This article first appeared in Sifted’s Daily newsletter, sign up here.

I recently came across a story in the Economist which described a startup boom happening in the US. Across the pond, people’s vim for entrepreneurship is on the up, with many new startups being created than half a decade ago. The average number of applications to form new businesses each month is also 80% higher than it was in the decade before Covid, the piece said.

It got me thinking: what does startup creation look like in Europe?

The short answer: it’s not that easy to tell here. There’s no single methodology that tracks the number of new tech companies emerging across Europe. Some countries do their own counting — but their methodologies differ. Often they don’t recognise the difference between tech startups and other small and medium enterprises, like a family shop or restaurant.

The EU wants to standardise the definition of ‘startup' across all its members — which would help track new ventures — but there hasn’t been much progress recently.

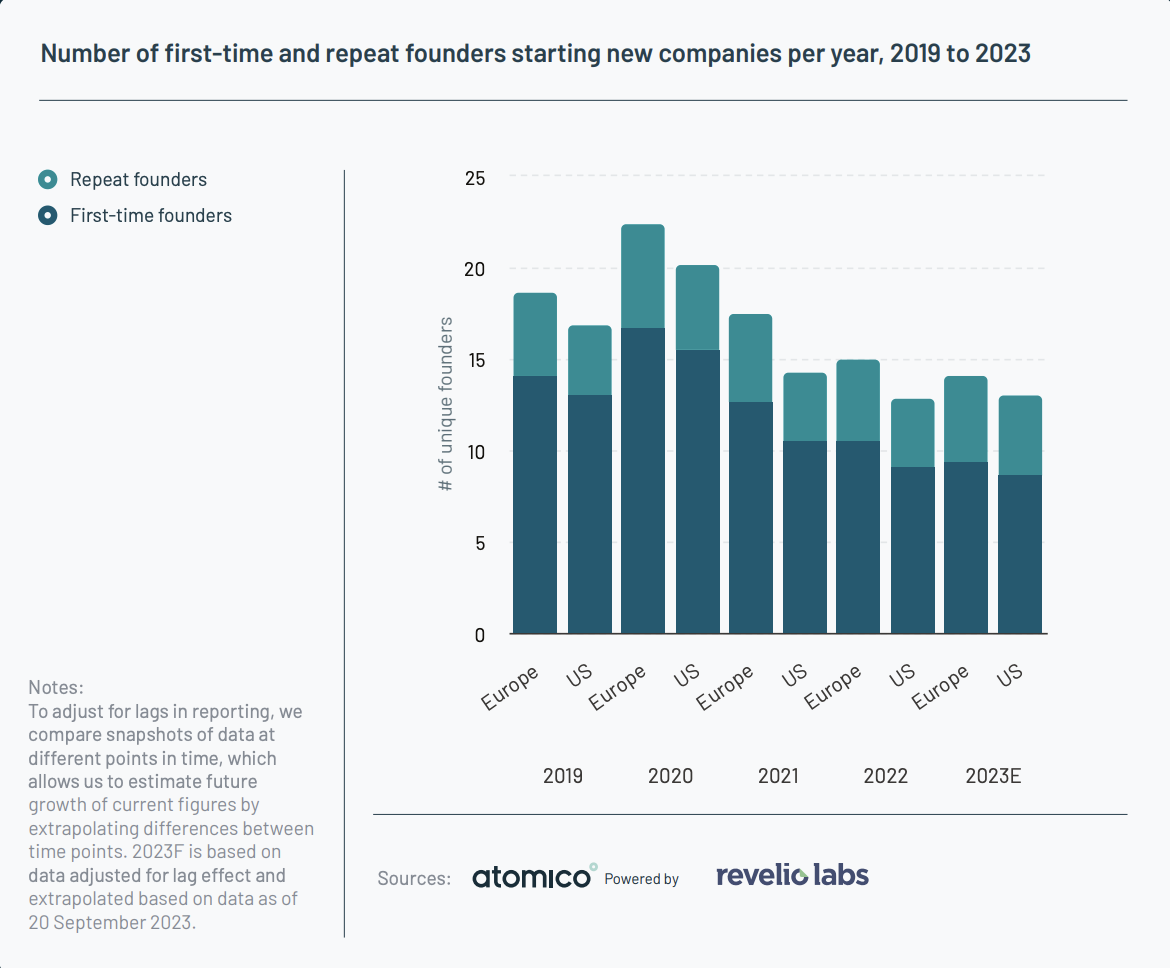

So, for now, we have to rely on data from external providers — for example, VC firm Atomico’s annual State of European Tech report. Its 2023 edition (its latest) says that between 2019 and 2023 the number of first-time and repeat founders starting new companies each year in Europe outstripped the number in the US. That said, the number of first-time founders in Europe has been on a downward trend since a peak in 2020.

Globally, the rate at which founders are launching new companies has also slowed by 30% since record numbers in 2020, the report says.

Looking at data from startup data platform Dealroom only tracking venture-backed startups headquartered or founded in Europe, the decline is starker. From 2010, the number of new startups grew every year, reaching 24.5k in 2018; that number then dipped drastically, reaching a low of 8.7k in 2022.

"We all agree that there was a drop off a couple of years ago — both in Europe and the US — that could be attributed to factors like the sharp decrease in VC funding, the rise in interest rates and even repercussions of the war in Ukraine, which has further disrupted global tech trade and supply chains,” says Clark Parsons, the CEO at the European Startup Network, a pan-European association.

Zach Meyers, an assistant director at the Centre for European Reform, adds that the bigger decrease in the Dealroom data might be a sign not of the tech industry's weakness, but rather that of Europe's VC sector — as the data only shows startups that got some VC funding.

“European startups tend to rely much more on public funding sources or traditional bank loans,” Meyers says. “Atomico’s [report] also reports that VC and limited partnership funders all have a decreased appetite for investing in Europe. This suggests that we have more and more small startups in Europe, but they are fighting over a pool of increasingly sceptical investors,” he says.

There is some good news in the Dealroom data: after 2022’s low, startup creation picked up slightly. There were 9,190 VC-backed companies started in 2023.

Parsons says some of the recent signs are “encouraging”.

“Given how many emerging tech ecosystems around Europe are seeing strong upticks in capital and startups, I’m convinced that the pan-European numbers will reflect that in the near future,“ he says.

Readers, I want to know what you think, and what you’re seeing in the market? How do we better track startup creation? Are you seeing the signs that more European ventures are being created? Or are you seeing the opposite? Let me know.

This article first appeared in Sifted’s Daily newsletter. Want more stories like this? Sign up here.