Non-profit Diversity VC, which seeks to do exactly what it says on the tin, has released its latest report into the VC sector in the UK. It has looked at publicly available data on 171 active VC firms, 2,114 employees and — this is the really interesting bit — run a survey on ethnicity.

Here are the top takeaways.

1. Just 8% of UK VCs know what it's like to work at a startup

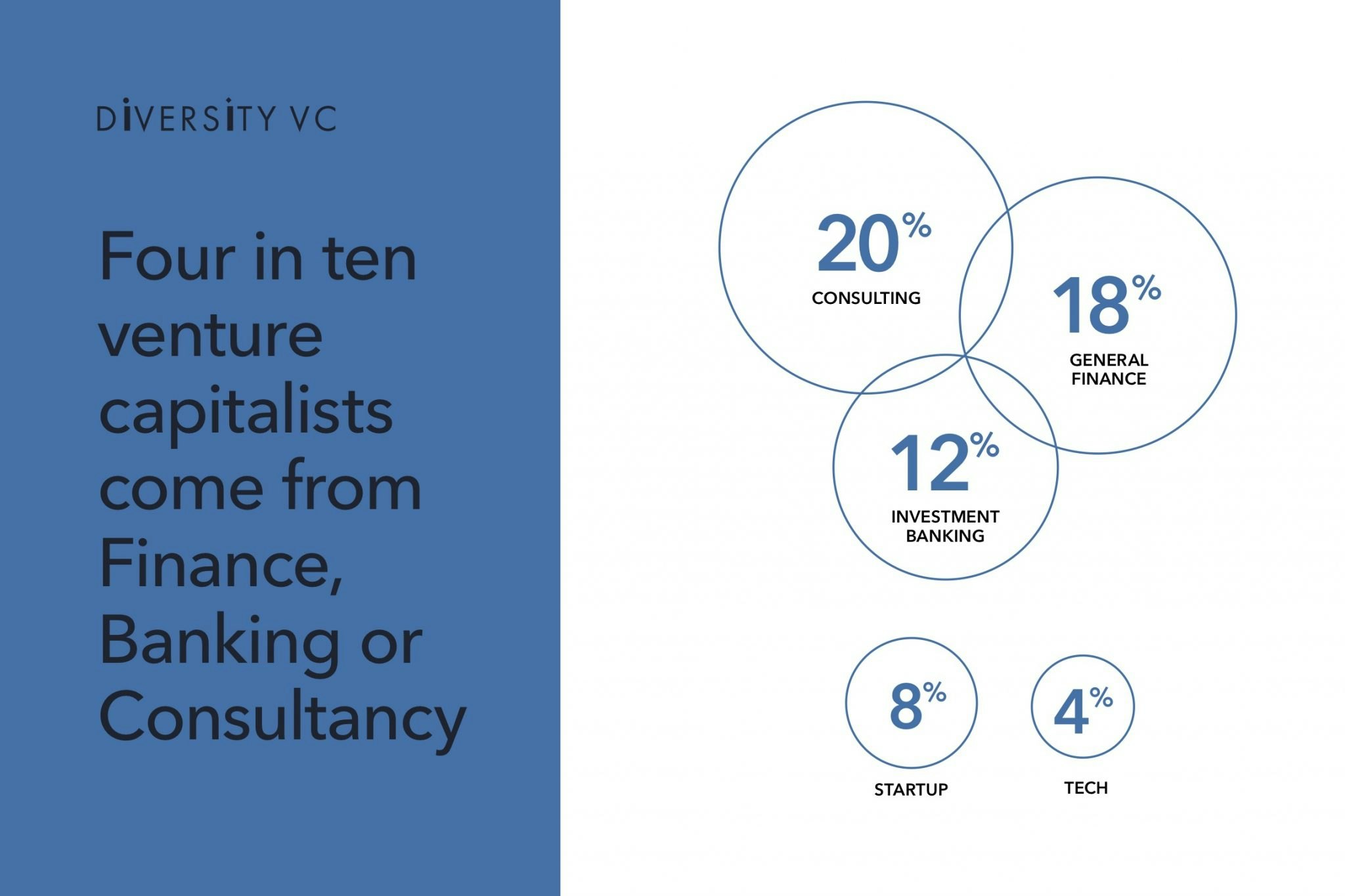

At top-tier venture capital firms in the US, 60% of investors have experience working at — or running — a startup. In the UK, just 8% of investors have experienced first hand what it’s like inside a fast-growing company.

In the US, 60% of investors have experience working at — or running — a startup

Instead, UK VCs are much more likely to have spent years in consulting (20%), finance (18%) or investment banking (12%).

Is that a shortcoming of the UK venture scene? Do Europe's entrepreneurs prefer investors with operational experience? Watch out for a column on the subject in our Monday newsletter.

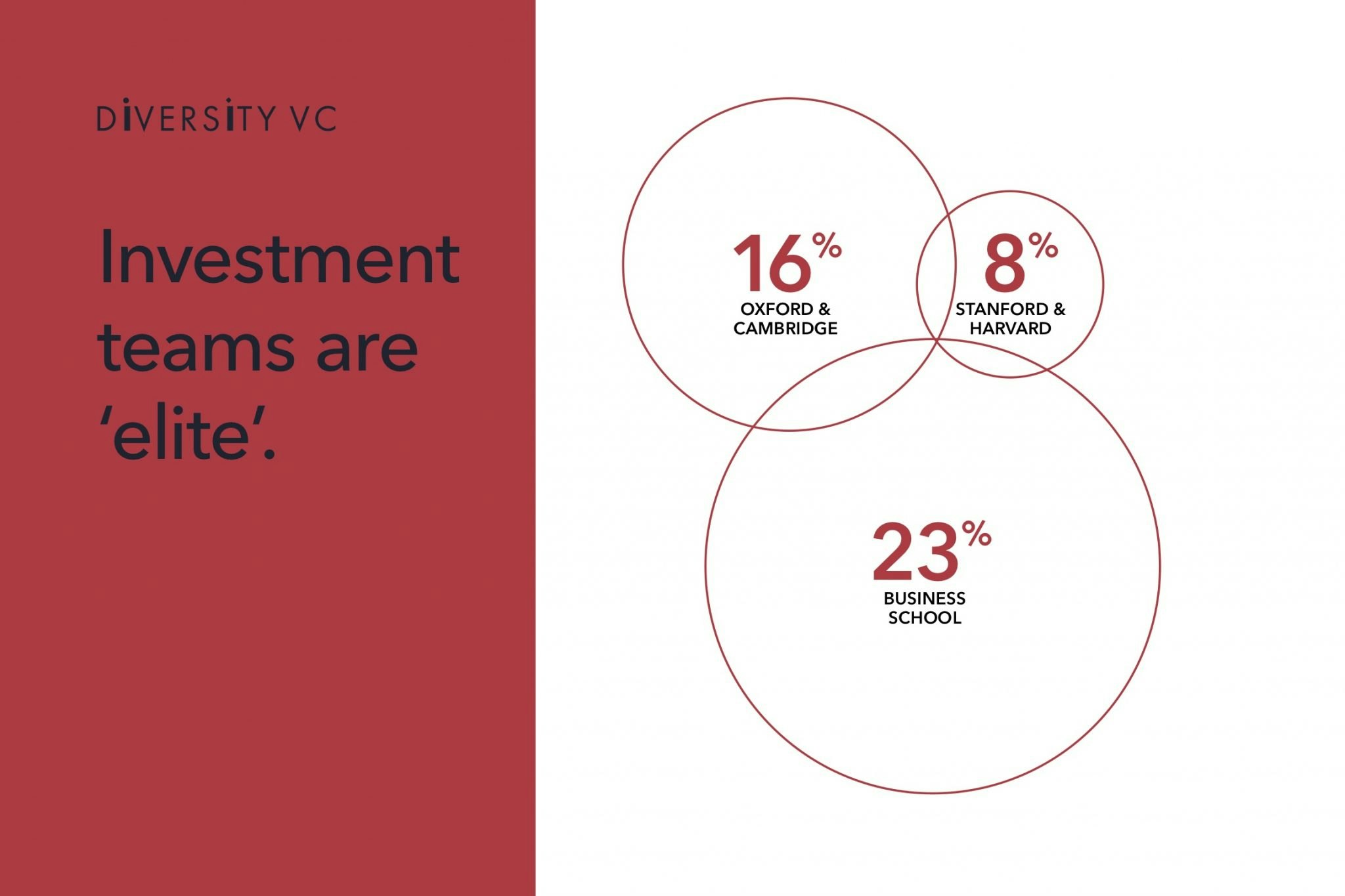

2. One in five UK VCs went to Oxbridge, Harvard or Stanford

A big chunk of UK VC investors went to one of just four institutions: Oxford, Cambridge, Harvard or Stanford. On top of that, 23% went to business school. That means the sector as a whole has quite a homogeneous educational background.

Is that a problem?

It is if VCs “pattern-match” or back mini-mes; if they are more likely to invest in founders who share their, or other as yet successful founders’, backgrounds.

16% of UK VCs went to Oxbridge — as did 12% of tech firm CEOs

And lo and behold, 12% of tech firm CEOs also went to Oxbridge, as did 9% of founders, according to the Sutton Trust.

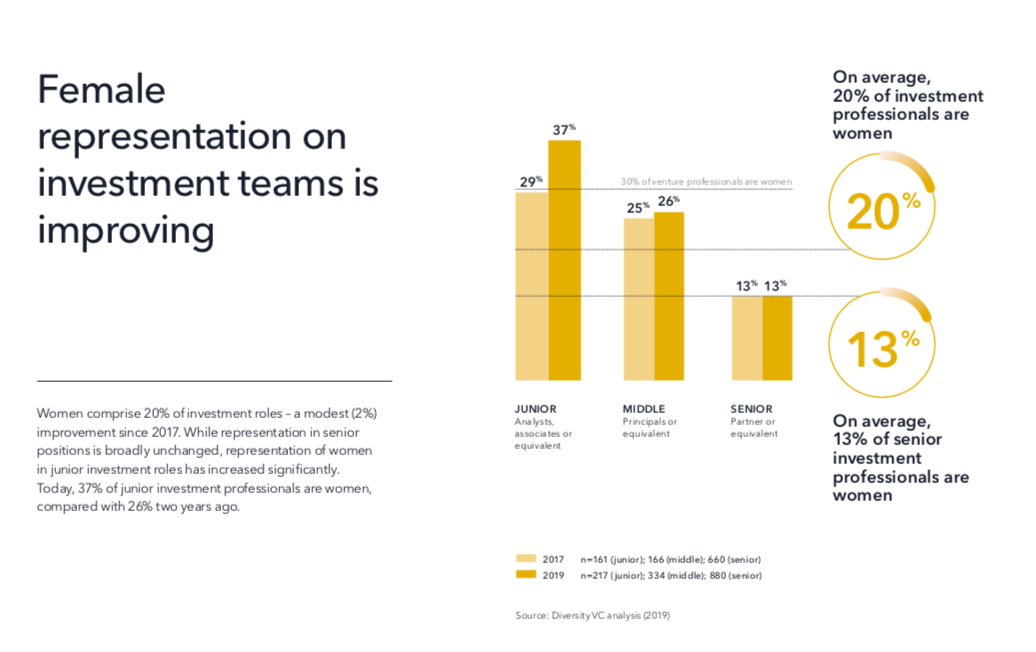

3. Just 13% of decision-making VCs in the UK are women

Beware of the top line statistics: 30% of the VC workforce and 20% of investment professionals are women — but only 13% of VCs who sit in investment committees are women.

That last statistic is dire, and it hasn’t improved over the past two years.

Some will say this is a “pipeline” problem: firms are hiring more women into junior positions, and it just takes time for them to progress through the ranks.

Still, it’s going to be another five to eight years until those junior VCs progress to senior positions, according to the report. That’s a long time in startup years to wait for more equal representation.

37% of VC firms are all-male

Other VC firms have no women on their investment teams at all. Two years ago, a whopping 48% of VC firms were all-men; now it’s 37% — but it’s still 37%.

Perhaps startups should just stop taking their money.

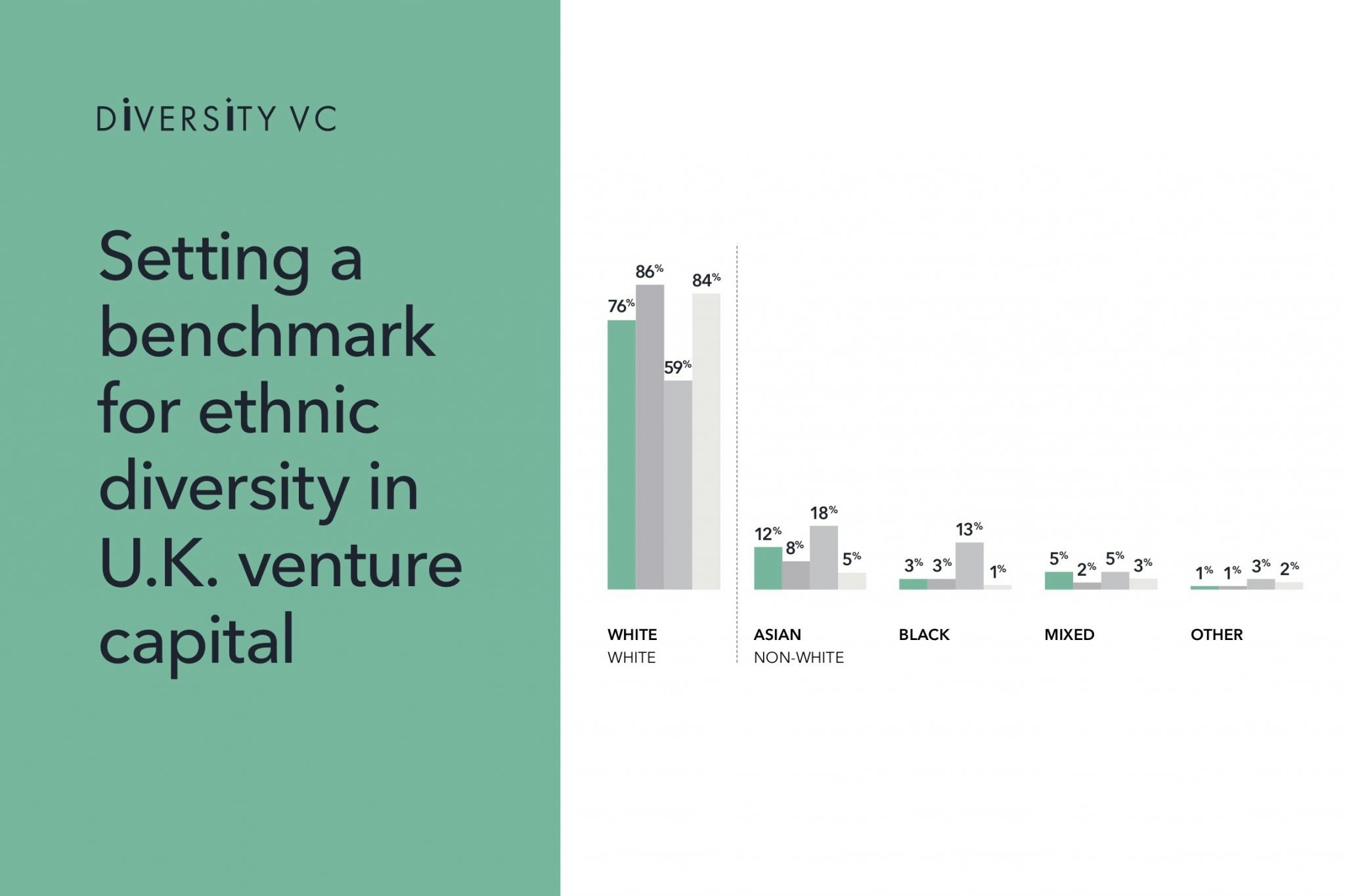

4. 76% of VCs are white

VCs, who are overwhelmingly based in London, are not as diverse as the city’s population as a whole. 76% of VCs are white, versus 59% of the London population.

There are, however, an increasing number of initiatives for BAME investors in the UK. In March, the UK’s black VC community gathered for the first time, and later launched office hours for black founders. Meanwhile, Future VC, an internship programme for wannabe VCs, kicked off in June with a 75% BAME cohort.