M&A activity in Europe is set to rise towards the end of 2024 — and continue into the next year. Startups looking to acquire a new business or sell in this competitive market must tread carefully, but if they can get it right, there’s a lot to be gained.

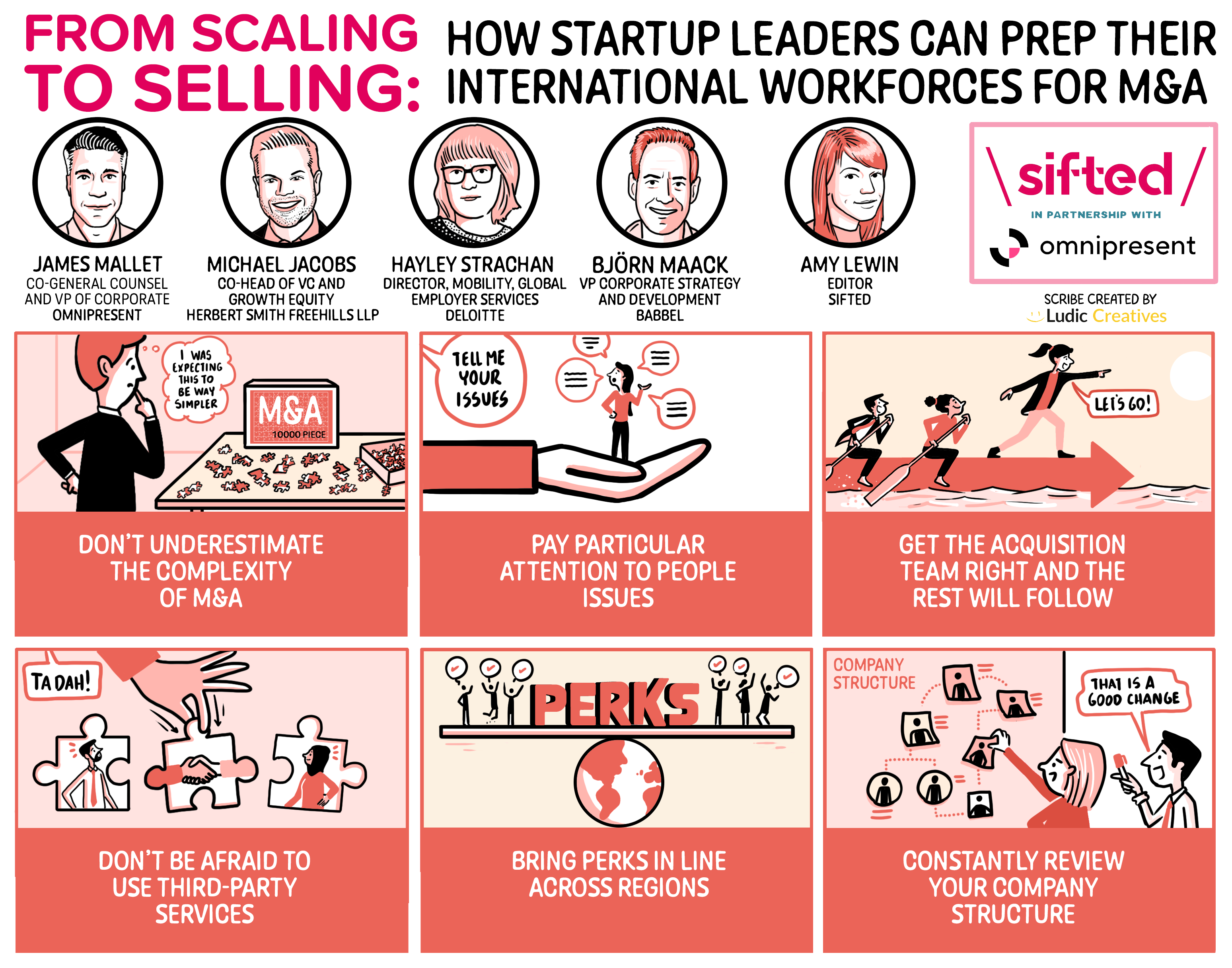

Our latest Sifted Talks delves into best practices for M&A activity, focusing particularly on the impact on your workforce and the complexities of managing teams or entities across multiple countries. Our expert speakers were:

- James Mallet, co-general counsel at Omnipresent, a firm that solves remote team management challenges

- Hayley Strachan, director for global employer services at Deloitte, a multinational professional services network

- Michael Jacobs, partner at Herbert Smith Freehills, an international law firm

- Bjorn Maack, vice president of corporate development at Babbel, a language learning app

Key takeaways from the panel:

1/ Don’t underestimate the complexity of M&A

Jacobs began the panel with a warning for founders. He said founders must pay close attention to financial, legal and intellectual property (IP) due diligence during M&A.

Most mistakes come from issues of corporate governance, such as incorrect share allocations, which can jeopardise deals.

Maack was asked for an example of an acquisition that Babbel declined and the reason why: “We had a case with attrition on the level below the exec team. That raised an orange flag for us. The head of HR ultimately gave a great explanation. The takeaway is, think about the questions an acquirer might ask so you can fast-track those questions.”

“The world of due diligence is a big universe because it covers a whole multitude of areas, and really depends on what, as a founder, as a company, you're focused on commercially, particularly at the outset.” — Michael Jacobs, Herbert Smith Freehills

2/ Pay particular attention to people issues

Strachan said immigration is an often-overlooked people issue. While not typically deal-breaking, neglecting due diligence on international workers can lead to business friction. For example, sponsorship licences don’t always transfer, and she has seen examples where "operational readiness" was impacted at launch.

Mallet said he most commonly sees issues around remote work and contractor misclassification. In cases where there is no future business entity planned, keeping this talent can be challenging. He warned:

“Be careful of some remote work providers, because in many jurisdictions, particularly highly regulated ones like Germany or Italy, there are providers who may buy template solutions that aren’t always in compliance with local laws.” — James Mallet, Omnipresent

3/ Get the acquisition team right and the rest will follow

Maack advised acquirers to establish a top strategy team to manage various key areas of the M&A, due diligence process, such as the director of product and director of tech, adding it’s fine to use external advisors for financial and legal areas.

For sellers, Maack said the big issue is deciding when to inform the wider team, which, if handled poorly, can lead to unnecessary uncertainty.

“Founders have an outside impact on the success of any startup. They’re absolutely key to the potential acquirer and it's really important to develop a clear view of what a founder wants to get out of a deal and after.” — Bjorn Maack, Babbel

4/ Don’t be afraid to use third-party services

The audience asked Mallet for advice on using an employer of record (EOR), which refers to a third-party organisation that legally employs workers for companies and takes on all legal and administrative responsibilities. To vet an EoR he said you should check the regulatory status, history of contractor misclassification, data privacy controls and onboarding style.

“Sometimes an EOR who says yes to everything should be a bit of a red flag, because there's some things you shouldn't do,” Mallet said.

"EOR is a tool in a suite, and it can be the right answer, but there are also other answers over short, medium, and long term as well. Keep the position under review, because what's right for you in terms of Day One prep, or pre-transaction, might not be right for you even after a few months.” — Hayley Strachan, Deloitte

5/ Bring perks in line across regions

When you buy a company, you inherit all employee terms and can't renegotiate them immediately.

“You can reset future incentives, like share options and things of that nature, but recalibrating benefits and perks requires a longer-term process,” said Mallet.

Maack emphasised the need to align sales commissions for B2B salespeople before finalising the deal. Misalignment on this can be devastating post-deal, especially if the sales team leaves.

The audience asked how to best manage redundancies. Mallet advised:

“You have to highlight that this is going to be a win-win for everyone — that’s the whole thesis behind the M&A transaction. Focus on the positives, but acknowledge the fact there are going to be some inevitable consequences.” — Mallet

6/ Constantly review your company structure

After the deal, systems (such as HR systems) will inevitably change, said Mallet. Whether you continue to use both or migrate and integrate, it can be a long, drawn-out process.

He suggested continually reviewing assumptions post-M&A: “There’s always a good reason to look back after a certain period to see if your assumptions were correct. Were our teams, these entities, where we operate, the outcomes, as we wanted? Or does there need to be further work?”

Strachan concluded the panel with a similar sentiment.

“Structure won't be the same in each location; it won't be the same solution over the years. It's about understanding business strategy. Where are your growth areas? What were the key value drivers of the transaction in the first place? And that's going to inform your structure — and where your people are.” — Strachan

Like this and want more? Watch the full Sifted Talks here: