Unless you’ve just started learning about Europe’s startup ecosystem, you’ll have heard about one of its biggest challenges: ‘the growth funding gap’.

Lobbying bodies like the European Startup Network have singled out securing late-stage funding as one of the biggest problems facing startups right now. Governments also think it’s an issue — and politicians and public funders are ramping up programmes to help put more growth capital into VC funds and startups. France’s Tibi programme has pledged €7bn to attract more investment into late-stage funds; the EIF’s Tech Champions Initiative has €3.75bn to back big growth funds; and the recently-announced WIN initiative in Germany aims to direct more money into growth funding.

European startups, however, raise far less than their US counterparts. According to the European Investment Bank (EIB), by the time European companies are 10 years old, they’ve raised 50% less capital than their San Francisco-based peers on average. Meanwhile, VC investment in US startups is up to eight times higher than in Europe.

US VCs participate in many of Europe’s chunkiest late-stage deals (Series C to D). So far this year, US VCs have invested in a third (238) of Europe’s growth rounds, worth €6.6bn; meanwhile there have been 801 growth deals without US VC participation, worth roughly €4.1bn, according to PitchBook data provided to Sifted.

Some think that’s a problem. But — given that many promising startups in Europe, like Mistral, Helsing and DataSnipper — are getting funded, others aren’t so sure.

Is the late-stage funding gap a myth?

“I tend to think the [late-stage funding gap] is a myth actually,” Christoph Janz, founding partner of Berlin-based VC Point Nine, told Sifted earlier this year. “The funding gap in Europe, which was massive 10-15 years ago, has been largely closed because there are now many more European funds [and]…because many US funds have started to invest in Europe some years ago.”

Janz adds there are still differences between the two ecosystems: “The best-funded companies still tend to be in the US, and most tech companies aspire to go public in the US. But in contrast to 10-15 years ago, European startups don't have to move to the US to raise a Series A or Series B round.”

Torsten Reil, cofounder and co-CEO of defence company Helsing — which is reported to be raising a new round at a $4bn valuation — agrees.

“There is no growth-funding gap in Europe. A quick scan of the past few years shows that good companies have found it easy to raise large rounds,” he told Sifted. “It is true that most growth funding in Europe has come from US investors, so there is an opportunity for quality European growth funds to participate more.”

“Having said that, most complaints about funding gaps come from sub-par founders. Please quit and do something else.”

Going long

Not everyone sees entirely eye to eye. “I believe the best companies do manage to raise growth rounds, mostly from non EU investors,” Jordi Romero, cofounder and CEO of Spanish HR unicorn Factorial, which raised an $120m Series C in 2022 and an $80m debt facility from General Catalyst in April this year.

“But having few growth investors locally definitely means fewer growth rounds here. Some companies skip the growth round and settle for less aggressive (but profitable) growth — or sell too early, which is one of the big challenges from the European tech ecosystem: few go long long,” adds Romero.

This is a concern often raised by European policymakers and — when it comes to strategically important technology, like climate tech and AI — they’re increasingly keen to keep those businesses on European soil.

“If you're looking at the type of [European] companies that could compete for global technology leadership, we need to be aware that over the last decade or so, 80% of the financing rounds that really brought those companies to global scale have been led by US VC firms or by Asian corporate VC firms,” Uli Grabenwarter, deputy director at European Investment Fund (EIF), told Sifted last year. That means those scaleups often IPO abroad, or are bought by foreign buyers. “This is something that an economic space like the EU cannot be satisfied with.”

Some startups, like German AI startup Aleph Alpha, have been eager to raise only from European investors for this reason, an investor in the company told Sifted. Its most recent $500m round in November was raised almost exclusively on the continent — with just US-based Hewlett Packard Enterprise chipping in a small ticket.

Others, like French GenAI poster child Mistral, are growing teams and gaining political goodwill on home turf — but also raising significant amounts of funding from US investors.

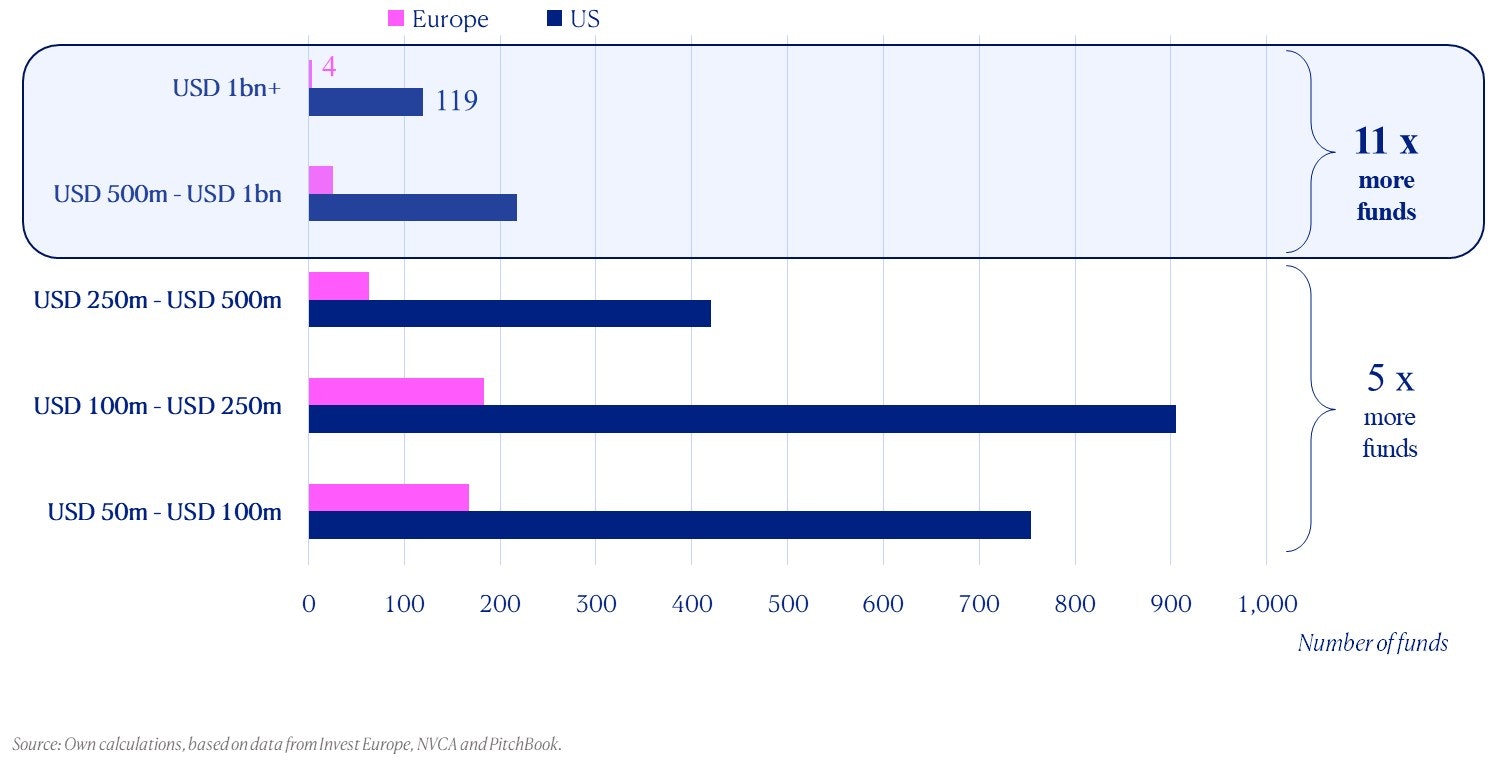

“The main issue is that the best European tech companies are being funded by non-EU capital," an EIF spokesperson told Sifted this week. “There are about 11x more US scaleup funds than EU funds."

"We have noticed a worrying trend as this gap is increasing in the past two years. The unicorns rounds in most of the EU countries shows that the largest tickets are taken by US and Asian investors, while European capital is available from pension funds and insurance companies," the EIF spokesperson adds.

Its European Tech Champions Initiative — which will invest in 15 growth funds, and hopes to invest in 15 more from a second pot of funding — hopes to somewhat close this gap. "It's difficult to match the investment capacity of the US but we will have a competitive alternative to offer European funding to Europe’s tech champions."

The big rounds

Among the big rounds closed this year is Mistral’s massive €468m equity round, space logistics startup D-Orbit’s $110m raise and hydrogen tech startup Sunfire’s €215m equity round.

Avid Larizadeh Duggan, senior managing director at growth investor Teachers’ Venture Growth, told Sifted earlier this year that the best businesses — many of which will have got to profitability or be on track to do so — don’t struggle to find new investment. “High quality and disruptive companies are coming to the market to raise,” she said. “It’s still competitive for the good ones at the later stage.”

Nirwan Tajik, senior associate at French growth firm Revaia, agrees. “High-quality scaleups, that might have stayed put in 2023, are coming this year to market and are now closing large rounds at very rich valuations.”

What's more, he thinks, things should only head up from here. If the “macroeconomic environment continues to improve, especially with interest rates finding a long-term equilibrium, we could see a significant uptick in later-stage dealmaking over the next 12-18 months."