Investors and governments are convinced that the next generation of companies will emerge from scientists commercialising their research from universities and institutions — known as spinouts. Many are building key technologies like quantum, AI, biotech and life sciences.

Governments are raising funds committed to spinouts while specialised investors are looking to get in on the university game. The UK government is also conducting a review into the best practices for commercialising research.

But which spinouts are already having an impact?

Sifted has analysed the 15 fastest-growing university spinouts, by headcount, based on data from Dealroom. To avoid the results being skewed by extremely small teams making lots of hires, we’re only looking at companies that have raised more than €50m in total. Headcount growth can give a good indication of rising stars, and which companies you should be keeping your eyes on.

Here are the fastest-growing university spinouts in Europe

Biomodal (formerly Cambridge Epigenetix)

Biomodal is a biosciences spinout from the University of Cambridge that is developing an analytics solution to glean more advanced epigenetics information — which explains how our behaviours and environment can cause changes to our genes — from DNA. It’s aiming to unpack how those things then affect cancer, neurodegenerative disease and ageing. It has raised close to $150m so far and is backed by the likes of Sequoia and Temasek.

Spinout from — University of Cambridge

Founded — 2012

Team growth last 12 months — 86% to 82 employees

Last raised — $88m Series D, November 2021

Total funding — $145m

PolyAI

Fellow University of Cambridge spinout PolyAI is developing a machine learning platform for conversational AI, which can automate customer service and solve issues related to bookings and reservations, account management and billing and payments.

Spinout from — University of Cambridge

Founded — 2017

Team growth last 12 months — 77% to 147 employees

Last raised — $40m Series B, September 2022

Total funding — $68m

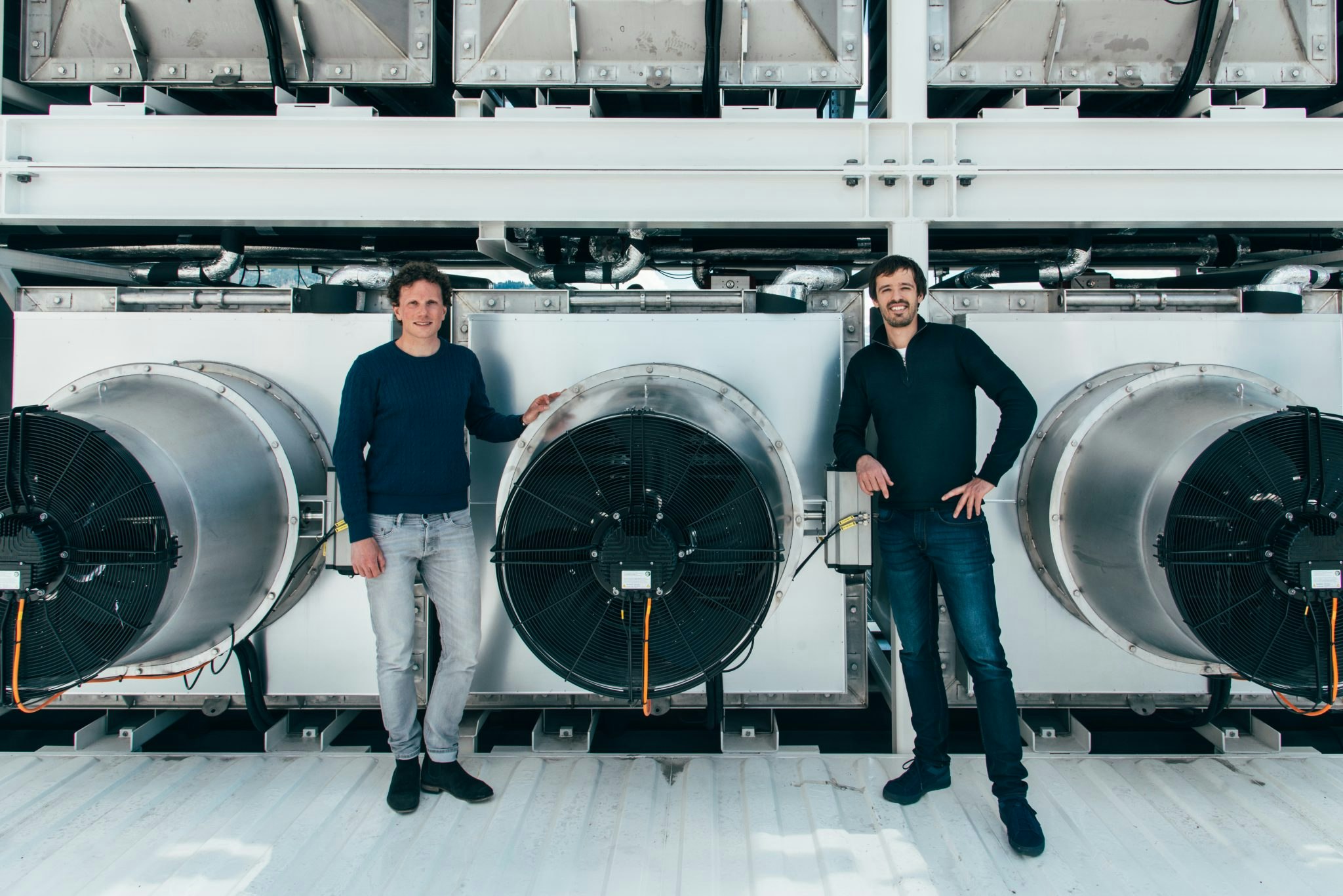

Climeworks

Climeworks is the world’s best-funded carbon removal startup, having raised $777m in total. It has more than 300 employees in Europe and plans to hire 100 more in the US, after it confirmed it's expanding stateside to take advantage of the country’s $369bn climate bill, which offers hefty financial incentives for climate tech companies.

Spinout from — ETH Zurich

Founded — 2009

Team growth last 12 months — 73% to 303 employees

Last raised — $650m, April 2022

Total funding — $777m

ZOE Health

ZOE Health is a UK-based nutrition startup aiming to help us understand how diet affects our health; its at-home test kit combines scientific research and AI to give users a breakdown of their gut health, blood sugar and blood fat, which is then used to give a personalised nutrition programme.

Spinout from — King’s College London

Founded — 2017

Team growth last 12 months — 73% to 252 employees

Last raised — $2.5m Series B extension, March 2023 (total Series B, $57.5m)

Total funding — $84.5m

Colorifix

Colorifix is a university spinout from Cambridge aiming to minimise the environmental impact of industrial dyeing by creating sustainable dyeing methods for fabrics — it uses synthetic biology to engineer micro-organisms so that they can produce and fix dyes directly onto textiles.

Spinout from — University of Cambridge

Founded — 2016

Team growth last 12 months — 70% to 75 employees

Last raised — £18m Series B, June 2022

Total funding — $56.8m

Nexxiot

Nexxiot is developing tech that improves the safety, efficiency and sustainability of global supply chains. Its IoT hardware, software and analytics solution, which allows transportation operators to track the location and condition of their assets and cargo in real-time, aims to mitigate risks associated with employees, infrastructure and cargo and to reduce emissions.

Spinout from — ETH Zurich

Founded — 2015

Team growth last 12 months — 66% to 111 employees

Last raised — $59.9m, May 2022

Total funding — $102m

Nyobolt

A total shift to electric vehicles requires solving one main bottleneck: rapidly charging the damn batteries. University of Cambridge spinout Nyobolt is trying to fix that with its ultra-fast charging solution; its batteries could make recharging an electric car as fast as refuelling a petrol vehicle.

It has grown its headcount to 70 employees in the last year, and was also highlighted by VCs as a spinout to watch last year.

Spinout from — University of Cambridge

Founded — 2020

Team growth — 63% to 70 employees

Last raised — £50m Series B, July 2022

Total funding — $89m

Planted Foods

Planted Foods is a plant-based meat spinout from ETH Zurich in Switzerland. It produces several plant-based products, including "chicken" pieces and skewers, "kebab" meat and a "pulled" meat product.

Spinout from — ETH Zurich

Founded — 2019

Team growth last 12 months — 62% to 216 employees

Last raised — $78m Series B, September 2022

Total funding — $107m

Synthesia

Synthesia is an AI video creation platform from University College London that allows users to create videos in 120 languages. It has so far been backed by the likes of Taavet Hinrikus and Mark Cuban.

Spinout from — University College London

Founded — 2017

Team growth last 12 months — 58% to 168 employees

Last raised — $47.5m Series B, December 2021

Total funding — $63.2m

Oxbotica

University of Oxford spinout Oxbotica is building autonomous vehicle software it hopes can be used to automate any vehicle — it also produces autonomous vehicles to help streamline the goods delivery process for grocery tech company Ocado. It recently raised a $140m Series C, has raised $231m so far and counts the likes of Chinese gaming giant Tencent on its cap table.

Spinout from — University of Oxford

Founded — 2014

Team growth last 12 months — 47% to 299 employees

Last raised — $140m Series C, January 2023

Total funding — $231m

MindMaze

MindMaze is a university spinout unicorn from the Swiss Federal Institute of Technology Lausanne that’s building a digital neuro-therapeutics solution to accelerate the brain’s ability to recover, learn and adapt from things like stroke, Alzheimer’s and Parkinson’s.

Spinout from — Swiss Federal Institute of Technology Lausanne

Founded — 2012

Team growth last 12 months — 46% to 172 employees

Last raised — $105m, February 2022

Total funding — $338m

Sphere Fluidics

Sphere Fluidics is developing a single-cell analysis system for use by pharma companies, biotechs and research institutions. Its platform can process millions of samples per day, according to the company, with results being used for things like antibody discovery and single-cell diagnostics.

Spinout from — University of Cambridge

Founded — 2010

Team growth last 12 months — 45% to 61 employees

Last raised — $40m, October 2021

Total funding — $59.4m

ENOUGH (formerly 3F BIO)

Glasgow's ENOUGH, a spinout from the University of Strathclyde, is developing a protein made from naturally occurring fungus which contains all essential amino acids and is high in fibre. Its product can be made into alternative meat, seafood and dairy products.

Spinout from — University of Strathclyde

Founded — 2015

Team growth last 12 months — 44% to 52 employees

Last raised — €42m Series B, June 2021

Total funding — $73.7m

Bramble Energy

Bramble Energy is an energy spinout focused on hydrogen. Its patented printed circuit board fuel cell helps to reduce the cost and complexity of manufacturing hydrogen fuel cells. Use cases include portable energy systems and electric vehicles.

Spinout from — Imperial College London / University College London

Founded — 2016

Team growth last 12 months — 43% to 73 employees

Last raised — £12.6m, May 2023 (including £6.3m grant)

Total funding — $61.9m

MoA Technology

MoA Technology is an agritech spinout from the University of Oxford that is aiming to tackle herbicide resistance in weeds which causes the efficacy of farming practices to decrease. Its herbicide tech is based on new chemicals that will both help farmers increase safe food production while reducing the impact on the environment.

Spinout from — University of Oxford

Founded — 2017

Team growth last 12 months — 40% to 56 employees

Last raised — £35m Series B, May 2022

Total funding — $63.7m