Digital banks, trading apps, savings bots, and ‘underbanked’ solutions are by far the most hyped companies in the fintech genre.

But investors feel differently.

European funding is now more heavily concentrated in business-to-business (B2B) fintechs than in consumer fintechs, according to Dealroom data.

This year so far, European fintechs have raked in €6.3bn; €5bn of which has gone to B2B fintechs across 373 deals. Meanwhile, consumer-fintechs have raised a total of €3.1bn across 209 deals (including several mega-rounds).

* Under Dealroom's definitions, B2B fintechs include companies like Klarna, as they provide payment solutions as well as consumer credit. They are therefore also counted in the B2C category.

Despite consumer fintechs enjoying greater brand recognition, European investors now seem to be prioritising less-glamorous B2B fintechs.

Startups in the B2B category include spend-management platforms like SpendDesk, as well as real-time payment processors and infrastructure players like Tink.

A similar shift towards B2B is also being seen in major hubs like India. In 2019, India's B2B fintech startups outpaced their B2C counterparts in fundraising for the first time in 5 years; taking in $657m compared to $617m in the B2C space.

"For a long time, B2B has been overshadowed by the glitz of B2C fintech," says Michael McFadgen, a partner at Element, a fintech fund focused on enterprise startups, based in London.

Payment-based fintechs are doing particularly well. There were 420 "paytech" deals globally (across acquisitions and investments) in the second quarter of 2020, overtaking the entire number of deals for 2019, according to PitchBook data.

New York's Melio secured one of the top paytech rounds with a $144m raise last month to help businesses pay their suppliers.

Another dominant area of B2B fintech investment is identity-authentication solutions for financial services. This includes CallSign, Onfido, Fundbox, and, Asensys — several of which have seen large rounds in recent months.

- Read TearSheet's list of top B2B fintechs

I would say B2B is the new 'el dorado'

Money talks

When it comes to turning a profit, B2B fintechs generally have the upper hand.

Most B2B fintechs are software-as-a-service firms, providing strong unit-economics and a sticky, scalable client-base.

In contrast, consumer fintechs have grown rapidly, but their ability to breakeven and defend against new competitors is still in doubt, making them a moonshot investment.

"Enormous markets, high customer retention, very attractive unit economics, and large scale shifts in buying behaviour all help make B2B fintech companies very valuable," says McFadgen.

Indeed, the B2B financial market is bigger than the consumer market. For instance, volumes of B2B payments dwarf business-to-consumer activity by $124tn to $2.5tn.

"I would say the new 'el dorado' is B2B," says Romain Grimal, an investment manager at France's BlackFin Capital Partners. "B2B revenues are perceived to be more stable [and] there’s still a lot of procurement money to be found in financial services."

Grimal also makes the distinction between fintechs catering to "small businesses" and those servicing "big businesses" (or enterprises). Although both technically classify as "B2Bs" and cater to an important niche, the latter has a particular advantage, he says.

"Incumbents are willing to put a lot of money on the table to improve."

To this point, one big driver of B2B investment has been major bank venture arms like Citi's and Santander's, which have an incentive to support fintechs they may themselves use one day.

Research by Bloomberg Intelligence shows that US banks "have been at the forefront of [global] spending on fintech;" much of which has gone to B2B startups the bank can leverage themselves.

There's also more money to come, with UBS planning to invest hundreds of millions of dollars in fintech startups that can improve the "underlying operations of the bank, according to a Fortune report.

It goes in cycles...B2C will come back.

The Covid effect?

The added pressure of the lockdown may have expedited investors' appetite for B2B, says CB Insights analyst Anisha Kothapa.

With the prospect of a global crunch and a rise in unemployment amid the virus, B2B arguably offers a better sanctuary for VCs than the high-risk, high-reward of early consumer-fintechs.

"The majority of fintech investments this year [in the UK] have gone to B2B fintechs like Onfido, Modulr, and Codat... B2B fintech companies are emerging to provide companies tools and solutions that can reduce the resources required to run a successful business [during the pandemic]," Kothapa said.

VCs will also be buoyed by soaring public stocks in this space, says Tim Levene, a partner at consumer-fintech fund Augmentum.

"Software as a service is hot for sure...clearly public market multiples are helping fuel this path," he tells Sifted.

Romain Grimal says his fund (traditionally focused in B2B fintech) has never been more active, despite initially pausing their investments at the very start of lockdown. As such, BlackFin has deployed more capital than in the previous 12 months.

Still, while B2B theoretically offers less risk for investors, it doesn't mean these companies are entirely immune from the effects of the virus.

Some companies are feeling the pinch, says McFadgen, especially with sales-cycles delayed and banks' budgets under scrutiny,

"No doubt B2B will feel some pressure if (for example) bank technology budgets shrink in 2021," he notes.

A broader change in flow

Although coronavirus may have catalysed VCs interest in B2B fintechs, it's also a sign of fintech's growing maturity.

In 2018, Mitesh Soni, director of innovation at giant software fintech Finastra, wrote that corporate and institutional buyers felt "neglected and poorly served by the fintech movement," and that "none of these innovations have made it to the corporate world."

In short, consumer fintechs had led the wave of innovation in financial technology, leaving a gap in the business sector.

This created a fresh opportunity for a new generation of fintechs, who began leveraging the learnings and infrastructure from the consumer-world to tap into the more complex needs of the business world.

It's natural then, that fintechs that began their journey several years ago are starting to get attention, says BlackFin's Grimal.

"B2B companies that may have started in 2017 or 2018 are now seeing some traction," he told Sifted.

He also noted that the dominance of consumer-fintechs in the last ten years has met a natural peak.

"It’s overcrowded and there’s investor fatigue there"

Yet Augmentum's Levene isn't convinced the shift will last. He argues that the recent boom in B2B investment could be part of a hype cycle, and that soaring public stocks have attracted 'tourist' investors to the B2B space.

"It goes in cycles...B2C will come back."

Indeed, consumer companies like TransferWise, Nutmeg, and SoFi are still held up as investor-darlings. Indeed, over the summer, consumer fintechs secured several mega-rounds amid the pressures of coronavirus.

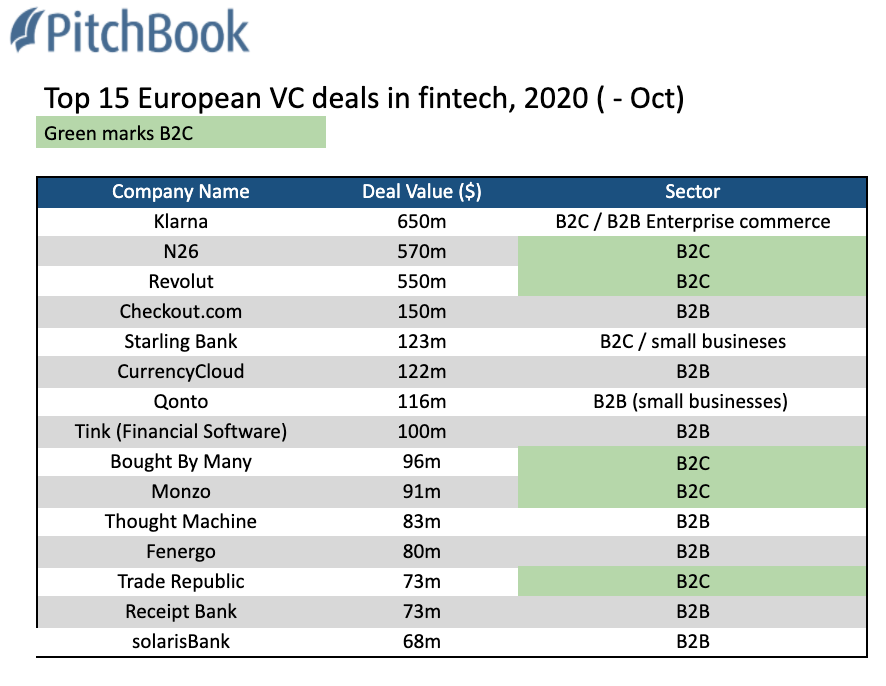

B2B fintech rounds topping Europe's leaderboard

Aside from there being more B2B deals in general, the size of these rounds also seems to be growing thanks to a wealth of large investors.

In 2019, digital banks dominated the list of Europe's biggest fintech rounds due to their high-growth models and large cost-bases.

But this year, just 5 of the 15 largest rounds have gone to pure B2C players. Instead, there's a much broader mix of B2B firms among the fray of top-rounds.