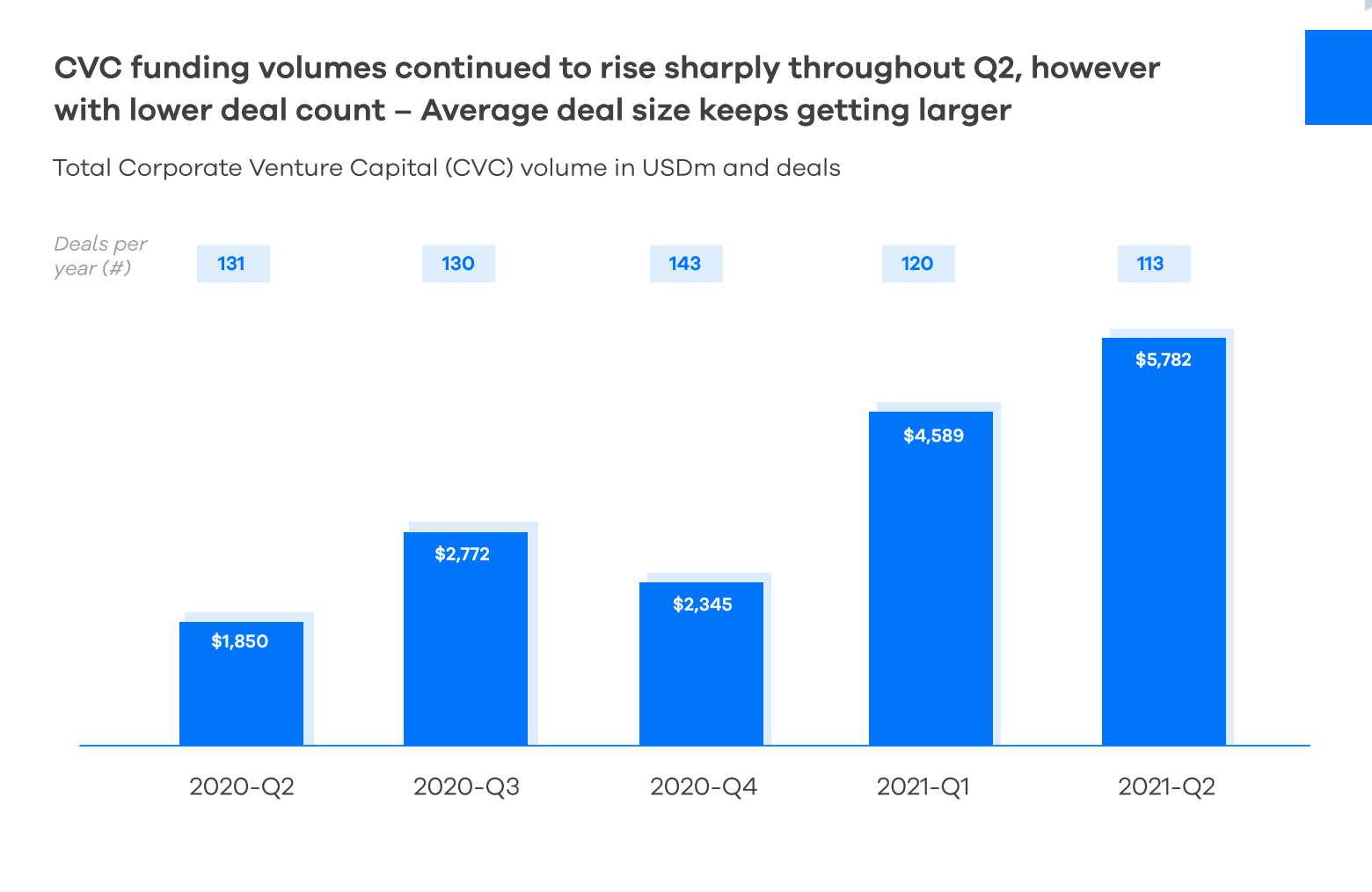

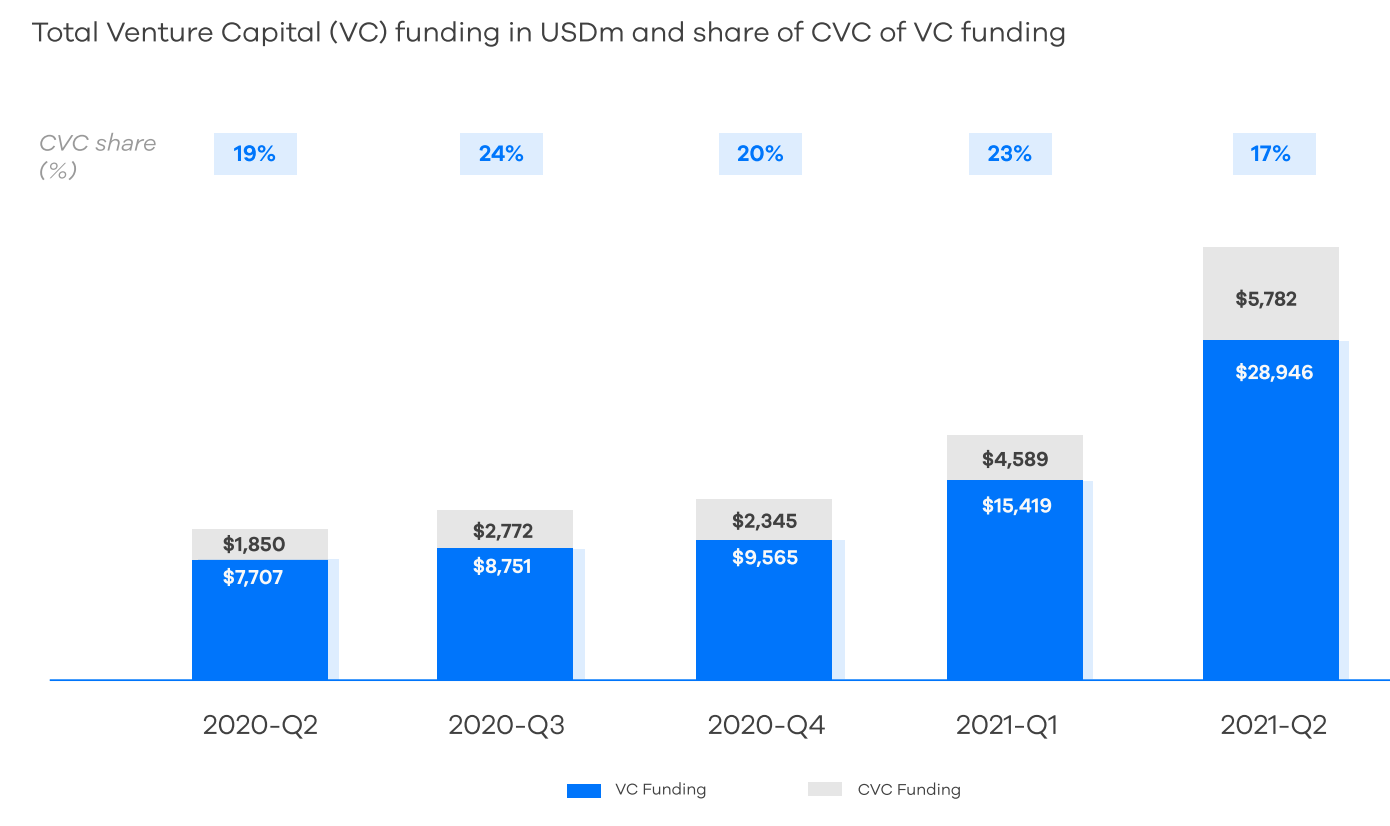

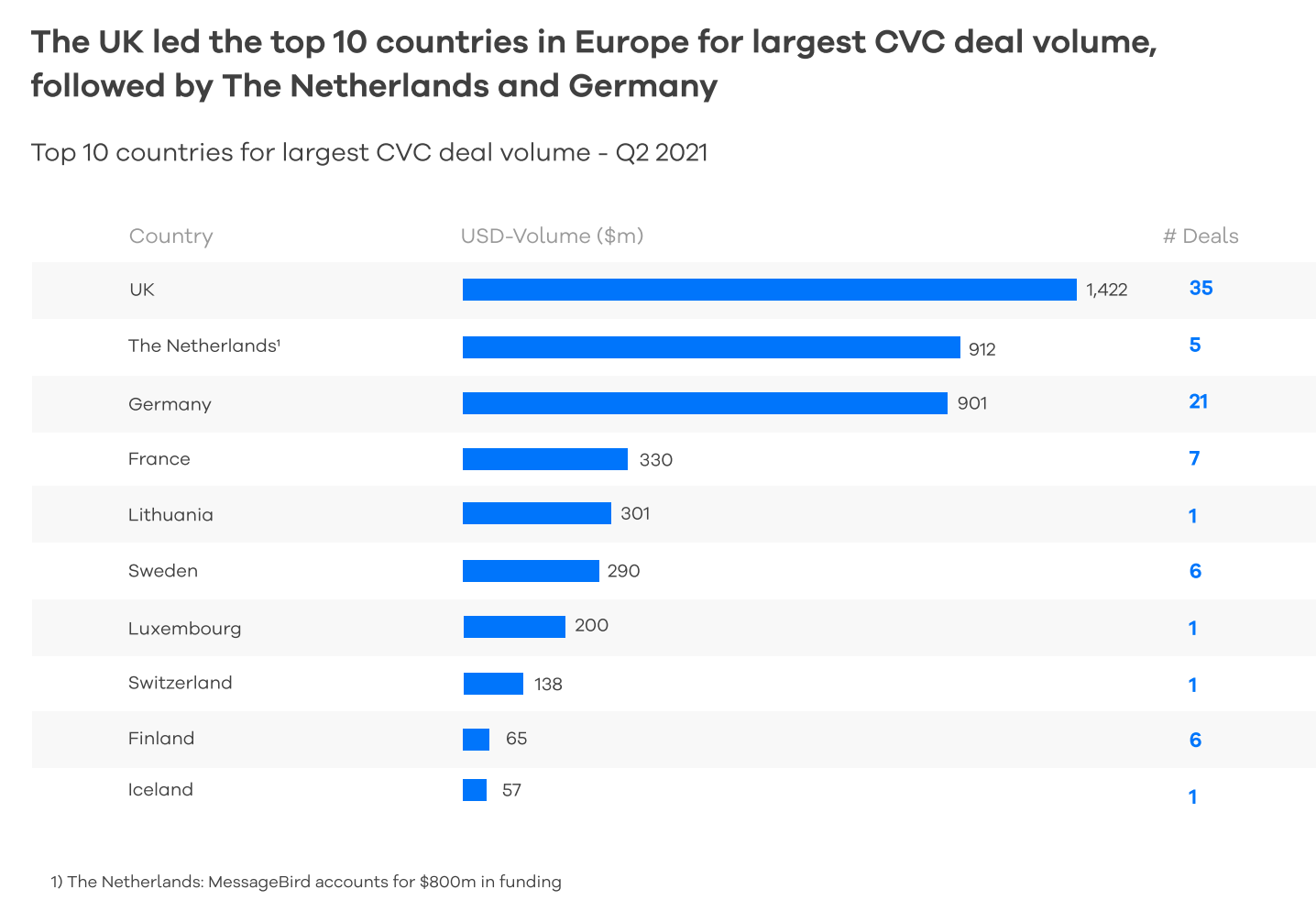

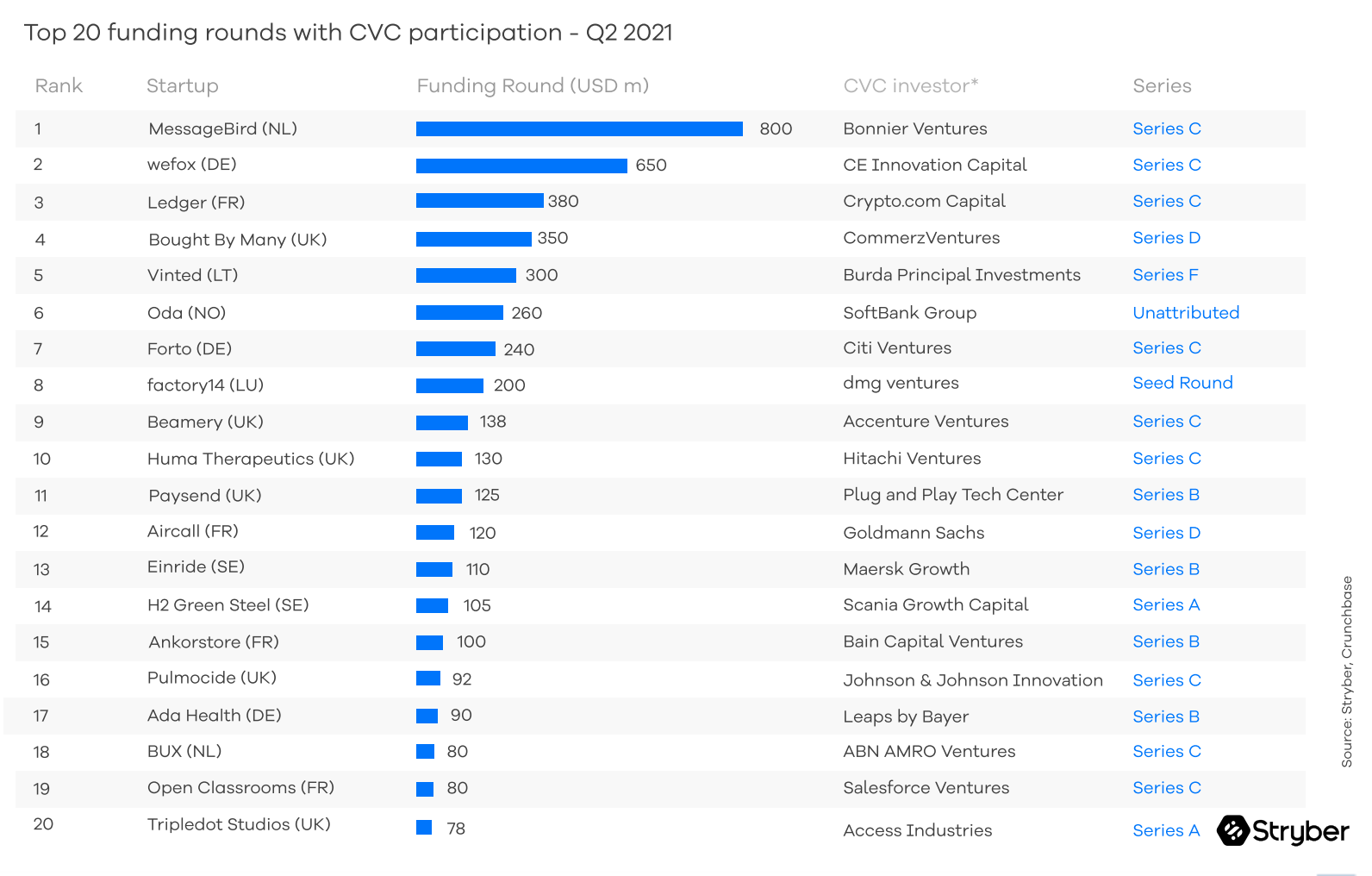

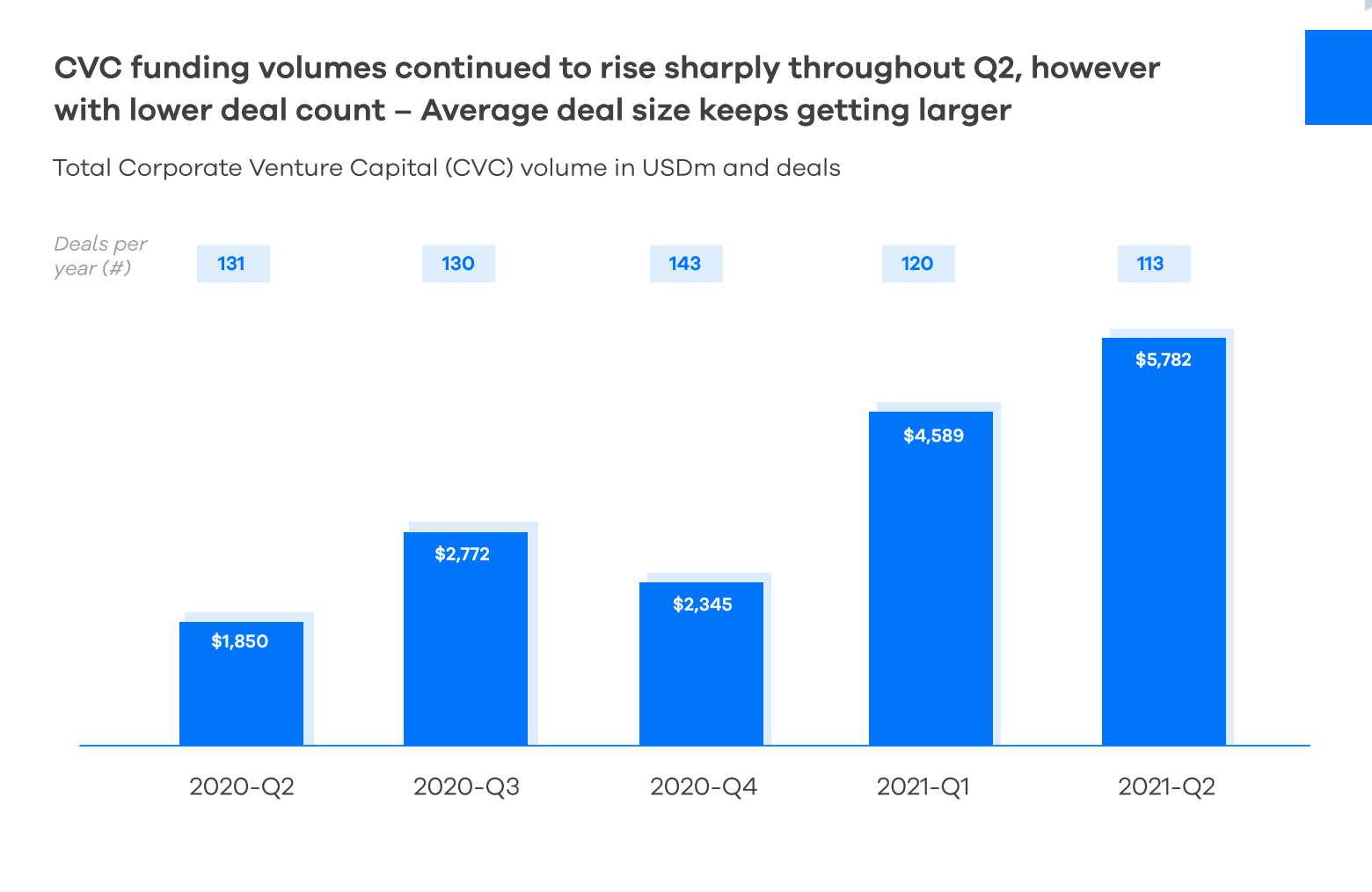

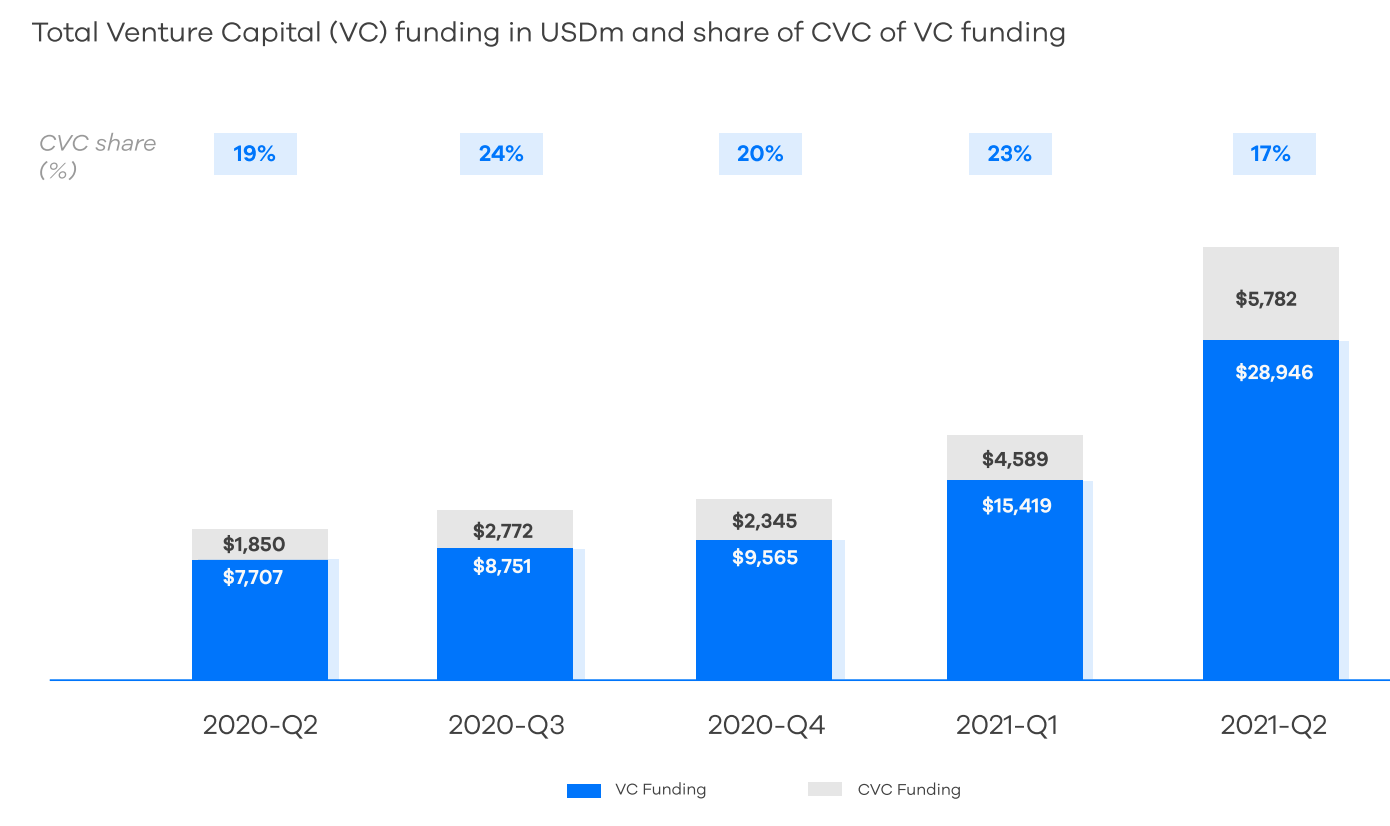

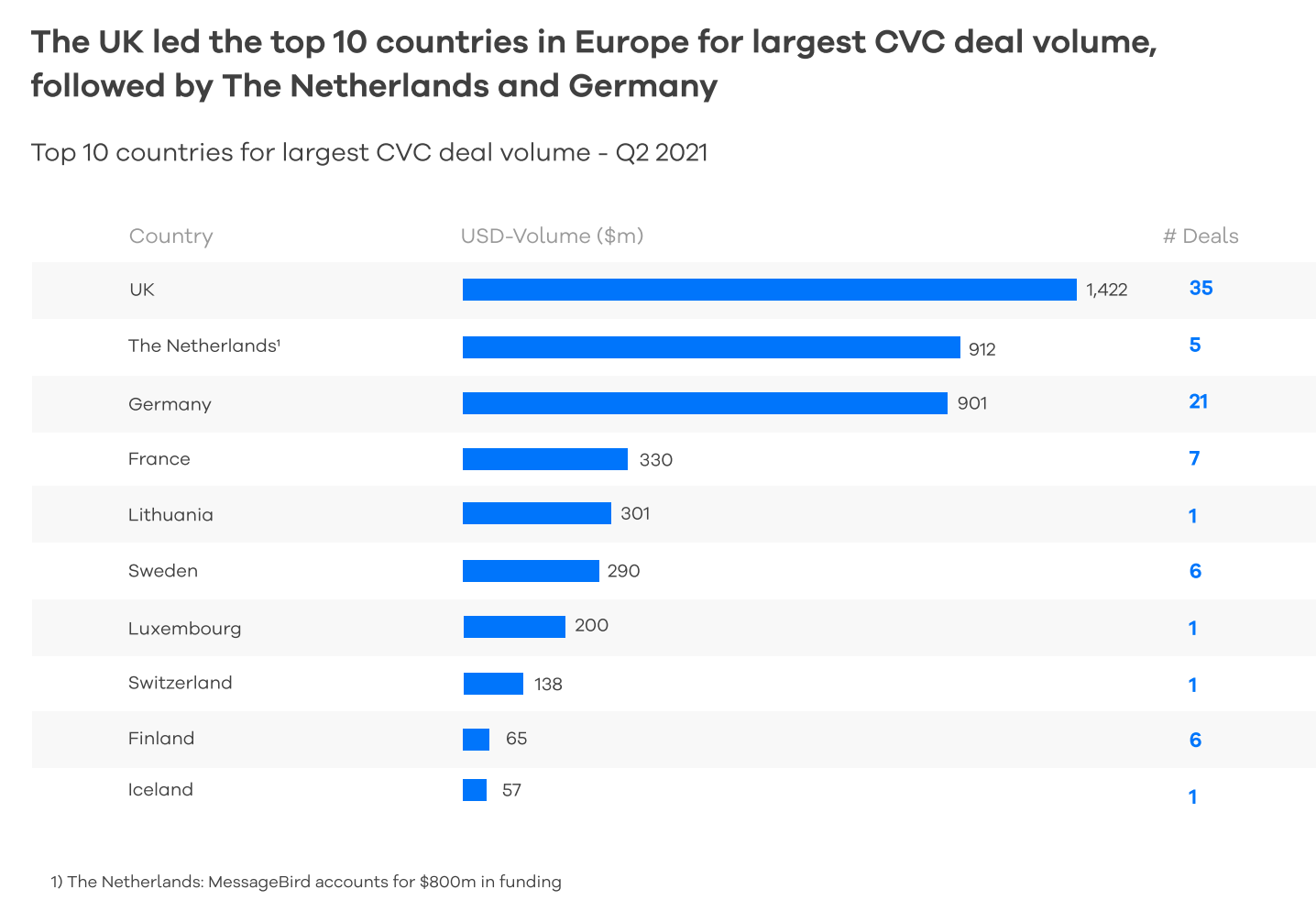

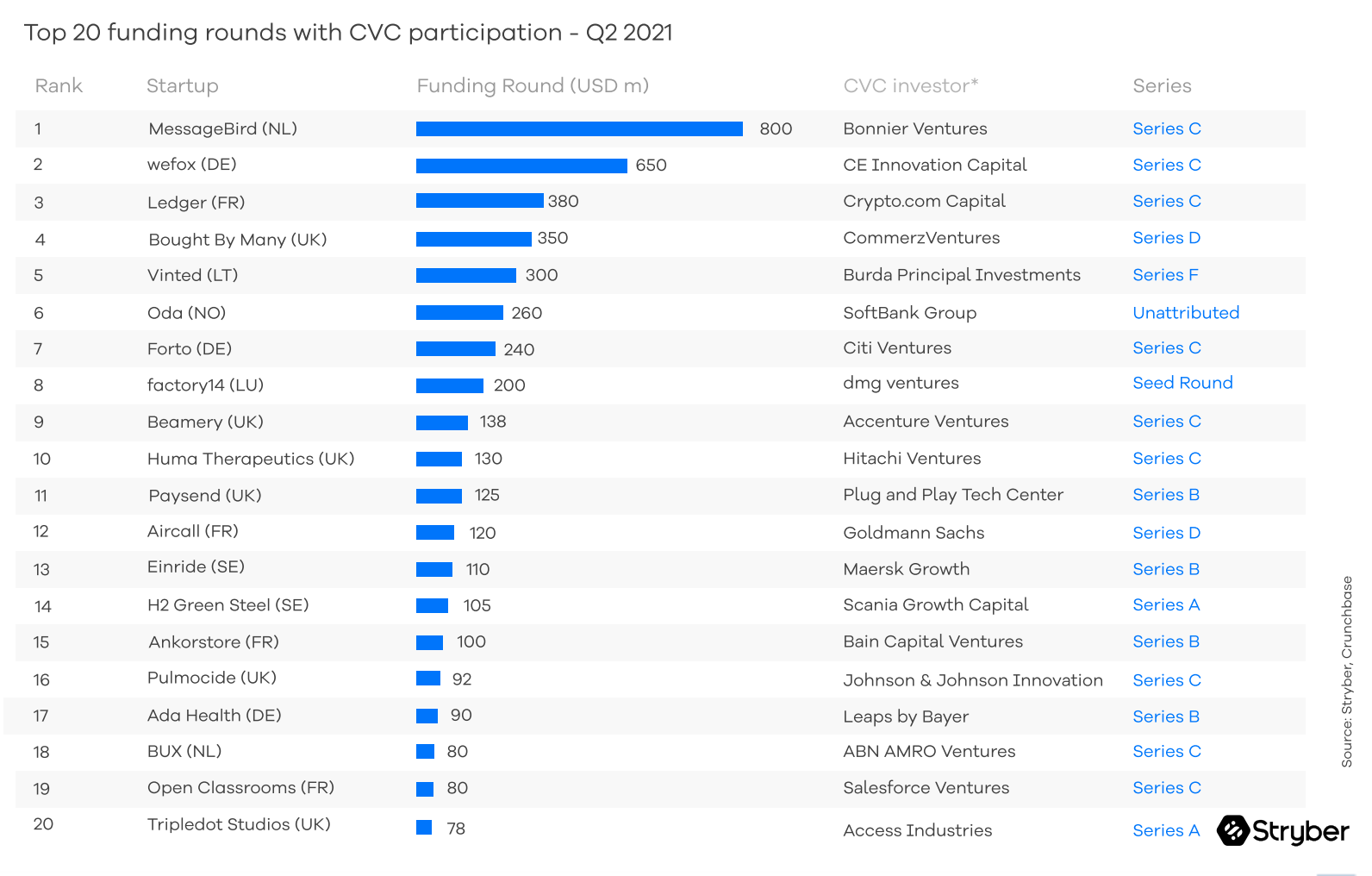

There is no sign of the corporate venturing boom slowing down, with investment reaching a new high of $5.78bn in the second quarter of 2021. Here's a snapshot of the market in five charts, courtesy of innovation consultancy Stryber.

Analysis

August 24, 2021

3 min read

There is no sign of the corporate venturing boom slowing down, with investment reaching a new high of $5.78bn in the second quarter of 2021. Here's a snapshot of the market in five charts, courtesy of innovation consultancy Stryber.

Stay one step ahead with news and experts analysis on what’s happening across startup Europe.

Recommended

Corporate VC deals hit a record high in 2020

A lot of 2020's biggest rounds included corporate VC involvement, like those secured by Northvolt, Hopin and CureVac

The six types of CVCs — and how to pick the best one for your company

From single balance sheet investments to an independent fund, here's how to chose the CVC model that works for you.

Why are corporates increasingly spinning-out their CVC units?

Moving faster on deals is often the stated motivation. But we need to discuss the problem of CVC partners earning more than CEOs.