Expanding into the US is the hallmark of a truly global company. Even with creeping competition from China, the land of the free continues to hold an unparalleled status for European startups.

No surprises then that Revolut, Monzo and N26 — Europe's biggest challenger banks — have slowly begun a three-way simultaneous expansion into the streets of America. Quite literally in N26's case, whose marketing effort is already in full swing in three cities (see photo in headline).

My trip to the US this month revealed some fascinating insights into how these firms are coordinating their efforts. In summary, all three European challengers will be targeting America’s underbanked — a trillion-dollar market, according to Forbes.

The newcomers are concentrating closely on those for whom “banking doesn't work”; those who have fallen through the financial cracks and who have been subject to eye-watering fees and interest. By way of example, while free current accounts and contactless cards are a given in Europe, they're still a rarity in the US.

As such, the neobanks have identified a gap for a modern debit offering, even in a country obsessed with credit cards. They are each preparing to offer fee-free services with varying multi-use app. Still, they will be competing with a herd of dominant incumbent banks, as well as existing US mobile-banks like Current, Dave, Aspiration and Chime, which has 5m users. Even Apple is in the game with the launch of its Goldman credit card.

Here's how each European challenger has progressed in their first few months stateside and a sneak peek into their varying go-to-market strategies.

N26

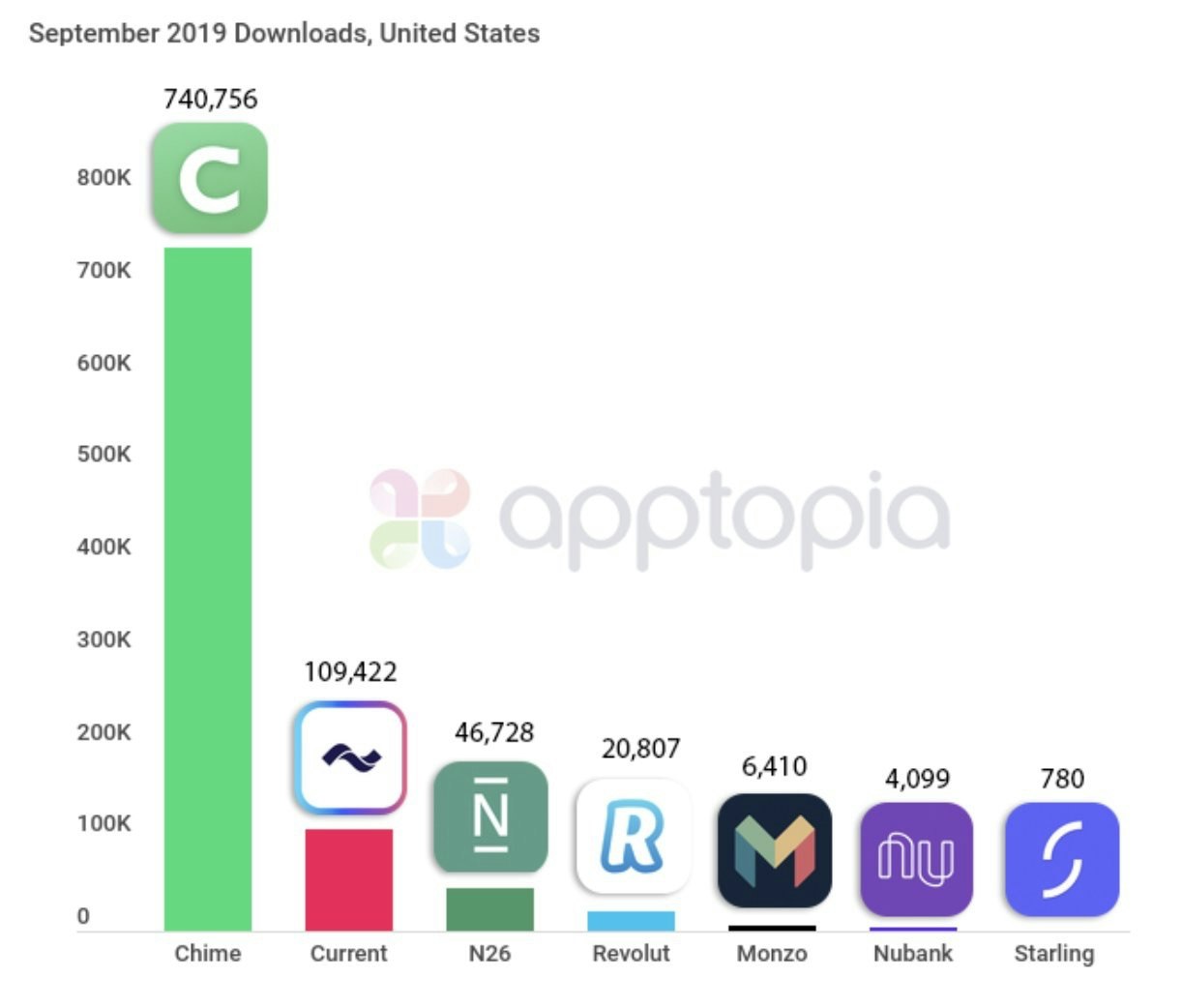

The German unicorn bank is the only European challenger to have fully launched in the US so far. By default then, it's currently leading the way, beating its European peers by monthly downloads in September.

Source: Apptopia

The company has nominated Swiss-born Nicolas Kopp to lead its 70-person strong team. He told Sifted that N26 is largely targeting America's outer-city rural demographic who had been “burned” by credit.

To lure these US users, N26's core features are free ATM withdrawals (banks usually charge US customers for using other banks’ ATMs) and early salary payments. US bank Chime already offers these perks but reportedly caps monthly deposits at $1,000. N26 also plans for an as-yet-undefined “rewards programme”.

“I would like the US to be a very significant part of our global footprint... This is not an experiment. If we take [a] decision to enter a market we don't take it lightly,” Kopp told Sifted.

Kopp added that while it was early days, he was confident that N26 had carved out a stronger “angle” in the US than its European peers. Indeed, N26 seems to have a more distinct focus there than it does in Britain, where it was a relative late-comer.

It's also worth noting N26 is “not in a rush” to introduce pay-to-use Premium accounts in the US, perhaps sensing limited demand, despite 30-35% of European users using Premium.

Revolut

Revolut has not yet launched its US or Canadian accounts but is scheduled to do so within the next few months.

Notably, Revolut is the only challenger with a business line in the works, which has proven a lucrative avenue in Europe. Meanwhile, on the retail side Revolut has identified two key “inner-city” target-groups. First migrants who cannot easily access credit lines and second US students overseas. Revolut hopes to offer students' parents an easier, in-app avenue to top up their children's accounts in the necessary currency.

“We are spending a lot of time focusing on niche. We want to be the best solution by a very long way,” Dan Westgarth, General Manager for Revolut North America, told Sifted.

His logic is that a niche in the US — a country of 330m people — is still sizeable.

“We think we can get 10m [users] in North America. We can grow very, very quickly,” Westgarth said. “Look at Venmo,” pointing to PayPal's money transfer app, which has amassed 40m users since it launched seven years ago.

Elsewhere, Revolut-US noted it is eager to offer micro-loans like Monzo does in the UK.

“We want to build our own balance sheet. We want to be a responsible loaner,” Westgarth added. He also hinted at the need for a rewards scheme if the challengers are to usurp credit cards and other incumbents.

The Brit is now leading a 50-person team in the US but the hunt for a regional chief executive is underway.

“We want to become a bank here. So you need a bank leadership team who know and are known by bank regulators.”

Monzo

Monzo has begun in beta, with less than 1,000 US users currently holding physical cards. The firm would not comment on plans for a full launch.

Its US waiting-list currently sits at around 20,000, built from hosting bespoke events in key cities.

Monzo declined to comment what its US niche will be, but Oliver Beattie, a vice president at Monzo who is now based stateside, told Sifted earlier this year that the bank was open-minded and was still getting a sense of what US consumers want.

Monzo's US team — headquartered in LA — is modest but growing. It also has the advantage of having secured some local heavyweights, including Erin Coppin as its compliance chief (she is a former executive at Airbnb and crypto giant Coinbase).

What about its plans to apply for a US banking charter? The firm hasn't actually begun the formal filing process yet (not least because it involves making a huge amount of information public). It's now unclear if this vision has been shelved, especially given a new ruling against fintechs last month. Monzo will, therefore, continue leveraging its partner US bank, Ohio-based Sutton.

Note that all three challengers declined to discuss the details of their US bank partnerships. For its part, Revolut said it has chosen its partner because it was “financially strong” and publicly listed in New York. N26's Kopp has also been vocal in opting against getting a bank charter initially, shifting the main regulatory duties onto its partner entity.

A big nut to crack

It's hardly revolutionary to highlight that Europe's neobanks face a tough battle in the US.

“What I tell companies when they want to go to the US is 'think of it like China'. The cultural gap between the US and Europe is as big as Europe and China,” Yann Ranchere, a partner at early-stage venture capital fund Anthemis, told Sifted.

Hence, I was surprised that not one of the neobanks has employed a US-native to lead the operation so far.

The key cultural barriers for the European challengers are firstly that Americans rely more heavily on credit cards, secondly that they travel overseas less (limiting the appeal of cheap FX fees) and thirdly that US millennials are reportedly less interested in financial management tools.

The challengers are also limiting their pool because — in the absence of a physical branch — they can't verify users without a US social security number. This, therefore, excludes overseas visiting students and unemployed migrants from signing up.

A beacon of light

Despite the barriers, I'm positive the challengers can carve out a limited niche. They can offer microloans that big banks won't. They've got experience rallying the grassroots. They cut across different verticals for genuine convenience. They're also not plagued by heavy bureaucracies and legacy systems so they can make the necessary partnerships and fixes quickly. And their healthy fundraises help too, meaning they can afford to get in front of people.

Admittedly, I was largely met by blank stares when I asked Americans about digital banks. But the handful who were familiar sounded hopeful.

“I first heard about Monzo while travelling South America. Banking with JPM Chase I was paying outrageous fees for all of my spending, while my friends with Monzo were living a fee-free experience,” said Mallory, 31, a marketing executive from Ohio. “I signed up when I got home and have been awaiting Monzo in the US since 2017. I love the concept of a digital, borderless bank and the flexibility it offers.”

As an aside, Estonia-based TransferWise has also shown America can be open to new fintechs. The company's annual report showed that the US made up 25% of its total revenue between March 2018 and 2019. TransferWise has been available in the US since launching in 2011.

Meanwhile, although credit remains king in terms of total transaction values, data suggests debit-cards and mobile banking are becoming more popular.

Ultimately, the US is not a winner-takes-all market, so Europe's challengers may well co-exist. But they will, of course, vary in their individual success — so who’s going to get ahead?

“People ask 'is it going to be Monzo, Revolut or N26'. I don't think that’s the way it’s going to be. It's also Chase and Wells Fargo... Americans go for the best offering. They don't care who [it is],” Revolut's Dan Westgarth surmised.

“I can't wait to see how it all plays out.”

Nor can we Dan, nor can we.