This article first appeared in Sifted’s Daily newsletter, sign up here.

A quarter of UK-based GPs have pushed back fundraising plans, according to a new survey from the British Business Bank, one of the country’s biggest LPs.

It paints a picture I’m sure many Up Round readers are familiar with: fundraising remains tough for VCs.

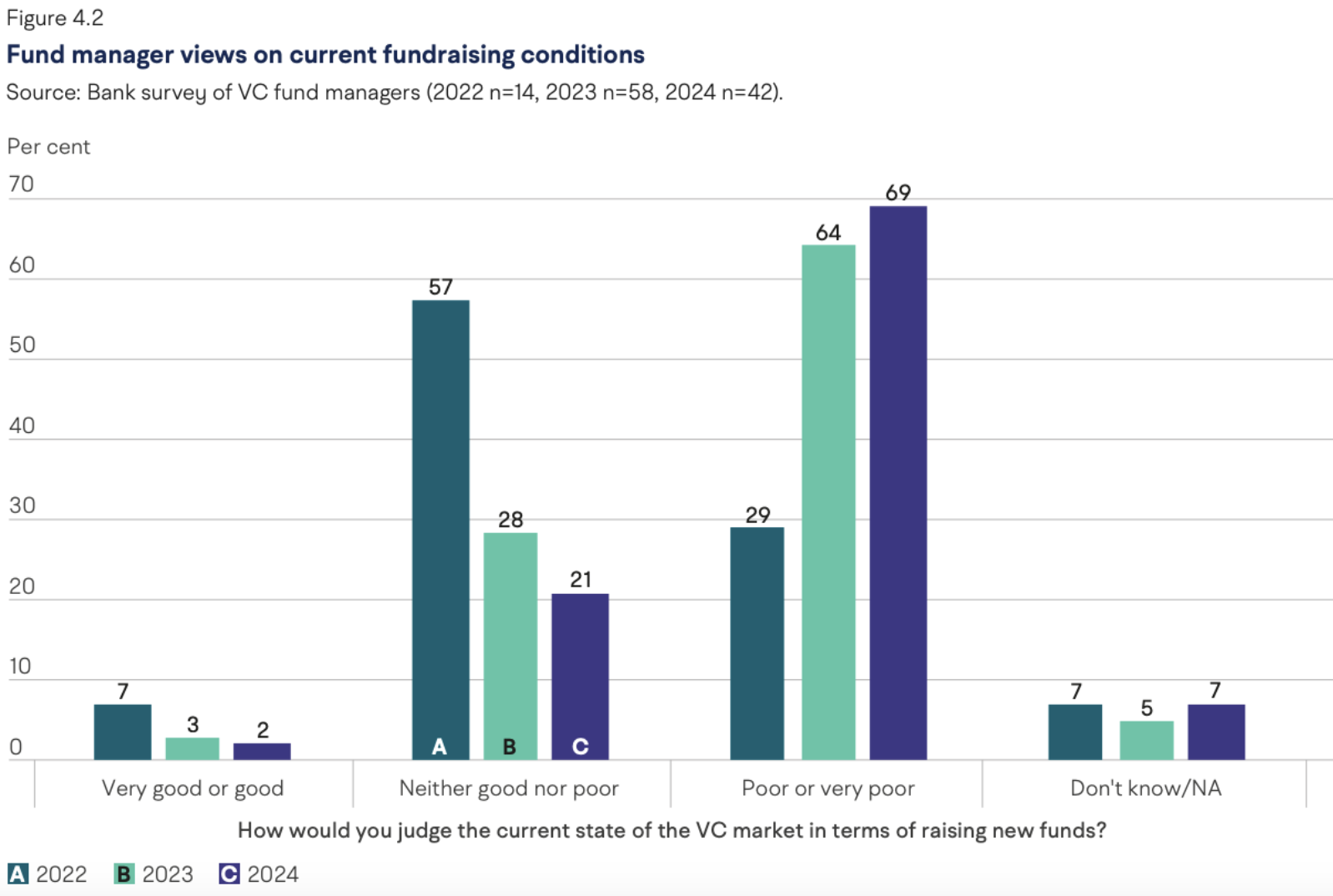

More than two-thirds (69%) of GPs said they thought the UK is currently a poor or very poor market to raise a fund in. Just one of the 42 fund managers surveyed said they thought it was a good time to raise a fund.

The findings are more or less on par with last year’s — but markedly different from 2022’s when GPs were more ambivalent.

As for why it’s so hard to raise a fund at the moment, GPs listed low LP liquidity, the macroeconomic environment, longer fundraising timelines and increased difficulty attracting investors as their most significant challenges.

Despite that, the majority (67%) of GPs said they haven’t changed their fundraising plans.

No exit

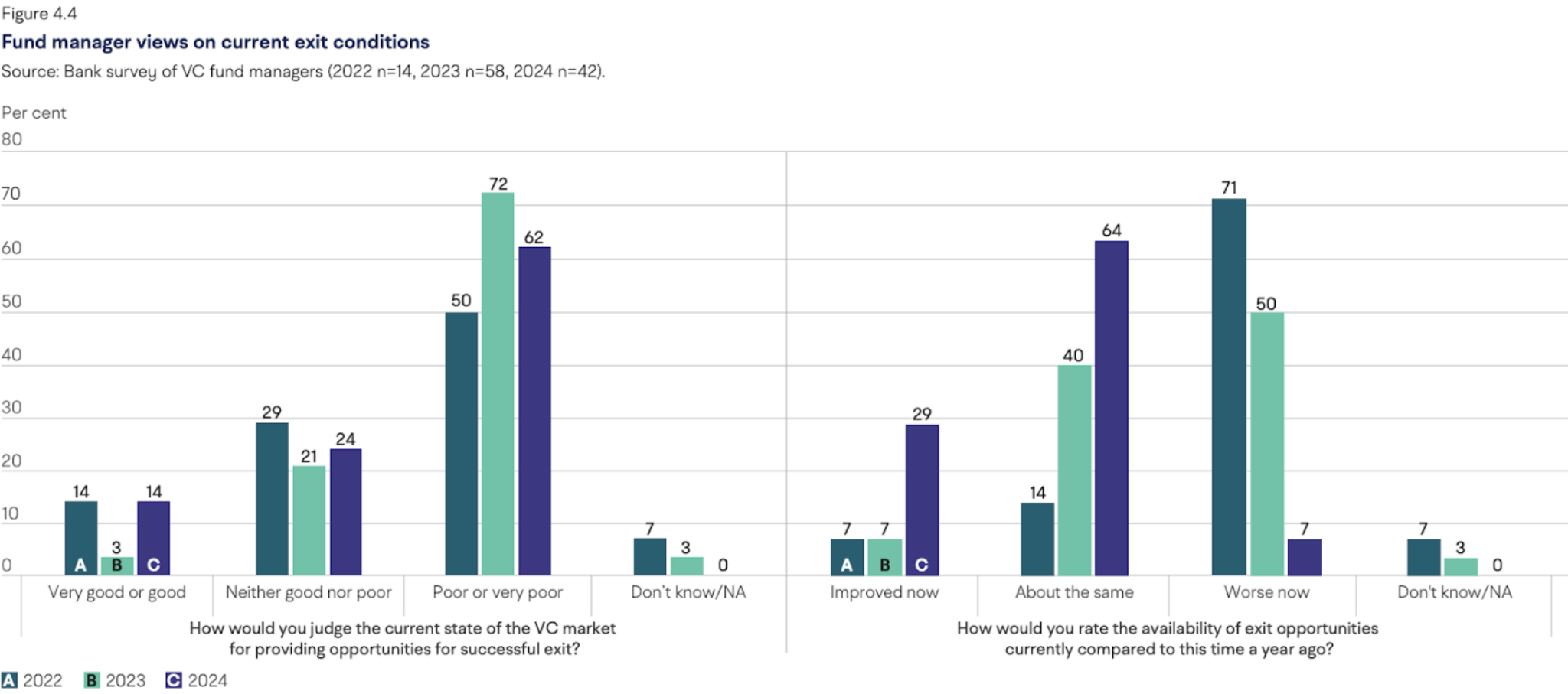

The exit environment has also remained stagnant — not helping those fundraising plans. In the first half of 2024, PitchBook recorded £430m of exits in the UK, a decline of 80% on the same period in 2023. There’s been an increase in activity during Q3 of this year, however, with more than £3bn of exits completed through 53 deals.

Most (64%) fund managers said the exit market has remained about the same this year, compared to last — and 74% think things will improve.

Reasons given as to why exits are hard to come by at the moment include differing expectations around company valuations, the higher interest rate environment and too few strategic buyers.

In good nick

Further reasons to be cheerful(ish): the majority of GPs (60%) said they think the quality of investments in the UK are good or very good. That’s up from 40% of GPs saying the same last year.

That means competition is strong; 30% of fund managers reported high competition for deals (up from 16% in 2023). Unsurprisingly, favourite sectors are software and fintech.

This article first appeared in Sifted’s Daily newsletter. Want more stories like this? Sign up here.