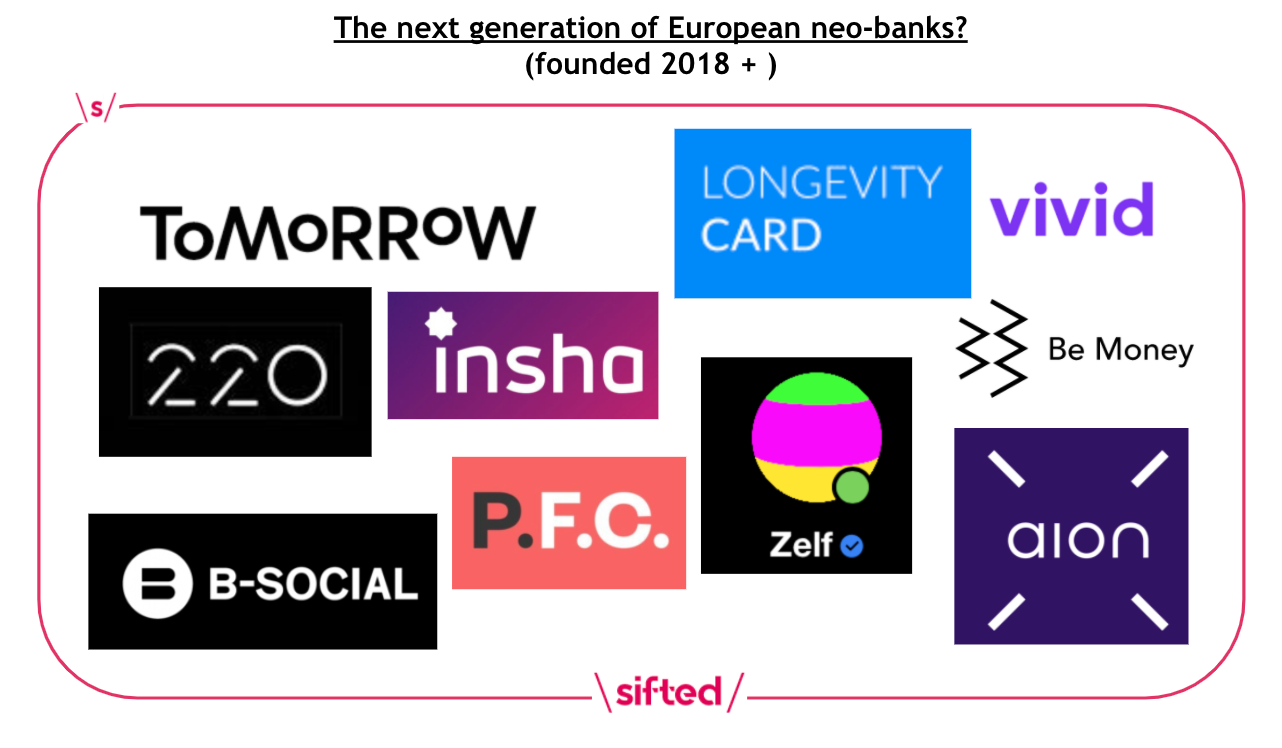

If you've had enough of digital banks, avert your eyes now — because there's an entire new generation on the horizon.

Fundraising-data shows that dozens of banking apps are gearing up to launch, adding to the 250+ neo-banks already live worldwide.

But this next generation of fintechs look prepped to take a radically different approach to that of the early pioneers, made up of Revolut, Monzo, N26 and Brazil's NuBank.

Indeed, a new consensus of creating 'good products at low cost' seems to be replacing the old chant of 'growth at all costs.’

"The new players want to grow to make money, not conquer the world," said Jeroen de Bel, partner at Fincog — a consultancy that manages a database of hundreds of neo-banks and interviews dozens of founders each month.

"You see more and more of the newer apps learning from [the mistakes of] the UK players, ensuring the path to profitability is there early on...It's all about sustainability."

In contrast, guaranteeing a route to profitability felt all but forgotten in the 'growth years' — epitomised by neo-banks' meteoric rise — with the exception of SME-focused digital banks like Qonto, Starling, OakNorth and Cashplus.

De Bel adds that the shift in founders' mindsets has also changed the feel of the newer banking apps.

"The difference is they're not going for mass market [anymore]... they're getting a core proposition," he said. "The ones who are going to survive are the ones with a core niche."

One shared element of this new faction, therefore, is creating more focused products — targeting specific segments of society based on lifestyle, or niche needs.

For instance, Germany's Tomorrow is a recently launched neo-bank for consumers focused on protecting the climate. Tomorrow offers not just an ethical current account but a whole swathe of sustainability-focused add-ons; boasting 40,000 active users, according to the company.

This speaks to a wider trend seen across this segment; namely, cross-selling various products from the outset with a view to revenue rather than simply launching a bank account and adding the money-making features later.

Most importantly, the broad shift in business-model is now attracting fresh investors to the space, says Barbod Namini, a partner at HV Holtzbrinck Ventures.

"2 years ago, every investor was too scared to go up against the Revoluts and Monzos. Doing a $10m round while they were raising $100m, that was a big risk. Now, we've reached a point where investors are saying 'ok we might have missed that boat, but there's probably going to be a number of billion-dollar banks per country,' " he told Sifted.

He also reinforced that the newer fintechs' emphasis on providing the full offering and good unit-economics "from day 1" was part of the renewed investor interest.

"I'd call it a new wave."

A change of tack

One key factor driving the boom in newcomers is the rise of 'ready-made' banking technology (known as ‘banking as a service’ players) in the last few years. This has allowed consumer fintechs to outsource their tech layer and to set up cheaper and faster than their predecessors.

Indeed, much has changed since Starling and Monzo were mere brainstorm sketches.

Gone are the days of having to build an entire banking stack from scratch, with only a handful of customers to bet on, and an expensive technological minefield.

Instead, so-called ‘fintech enablers’ (or BaaS players) quietly rent out their core banking infrastructure to the new neo-banks. Examples of these infrastructure-fintechs include Germany’s Solarisbank and the UK’s ClearBank.

This has created a new opportunity to turbo-charge and refocus neo-banks, says Nigel Verdon, chief executive of BaaS platform Railsbank.

"I wish the tech part of 'fintech' had been taken out. It should have been focusing on the 'fin' and changing the economics of banking," he told Sifted earlier this year.

Joerg Diewald, the CCO of German competitor Solarisbank, agrees.

"We are just providing the commodity. So then others can add their own USP on top," he told Sifted. He also confirmed there was a strong pipeline of neo-banks ready to onboard with the company.

"Things are very different from the 'Big 5,' that went out with the nice card, the nice app, and went out for free," Diewald added.

Smaller success?

The theory is that if digital banks can now spend less time building technology, they can invest more in disrupting banking. In doing so, the new wave of neobanks could also potentially avoid heavy losses; leapfrogging over this phase.

Yet this will likely come at the cost of a smaller user-base, and much smaller overall ambitions.

One director at Starling commented:

"I'm willing to bet you a nice bottle of wine that no 'bank' relying on cross-selling other people's products for their main source of income will go into profit within the next five years. You can't make enough money doing this. Also, third party banking software packages are fine, till they go wrong, which they will do on a daily basis."

Fintechs will also soon have to compete with Big Tech, who are driving a new frontier of 'embedded finance' with the help of BaaS players, SolarisBank's Diewald warns.

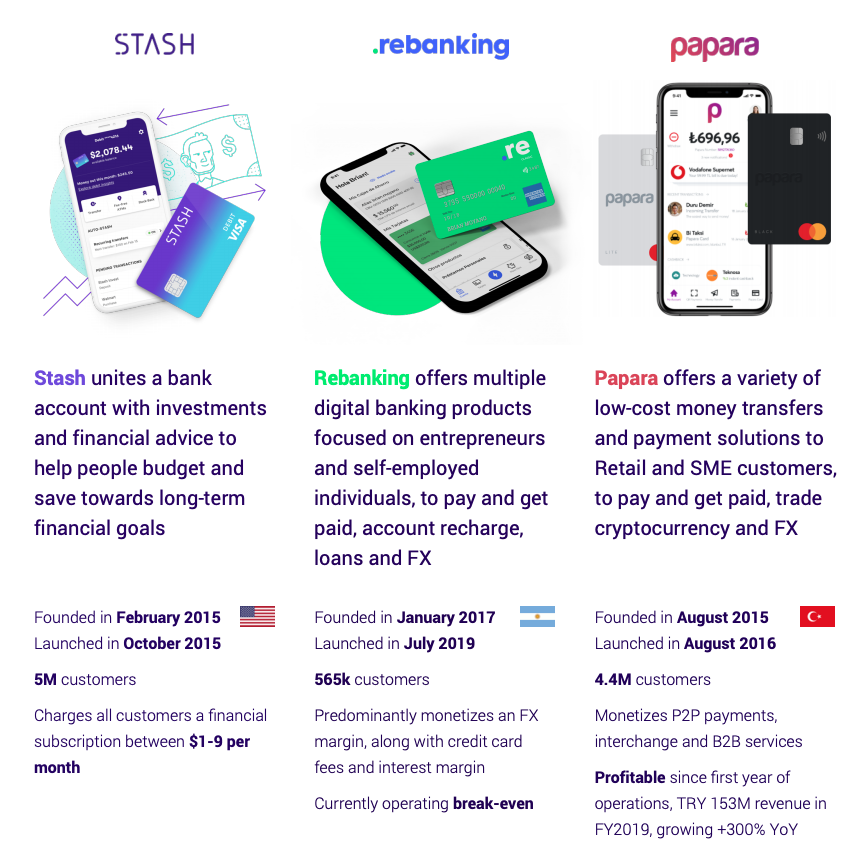

Still, a handful of newer players have already proven they can get users to pay upfront, and even turn a small profit — as shown below.

Additionally, this new wave of fintechs may also benefit from the fact they're proving more willing to collaborate with old banks, says fintech-analyst Chris Skinner.

"There is a determined shift away from the first wave of fintechs, who wanted to disrupt and destroy banks, to a new wave of fintech that wants to work with and support banks. It's a very different focus," he told Sifted.

"I’ve said for a while that fintechs should stop trying to replace banks and either come up with something new or make banks work better. The second wave gets that and will be profitable as a result."