tech on its digital platform, in those calculations. Kry says it’s likely to hit profitability in France by the end of this year. It hopes the UK can follow suit sometime at the start of 2024.

The company doesn’t plan to hire as many new employees in 2023 as it did last year.

Investing in technology

While Kry doesn’t need to raise more capital right now — it had €72m in the bank at the end of 2022 and took on €30m in investment since then — the company hasn’t ruled out a fundraise in 2023, says Conneryd-Lundgren.

“If we see that what we are doing can be accelerated with an investment of some sort, we may look into it — but we can also accomplish our aims on our own,” he tells Sifted.

In April and May 2022, Kry completed two acquisitions of businesses with physical care units in Sweden, as it looks to double down on providing a physical healthcare service alongside its digital platform. Kry now has about 50 physical clinics spread across all its markets except for the UK, predominantly in Sweden.

Last year it opened two physical clinics in France by partnering with the hospital care provider ELSAN. In the UK Kry is the largest digital health partner to the NHS. Its patient-doctor messaging platform Mjog became the first messaging service to be integrated into the NHS app and is used by 40% of healthcare clinics in the country.

However, Kry hasn’t acquired any other businesses in 2023, Conneryd-Lundgren says — although he doesn’t rule out further acquisitions in the future. “A lot of our acquisitions in the past have been physical units, and at this point in time we are quite proficient in setting those up ourselves.”

Instead, over the next six months, investments in the technology that underpin Kry’s digital and physical healthcare platform will be one of the biggest costs, he says.

About 20% of that will go towards investing in AI, which Kry is beginning to explore in small-scale pilots. It launched one trial with a cohort of individual clinicians two months ago, using generative AI to support admin around patient data.

While deploying generative AI is still in its early stages, the company eventually plans to roll out some tools to assist clinicians in decision-making, too, the COO says.