One message shouts out of the 2018 State of European Tech report, produced by Atomico, Slush and Orrick: it’s all about the people.

Overall, Europe’s tech crowd is multiplying, mixing, and mutating. The number of entrepreneurs, researchers and developers is rapidly expanding (especially in Spain, Turkey and Russia), they are attending more meetups (a good predictive sign of startup activity), and they are increasingly leaving big companies and universities to launch startups. If tech is ultimately about culture then something interesting is going on across Europe.

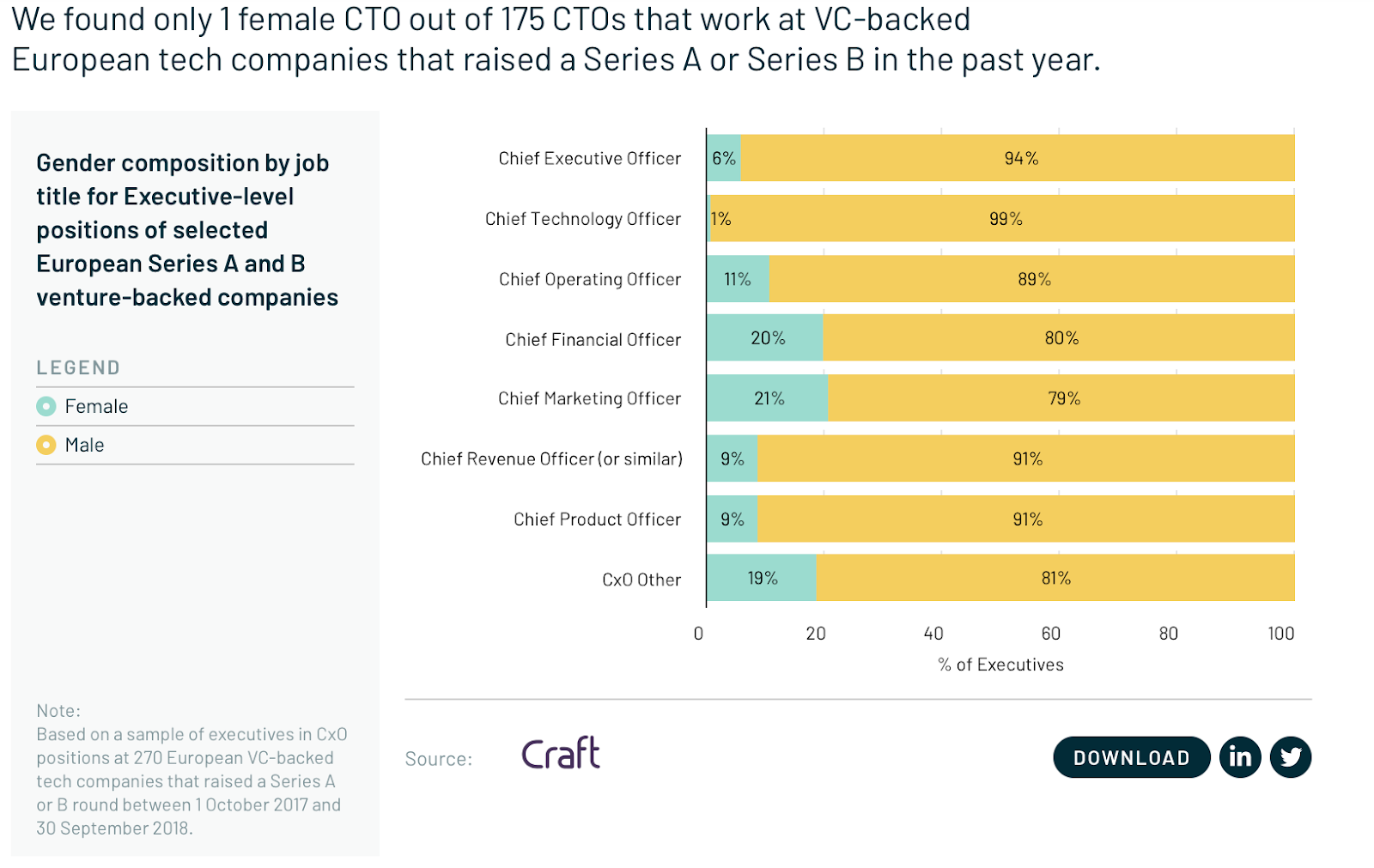

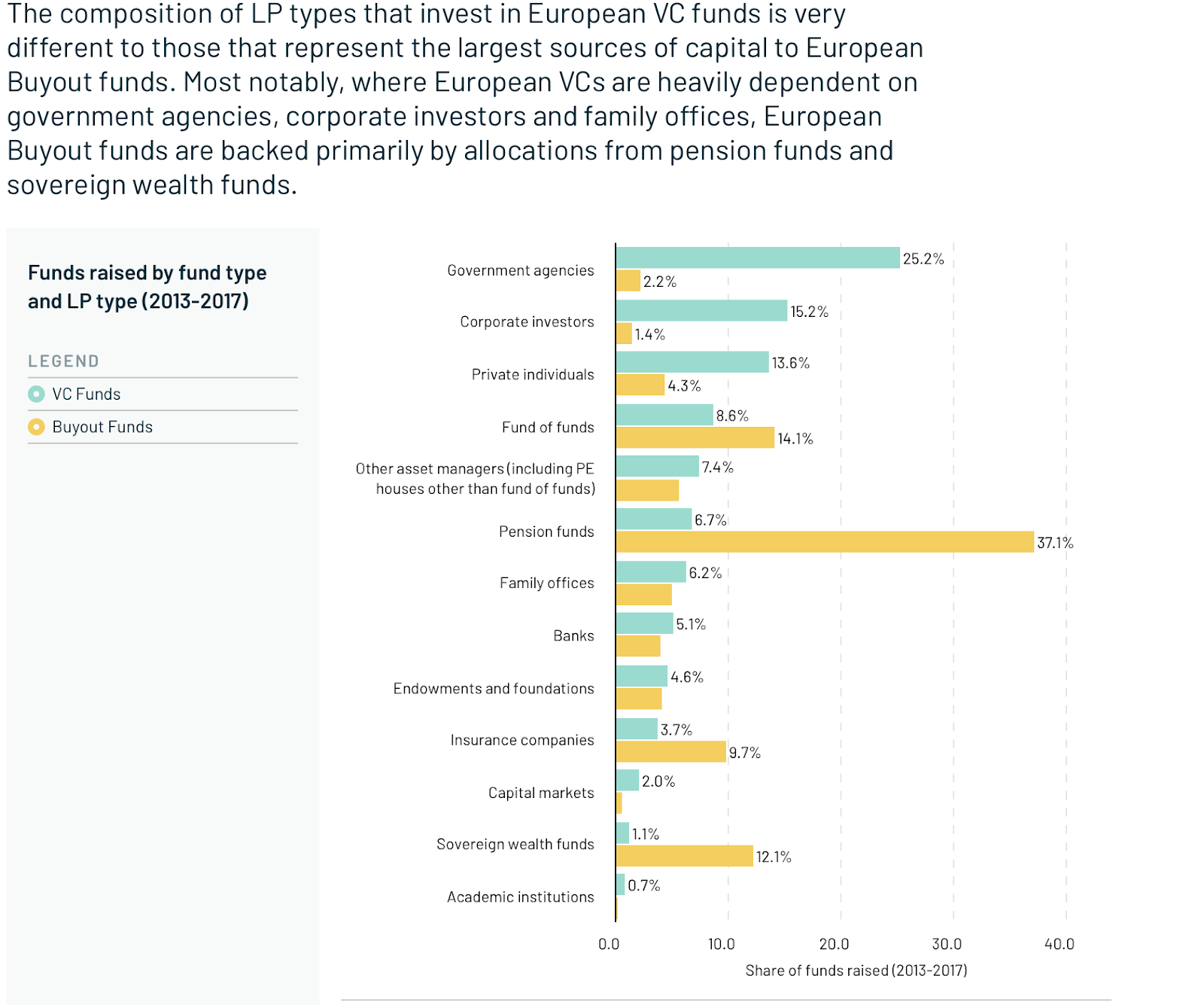

But the report also captures some of the big downsides of European tech. Shocking - if unsurprising - numbers on lack of gender diversity highlight how much work still needs to be done to build a representative industry. And the difficulties that national businesses face expanding across the region and the lack of institutional investor interest are also striking.

Here are the five charts I found most interesting:

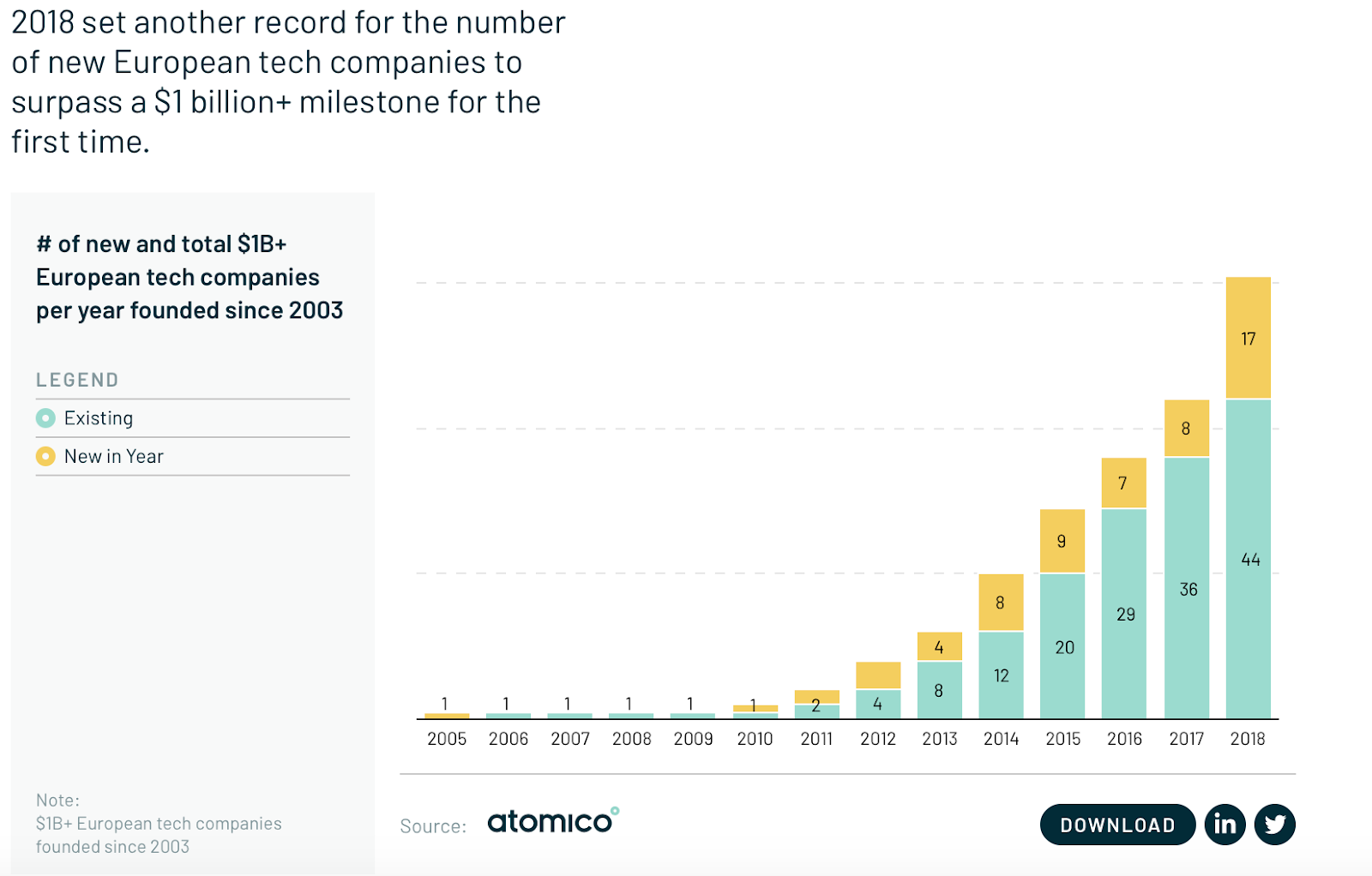

1. In terms of investment flows, European tech is in good health. Some $23bn was invested in European startup world in 2018, compared with $5bn in 2013. Europe is also giving birth to an impressive number of unicorns. It will be interesting to watch, though, how the current “tech-wreck” in the valuations of US, Chinese and European public companies affects private market valuations in 2019.

2. Europe likes to pride itself on its diversity. But in terms of gender diversity the industry is retrograde. Alarmingly, some 46% of women who responded to the survey said they had suffered discrimination.

3. European tech is no longer just about the big centres of London, Paris, Berlin and Stockholm. Judging by the number of tech-related meetups, Europe is catching the tech bug. Interesting to see how hubs in former industrial centres and eastern Europe are hotting up.

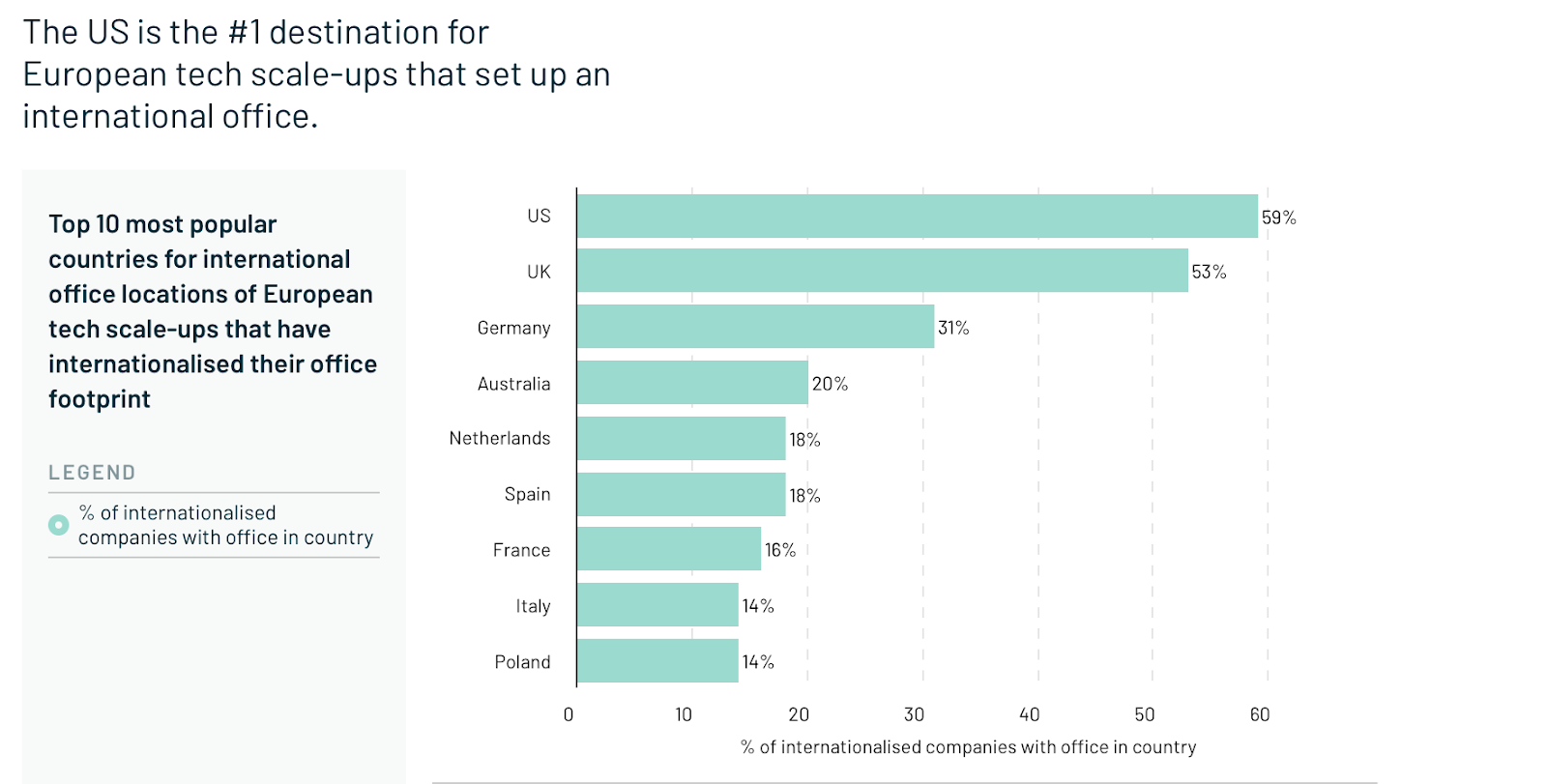

4. The report highlights how far Europe is from having a truly single digital market, a point made to me recently by Diego Piacentini, Italy’s former digital commissioner. He argued that too many national markets were sub-scale yet companies struggled to operate across Europe because of its complexities. It is certainly striking to see how many startups open their second office in the US (and Australia) rather than in a neighbouring European country - although this may also reflect the fact that they do not always need to do so when expanding from Denmark into Germany, say.

5. The lack of institutional investor interest in one of the fastest growing sectors of the European market is also remarkable, and disappointing. The chart below shows how European pension funds, which collectively manage some $4 trillion of assets, commit far more money to buyout funds than they do to VCs. Small shifts in the asset allocation could make a vast difference.