Quantum computing has been getting a lot of attention from investors in the last two years. One of the earliest — and most lucrative — applications could be in the pharma industry, and in particular for drug discovery.

“The pharma industry spends about 15% of its revenues on R&D. That is a huge amount of money. If quantum computing were to be used for only 1% of this work, it would be a fairly sizeable market,” says Oliver Kahl. He’s a principal at MIG Capital, a German VC firm that has invested in IQM, one of Europe’s biggest quantum startups.

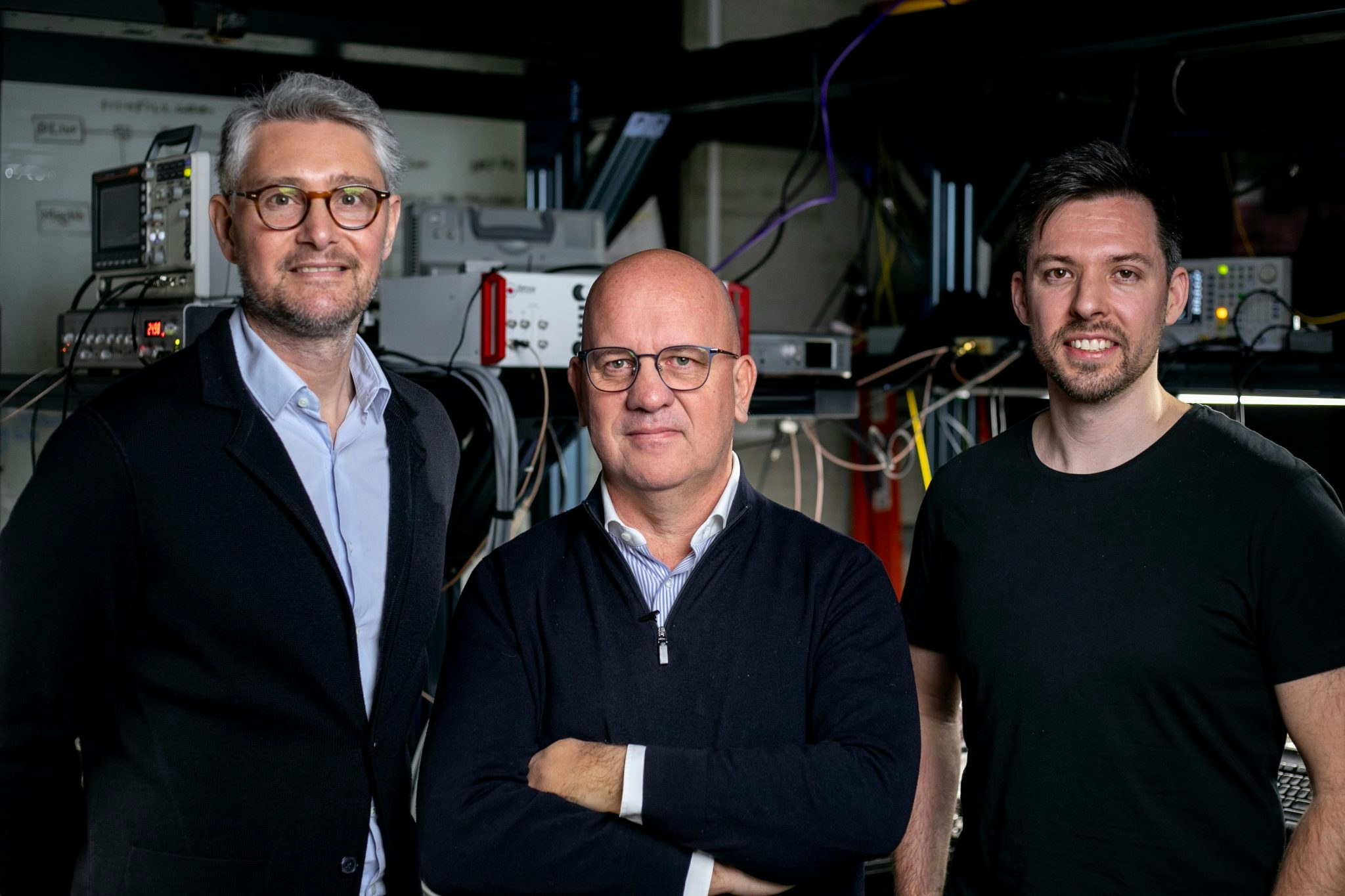

Two European startups using quantum computing for drug discovery have already raised cash this year: Finland's Algorithmiq brought in $4m in February and Paris-based Qubit Pharmaceuticals raised €16m in June. On top of that Swiss company Terra Quantum, which has pharma applications in its quantum-as-a-service model, raised $75m in March.

But how far off is quantum from really disrupting pharma?

What can quantum computing offer drugs companies?

In a few words: much, much faster drug discovery.

"Traditional" drug discovery requires screening thousands of molecules to find candidates that then have to be tested in animals and humans in extremely controlled conditions. Before that can happen, scientists need to identify the right molecule in our bodies that the drugs can target to treat a particular condition.

The whole process can take years. Considering that only 10% of drugs tested in clinical trials get approval, the picture looks quite bleak.

👉 Read: The different types of quantum computer startups, explained

To speed up drug discovery and lower costs, startups like UK-based BenevolentAI and Exscientia are using artificial intelligence to predict which drug candidates are most likely to succeed.

Quantum computing could take these predictions further by simulating drug candidates and their targets to find the best match. This is something that classical computers just can’t do.

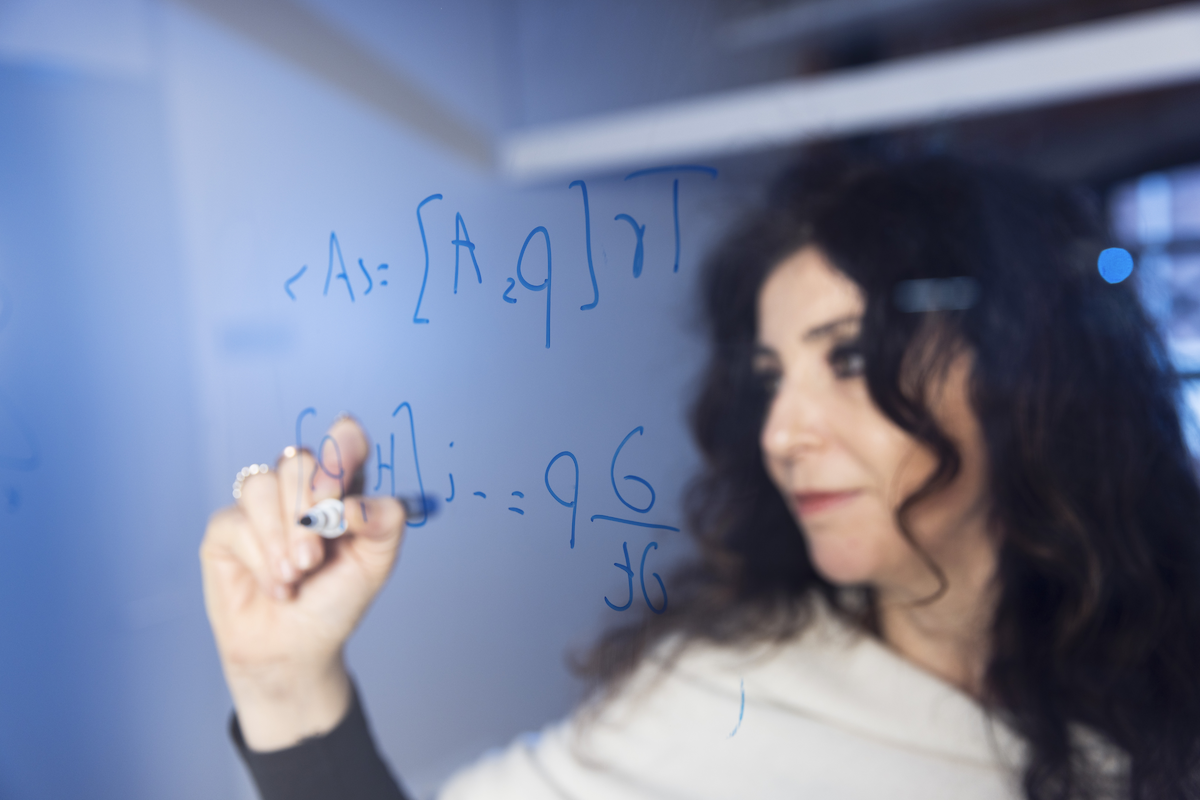

According to Sabrina Maniscalco, CEO of Algorithmiq, simulating a simple molecule like water with a quantum computer would need the memory equivalent of a WhatsApp message. But simulating a complex molecule like penicillin “would need more memory than the total number of atoms in the universe — it is fundamentally impossible to simulate it on a classical computer”.

“We want to be the first to prove that quantum computing can do something silicon computers can’t,” Maniscalco tells Sifted.

Quantum simulations wouldn’t just reduce the amount of time and money drug discovery takes — they could also allow scientists to find completely new drugs that traditional approaches haven’t. “It will not be an incremental change, but a disruptive one.”

Working with imperfect quantum computers

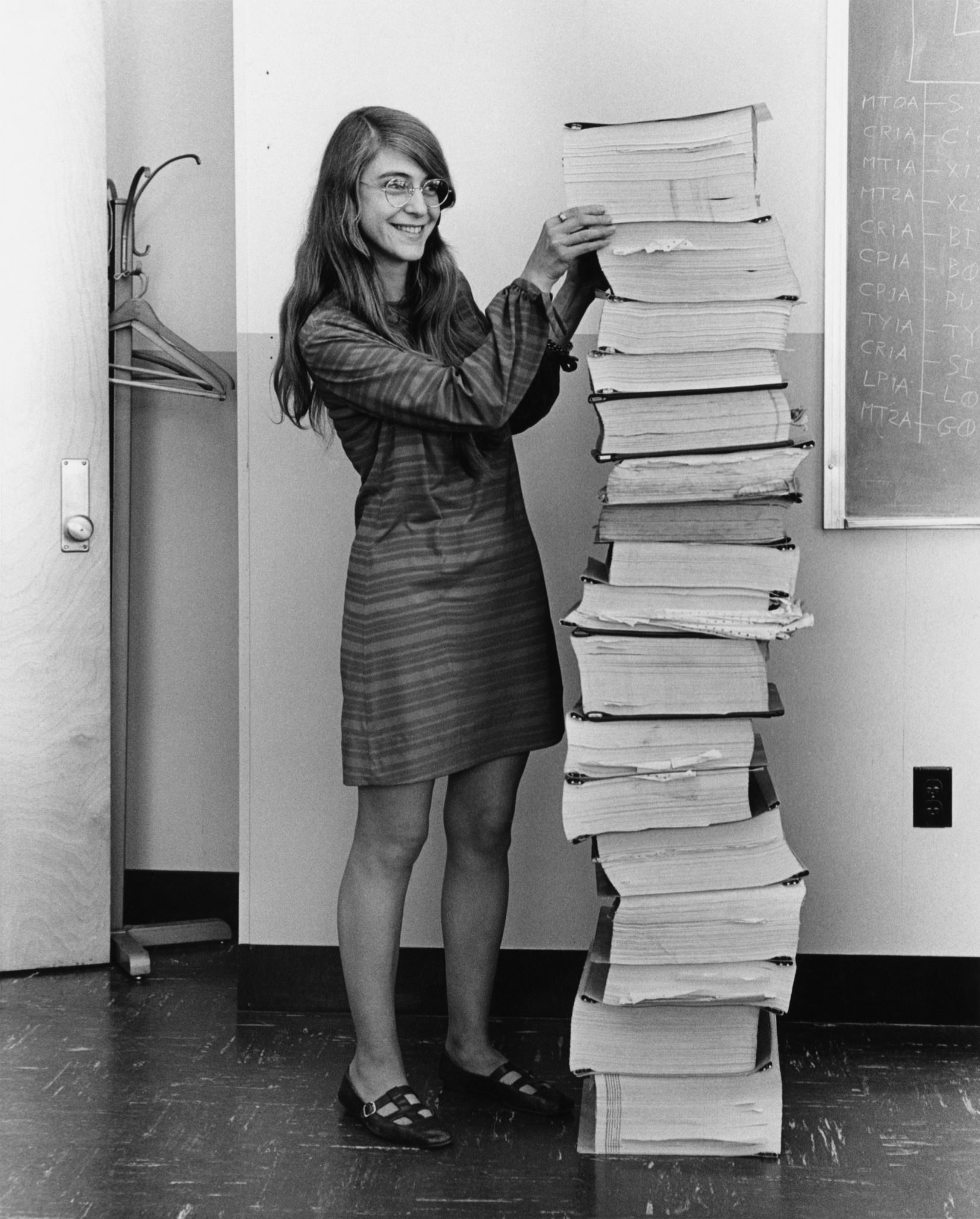

Despite all the talk about the potential of quantum computing, the technology is still in early stages of development. Currently IBM has the most powerful quantum processor, with 127 qubits — the quantum equivalent of a computer bit.

The computation power is limited in these small processors, but Maniscalco believes it's enough to be used in real-world scenarios. Her company’s first target is to partly simulate enzymes — in particular, the part of an enzyme that interacts with other molecules.

Algorithmiq’s main challenge is that existing quantum devices are extremely sensitive to their environment, meaning that any interactions with their environment — such as the smallest change in temperature — can lead to errors in the calculations. Future quantum computers will come with error-correction features, but that will require much larger memories that Maniscalco estimates won’t be available for 15 to 30 years.

Algorithmiq wants to solve that problem now. The startup’s strategy is to develop an algorithm to clean the signal generated by a quantum computer. "It's like taking a photo with the best light setting, the best camera and further enhancing it in Photoshop."

“Quantum computers are now where classical computers were in the 60s and 70s — they are built to solve specific problems, they are not universal computers,” says Robert Marino, CEO of Qubit Pharmaceuticals.

His startup has opted for a hybrid approach to get around the current limitations of quantum computers. The idea is to identify specific steps where quantum computing could solve complex mathematical problems more efficiently than a classical computer. “We cut big problems in small pieces to work with what is available,” Marino tells Sifted.

One such step would be mapping all the possible "shapes", or states, that a drug target can take. Since some molecules can only interact with drugs when in a very specific state, using quantum computing to map them could reveal rare targets for drug candidates that classical computers haven’t been able to find.

“Lots of computations are required just for that step; quantum computing could save thousands of computing hours,” says Marino.

Within two to three years, he expects Qubit Pharmaceuticals to be using quantum computers for 5-10% of the drug discovery process, and classic computers for all the rest.

Is pharma showing interest?

“Currently pharma companies are in the ‘what can we do with it' phase — everyone is very interested in trying, learning, seeing use cases and comparing quantum computing with classic computing,” Marino says.

“I would say they are in a state of technological curiosity. I am not aware of any established pharma company that currently uses any quantum computing means beyond a proof-of-concept or pilot level,” Kahl tells Sifted.

Some pharma companies are starting to dip their toes into quantum computing. M Ventures, the venture arm of Merck, has invested in US-based quantum startup Seeqc. BASF is one of the investors in Zapata Computing, a US-based startup developing quantum software. Biogen has partnered with 1QBit to use quantum computing to speed up drug discovery. And the Novo Nordisk Foundation has just put $200m towards the development of quantum computers for pharma and climate applications.

“Today, there are no quantum computers that can run truly commercially meaningful algorithms,” says Gangolf Schrimpf, who runs media relations at Merck. “We estimate that the first commercially relevant machines will arrive in 2025 or later. That doesn’t mean, however, that we will not work earlier than 2025 with less sophisticated versions.

“It is safe to say that most pharma companies are aware of the field and its disruption potential and have engaged their innovation ecosystems (venture, accelerators, business development) to forge early partnerships.”

He adds that developing the internal know-how of quantum technologies is part of Merck’s strategy to be ready when quantum computing takes off. “We are actively scanning the quantum space for additional investment targets, also including adjacent technologies such as quantum sensing.”

When — if at all — will the technology deliver?

“Quantum computing is already proving useful in drug discovery, even if we can’t yet simulate complex molecules,” says Florian Neukart, chief product officer at Terra Quantum. He believes meaningful molecular simulations for the pharma industry could be possible within the next three to five years.

Maniscalco compares the work that quantum startups are doing today to the Moon landing — the computer used for the Apollo landing had less processing power than a smartphone has today, but the team behind it still managed to accomplish something that was impossible until then.

“Full-fledged molecular simulations require millions and billions of qubits and high-fidelity gates. I personally expect decades of further development before such systems become reality,” says Kahl. “As to when quantum computing will be able to create value for pharma companies, a conservative guess is not before the end of the decade.”

Leonie Mueck, chief product officer at UK-based quantum startup Riverlane, offers a more optimistic vision. She points out that future research breakthroughs may reveal new methods that significantly reduce the resources needed to run these quantum algorithms. This has happened before in the quantum field and might speed up the projected timelines.

Quantum computing could benefit the pharma industry in other ways too. For example, optimising the supply chain of drug manufacturing or using quantum computers to simulate the effects a treatment will have on patients, which could significantly increase the success rate of clinical trials.

Can we expect a quantum bubble?

“Quantum computing has attracted quite a fan base and numerous quantum evangelists vociferously praise the coming of the quantum age. This may sound sarcastic, if not cynical, but quantum is a highly complex field that is not understood by many,” says Kahl.

A common false belief is that quantum computing will provide an exponential increase in computing speed over traditional computers. According to Kahl, there are only a few algorithms known that we know for sure will significantly outperform classical computing when run on large quantum computers. “Recent research points out that there is no evidence for exponential quantum advantage in quantum chemistry and therefore pharma applications.

“Unfortunately, many investors seem to not know, not want to know, or not understand this; fear of missing out is certainly a big contributor.”

Schrimpf adds: “Our primary concern is that quantum technologies will undergo a boom-bust cycle that will dry up funding opportunities. Quantum computing will not be the be-all and end-all solution to computing, and neither will every future smartphone have a quantum computing core — at least not in the foreseeable future.

“Quantum computers tackle very niche, complex mathematical problems in high-value, industrial use cases [...] We believe that it is important to manage the hype and the expectations, and provide the field with a strong, but more importantly continued stream of funding, including patient private capital and public funding initiatives.”

Neukart thinks that quantum computing will likely follow the typical hype cycle that many other tech sectors have been through. “When machine learning started, people thought you could apply it to any problem you have. The challenge is to communicate where quantum computing is useful and where it isn’t.”

According to Neukart, compared to other industries pharma tends to be careful not to make any extraordinary claims — meaning the hype cycle might not hit it so hard.

“I would expect the markets to cool down — hopefully not freeze over — as people wake up to the reality of slower-than-anticipated technological development,” says Kahl. “A second wave will develop more slowly and will likely be more focused on industry verticals where there is clear evidence of exponential quantum advantage.”