Venture builders are currently the hottest topic in the open innovation arena. They're different from accelerators and startup studios (as discussed here), but there are also many different approaches to venture building.

There are no silver bullets. If any advisor shows up with a set playbook, walk away — fast.

The model itself is still in its infancy. Nothing is written in stone and the models are evolving as we speak. Therefore, there are no silver bullets, rather mostly weak signals that need to be managed with care. If any advisor shows up with a set playbook for this, my advice would be to walk away — fast.

4 key parameters for setting up a venture builder

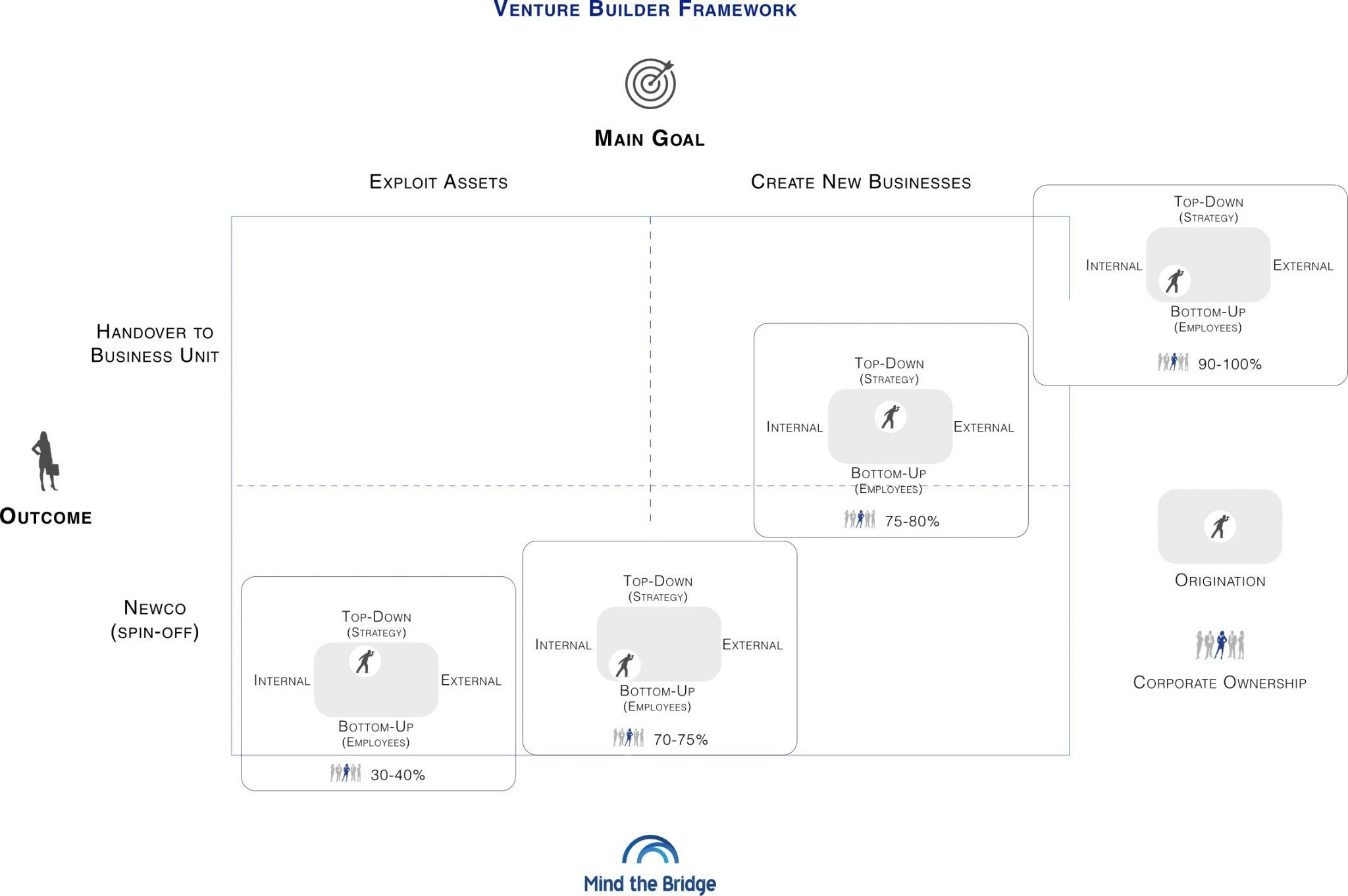

The matrix above shows the possible alternative approaches corporates adopt in setting up their own venture builders (four real cases, anonymised, have been included as a reference).

There are four key criteria to be considered.

1. Goals

This is the key differentiator. There are two main types of venture builders based on the goal they pursue:

- Initiatives aimed at starting new businesses (far from the core, in adjacent or disruptive markets). BP Launchpad and SAP fall into this category

- Builders focused on exploiting existing assets such as intellectual property (IP), research and development (R&D) projects, technologies and know-how that are no longer aligned with the core strategy of the company. Telefonica Wayra Builder is a good example of this.

2. Outcomes

The second most important decision is about the results you want. Will the new business be handed over to an internal business unit, or spun off into a new company?

If you're planning a spinout company, you need to make an immediate decision about control. Would you be happy to allow investments from third parties (and eventually lose control of the new entity)? Telefonica Wayra Builder is designed to onboard external investors and give up the majority of the new ventures, while most of other venture builders still want to retain control. Typically they would own 100% of the equity, except for when they have acquired an external startup (BP) or given some equity to the originators (Enagas).

3. Origination

Where do the new ideas come from? Some venture builders are designed to be the logical extension of the corporate intrapreneurship program. Then, they're focused on scaling employee-led innovation. This is the case of Enagas and SAP.

Others (e.g. Iberdrola Perseo Builder) are designed to execute strategic directions identified by the top management. Some of them (BP Launchpad) might bypass the early phases by acquiring external startups and scaleups — Fotech, Finite Carbon, Onyx and, most recently, Open Energi are good examples. In this case, origination is a mix of internal (strategic inputs) and external (outside entrepreneurs and teams) contributions.

4. Independence

Working in an environment physically separate from the rest of the company is one of the common traits in all the venture builders we see on the market. However, the way separation is implemented might vary.

- It might be a mere organisational separation: the venture builder is kept separate from the rest of the corporate R&D, ICT and business lines. It's typically part of the innovation unit. Iberdrola, for example, has its venture building unit inside the Perseo innovation team, which is also in charge of the CVC fund and the scouting challenges). Engie New Business Factory is another example.

- It might be a physical separation. PMI’s Cube, for example, is located in Neuchâtel, far from PMI's core business. UK power company National Grid’s innovation activities — both CVC and venture builder — are physically located in Silicon Valley.

- It might be an independent legal entity. National Grid has created a separate company, NGP — although it maintains full ownership. Daimler Mercedes-Benz has gone even further, spinning off its venture builder (formerly known as Lab 1886, which created ventures like Car2Go) into a separate and independent entity (1886 Ventures). It owns just 10% of 186 Ventures. There are several reasons behind this model that requires a fully dedicated deep-dive in a subsequent article.

Properly clarifying the end goal for the venture builder will help navigate through these decisions. As the Cheshire Cat in Alice in Wonderland said: “It doesn't much matter which way you go” if you don’t know “where you want to get to”.

Alberto Onetti is Chairman of Mind the Bridge.