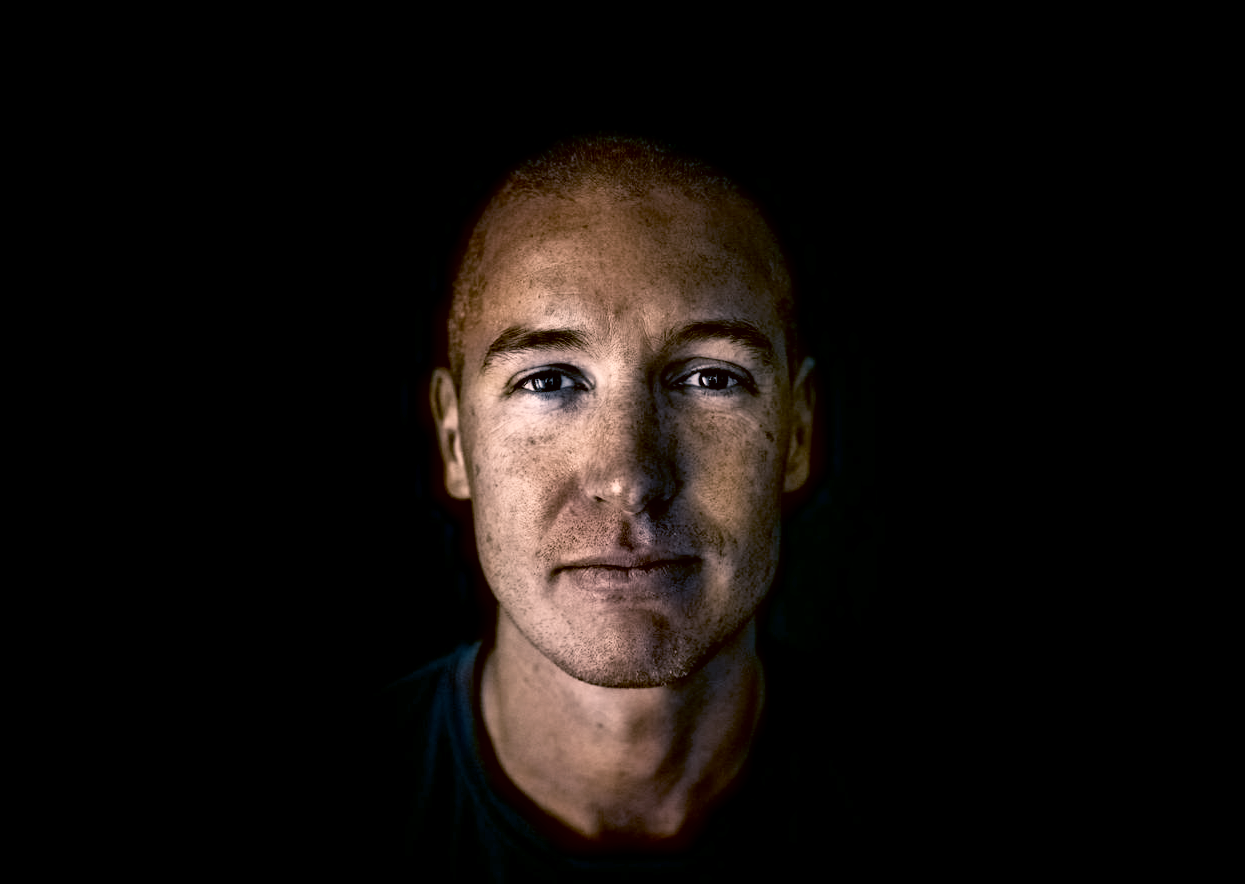

Christian Hüttenhein, venture clienting lead and director of strategic partnerships & co-innovation at Robert Bosch Venture Capital, is a hard man to pin down. “If people ask me what my job is or what my profession is, I tell them ‘I don't know yet. I will tell you in the future what my profession was,’” he jokes.

Since 2018, Hüttenhein has been in charge of Open Bosch, the venture clienting unit within Robert Bosch Venture Capital (RBVC) –– the German engineering multinational Bosch’s corporate venture arm.

“RBVC was and is doing a great job when it comes to earning profits by buying and selling shares in startups. But [...] the venture capital arm has not been so good at transferring great innovative solutions to the Bosch Group,” he says.

Hüttenhein was tasked with setting up the corporate venture client unit, which was one the first in Europe, after BMW Startup Garage pioneered the model in 2015. Corporate venture clienting is a process in which a corporation actively seeks out startups with solutions to specific business challenges it is facing –– and then becomes a client.

We spoke to him to find out what lessons he has learned over the years working with startups, and why he thinks of himself as a DJ of innovation.

The purpose of Open Bosch's venture client model

“Bosch is a very traditional engineering company [...] and we are great at inventing stuff and making it end to end,” Hüttenhein says “But that's also slow.

”Making sure that Bosch — besides having great engineers inventing great solutions — has a fast track [model] for partnering with great solutions, and bringing in startups to improve complex solutions, is our task at Open Bosch.”

👉 Read: How to get people to say yes to innovation

Hüttenhein's team is embedded in every business unit. “Open Bosch is a service we offer for the whole Bosch Group, so we need venture managers in business units to deal with specifics. This is crucial, without that, this would not be possible for a corporation like Bosch.”

The unit is designed to exist next to the traditional central purchasing unit at Bosch as a more accessible point of contact for startups.

“Central purchasing within Bosch is huge. If central purchasing was looking at startups, for the first meeting they would rent a minibus and drive 15 engineers and 13 lawyers to the startup CEO and interview them. And that's scaring startups off.”

Think of venture capital as extra R&D budget

Bosch’s $7bn R&D budget is not small by any means, but it’s dwarfed by the amount of capital that traditional VC firms have ploughed into startups to develop innovation. Hüttenhein doesn’t see this capital as competition though.

“We treat the VC money out there as Bosch’s extra R&D budget,” he says “Bosch did not have to raise that money to use the startup’s solutions. That's why we partner.”

In a recent talk, Hüttenhein gave the example of Israeli startup StoreDot, which is developing EV battery technology. It was given $120m in VC funding to spend on research and development for that specific technology, an amount that would never be matched by internal R&D spending on a single innovation.

Pull not push

Venture clienting is a pull process, not a push process, Hüttenhein says. “My venture capital colleagues make a deal and tell a business unit, ‘I have a great solution here. Your business units should take a look,’” but this doesn’t work. Business units are too busy to just take a look, he adds, so it gets pushed down the priority list.

Open Bosch actively approaches business units and asks them about their problems and challenges. What can’t they solve? What processes have been an issue for a while? Are there products needed for which there is no established provider? It then scouts to see if there’s a startup with a solution.

Standardising your venture clienting model

Open Bosch has developed a repeatable five step process to efficiently go from business unit requirements to delivery of a proof-of-concept by a startup.

The first step is a deep dive into requirements, and how possible solutions would deliver strategic results for Bosch.

Second, Hüttenhein and team explore their sourcing lists. Aside from external startup databases, Bosch has an internally accessible database of startups that it’s worked with or invested in. Selected startups are screened for technology and their fit with the business unit requirements.

👉 Read: How is the economic downturn affecting corporate innovation?

Step three is a lean purchasing process, in which as much as possible –– NDA’s and contracts, for example –– is standardised. “We don’t waste time on purchasing,” Hüttenhein says.

After that, a pilot is run with the business unit and assessed for business impact, and finally, if the pilot was successful, the startup and business unit receive adoption support.

“The magic is there is no magic,” he says.

In his recent talk on Open Bosch’s venture clienting, Hüttenhein revealed that the complete process costs RBVC $12k on average. With about 50 PoCs per year, you can do the math on required budgets.

“It's really cheap. It's not like venture capital where you need a few million to get in. It's about buying the product of a startup. And if the startup is making use of the client reference Bosch then that’s already helping the startup. So it's not expensive.”

Thanks to the set process, the complete cycle takes just four months from business unit requirement to delivery.

Act like a DJ

Hüttenhein uses the analogy of a disc jockey to explain what his job really boils down to.

“When I think of this activity, it's like I'm a DJ. I have two music discs. One disc is very standardised, professional, very good, industrialised, very slow and not innovative, with really high standards and very high risk aversion.

“Then I have a disc that is very risky, very innovative, with disruptive ideas, that has no clue how corporate purchasing works, and works at a totally different speed. And I need to bring them level.”

Sometimes, as any visitor of a house party will know, it’s just not possible to match two tracks together. “If the startup is very early stage, we mostly don't get it. So we tend to target more mature startups.

"If it's too early stage it's difficult because Bosch is a huge organisation, and early startups mostly don't have the breadth to commit to a longer-term agreement.”

Find the right person on the ground

Venture managers are not always specifically hired for the job; they’re often current employees that are interested in driving innovation.

“It’s different from business unit to business unit. But what we learned is that we’re not focused on a certain profile or a certain department,” says Hüttenhein.

👉 Read: How the Flemish public broadcaster VRT became a media innovation powerhouse

“So it's not like the venture manager is always coming from business development or from purchasing or from manufacturing. It's mostly about the person, it's about having a person with an intrinsic interest in startups.

“When it comes to recruiting our team, it's about the bottom up support. If you tell someone they have to spend 50% of their time now on venture clienting, it doesn’t work,” he says. That’s why Open Bosch often gets calls from internal Bosch employees interested in working with it.

“Sometimes we get a call. ‘Hey, I heard about Open Bosch. Can I help you guys,’ and then after a month, we have four or five leads and the first PoC. It's really about the intrinsic motivation to deal with startups and to deal with this process. That is the success factor for us.”

Get your KPIs straight

Hüttenhein is adamant about having measurable results, and keeping KPIs simple. “You can have 50 KPIs, from the speed of the process to budget spent, and those are interesting figures that can tell a message,” he says.

“But in the end, to have a lean process, there should be a focused KPI. And from my perspective, business impact is the best one,” he says. Business impact is not always so straightforward though. It could be about revenue, cost reduction, new markets and more, so it’s important to have the main metric you’re looking at from the get go for each pilot.

“It’s all about bringing in great solutions to be more efficient and have better products. That's it,” he says. “It's not about strengthening the brand. We are an internal service provider, and actually have few branding and marketing staff. I'm doing sales for startups.”

Process is key to making venture clienting work

As a final piece of advice to venture clienting units, Hüttenhein says that it’s crucial to bring in someone who understands the gold standard of the process.

For Bosch, that person was Gregor Gimmy, who previously set up BMW’s Startup Garage venture client unit and was brought in to advise Open Bosch.

“Having a person who really understands the nitty gritty details is important. You could think that purchasing from startups is easy innovation but there are certain hiccups, and establishing it can be very complex.

“It's probably also very different from company to company. Considering that most corporates already have something like an intrapreneurship programme or accelerators there’s also the question of how to combine venture clienting with them without mixing it up.” Having someone like Gimmy can set you on the right path from the get go.