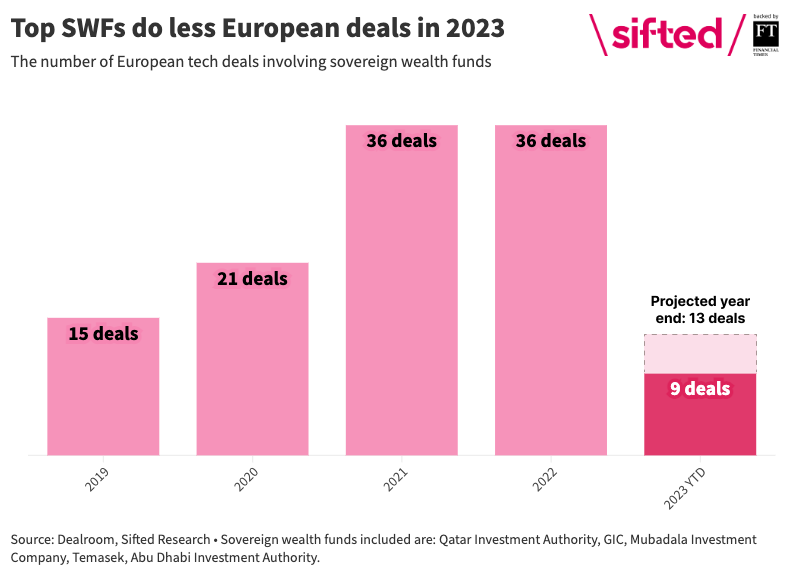

Sovereign wealth funds (SWFs) — some of tech’s biggest ticket investors — are projected to take part in 64% fewer deals into Europe’s startups in 2023 compared to last year.

The downtick in activity means reduced access to a pool of capital which has historically backed some of the continent’s fastest-growing companies. Sovereign wealth is predominantly deployed at Series C and beyond.

Deal count slides

In 2022, there were 36 European tech deals involving either the Qatar Investment Authority, GIC, Mubadala, Temasek or the Abu Dhabi Investment Authority — some of the most active SWFs. As of mid-September 2023, there have been just nine deals involving the funds.

Sifted did not count smaller funds and funds that don’t do direct investments into scaleups — and it’s important to note that there may be a reporting lag for deals in more recent months.

If that rate continues across the remainder of 2023, it would mean a 64% drop in deals involving the SWFs year-on-year.

The drop in activity in Europe echoes the global picture. In 2022, these five SWFs were involved in 154 tech funding rounds, compared to 49 so far this year. The US is projected to end the year with a 42% dip in SWF deal count activity, and Asia a 70% reduction.

The total value of the deals these SWFs participated in has also dipped this year. Last year they participated in deals worth $6.8bn in Europe, including rounds for fintech unicorns Checkout and Klarna. So far this year, they have invested in deals worth a total of $2.7bn.

Why the decline?

The decline in activity from SWFs echoes a wider down tick in deal count in Europe — Dealroom counts 6.5k deals in 2023 so far compared to 13.4k last year (though it’s important to note that not every round is tracked and there is a reporting lag).

“SWFs typically don’t lead a round, so they follow the market cycle in that sense,” says Yoram Wijngaarde, founder and CEO of Dealroom.

SWFs will remain committed to backing tech, he predicts, because it’s often part of their own industrial strategy — though Wijngaarde says we could expect an increased shift towards more domestic deals,

Climate tech top the list

Despite the reduction in deal count, SWFs have still backed a number of hefty rounds this year.

The largest round this year involving sovereign wealth went to H2 Green Steel, which raised a €1.5bn equity round from investors including GIC, Temasek and Northvolt.

The other European companies to secure sovereign wealth funding this year are AI startups Builder and Quantexa, marketing platform Insider, booking platform GetYourGuide, healthtech ITM Radiopharma and quantum computing startup Pasqal.

Alongside SWFS, other big institutional investors in European tech include pension funds, Those include the Ontario Teachers’ Pension Plan (OTPP) and Canada Pension Plan (CPP), both of which have remained active in Europe this year but with a notably lower deal count. Others, like Canada’s OMERS, have withdrawn from Europe this year.