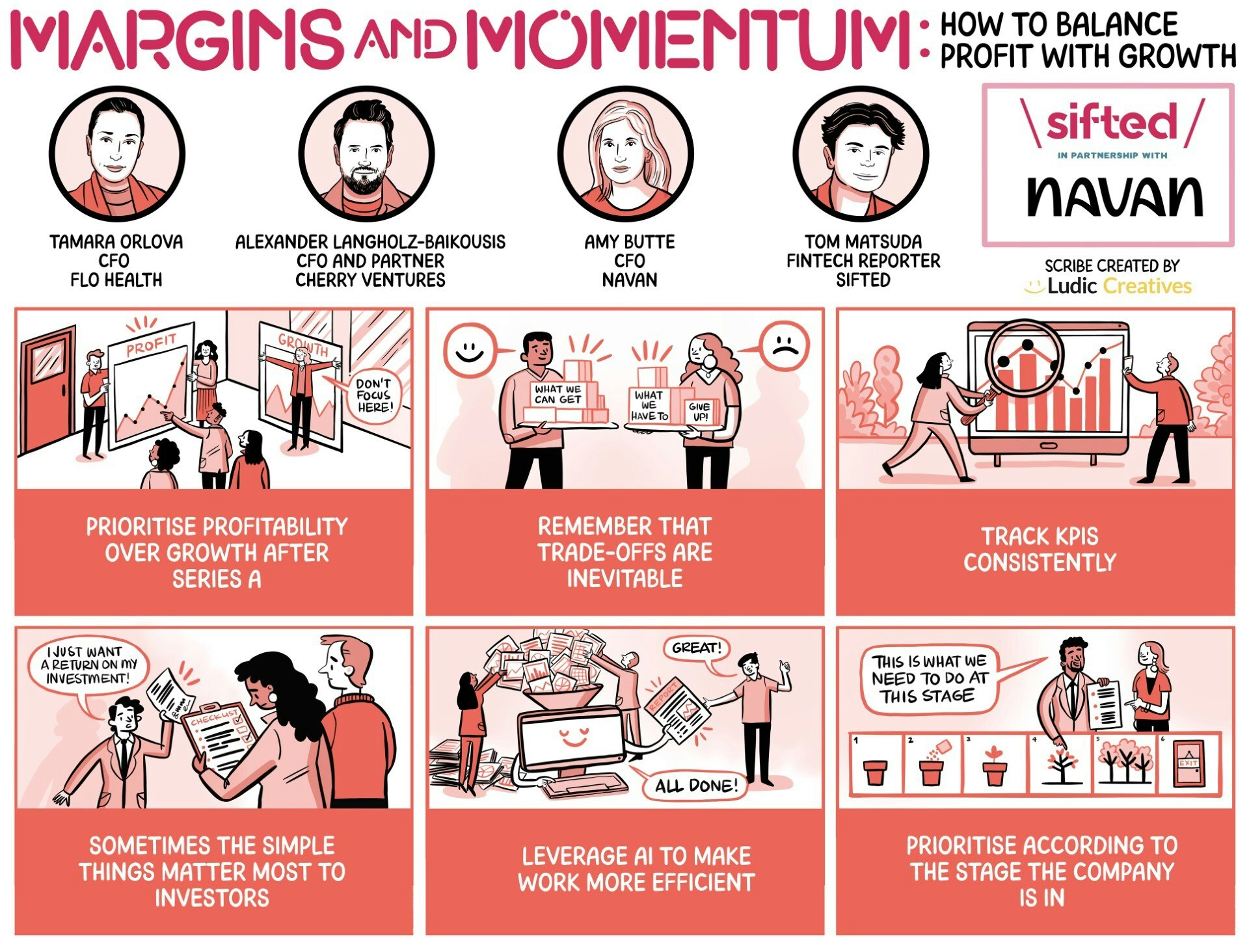

Balancing profit with growth has never been more challenging. Inflation, rising costs, macroeconomic uncertainty and rapid technological advancement are making it increasingly difficult for startups to determine where to allocate their time and resources.

In our latest Sifted Talks, a panel of experts — Alexander Langholz-Baikousis, CFO and operating partner at VC firm Cherry Ventures, Tamara Orlova, CFO at female health app Flo, and Amy Butte, CFO at business travel and expense management platform Navan — explored how to strike the right balance between growth and profitability in 2025.

Here are the key takeaways from the panel:

1/ Prioritise profitability over growth after Series A

Firstly, why is it so important for startups to focus on profitability over the ‘growth-at-all-costs’ strategies tech saw in the early 2000s?

Butte said that investors have now decided that showing discipline, or the ability to be cash-flow positive, is a priority.

“For a business like Navan, we think about this discipline as being illustrative of our maturation process. Capital isn't as easy to find today, and so profitability isn't only a measure of your discipline — it’s an indicator of your ongoing operations,” she said.

While Cherry Ventures’ Langholz-Baikousis agreed that the status quo has changed in recent years, he said the goal for young companies remains finding product-market fit and testing the go-to-market strategy. However, for those in the later stage — Series A and B — it is crucial they prove their unit economics actually work.

For Orlova at Flo, which was valued at €1bn in August 2024 during its Series C, making it Europe’s first femtech unicorn, the priority should be on both growth and profitability equally.

“Out of more than 6,000 publicly listed businesses in the US, there were fewer than 300 that grew more than 30% last year. High-paced growth does contribute significantly to valuation.” — Tamara Orlova, Flo

2/ Remember that trade-offs are inevitable

For Orlova, startups are constantly mulling what trade-offs must be made between growth and profitability: Can we hire more and raise more? Should we take a more conservative approach to growth? She said Flo always chose the latter, raising relatively little throughout its lifespan (by Series C, less than €100m).

Butte echoed the sentiment, adding that Navan's team discuss trade-offs “once a month, if not once a week” when making key decisions. Her advice: agility is key when managing trade-offs, so look for efficiencies.

“We've gone from a mid-50% gross margin to 70% by leveraging AI. The conversation has shifted from how we use AI to improve our gross margins to how we can now use AI to grow revenue. It gives you the flexibility to invest more in growth.” — Amy Butte, Navan

3/ Track KPIs consistently

Langholz-Baikousis emphasised the importance of consistently tracking KPIs. One critical metric is burn multiple, which measures how much a startup spends to generate new revenue. Another is efficiency over time, such as gross margin, which serves as a strong indicator of profitability.

As both a former seed-stage startup founder and an early-stage startup investor, Butte noted that thinking ahead is crucial, even in those busy, early days.

“When making choices — whether hiring in finance or elsewhere — showing that you’re thinking about these topics, that it’s not just about the product but also about the infrastructure, demonstrates you’re thinking in the right way.” — Butte

4/ Sometimes the simple things matter most to investors

What are the most critical KPIs a startup CFO should track to measure ROI?

Orlova said it’s first about identifying the main areas of investment and spending, as well as where controls should be tight and well-defined. She gave marketing as an example, explaining that traditional metrics like Lifetime Value Transaction, customer acquisition cost and the length of the payback period are key KPIs of performance and marketing efficiency.

Langholz-Baikousis agreed with the other panelists but pointed out that sometimes the simple things matter most.

“Think of the things that investors don't often ask about. Do you need five offices if the leadership team works remotely? These things are increasingly important, because it’s also your money you're investing.” — Alexander Langholz-Baikousis, Cherry Ventures

5/ Leverage AI to make work more efficient

One of Navan’s recent successes is their chatbot Ava, which now fields 55% of all customer support requests. By the time a request reaches a human, the easy stuff is done, said Butte.

The top use cases for AI at Flo? Predicting customer behaviour and marketing. Orlova said AI has helped assess the effectiveness of user acquisition by predicting lifetime value, conversion rates and retention at the user level. In finance, AI has helped with reconciliation and financial planning and analysis. But some doubts remain.

“We're yet to see how well it could work in those areas. Almost every vendor advertises AI, but I suspect a lot of them are still probably at an early stage.” — Orlova

6/ Prioritise according to the stage the company is in

Orlova reiterated the importance of defining focus areas, understanding the company’s position and setting appropriate benchmarks.

Butte said the best CFOs think ahead — not just “three steps, but 10, 20, or even 25.” She stressed that vision is crucial for messaging to investors and internal teams. Everyone relies on that vision, she said, and a CFO has the opportunity to shape it — whether through the tools they choose or the strategic priorities they set.

Lastly, Langholz-Baikousis said that a CFO must stay deeply connected to the business, acting as a counsellor to the CEO and providing answers on increasing spending.

“CFOs need to be very literate, and need to know their numbers. Maybe at a later stage, you're profitable and want to focus on treasury management because you have so much cash in the bank. It’s all about prioritisation according to the stage you're in.” — Langholz-Baikousis