It’s a good time to be a fintech-focused VC. Over the past six months in Europe, there have been €22.6bn worth of exits, according to PitchBook data, meaning big wins for a lucky few investors.

Among the biggest exits were Wise’s £8bn direct listing and Visa’s planned acquisitions of Tink for €1.8bn and Currencycloud for £700m.

€22.6bn is already an all-time record and compares to less than $2bn in 2020, where there was an unexpected dearth in M&A activity.

The data paints a picture of impressive price tags and a maturing sector, building on top of a strong year of fundraising.

The large number of exits is good news for investors and founders alike, with VCs looking to reinvest their returns back into the ecosystem.

Among the VCs who are celebrating this year will be Tink backers Eurazeo Growth and Dawn Capital, as well as Valar Ventures, who was one of Wise's top investors.

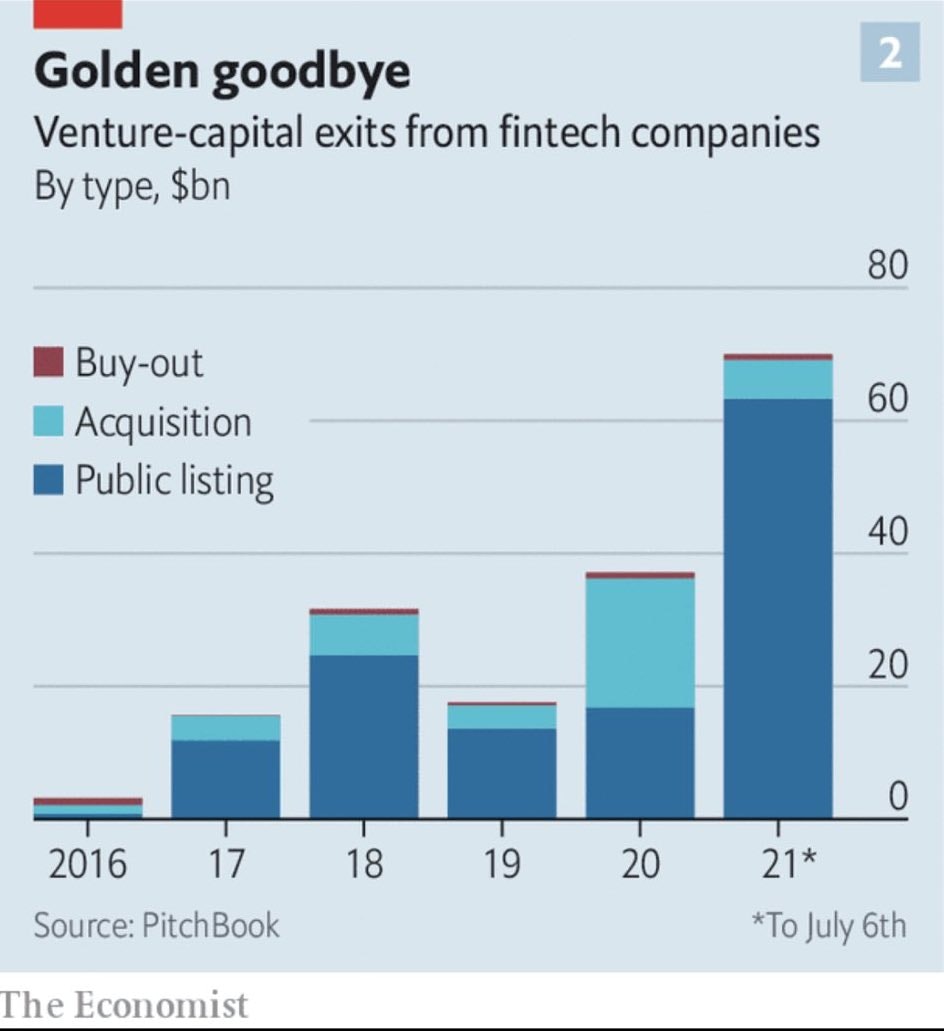

The exit train has also taken off outside of Europe. PitchBook shows that the first half of 2021 has already been twice as lucrative as 2020 for fintech exits globally.

In total, fintech exits banked VCs $70bn between January and July globally, concentrated in major public listings like Coinbase. Around 20% of the global exit figure came from Europe.

Unsexy sells

A breakdown of the data shows that much of the fintech consolidation in 2021 has happened in the B2B segment.

Among the top acquisitions were Tink, Contis (which recently sold to Solarisbank) and Nowo. These broadly encompass the unglamorous but profitable world of financial management, payments, application programming interface (API) connectivity and banking-as-a-service.

B2B acquisitions make sense for older companies who needed to modernise quickly during the pandemic, says Paul Cuatrecasas, the CEO of boutique M&A firm Aquaa.

"The pandemic created a digital tidal wave. If you were not digital before the wave hit, then you had to acquire something to become more digital once the wave hit, even as the tide rose," he tells Sifted.

B2B fintechs have also proven more popular on the investment side, overtaking funding into consumer startups last year to become the new ‘el dorado’.

Nonetheless, consumer fintechs still have their own appeal as potential acquisition products, according to a16z general partner Anish Acharya.

"I think the best companies own distribution not product... These products are not that sophisticated, what's sophisticated is the reach that companies [like Plaid and etrade] have," he said last year on the a16z podcast.

"For the first time, fintech startups are at the scale that they can actually represent a new growth curve for incumbents," he added, commenting on the burst of fintech M&A seen in the US last year.

Saying that, digital banks are yet to edge towards consolidation. Although there are now 300+ digital banks worldwide, very little M&A has materialised here in Europe or beyond (with the exception of JP Morgan's recent purchase of Brazil's C6). A report last year by Finch Capital blamed this on a lack of "big bold buyers" in fintech.

More in the pipeline

2021 could still deliver another wave of exits before it's over.

IPOs rumours are already swirling around Sweden's Klarna listing for north of $33bn. Others expected to be courting the public markets are Trustly and Interactive Investors.

There are also several key buyers on the acquisition hunt.

Firstly, SPAC sponsors are looking to buy (and list) Europe's fintech unicorns. While most of the SPACs are based in the US, Europe also welcomed its first fintech-focused SPAC in EFIC1 recently. That would prompt an exit of at least $1bn, following in the footsteps of eToro.

"[SPACs] could definitely create opportunities for... [smaller] candidates such as Qonto or Solaris," says Claire Calmejane, chief innovation officer at Societe Generale.

Meanwhile, large financial institutions — from banks, to PayPal, Visa and Mastercard — are expected to ramp up their M&A budgets in the post-Covid, digital world. This is likely to focus on features like digital wealth products or technological improvements.

Another possible set of buyers could be large Chinese firms. Earlier this year, Sifted reported that Chinese strategic investors were increasingly eyeing European fintechs. That trend could now well branch into acquisitions (pending regulatory approval).

Finally, intra-fintech M&A could be on the cards. Among the local fintechs who have publicly stated their intention to buy their peers are Revolut, Bunq, Starling and N26.

There were over 30 intra-fintech acquisitions globally in 2020, particularly in the remittances space, according to TNW's Index.

"To remain relevant in a world where digital disruption rules, these fintech players must use acquisition as a means to remain relevant, increase scale and not become a takeover target themselves," says Aquua's Cuatrecasas.

The question now will be: will their desired startups agree — or be forced — to sell?

The exit leaderboard

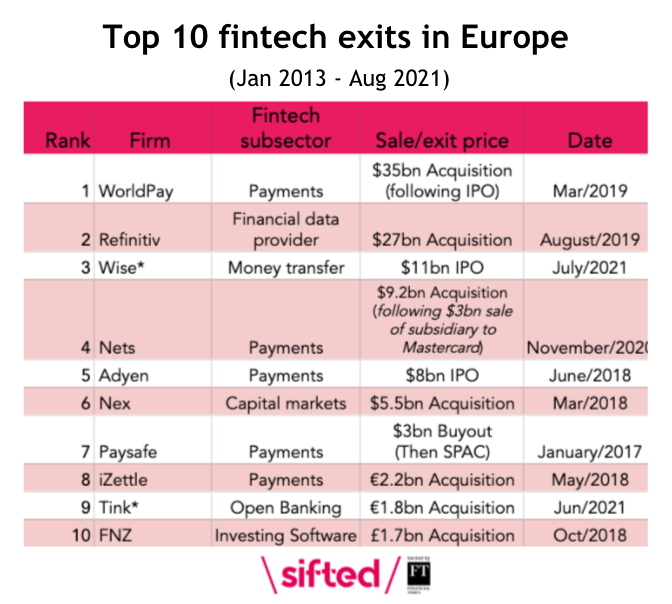

While 2021 has been a blockbuster year, lucrative fintech exits aren't entirely novel.

Between 2013 and 2019, European fintechs pulled in €83bn via initial public offerings or acquisitions, according to one Dealroom report. Much of that was concentrated in payment companies, like Adyen and WorldPay.

By way of context, the top 10 exits in the fintech space ever are as follows:

**

*Appendix: Fintech exit volumes on a global basis