March 2020 was the least active month for funding rounds in Europe in two years — yet, according to the venture capital investors hanging out on Twitter, they’re all still ‘open for business’.

Sure, there were some big raises — flying taxi company Lilium raised €224m and online car marketplace Cazoo raised £100m — but those deals were in the making long before the crisis hit. Overall, funding rounds were down 22% in March, according to Dealroom, and valuations have also taken a hit.

So what’s really going on?

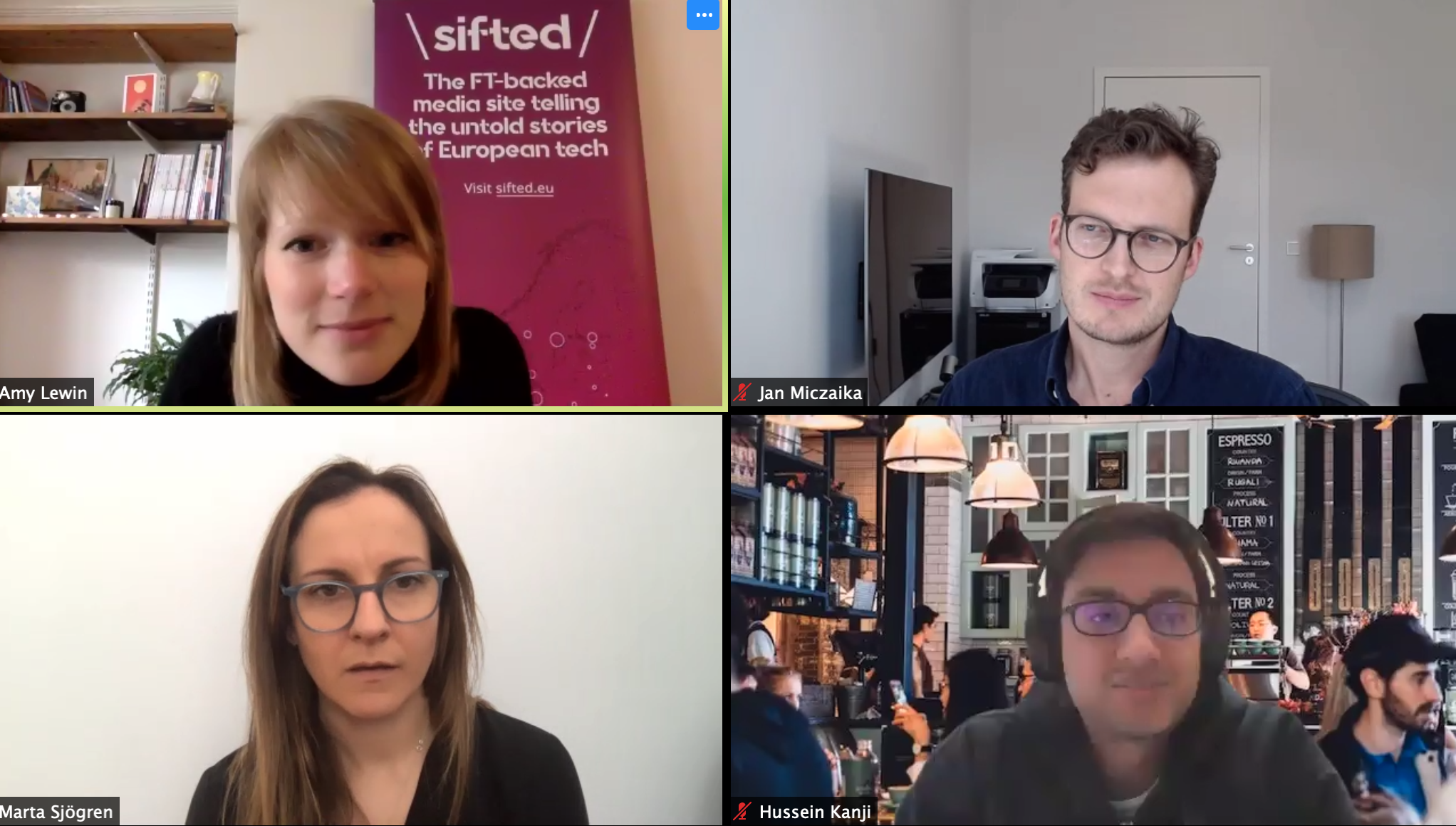

Last week, Sifted and Dealroom gathered a (virtual) panel of VCs to ask just that. On the ‘couch’ were Marta Sjögren, partner at pan-European VC firm Northzone, Hussein Kanji, partner at London-based VC firm Hoxton Ventures and Jan Miczaika, partner at German VC firm HV Holtzbrinck Ventures.

Below is a brief summary of the main points covered — and following this an edited version of our full conversation.

We’d love to hold more webinars like this over the coming weeks. If you’d like to partner with us, or sponsor one of our webinars, get in touch with helen@sifted.eu.

The top line

- Investors are still investing — but expect them to take longer than usual, as some have their focus diverted to helping portfolio companies, while others may need to invest their capital over a longer period of time than anticipated.

- Valuations are likely to be lower, reflecting the new market conditions — but this might put a startup in a better position for its next funding round as a result.

- No sectors are ‘off-limits’ — investors are still investing for the long-term — but they’ll be paying close attention to what growth looks like and where it comes from over the next few months.

- Some investors will disappear for a while — most likely family offices and corporate investment funds.

- It’s worth looking into government funding schemes — but don’t rely too heavily on them, as they will not work for everyone and may take a while to pay out.

- It’s important for startups to keep developing, even if they’ve become incredibly lean — and smart pivots now could seriously impress investors further down the line.

The full conversation

So, investors, what are you spending your time on at the moment?

Marta Sjögren: It’s been a busy few weeks. For all of us, the primary focus is the portfolio — and making sure we have our current portfolios under control, so that we can help those founders the most. Everything else comes secondary. We have had continuing discussions, as well as starting new discussions with entrepreneurs, but I can’t say we’ve closed many deals.

Jan Miczaika: The first week or so was really also as a fund planning for us: how many reserves do we need to support our existing companies? What are scenarios? How can we help them? So, for example, in Germany, there are a number of state aid mechanisms which we tried to inform our startups of. We've been in lockdown for three weeks [in Germany] — and about a week ago we started to process incoming deal flow again.

Hussein Kanji: We've been juggling. We spent our first week with our portfolio companies, spending some time with them, figuring out what's happening on their side. We're pretty fortunate in that most of our companies are pretty unaffected by this — to the extent that you can be unaffected. And we also called all of our LPs and gave them a debrief on what we saw was happening. In parallel, we've been incredibly busy; we're in the middle of two or three closings right now, all happening at the same time. We're a small fund of three people so it's all hands on deck.

With those deals that you're closing, I presume those have been relationships you've been building from before the crisis hit?

HK: Not, not all of them. One of them [started] quite a bit of time ago and then we announced this week, another one started or kicked off right before [the crisis began] — so we spent quite a bit of time with the founders prior to us all self isolating. And then the third one is dead smack in the middle of the crisis. So our only engagements have been like this, over Zoom. We're excited and writing the cheque.

And how is it different? Is it different? I know there are founders and investors who are worried that you can't build the kind of relationships that you need to over Zoom and that things will take longer, or it will be harder. Is that actually the reality? How does assessing companies differ in the everything-on-Zoom era?

HK: It's different. But you know, you learn how to adapt. The bandwidth in terms of being able to get information over a medium like Zoom is a little bit different. But you know, it's not a zero, it's just different. And so you find other ways to kind of communicate. We haven't felt troubled in terms of making assessments in this new world — although we'd be really happy to go back to the old world.

You're all generalist investors: are you now not looking at say travel companies or transport companies or other companies that are super affected by this? Are they off limits for a while? Are you only looking at remote working or medtech — these sectors that are booming at the moment, as a result of the pandemic?

MS: It's too early to tell. We've been in this for what, three weeks? Of course companies whose volumes have dropped off any kind of reasonable growth graph are going to be harder cases to make, but I'd argue that if your business model and the proposition that you have were long-term sustainable, and this is a blip in the curve merely, and it is a sustainable business model, I don't see a reason why you wouldn't look at something that's disrupting fundamentally inefficient, usually high-margin industries. So from that perspective, yes, we would continue looking at it — but it's difficult to see how long this will affect things like travel or hospitality or similar. But definitely open to business for all sorts of things.

I think what we're looking for, however, is more 'recession-proof businesses', and understanding where those revenues are going to come from and what is the value of growth. How do you value growth these days as opposed to how you might have valued it a month ago?

What makes a recession-proof business? If founders are in the unlucky position of having to raise money in the next six months, how can they prove that to you? What are you looking for?

MS: A lot of industries are going to be caught by not being able to sell, whether it's B2B or in some cases, B2C as well — because you're not meeting people, you're not meeting your customers, and your customers might be putting things on hold to be able to just survive.

I'm really excited to talk to product owners, product leaders and engineering leaders to understand what gaps in their team's productivity they're starting to see and what tools they're starting to adopt.

I will be looking for engagement in products and really seeing what products really stick. I posted on Twitter the other day that I'm really excited to talk to product owners, product leaders and engineering leaders in particular right now to understand what gaps in their productivity and their team's productivity they're starting to see and what tools they're starting to adopt. You’ve got to remember that even companies like Salesforce had some very pivotal moments during the 2000s when they were just giving out their software for free and building behaviour and then hoping that would turn into a commercially viable relationship over time. I think we're going to see a tonne of this behaviour. And I think we're going to see some really exciting winners that come out with just a very, very strong user love, and that's going to convert into revenues over time.

There was this meme on LinkedIn, you know, ‘Who digitised our business? Was it the CEO, the CIO or Corona?’

JM: It's a question we asked ourselves as well, but on the other hand, we invest on a five- to eight-year time frame. So, as Marta correctly said, it's more of a blip. I do think there may be sectors which even accelerate due to this. There was this meme on LinkedIn, you know, ‘Who digitised our business? Was it the CEO, the CIO or Corona?’ Those are the types of companies we'd now be looking for more strongly, who profit from digitalisation, be it in science, education, business, procurement, marketing, etc. Rather than some of the more traditional, heavy-hit industries.

HK: I think the challenge with travel is not going to be a short-term blip; it's going to take a little bit of time for that sector to rebound. And the challenge with most of our companies is they're burning cash and if you're burning even more cash than normal, because sales are going to take a while, that just makes it really hard to fund, because you're compensating for that deficit. If you're a small early-stage fund, you can't do that infinitely and your cheque size kind of has to double if the sales aren't going to be there.

I think the challenge with travel is not going to be a short term blip; it's going to take a little bit of time for that sector to rebound.

The kind of stuff that we're looking at — they're literally all across the board right now. There's no pattern for them whatsoever. We're pretty generalist, and this is a five- to 10-year game, not a one- to two-year game.

So your one year plan, has that changed at all? Are you thinking, ‘Okay, we were going to spend this much more on new investments, but actually, we need to keep X% back for existing companies if they need a bit of extra runway’?

HK: We did that exercise in that first week to get a sense of everyone's health. Our first fund is in its later days, and our second fund was raised only about a year ago. And so most of it is sitting on the sidelines. And most of those companies, from a kind of bill of health perspective, are perfectly fine. Our advice to everybody has been: lengthen cash flow, lengthen your runway as much as possible and make the hard decisions if you have to make any hard decisions. But because everyone's been funded in the last roughly three to nine months, everyone has a decent balance sheet to ride out the storm, which means that most of our fund is sitting ready to go. We don't have to patch anything over and use any of that money for existing companies; it's a privileged position to be in.

MS: A few months ago we announced our ninth funds. I think the benefit of a fund like Northzone that's been around for coming up to 25 years soon, is that we've seen this before; we've seen it not once, but three or four times and at different scales. What we've learned is that you need to pace yourself and you need to pace the portfolio as well. So echoing what Hussein was saying, it's about deploying the fund, but also not rushing it. We had a few years of really high-pace investing. I think that's certainly going to slow down somewhat. But I think it's too early to tell how much capital we will deploy in the coming year just on the basis of three weeks’ of data.

I think some great entrepreneurs are going to come out of this.

I think some great entrepreneurs are going to come out of this. Let's not forget that some of our best investments were for companies that were funded in less great circumstances: Spotify’s Series A was 2008; iZettle’s Series B was 2012. And those are some of our biggest exits over the past decades.

Quite a lot of people in the audience are asking about the numbers. So talk us through the kind of term sheets you are seeing or what you're hearing on the grapevine: What is happening to valuations and to how big the rounds are and the number of investors investing?

JM: In the past few months we’ve had some extremely competitive rounds in Europe which were joined by Asian or US investors, where valuations just exploded, and I think there’s definitely going to be a cutback on those. I think the investment pace will be slower. At the same time, even out of this very small bracket of startups, I think we will see valuations go down. Public markets have gone down, depending on what you look at, between 25 and 40%. And private markets even before the crisis, many people were saying were overvalued as well, if you look at the number of unicorns in Europe etc. And so I think the reality for any founder is that valuations will likely return to a level they were maybe three, four years ago, across the board because we're not at peak market anymore.

Valuations will likely return to a level they were maybe three, four years ago.

MS: To add to that, what I'm starting to see and hear about is that in some cases, especially serial founders, are coming back to the table where they were expecting a certain valuation and bringing the valuation down themselves. Saying, ‘We don't want to be in a position whereby even if we do end up closing this round at this valuation, we're going to inevitably have a flat or down round next time we need to raise’. So we're seeing that as well. And I think it's really mature of founders to think that way and to think two years ahead, about where they need to be in terms of metrics to raise that next round. And that's changed considerably in the past few weeks. And I think companies that were previously rewarded for burning quite a bit, being able to raise every whatever it is nine months or something, are in a very different position now from companies that are able to reach profitability and then raise again, or at least trend towards it.

Serial founders are bringing the valuation down themselves.

HK: You can't expect bull market multiples and bull market valuations in bull markets and not expect bear market multiples and bear market valuations in more recessionary type markets.

Now, the only catch to this is there's still a tonne of money, maybe less so in Europe, but a tonne of money at the growth stage. And it's all sitting idle. It's all been raised in the last year or two or three. And so it has to get used. And so we'll see, I think for the really high quality companies — like the top 1% — I think we'll still see big prices, because there'll be an auction. There's always a flight to quality in these kinds of things. And then I think for everyone else, that's where it gets really tough, probably much tougher than it has been the last couple years. I think a lot of the tourist money — all the family office money, all the corporate money — the people who come in to ride momentum and play the bubble game, they're the first ones out the door when you actually have to make real decisions, and not everything that you're investing in goes off to the right.

If I'm a founder right now, I have to raise money or I'm already in the middle of raising, how do I tell the difference between my valuation getting slashed fairly because of the situation we're in, or you've got a dodgy investor who's really trying to take advantage of you? Because there's been lots of reports of not-so-great behaviour at the moment. How do you navigate that as a founder?

MS: I think that in good and bad markets you need to create a sound cap table — one that future investors will also want to back. And if you don’t, if you're diluting the founding team or the management team too much, that's not going to fare well for it down the line. So I think there's still some norm around what dilution you should be expecting at the different rounds; I'd say that's probably around 20%, max 25%. But maybe you will adjust how much capital you're raising and at what valuation to get that maths to work.

The challenge with some of these joker investors is that they'll pay the high price and then at the first sign of trouble, they're the first ones to leave.

HK: I would say you need to run an auction, and you need multiple offers on the table — because if you're only picking from one, it's really tough. So you need to try and get as many people interested. And then when you get all the people interested, you need to pick the high-quality money now, or you have to factor in high-quality money in addition to just high price. The challenge with some of these joker investors is that they'll pay the high price and then at the first sign of trouble, they're the first ones to leave. Firms like Northzone that have been around 24 years, that are really good practitioners of this business, won't do something like that. We're a newer fund, but we've been in this industry for 10 plus years, so we're not going to do something like this, the same goes for Jan. So you just have to be really discerning about who you're going to pick, maybe even if it comes with a slightly lower price, as long as it's not too low relative to the rest of the market. I'd say you want the higher-quality money on your side because they're going to stick with you through thick and thin.

Are companies at different stages more impacted than others? What differences are you seeing between seed and later stage companies?

HK: I think my feeling is that a lot of the seed rounds are probably the easier ones to get done because there are a bunch of seed firms that have set up in the last few years and they all have dry powder. There's an influx of seed capital. There's also an influx of growth capital; every larger kind of private equity type firm is playing around in the growth space. Everything in between gets tough.

If you're at the Series B or a big Series A, like your €10m+, you need a real size cheque, you need a real firm who's raised real capital. Europe only raises five €250m funds per year. If you assume everyone sets up at a different time, and everyone has a three or four year cycle, that means there's a very small pool of those firms out there. And the reason why the Americans — and it's largely Americans — are in such a high proportion of European rounds is because there are just not enough Europeans doing this kind of stuff in the market. And so I think if you end up with a thin balance sheet, like you haven't raised the €50m or the €20m a few months ago, and you're still a loss-making business — so you're not as attractive to the growth firms — and you can't necessarily turn the corner anytime soon, given the crisis, you've got a very small handful of people that you can call and the other people that you could have called, can't fly over and kind of rescue you. I think that's where it's the most pronounced.

If you end up with a thin balance sheet and you're still a loss-making business, you've got a very small handful of people that you can call.

It's sad because Europe was finally kind of getting its mojo and scaling as an economy in the tech industry. And now we have this shock, and it kind of tells us how weak we actually were at that level.

Do you think we'll see a lot less investment from the big US investors in Europe now?

HK: I don't think they know the founders well enough, I don't think they can socially reference among their circles, they actually physically have to fly over or set up offices here. Sequoia’s set up their first person — but they're not up and running just yet. There are just not as many of those flyovers that are going to happen, and they're going to have their attention on their own economy and with their own companies, which means that you're going to be dependent on the local ecosystem and the local ecosystem is just really small when it comes to proper size funds. The small funds like ours, we're a dime a dozen — there's a tonne of us now. But there are not that many high quality €300m, €400m, €500m funds in Europe that are doing early stage versus growth.

MS: If I compare the landscape of investors in Europe now to when I started my career back in 2008, we have at least 10x more capital than we had then. And I do believe that we have more funds than ever before. So the question is, then, how will some of the larger funds use this opportunity to reshape their strategy? Maybe you're managing a fund of €500m, €600m, €700m. Are you still going to be very focused on Series A and Series B, or are you going to lose track of the letters there and just start seeing where you want to deploy that capital and the larger cheques — perhaps in companies that you might have missed in the past, and that you have the potential to revisit? I think we're going to some really exciting things here. So I'm a little bit more optimistic. You're going to see the fly-ins come back at some point. But I think I wouldn't hold my breath in the next three to six months — and then there's summer, which slows things down as well. So I do think we're way better positioned than we were during the last downturn.

So what’s some advice, if there is any, for those founders who are in the shitty position that they're raising their Series A or Series B, and stuff was ticking along pretty nicely, and then this happened. What do you do? How do you make the best out of this not-excellent situation?

JM: One tricky part is conserving cash as much as possible while avoiding this kind of death spiral of not going anywhere. It's quite easy to become a super-lean startup where nothing happens. You need to be very efficient about your cash but also creative about it — how do you extend your runway pre payments, using suppliers, all these kinds of things.

It's quite easy to become a super lean startup where nothing happens.

To be quite honest, I think it's harder to build relationships via Zoom than it is in person. So I'd start talking to people who were interested in the past and with whom you were in contact. I'm often disturbed by this, ‘Oh, we have to raise an A now because we did a seed’. Everything that happens in 2020 people will always exclude a bit, the same way we excluded 2008/2009. It's okay if your rounds are a bit messy, if there's convertibles here and there and so on. It doesn't need to be picture perfect.

Everything that happens in 2020 people will always exclude a bit, the same way we excluded 2008/2009.

And then just do what good entrepreneurs do: be scrappy and pivot and change and get money in however you can. This is all assuming you're a seed-stage startup with burn of around €50,000 to €200,000 a month. I think where it gets really hard is if you're burning significant amounts of money, let's say a million plus a month. That's really the tricky position to be in.

HK: These are tough times, so it's not super easy to come up with any kind of formula for this market. If you're starting but you can't get funding, and you can't extend your runway, I don't think there's a prescriptive get-out-of-jail type formula. It's just hard. It's hard to be a startup and it's really hard to be a startup during a crisis. When the whole world's coming in on itself, it's like a gazillion times harder. We have a lot of sympathy for folks that have to do these kinds of difficult things. It's a much harder job than being an investor in many ways.

Take action fast and create a real sort of survival mode within your company.

MS: I will be keeping a very close eye on how the founders reinvented the business and how they survived this; what action did they take and how does their resilience show up in the aftermath of the crisis? I think those will be some of the more fascinating dialogues. I'm always interested in the why; why did you act in a certain way, whether it's in a positive scenario or a negative scenario. I'm looking forward to seeing how the more resilient entrepreneurs have moved fast — because that's the most important thing — take action fast and create a real sort of survival mode within your company.

It might be too early but do any of you have good examples of companies who have already started to pivot or refocused their efforts or energy in what seems like quite a smart way?

JM: One of the larger companies from our portfolio, Urban Sports Club, has a model where you pay one subscription, then you can access all these fitness clubs all over Europe. What they've done is they've moved a lot of their local studios over to virtual classes, and allowed people to stay subscribers, even if they're not as happy with the service as they were before because gyms are closed, obviously. But then that money goes to support the local studios and at the same time, they're educating the studios on how to become virtual. In a way, Corona is now bringing a bunch of yoga studios and personal trainers into selling their courses online on Instagram, via Urban Sports Club, etc. So to me, that's a win-win in a way which wouldn't have happened as quickly without the crisis.

Let's talk a bit about non VC funding options. What are some of the good government schemes or other kinds of initiatives you've seen out there that you think founders should be taking advantage of, or if it's not available in their country, other countries should be copying?

MS: I think I've spent more time reading various governmental websites in the past few weeks than I have in my entire life. Within the EU there is a whole variety of schemes going on. What I'm excited to see is what the private sector is doing as well — how the banks are dealing with this and which banks are stepping up. Our friends over at Silicon Valley Bank have introduced a product that could be helpful.

I think there's a lot of confusion with regards to what you actually qualify for. And I think the next step is seeing how this tremendous amount of companies that are going to start applying for these government types of assistance, how long they're going to need to wait and what might be just sunk time or efforts because they might not qualify at the end of the day.

What do founders need to be wary of when they're taking advantage of some of those schemes, whether it's furloughing or taking loans. What do they need to be a little bit cautious of?

JM: The issue I see is that many of these programmes were created literally in the past week or two — and there is often one small detail which makes it hard or impossible to get access to these funds. So, at least from my perspective, what has worked is giving small amounts of money to lots of people, like €5,000 to €15,000; furloughing works very well in Germany. But then once you get into the debt programmes there's all kinds of small limitations or process implications, which make it very hard. And so, as a founder, if you're thinking about where to invest your time and your resources, I think you can look at these government programmes and evaluate them but then at some point, I also encourage people to stop and go back and look at their business and their company and their existing investors or new ones, because I think it's easy to spend a lot of time with these government programmes and right now, it still seems very much in flux.

Do you think governments need to do? Do they need to do more? We had an opinion piece in Sifted yesterday, calling on the government to do this Runway Fund idea, which is that the UK government would stick in £300,000 and some VCs would get involved, as well, and that would help fund a whole chunk of UK startups. Is that what national banks should be doing? Does that make sense or what kind of problems are there?

HK: At a high level this industry is still nascent, and it's under capitalised and could always use all the help that it can get from anyone — and the government's a great source of help. Now, that said, there's a lot of other stuff for the government to do. And I think one of the perils... One of the good pieces about being in Europe is that the government is super supportive. One of the bad things is we're so incredibly dependent on the government for everything in this economy; the EIF is like 20 to 40% of the overall capital. At some point, you got to wean yourself off this stuff. We're not welfare recipients.

One of the good pieces about being in Europe is that the government is super supportive. One of the bad things is we're so incredibly dependent on the government for everything in this economy.

What's the impact on VCs? What are the challenges for venture capitalists at the moment?

JM: We're investing out of fund seven, which is a €300m fund, which we started investing in 2018. So it's still relatively fresh. I think many founders need to remember that VCs have a kind of a two-sided marketplace. On the one hand, we have to please our LPs, but then we also have to please our founders. We are, as many others are, in the lucky situation of having mostly institutional money backing us, to take a long-term view on technology. If you're collecting pension funds and you need to provide pensions for people in 30 years, probably investing in technology is a good idea, irrespective of in-between bumps. We're obviously communicating a lot more with our LPs than we were in the past. However, we haven't seen widespread pullback or anything like that.

Do you think we'll see a lot fewer VC funds get raised over the next year? Or will it depend on whether you're a new fund manager versus the Index, the Accel, the Northzones of the world?

HK: My suspicion is we will see a slowdown in fundraising in 2020. One of the big challenges on the LP side was that a lot of funds were coming back for re-up — the same funds were coming back for the next fund, and that pace was accelerating. There wasn't that much of an allocation for newer type funds, because the LPs were already pretty busy talking to and dealing with their existing portfolio [of VC funds] who were coming back. In addition, when the public market corrects like this, people's allocation percentages to venture go up because venture doesn't move dynamically the way the public markets do. So if you're investing X into venture and Y into public markets, and then Y goes down by half or Y goes down by 20%, then you're over-allocated on the venture side — and so that necessarily leads to a pause. And then in Europe, unfortunately, there's just not that many strong institutional investors who allocate to venture, which is why the government's historically had to step in and be that support network. There's a lot of family office money, and I find that those folks are the most skittish, because if they see 20% of their portfolio is wiped out in the public markets, and the real estate market doesn't look like it's any healthier right now given that rents aren't being paid, it is very natural for a lot of those folks to not think like long term like university endowment type money, which is very long-term durable, but to be much more short termist and to kind of hit the pause. Which means that if you're a fund raising right now, or even probably going out at the end of the year or going out next year, it is going to be tough and I think the natural inclination for a lot of venture funds is to stretch your current fund a little bit longer to use it to get you through this storm and then to go out for a fundraise after this is over, which means that you're again more cautious on actually investing and you spread your dollars a little bit slower and a little bit thinner across opportunities.

What are the opportunities in this? Who is this good for? Or how is this good for us in six months, 12 months or whenever we get over this?

MS: It's back to what I was saying before with regards to resilient entrepreneurs and resilient teams that really get this sort of survival culture going. That becomes a force towards building a new chapter of your company. We're going to see a lot of really, really resilient teams come out of this.

I think we're going to see more disruption in certain industries that we haven't seen to date — digital healthcare being one of them, of course, and I think education being another. We're going to see some maturity with regards to things like food delivery companies, which ones are actually profitable versus the perhaps more flawed unit economics. And I'm excited to see what new teams come up with, because I think a lot of people that are great engineers, great product people will unfortunately lose their jobs or decide to leave. And I think that the shift of focus will go somewhere else. So I'm excited to see what new companies come out of this that will be solving real problems that we have this decade.

JM: It's a very interesting question. On the one hand, there's obviously a bunch of areas in the B2B software space which we could look at as companies change, and maybe reconfigure, change their supply chains, logistics, the type of products as they go into recession, their spending patterns, these kinds of things. But I'm actually really interested also in how consumer behaviour will change. And I have no idea right now. In Berlin, will we have the best summer ever because everyone after quarantine just wants to go out and discover the parks and the bars and the clubs, or will we have turned into social hermits? Will we stop going to fitness clubs and stop going to school? I don't know right now.

MS: I'm really excited to see how even the entertainment space will move. I think it will be about new connections and how you create connections and I think we're going to see a lot more happen on the B2C social side of things.

Are we going to come out with this and realise there are some things that we just don't actually need? We had a piece this week about coworking spaces: will people actually really enjoy working at home so much that they won't want to rent desk space as much? Are you seeing any businesses or sectors not continuing on the trajectory they thought they would as a result of this?

HK: That may be academic — there may be no WeWork after this whole thing.

Office space and rent is one of the things that I'm seeing most startups start to question.

MS: On a more serious note, office space and rent is one of the things that I'm seeing most startups start to question — whether they should be paying it or just avoiding to pay it altogether — and even if they are able to pay their rent, everyone is renegotiating with their landlords. So even when things go back to normal or ‘new normal’, whatever you want to call it, the question is whether we'll need space for everyone or whether we'll make it half the space. Everyone is using this to renegotiate with the landlords and I'm sorry landlords, but this is a reality you're going to have to deal with as well.

Will VCs focus more on startups that can deliver sales from day one? Will there be even more focus on companies that can actually make money when we come out the other side of this?

HK: Not necessarily. I think one of the one of the best things right now is to invest in a company that’s heads-down on product for a while, especially if it's engineering-led. Software developers are probably the best tuned to work remotely. If you're heads down for the next 12 months building, you'll see through the storm because you're in a very different phase. Sales-led companies are the most sensitive towards market conditions, building-oriented companies less so — and those are more interesting investments weirdly enough, because you write the first €1m or €2m or €5m so they can stay dark for a year while they're building whatever it is that they're putting together and come out on the other end much more safe and sound.

JM: To me the question is what is revenue really? Revenue is validation, someone out there is willing to pay. In an enterprise product, it could be two customers — but if they love the product, that's already a really strong data point. And I think, as the VC markets tighten, and investors have maybe less appetite for risk, that early market validation could play a larger role than in the past. It's a hypothesis, but this could happen.

MS: I think we're at an interesting stage of B2B SaaS; we've seen a shift to bottom-up adoption over the past few years. That's how a lot of the software that's become must-have tools have gained a user base and as a result have grown their revenues over time. So I'm really excited to see what engagement companies are seeing rather than necessarily how fast their sales are growing. I think sales in this climate might be a false indicator because it might [come from] temporary needs. Adoption and engagement within the product is more important. I'm way more interested about net retention and what you're able to do to keep your customers and potentially upsell or cross sell within those organisations. And I think that is going to really shine in this climate.

What do you think a founder or a startup can do over the next six months — if they can stay around that long — that will set them in really good stead for the future? And when they're telling you this story in six months time or 12 months time or whatever, what will make them stand out to you?

JM: Marta had a very good point earlier on seeing what they did during this time of crisis, and how fast. When I started my first startup, I think it was four years of constant crisis. And then two more and then we sold it. The situation changes — you may get funding, you lose a key employee, a key customer — crises happen all the time, especially young startups. And a lot of what we do is trying to figure out how the entrepreneur acts, how resilient he or she is, etc. So, I think I'd be most impressed by thinking fast, acting fast, coming up with new ideas, maybe slightly pivoting, being scrappy, etc.

MS: This is a great time to show that people actually love your product. And as an early-stage investor, we look for that way more than revenues, whether it's B2B or B2C. So this is a great time to just invest into the virality of your product and figure out what engagement you can see from your power users and how you shift average users to power users over time as well. That would be my best advice — and stay positive.

I give a lot of credit to folks who don't shy away from those kinds of [hard] decisions.

HK: Did you make the hard decisions that were required? It's really hard to be a founder, it's really hard to be a CEO. Sometimes you just have to make these hard decisions of letting people go and lengthening your runway — and I give a lot of credit to folks who don't shy away from those kinds of decisions, because the longer you take, the business might deteriorate and the worse it gets for you. I don't think anyone here is going to be like, ‘The crisis happened and your sales were down 10%: shame on you’. It's kind of a given. It's what you do with your time.

We'd love to hold more webinars like this over the coming weeks. If you'd like to partner with us, or sponsor one of our webinars, get in touch with helen@sifted.eu.