Europe’s startups are getting some of their mojo back in 2025, according to Atomico’s State of European Tech report.

The latest edition of the annual temperature check on the region’s tech landscape paints a rosy picture of rising optimism among founders, increased funding and new opportunities in sectors such as AI and defence.

On the not-so-good side, however, the report shows the continued decline of climate tech and the growing gender funding gap.

The State of European Tech report features data from several deal-counting platforms, alongside a survey of more than 2,500 founders, VCs, LPs, M&A advisors and startup operators.

Sifted combed through the 183 charts in this year’s edition to pick out 10 key findings.

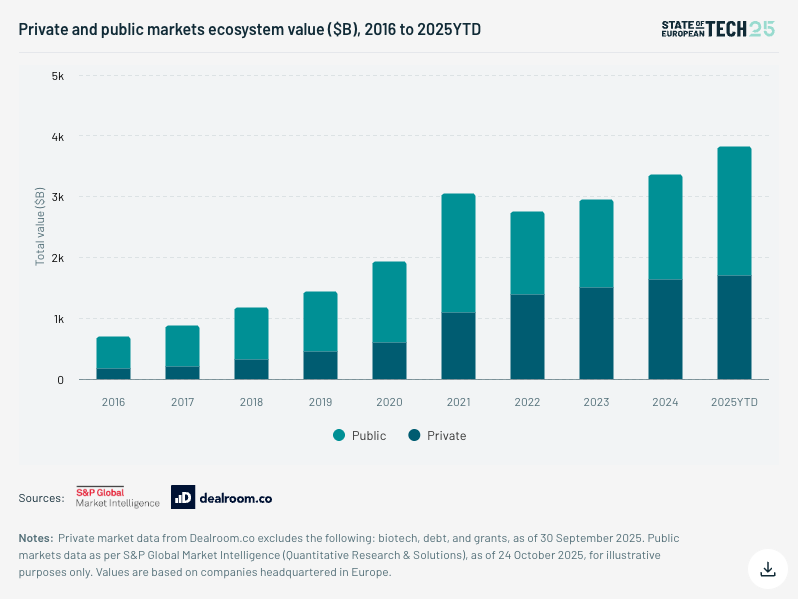

1/ Ecosystem valuation soars

Europe’s tech sector continues to rise in value. Public and private companies are now worth nearly $4tn, a fourfold increase on a decade ago.

The value creation has seen European tech contribute ever more to the region’s GDP. In 2025, it represents 15% of the figure, rising from 4% back in 2016.

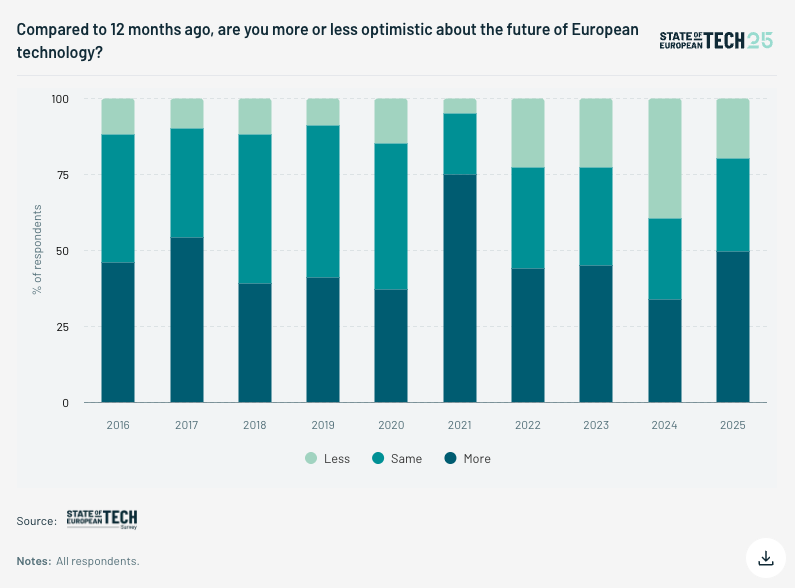

2/ Optimism back up

Sentiment among founders, VC and operators is picking up in Europe too. Exactly half (50%) are more optimistic about the future of European technology than they were 12 months ago, the highest figure since the boom times of 2021. Just 20% were less optimistic.

Survey respondents were more bullish on starting new companies, too. 42% of them said it’s more attractive to launch a startup today than it was 12 months ago, compared to 26% and 25% in 2023 and 2024, respectively. Just 19% of respondents said they thought it was a worse time to begin a company today.

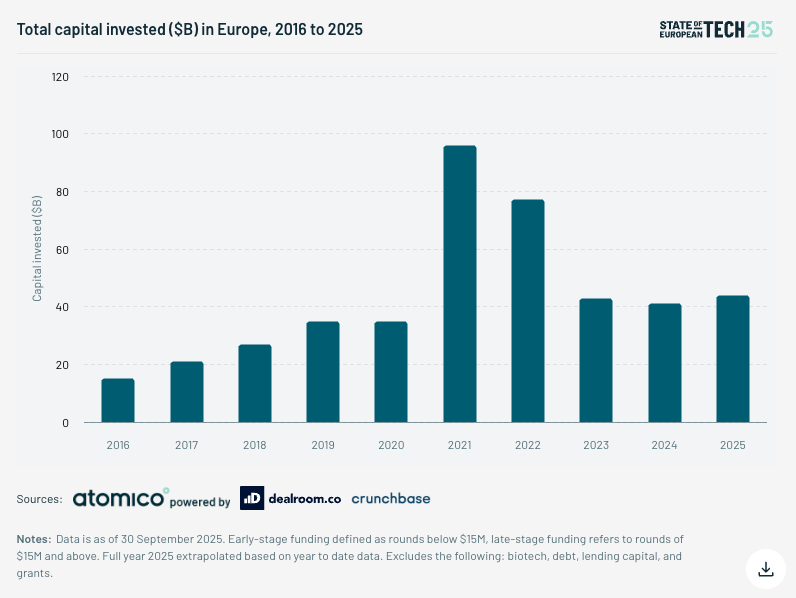

3/ Funding rises

Total capital invested into Europe’s startups is projected to hit its highest levels since 2021 and 2022. The report predicts $44bn will be raised in 2025, topping the $43bn and $41bn picked up across 2023 and 2024.

France’s AI darling Mistral raised the biggest round of the year so far, with a €1.7bn Series C in September. UK-based AI data centre provider Nscale picked up $1.5bn across two rounds in September and October and German defence tech Helsing raised €600m.

Startups from the UK brought in the most funds, raising $14.4bn. Germany came in second with $7.4bn raised and France third with $6.1bn.

Venture debt had a good year in Europe. Startups in the region raised $5.6bn of the financing, making up 12.7% of total funds, both records.

4/ Deeptech’s moment

In 2025, 36% of European VC dollars went into deeptech companies, up from just 19% in 2021.

As well as those mentioned above, DeepMind spinout Isomorphic Labs picked up $600m in March, while Finnish quantum startup IQM also brought in a $320m Series B and defence tech Quantum Systems a €160m Series B.

But those pale in comparison to some of the biggest deeptech rounds in the US. OpenAI raised the biggest ever private round for a startup with $40bn in March and Anthropic picked up $13bn in September.

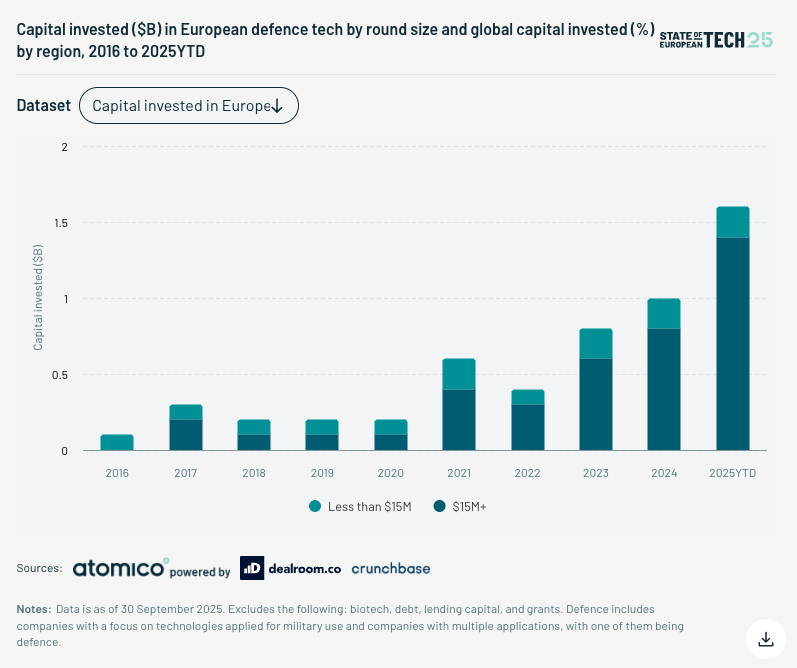

5/ Defence tech booms

One of the buzziest verticals across European tech in 2025 has been defence tech.

Startups in the sector have raised $1.6bn so far in 2025, a record figure and way ahead of 2024’s $1bn.

All that funding is seeing Europe’s crop of defence techs ramp up expansion across the continent as they look to take advantage of rising government spending in the area.

Many of the best-funded are also increasingly looking to M&A as a way to bolster capabilities in the face of competition on both sides of the Atlantic.

Elsewhere it’s been a bad year for climate tech. In Europe, it’s gone from raising 32% of total capital invested in 2023 to just 18% in 2025, as sentiment has cooled on the sector.

6/ Talent war? What talent war?

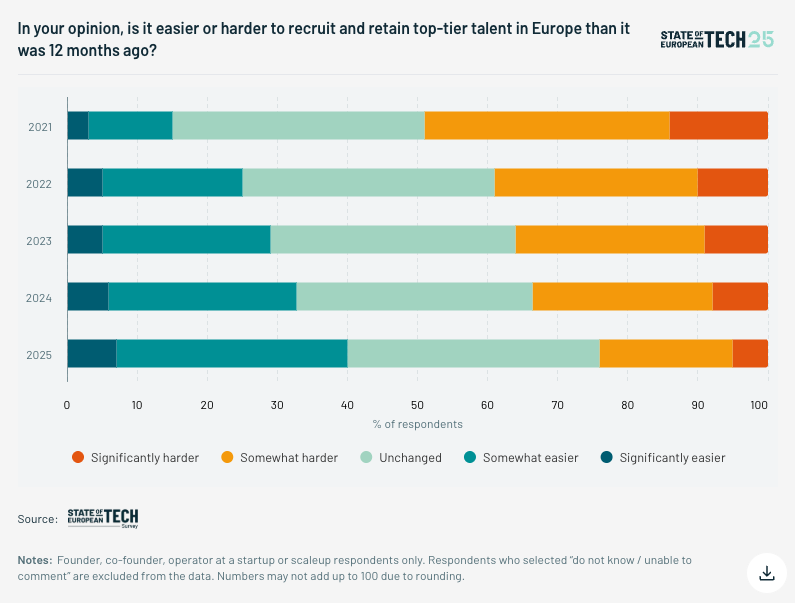

While much has been said about European startups scrambling to fill talent shortages and offering ever increasing salaries as they look to beat out rivals to the region’s best and brightest, respondents to the survey said it had become easier to hire top talent.

Around 40% said it had become somewhat or significantly easier to bring in top hires in 2025, compared to just 15% in 2021.

7/ US top destination for founders considering relocation

15% of surveyed founders tell Atomico they have moved their company’s headquarters to another country, with 42% saying they considered relocating but ended up staying put.

For those that thought about a move or actually upped sticks the US was the destination of choice. 57% of those that relocated headed across the Atlantic, with 73% of those who considered it mulling the US.

The key driver was access to capital and customers. 66% of those who considered moving and 51% of those who did said funds were the main driver. Around 40% of both groups said customers were a big consideration.

That chimes with the doubling down on the US made by UK accelerator Entrepreneurs First in recent months.

“American customers are very fast in terms of procurement experimentation,” cofounder and CEO Alice Bentinck told Sifted at the time. “They have very deep pockets and it means our companies are getting to hundreds of thousands of dollars in annual recurring revenue (ARR) within three months of landing in the US.”

8/ Lack of exits barrier to VC funding

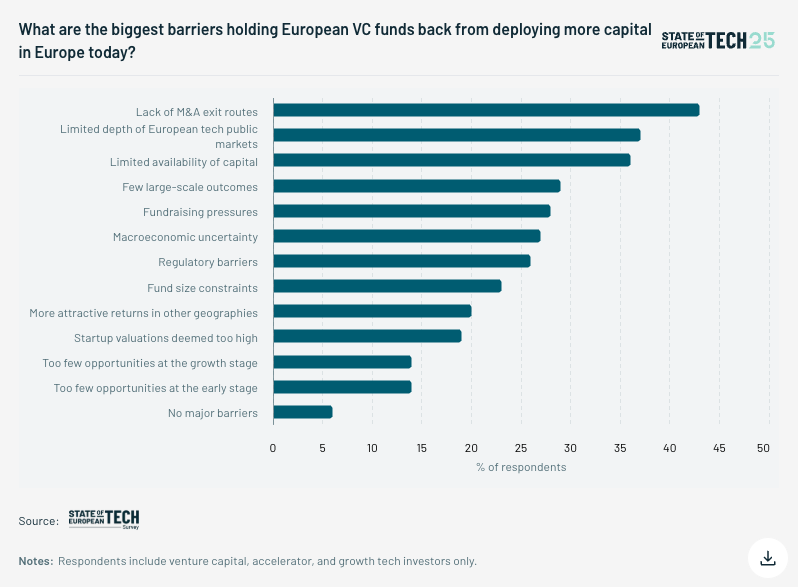

The biggest barrier holding European VC funds back from deploying more capital was a lack of M&A exit routes, with 43% of investor respondents saying it stopped them writing more cheques.

37% said the limited depth of public markets was an issue and 36% said a lack of capital available from LPs.

9/ Stingy pension funds

Pension funds in Europe are showing little interest in startups.

2024 saw European pension funds allocated just 0.01% of their assets under management to VC. While that figure increased from $650m in 2023 to $1bn in 2024, the proportion still looks like a rounding error.

European pensions contributions to VC lag the US by a factor of three. If they matched US allocation levels, an additional $210bn could flow into VC in the region over the next decade, the report says.

10/ Diversity divide in Europe is growing

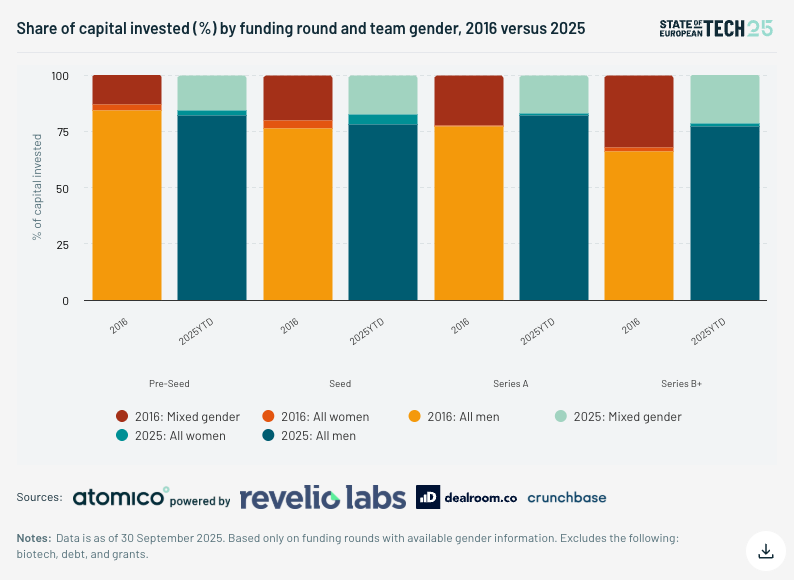

There’s been no progress on closing the gender funding gap over the past decade.

At all stages of investments, the share of capital invested into all-women founding teams has either remained stagnant since 2016 or dropped.

At pre-seed there’s been a slight improvement in the percentage of funding picked up by mixed gender founding teams, rising from 13% to 16% over the last 10 years.

But as Series B and beyond, the figure has dropped markedly. Mixed gender founding teams raised just 22% of capital at that stage in 2025, falling from 32% in 2016.