London-based AI investment firm Air Street Capital has released its latest State of AI report, an annual deep dive into the big themes shaping what has become the VC industry’s favourite sector.

The seventh edition of the report describes how entrepreneurs are starting to get to grips with large language models (LLMs) and other generative technologies in video, image and audio, learning how to get the best out of them, as well as addressing their shortcomings.

And while it’s US tech giants like Google, Microsoft, Meta — not to mention ChatGPT maker OpenAI — that get the lion’s share of attention in the report (particularly when it comes to research), there are some notable European success stories.

Here’s what we learnt about how AI startups are beginning to build businesses with the technology and how Europe’s faring in that market.

AI is starting to stick

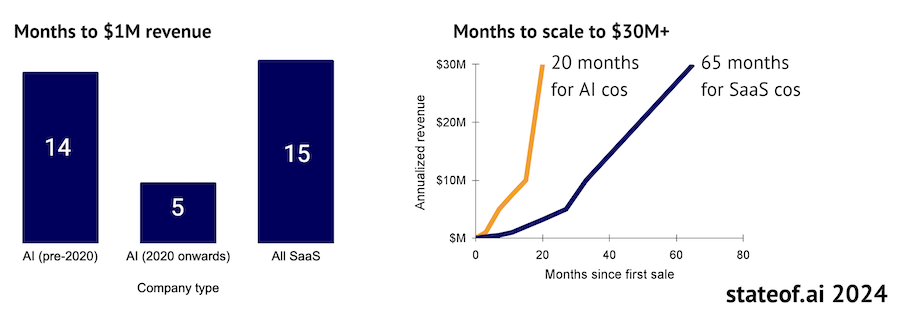

There’s been a growing sense of anxiety among some investors that AI hype might be turning into a bubble, as many enterprises still puzzle over how to make best use of the technology. But the report cites research from payments fintech Stripe that shows that AI-first startups have been able to scale their revenues faster than traditional SaaS companies.

Analysis of the 100 highest revenue-grossing AI startups that use Stripe shows that they’re reaching $30m in annual revenue in 20 months on average, compared to 65 months for a comparable cohort of more traditional software companies.

AI companies founded since 2020 are also reaching $1m in revenue in just 5 months on average, compared to 15 months for SaaS startups.

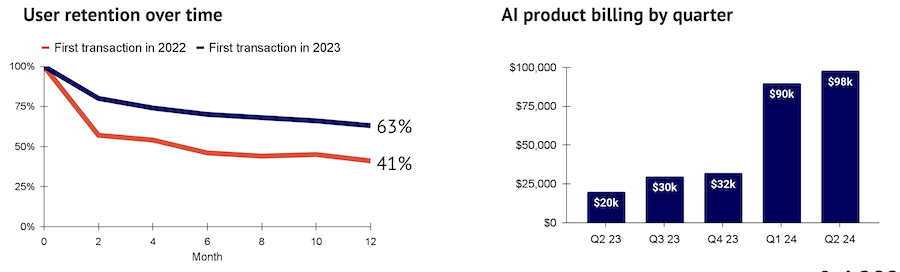

The report also cites research from US corporate fintech Ramp, which found that GenAI products are significantly improving customer retention rates, and steadily billing more each quarter. Top performers include US companies OpenAI, Midjourney, Anthropic and Otter, as well as European players Grammarly and ElevenLabs.

European winners

Polish-founded ElevenLabs — which hit unicorn status this year — is the “market leader” of the “booming” text-to-speech market; 62% of Fortune 500 companies now have at least one employee using its tech, according to the report. Bigger research labs, meanwhile, are approaching the space with caution. OpenAI is yet to make a decision on whether it will make its own voice engine widely available.

The report also namechecks London-based video avatar creation startup Synthesia as one GenAI application that’s getting traction. Its tech is now used by “the majority of the Fortune 100 for learning and development, marketing, sales enablement, information security and customer service”, and is seeing “exponential” growth, with 14.6m videos created by users in 2024, up from 4.6m in 2023.

UK-HQ’d self-driving car company Wayve is another global AI leader from Europe; the startup bagged a $1.05bn round from Microsoft and Nvidia earlier this year. Alongside Google’s Waymo, the report describes Wayve as one of the two “last ones standing” in autonomous vehicle tech, and the London-based business “scored a win when the UK passed legislation allowing autonomous vehicles to hit the streets in 2026.”

Norwegian startup 1x is also the leading European player in the humanoid robot sector, where startups have raised close to $1bn this year. Air Street’s report cautions that two-legged, humanlike robots could follow in the footsteps of the self-driving car sector, which has taken many years to begin delivering on its promises.

Another notable area of European AI success is in techbio. Germany-based BioNTech is taking a computationally designed cancer treatment through clinical trials, while Oxford-based AI drug discovery company Exscientia signed a $688m deal with US company Recursion to bring new treatments to market.

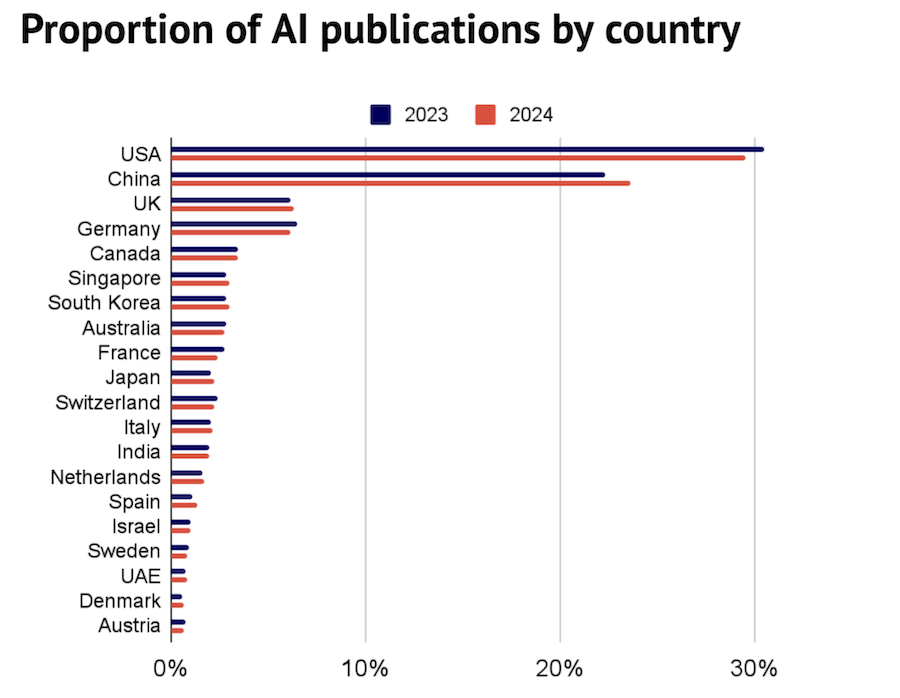

The UK overtakes Germany in research contribution

Europe isn’t leading the pack when it comes to its contribution to AI research. In 2024, the US is still responsible for the greatest proportion of AI publications published, with 29.5% of all papers. China is nipping at its heels with 23.6%, narrowing the gap with the US by 2.3% compared to last year.

In Europe, the UK overtook Germany this year, publishing 6.3% of AI publications, up from 6.2% in 2023. The only other European country in the top 10 countries for research was France, accounting for 2.4% of papers.

DeepMind is the European company that gets the most mentions in the report when it comes to research, and Air Street describes how the research lab has “quietly emerged as a robotics leader”, steadily improving its technology in the field.

Looking ahead

The report notes how US Big Tech companies like Apple and Meta are struggling to adapt to the EU’s AI Act, announcing that they won’t offer full services in the bloc due to the regulation. It does, however, predict that the implementation of the legislation will be “softer than anticipated after lawmakers worry they’ve over reached”.

It also forecasts that investment into humanoid robots will decrease, as “companies struggle to achieve product-market-fit”, that “a video game based around interacting with GenAI-based elements will achieve break-out status” and that “an app or website created solely by someone with no coding ability will go viral”.