This year, a record 29 companies in the FTSE 100 appointed new CFOs. At the same time,a new crop of finance startups have been looking to bring automation and AI to the office of the CFO.

These developments point to a shakeup in finance.

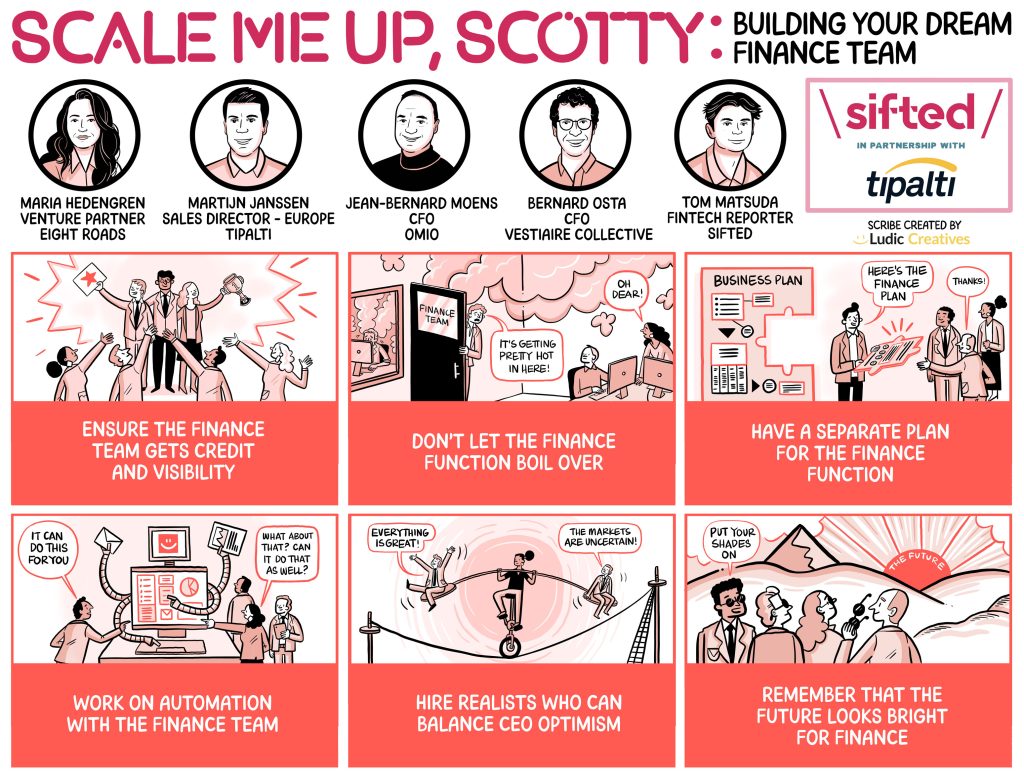

In our latest edition of Sifted Talks, we discuss how startups can retain and build finance teams under these conditions. We also explore the significance of automation and where the finance function is headed in the future.

Our speakers were:

- Maria Hedengren, venture partner, Eight Roads

- Bernard Osta, CFO, Vestiaire Collective

- Martijn Janssen, sales director - Europe, Tipalti

- Jean-Bernard Moens, CFO, Omio

Here are the key takeaways from the panel:

1/ Ensure the finance team gets credit and visibility

The panel opened by discussing the reasons behind CFO exits over the past year, including high visibility on a company’s finances leading to high expectations and emotional strain, shifting market conditions, and pressure from manual tasks and operational demands.

Osta, a newly appointed CFO, said the finance function is a highly visible and scrutinised role. He advised founders: "Ensure the finance team gets the credit they deserve, the visibility they deserve, and the firepower they need to execute."

For Moens, holding frequent Q&A sessions to emphasise the finance team’s trusted position within a company and to give staff the floor to express concerns can help manage stress. Also, it shows leadership "sometimes" has the answers.

"The finance team is sometimes viewed more as a cost centre than a function that has the potential to improve cash flow and the top line," — Maria Hedengren, venture partner, Eight Roads

2/ Don't let the finance function boil over

Next, the panel noted that high CFO turnover might be due to changing market conditions, moving from a high-investment, growth environment in the early 2020s to a more challenging backdrop today.

"The shift from a 'growth-at-all-costs' mantra towards 'we need to be more savvy, look at different metrics, be more agile' is going to be difficult for CFOs from a traditional background," said Janssen. "A lot of time is wasted on manual tasks, keeping the business running… and that's where there's a lot of pressure."

Osta believes automation may hold the key but warned: "You can only automate a process you have mastered." Otherwise, it is not the "magical solution" some believe it to be.

Moens, whose travel company Omio experienced a significant downturn during Covid, added it’s important to hire for where you are in the business lifecycle.

"I inherited a [legacy] system. Yes, you can fine-tune it, but if you don't have the right people to lead, it won't work," — Jean-Bernard Moens, CFO, Omio

3/ Have a separate plan for the finance function

In a strong economy, Osta said there is often a desire to grow the finance team at the same pace as the rest of the business. He advised against this: "For me, the pace of development of finance should be one of its own, not related to upturn or downturn."

Hedengren said CFOs with soft skills are the most appropriate for today's market.

"If you put your hand on the finance leader's chair, it should be cold, because they're out there interacting with their business," — Hedengren, Eight Roads

4/ Work on automation with the finance team

Don't dictate how automation is implemented if you want buy-in, said Hedengren. "Someone once taught me to use the 'Ask, Don't Tell' strategy so that the learning emerges from the bottom up," she said.

Janssen said that the aim of AI and automation should be to enhance human work. But there are a few areas where automation excels, such as invoice scanning, he said, adding that Tipalti’s system can recognise patterns, flag potential issues and provide advice.

Janssen warned against pessimism and said AI and automation give finance professionals the tools to gain credibility.

"[Involving finance teams when implementing new systems] helps them realise that automation can bring them forward and be helpful rather than feeling imposed upon," — Moens, Omio

5/ Hire realists who can balance CEO optimism

In today’s challenging economic climate, hiring staff who can play devil’s advocate is useful, said Moens: "It’s about communicating with people and thinking through problems together and finding out where we can land."

Hedengren had some advice for CFOs: "I'm always thinking, how can I help them navigate their ideas? Take every opportunity to show that you are business-oriented, so when you do need to put your foot down, you have some credibility.”

"How can you ensure that as a finance person, you're not just there to say, 'Oh, sorry, Mr. CEO, this is not reality'? You have to become more of a business partner for them." — Martijn Janssen, Sales Director - Europe, Tipalti

6/ Remember that the future looks bright for finance

The panel concluded with optimism about the future of the finance department and automation playing a key role in making the department more varied.

Osta said: "When Gen X comes into finance, it will remain a great place to learn how to do business because you have a very comprehensive view of the issues a business faces."

Janssen predicted finance processes will become more demanding due to more stringent approval processes and the complexity of managing supplier information — a Tipalti report found that processing times for accounts payable have risen by 24% to 41 minutes per invoice — but he said he remains optimistic about the future.

"Finance is becoming much more of a central piece of any organisation, and that's what people want—they want to make an impact. Leave automation to the boring stuff so they can spend more time making an actual impact." — Janssen, Tipalti

Like this and want more? Watch the full Sifted Talks here: