US food delivery giant DoorDash has been hunting around Europe for competitors to buy for months, and it’s finally picked one: Finland’s Wolt.

Today, the two businesses are announcing that DoorDash has acquired Wolt in an all-stock transaction for €7bn.

That’s a solid outcome for the Helsinki-based scaleup. British competitor Deliveroo was valued at around £7.6bn when it listed on the London stock exchange in May this year, although its share price subsequently plummeted and it's currently valued at £5bn. JustEat, another UK-based food delivery behemoth, was acquired by Amsterdam-based Takeaway.com in a deal worth $7.3bn in 2020.

Wolt, which was founded in 2014, was a pioneer in the European food delivery sector. It has over 4,000 employees and operates in 23 companies.

Frankly speaking, if you had asked me a few months ago, I would have said we would rather compete [against DoorDash]. I just saw that we can do so much more together

Like many of its competitors, Wolt saw business boom during the pandemic, jumping from 700 employees and €87m in turnover in 2019 to 2,200 employees and $345m in revenue in 2020.

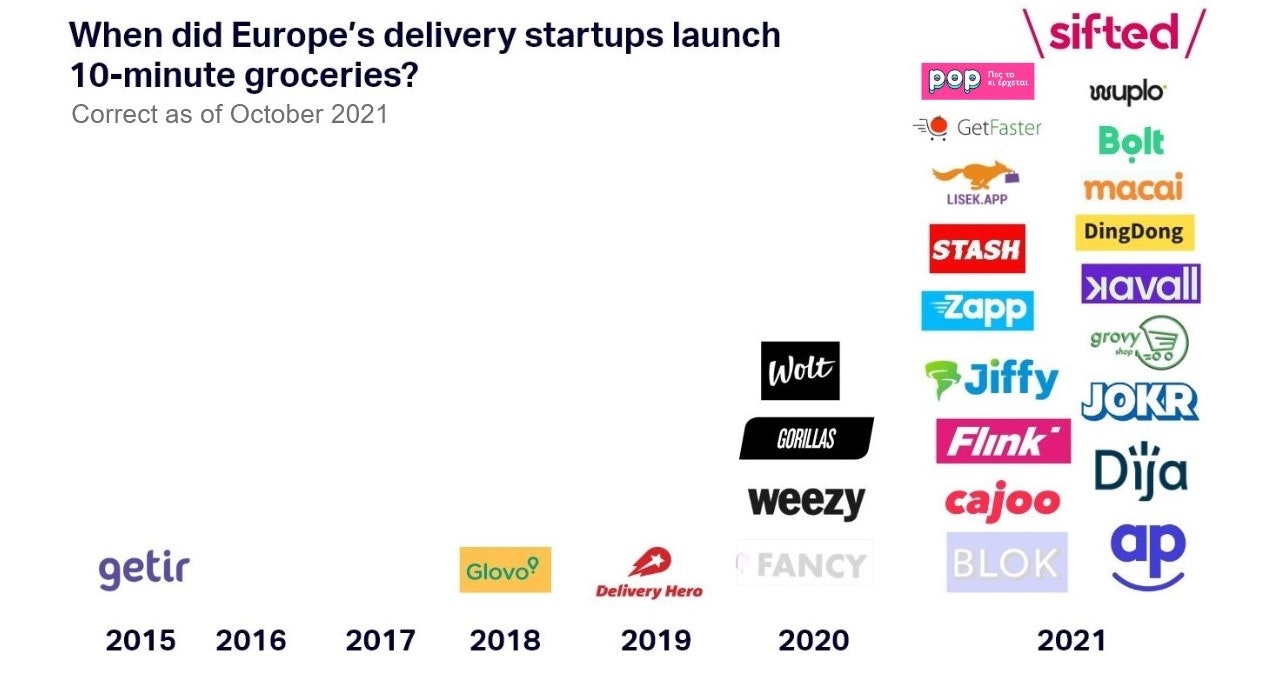

It has also been exploring the super-hot grocery delivery sector, experimenting with a handful of “dark stores” in Finland and signing partnerships with big and small food retailers across Europe.

What about that float?

Last time Sifted spoke to Miki Kuusi, Wolt's cofounder and chief executive, the endgame was an initial public offering (IPO). “We started the readiness process after the last round,” he told us back in January, when Wolt announced a $530m investment led by ICONIQ Growth.

In conversation with the FT this week, Kuusi said: “Frankly speaking, if you had asked me a few months ago, I would have said we would rather compete [against DoorDash].

“I just saw that we can do so much more together, because ultimately, we’ve always been an underdog company that came from a difficult home market.”

If the acquisition goes through, Kuusi will run DoorDash International and expand the joint business into new markets. He will report to DoorDash boss Tony Xu.

A spicy market

This acquisition is just the latest in a frenzied market, in which several better-capitalised food delivery companies are snapping up — or investing in — smaller or younger businesses.

Earlier this week, US-based Gopuff formally announced its expansion into the UK via its acquisitions of Dija and Fancy.

DoorDash is also reported to be investing $400m into Flink, a Berlin-based super-fast grocery delivery startup, as part of a $600m Series B round expected to close this week.

Meanwhile, Germany’s Delivery Hero invested $235m into speedy grocery upstart Gorillas as part of a $1bn Series C round in October.