Atomico’s 2023 State of European Tech report paints a topsy-turvy picture of European tech.

Investors and founders alike are struggling to raise cash, investment has dropped on levels seen across 2021 and 2022 and funding for underrepresented founders is still embarrassingly poor.

But it’s not all bleak in Europe.

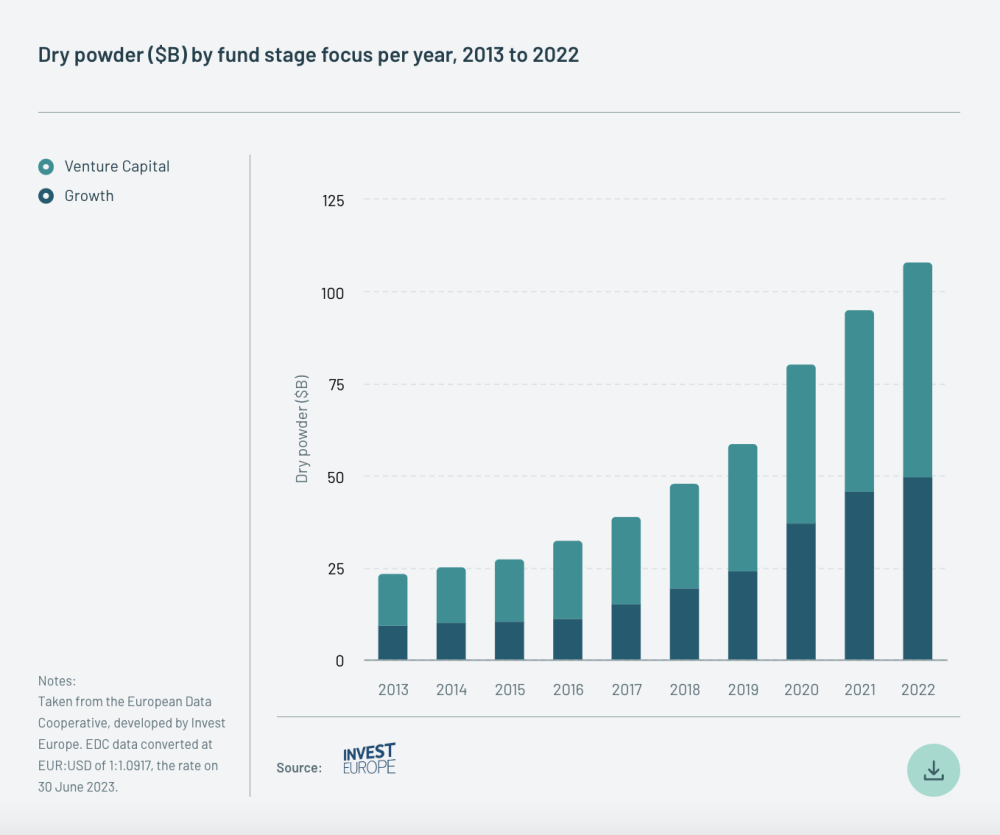

VCs are sitting on record amounts of dry powder, early-stage funding has stayed relatively stable across 2023 and Europe is producing more new founders than the US.

The State of European Tech report features data from a number of deal counting platforms, alongside a survey of more than 4,100 founders, VCs, LPs and startup operators.

Here are Sifted’s top takeaways.

Europe vs the US: Europe can hold its own against the world’s biggest startup ecosystem

1. European funding figures aren’t as grim as they first appear

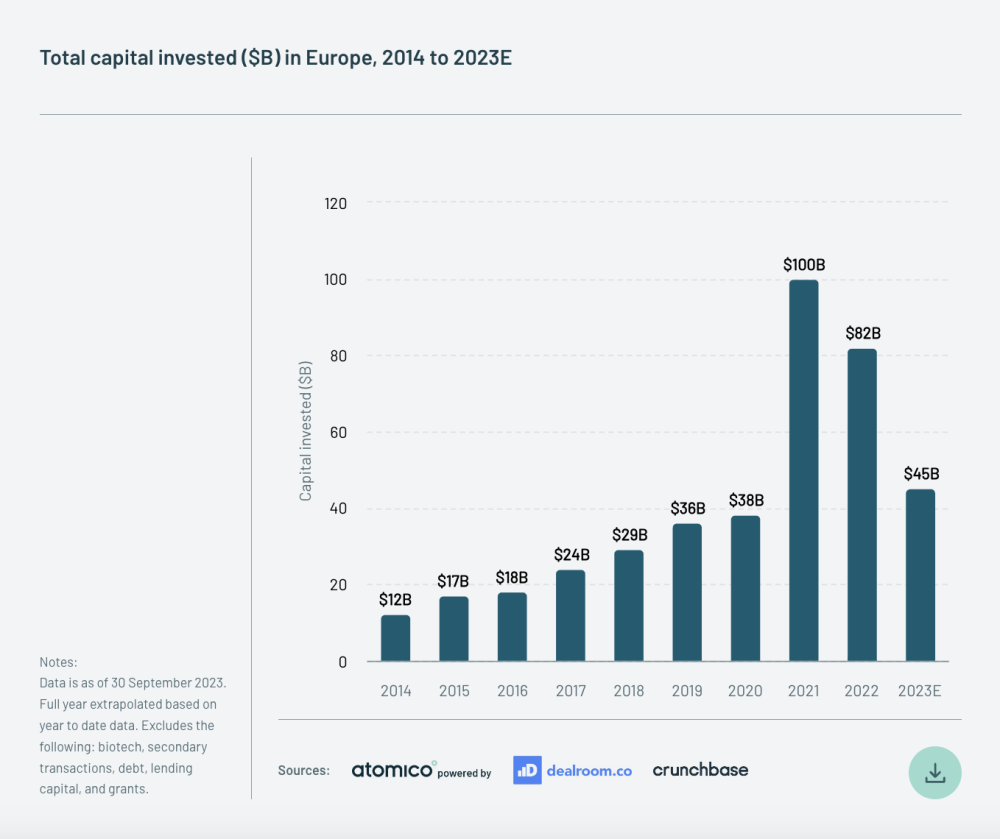

$45bn will have been pumped into European startups by the end of 2023, the State of European Tech report predicts — a drop of more than half on the peak of $100bn in 2021.

But Europe is the only region where those numbers have risen from 2020 levels, rising by 18%. In the US, the expected $120bn in funding for 2023 is a 1% drop from 2020. Figures for China and the rest of the world are expected to drop by 7% and 8%, respectively.

2. New European founders outnumber US counterparts

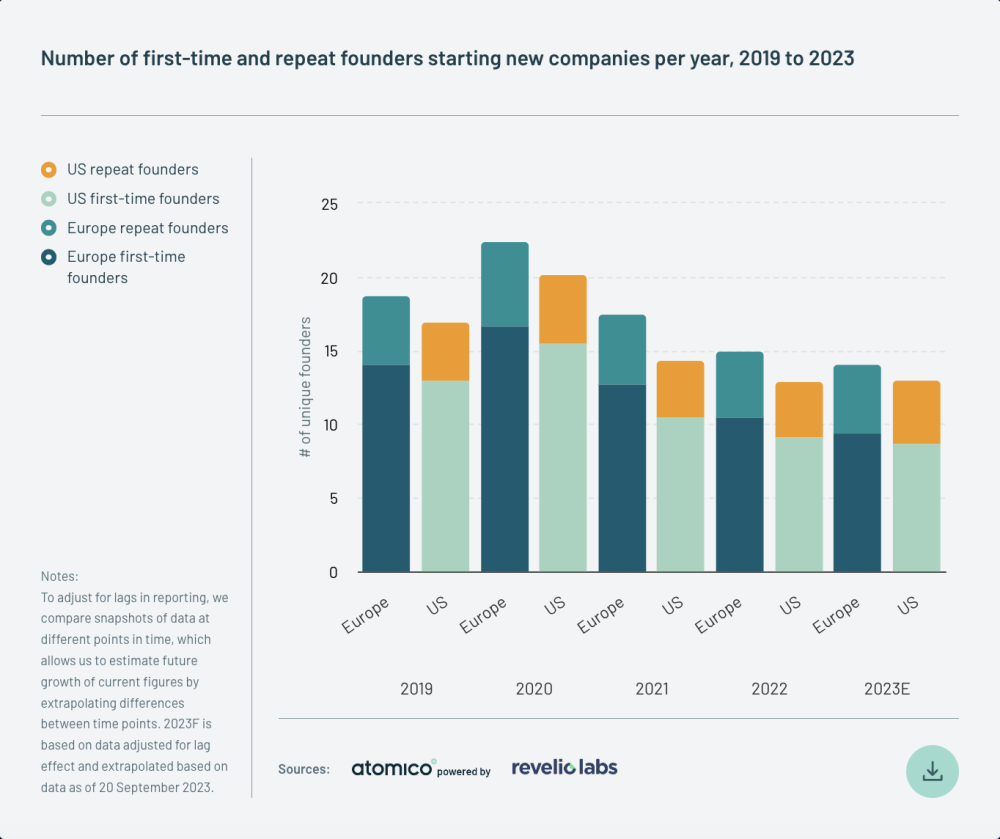

While the rate that founders are starting new companies has fallen 30% since its peak in 2020, there are more new first-time founders in Europe than there are in the US.

3. Talent continues to turn to European tech

Europe is also poaching more US talent than it loses to the country. 8,400 US tech workers have arrived in the region so far this year, compared to 8,300 heading across the Atlantic.

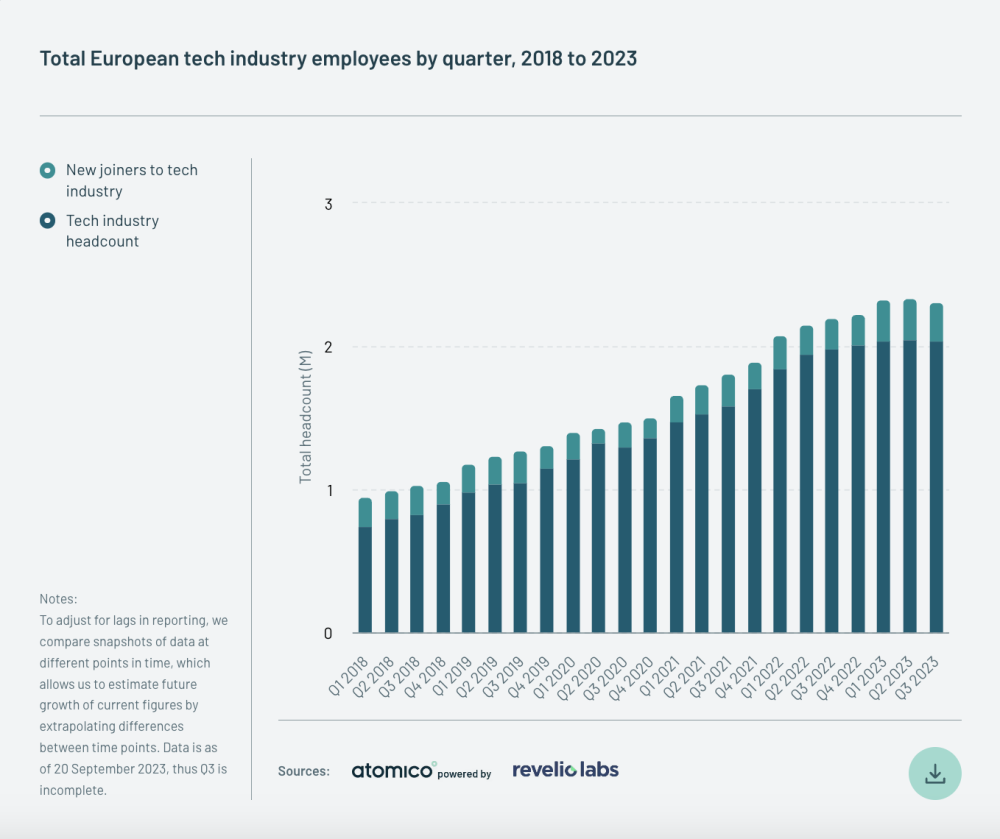

It's part of a wider trend of a growing European tech talent pool. While numbers seem to have levelled off in 2023, in the past five years European tech has expanded its workforce from 1m employees to more than 2m.

The slowdown

1. Where have all the unicorns gone?

The unicorn stable is looking very bare in 2023. Just seven new unicorns had been minted as of the end of October — including AI startups Synthesia and DeepL and financial crime company Quantexa — falling from 108 and 48 in 2021 and 2022, respectively.

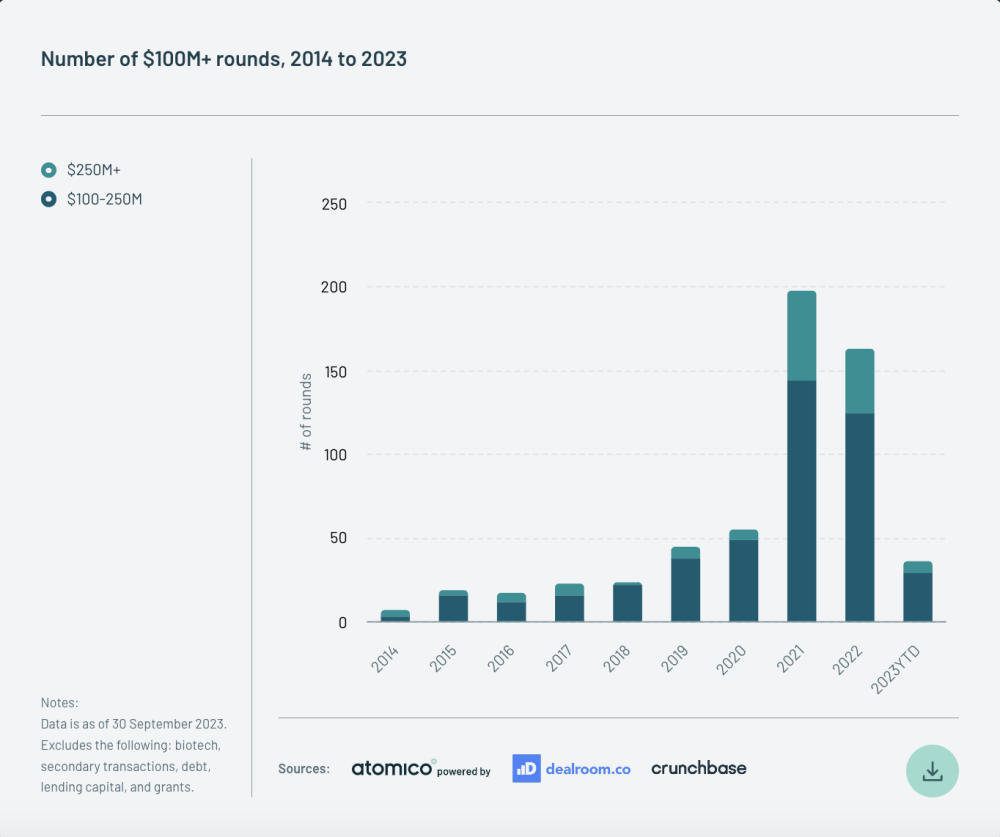

That’s driven by the dearth of megarounds in tech this year. In the first nine months of 2023, just 29 companies have raised $100+ rounds and 7 have raised $250m or more.

But things aren’t looking so gloomy at smaller startups in European tech.

$13.7bn was raised by early-stage companies in the first three quarters of 2023. Annualised, that figure rises to $18.3bn — a short drop from highs of $20.5bn and $20.6bn in 2021 and 2022, respectively.

2. Bridge rounds on the up

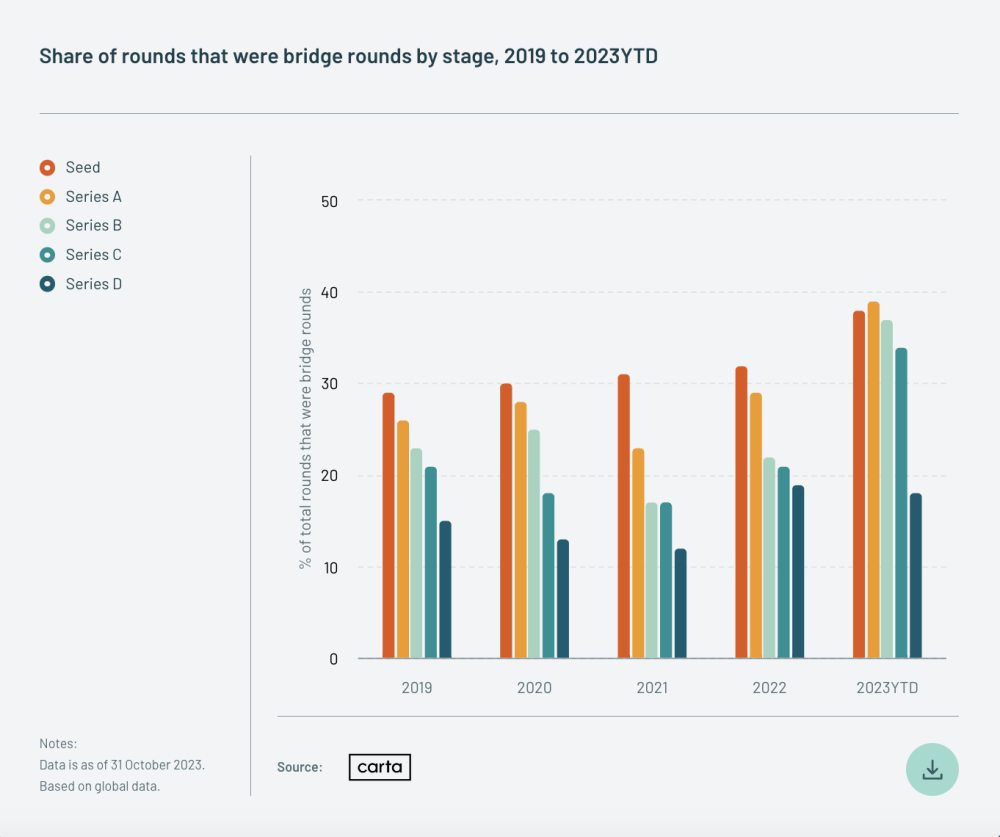

As it’s become harder to raise funding, bridge rounds have become ever more important for startups.

While bridge rounds are historically more common at early stages, as startups look to buy time to develop product-market fit, the biggest increase in 2023 has been at Series B and C. As of the end of October, 34% of Series C rounds were bridge rounds, versus 21% the previous year. Those figures were 37% for 2023 and 22% for 2022 for Series B.

3. Falling international investment hits growth stages

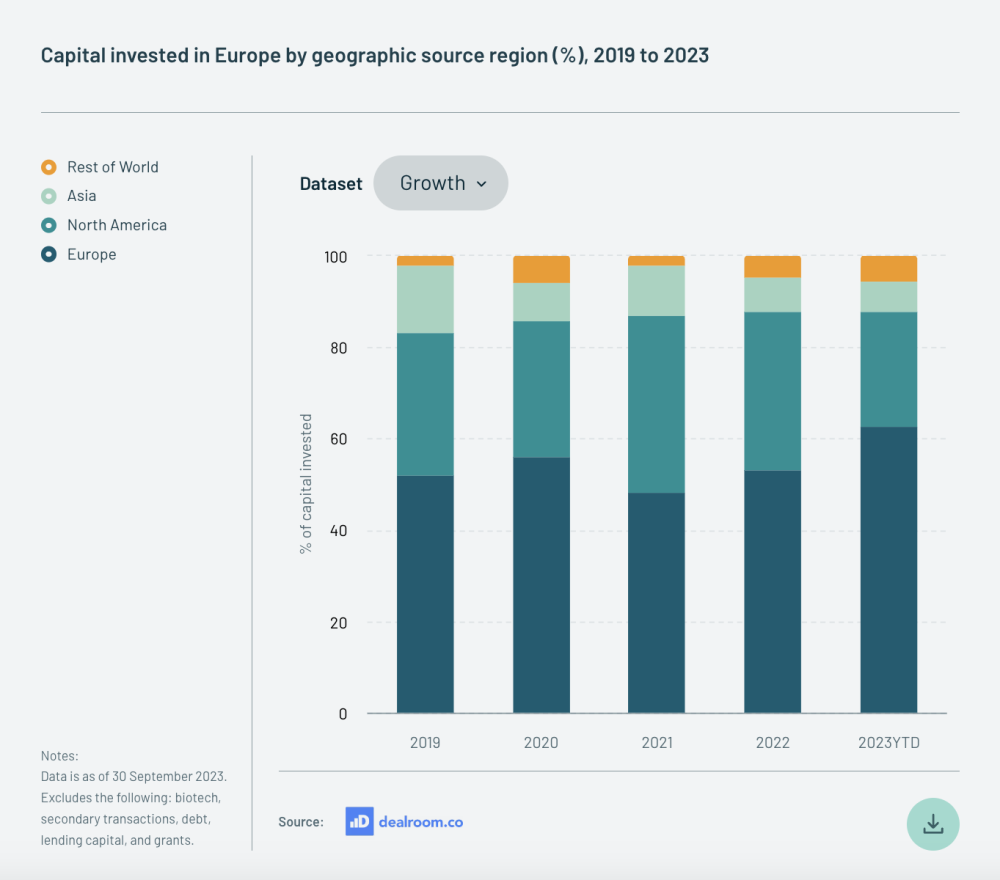

Investors from North America have provided 25% of Europe’s growth-stage capital this year — dropping from 39% in 2021.

It’s a different picture at the early-stages, though, as many early-stage companies raise money from local VCs and non-European investors are greater contributors of growth capital. Funding from North American investors for early-stage European companies has hit 14% so far this year, the same level as 2021.

Startups

1. Fundraising challenges

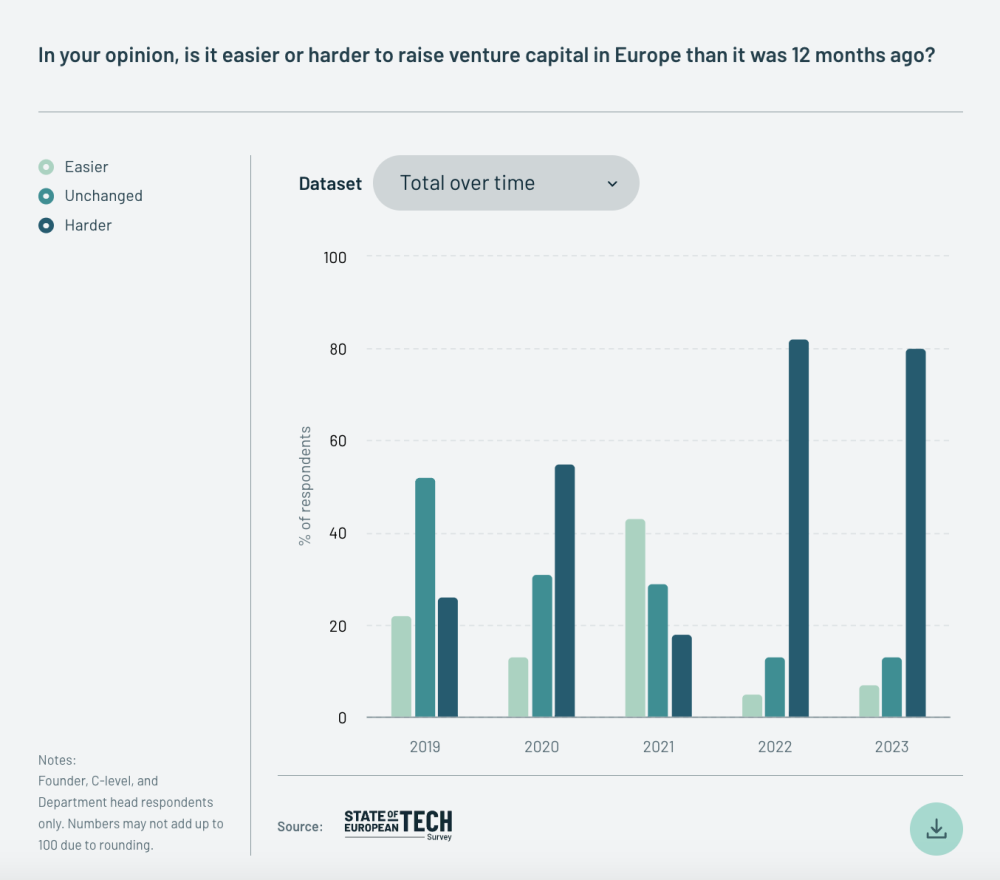

Startups are all too aware of the lack of funding in 2023. 80% of founders, C-suite and department heads said that fundraising was harder this year than it was 12 months ago.

The situation is bleaker for underrepresented founders. 87% of non-white founders said that they thought it was harder to raise, compared to 79% of white founders.

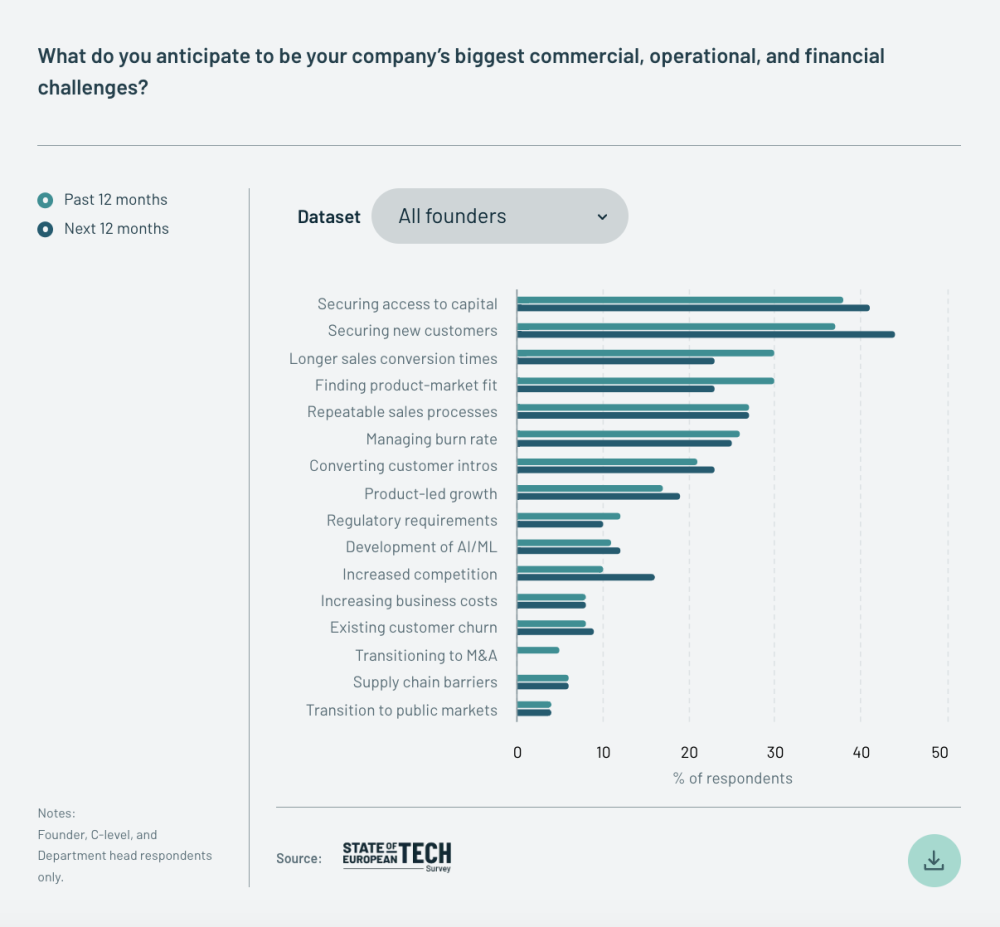

Over the past 12 months, raising capital was the most frequently cited challenge by founders and senior startup leaders, with 38% saying it was their biggest challenge. Securing customers was next on the list of anxieties, with 37% saying it was their biggest challenge.

Founders aren’t particularly bullish for 2024 — 41% said raising capital would be one of their biggest challenges and 44% said securing customers would be.

Diversity still sucks

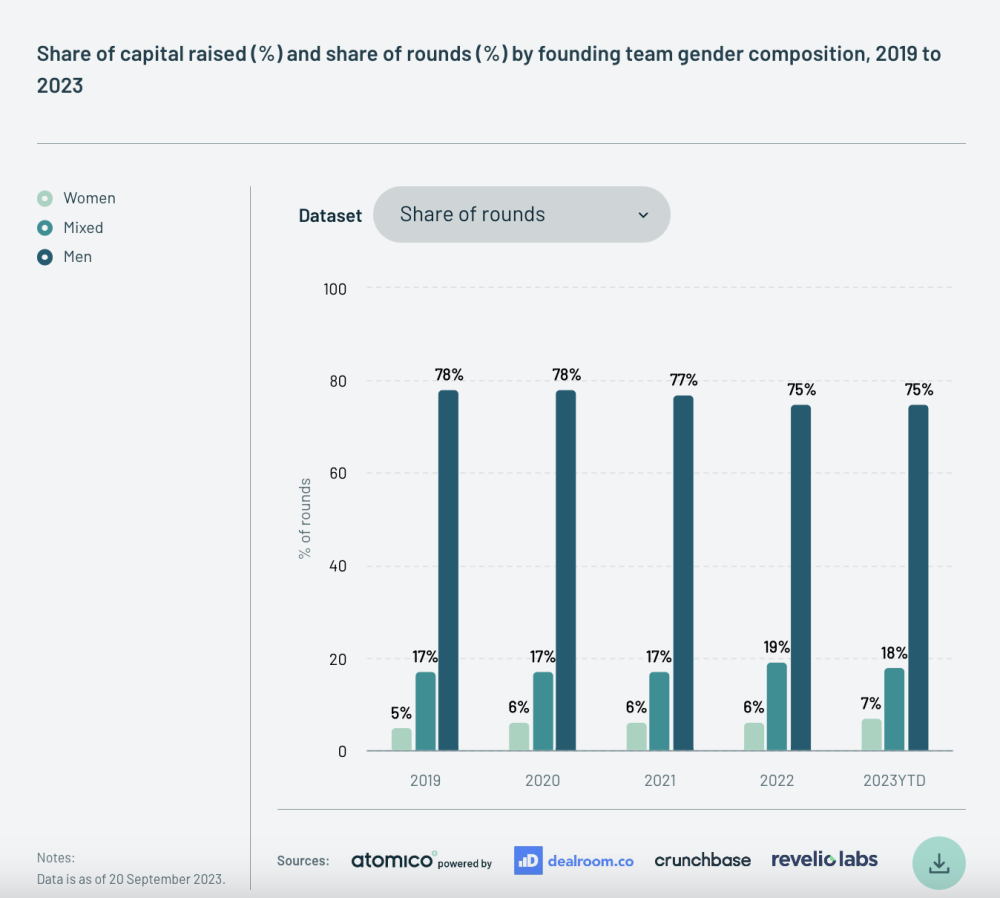

Just 7% of European funding rounds went to all-women founding teams in the first nine months 2023. It’s an ever so slight improvement on previous years, but still woefully low.

The numbers make for bleaker reading when looking at how much those teams have raised. Just 3% of total capital went to all-women teams in 2023 — compared to 82% for all-male teams.

Those hugely uneven funding figures are driven by a lack of diversity among investors, with just 16% of GPs in Europe being women, the report says.

A report by the European Commission found that VC firms with women partners are more than twice as likely to invest in women-led enterprises, and more than three times more likely to invest in enterprises with women CEOs.

Looking ahead

1. Layoffs expected into 2024

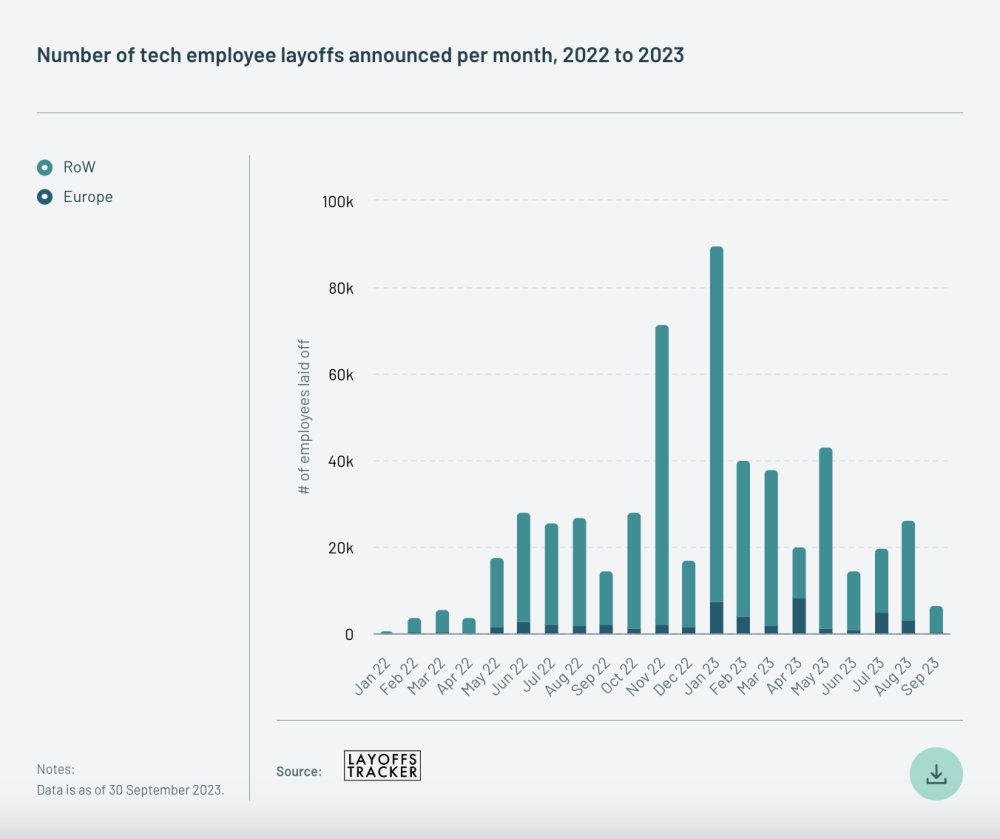

While the number of layoffs in European tech rose across the first few months of 2023, those figures seem to have peaked — although it's worth noting that many layoffs and redundancies go unreported, the report says.

It adds that layoffs are expected to continue in 2024, as startups fail to secure the funding or growth needed to sustain current cost levels.

2. Is the UK’s time at the top numbered?

While UK startups continued to lead Europe in terms of total capital raised, it’s seen the biggest drop in share of capital across the region over the past few years as other local ecosystems have matured.

Funding in the UK from 2021-2023 has fallen 2.6% on its share from 2018-2020, as a number of emerging nations have been increasingly enticing investors.

Estonia and Austria have seen a 0.7% increase of funding share across that period, Norway 0.9% and the Netherlands 1.7%.

3. Rise of AI

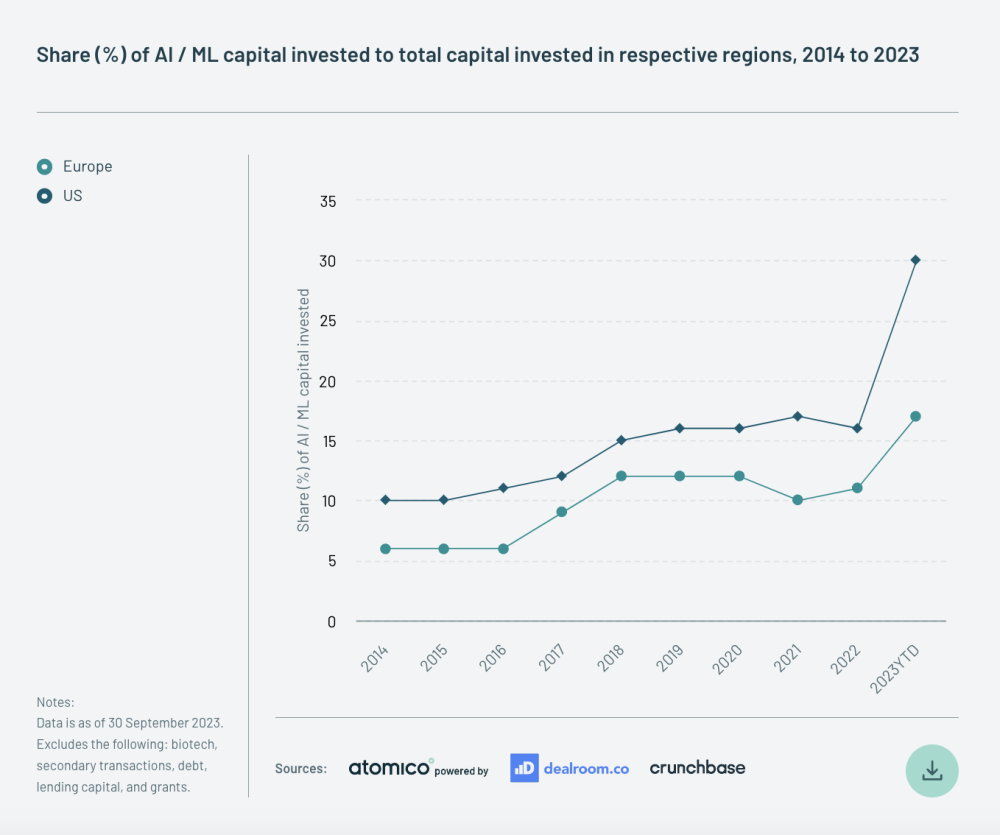

There’s still one sector that’s driving VCs to the kind of crazy, FOMO driven rounds that were commonplace during the boom times of 2021.

Startups like Aleph Alpha and Mistral have raised $100m+ round this year, and investment into European AI startups made up 17% of total capital pumped into the sector across the globe — rising from 11% in 2022.

4. Record levels of dry powder

Despite the drop in VCs getting out their cheque books in 2023, they’re sitting on the largest war chest Europe has ever seen.