Direct air capture technology makes a seductive promise: machines which can suck carbon dioxide directly out of the sky, removing the emissions that are heating up the world at an alarming rate.

The International Energy Agency and the Intergovernmental Panel on Climate Change (IPCC) now agree that reaching net zero will require carbon removal (alongside solutions which prevent emissions in the first place).

But there’s a key problem. It costs between $600 and $1,000 to remove a metric tonne of carbon dioxide from the atmosphere using direct air capture (DAC). Analysts and policymakers agree that, to scale the industry to the levels needed to move the needle, the price needs to get to around $100 per tonne.

There’s a new cohort of direct air capture (DAC) startups working on getting the price down. One of them, German startup Greenlyte, has just raised €10.5m, from Earlybird, Green Generation Fund, Carbon Removal Partners and Partech.

Its approach could, the company says, bring the cost of carbon removal down drastically.

Searching universities for climate tech

Greenlyte was founded by Florian Hildebrand, who previously headed up healthtech software startup Qualifyze. Hildebrand left the company in 2022 and set about finding climate tech solutions in research labs that he could help bring to market.

“My hypothesis was that in Germany, we have a lot of great research, but not the ability to bring a lot of that into the market. I reached out to about 100 researchers in Germany, and travelled the country, looking for interesting technologies and ideas that can change the world,” Hildebrand says.

Hildebrand met Dr Peter Behr, a researcher at the University of Essen, who had been working on carbon removal for 15 years. “He's developed this radical approach, which we believe allows us to bring down the cost of CO2 removal to around $80 per tonne,” says Hildebrand.

A new generation of DAC

The best-funded and oldest DAC startup in Europe is Switzerland’s Climeworks. It was founded in 2009 and launched the world’s first direct air capture plant in 2021, in Iceland. Climeworks raised a mammoth $650m equity round in 2022.

“Climeworks built the market,” says Hildebrand. “They were the innovators in a market which nobody understood at the time, and they created the tracks for everybody else.”

Climeworks was twelve years old by the time its first plant, Orca, became operational. For the newer cohort of companies in the space, it’s possible to shorten that timeline. Greenlyte, which was founded in 2022, plans to deploy a DAC unit to Canada at the end of this year. It’s also signed a deal to develop a plant in Kenya and is now looking at sites in Europe.

Working on similar timelines, Sirona, a Belgian DAC startup founded in January last year, plans to begin mass production of its machines at the end of this year.

“I think now you see an amount of people with previous entrepreneurial experience and you see different forms of capital in the market, that leads to faster iteration,” says Hildebrand.

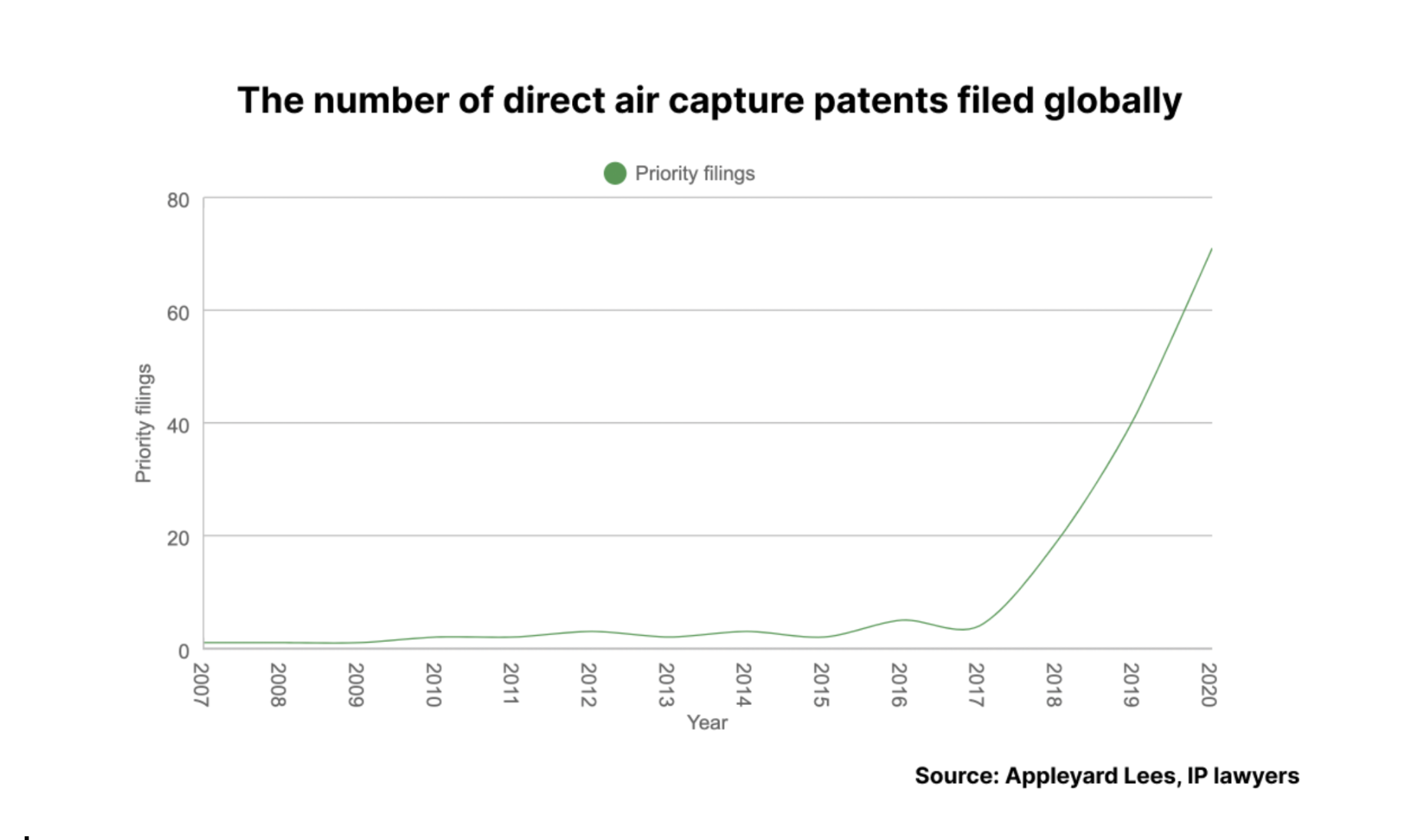

Another measure of the gathering pace of DAC innovation is the number of patents being filed: the global figure has soared from 2017 onwards.

Greenlyte’s tech

Climeworks’ tech works by running air past a solid which absorbs CO2 molecules. Greenlyte’s system uses a liquid instead, which the company has patented.

Once the liquid has absorbed CO2 it solidifies into a slurry. That slurry is then put into a renewable-energy powered electrolysis machine, which releases CO2 from the slurry and produces hydrogen in the process. The released carbon dioxide is captured again and either stored or used to produce things like synthetic fuels.

Hydrogen is a valuable by-product — it can be used to lower the emissions in hard-to-abate sectors like steel manufacturing. Selling hydrogen can also help keep the cost of Greenlyte’s plants down.

British startup Parallel Carbon is also working on producing hydrogen from DAC processes. It raised $3.6m in seed funding earlier this year.

Hildebrand says Greenlyte is removing CO2 at about $400-500 per tonne. There are three levers that will bring that down: energy efficiency of the design (which it’s iterating on at present), the manufacturing of components at scale and the cost reductions that will come when Greenlyte’s plants are at scale.

Greenlyte is currently removing 100 tonnes of CO2 per year. Once its capacity crosses 10k tonnes per year, it should be able to get the price down to below $100, Hildebrand says.

Despite the race to drive down price, Hildebrand says there’ll be more than one winner in the DAC sector. “There's probably room for five to 10, potentially twenty, companies,” he says.