Quantonation, a Paris-based VC firm focused on quantum technologies, has closed a €220m early-stage fund.

It is Quantonation’s second fund, and is more than double the size of its first vehicle, which closed in 2022 at €91m.

“We surpassed our target [of €200m], with strong acceleration in the past six months, which reflected what was happening in the sector,” partner Olivier Tonneau tells Sifted.

Global funding for quantum technologies last year reached a record $5bn, according to Dealroom data, a sharp increase from previous years. Between 2021 and 2024, annual funding for quantum hovered between $1.5bn-2.5bn.

Quantonation backs startups in Europe, North America and Asia-Pacific from pre-seed to Series A, with a focus on quantum computing, sensing and communications.

The firm was an early investor in French startup Pasqal, which builds quantum computers, and Spanish startup Multiverse Computing, which has developed a quantum-inspired technology to improve the efficiency of AI models.

Launched in 2018, Quantonation is one of a handful of firms globally which are dedicated to quantum technologies. Others include Danish VC 55 North, which last year announced a €300m first-time fund.

The new fund is backed by Singaporean investor Temasek’s subsidiary Vertex Holdings, French public bank Bpifrance and Bradley M. Bloom, the founder of US PE firm Berkshire Partners.

Other LPs include the European Investment Fund (EIF), Spanish construction company Grupo ACS, Novo Holdings, Toshiba and growth equity firm Planet First Partners.

What will Quantonation invest in?

The past year has seen an explosion of interest for quantum technologies and particularly quantum computing, says Tonneau, including several megarounds in Europe such as Finnish scaleup IQM Quantum Computing’s $320m Series B and Multiverse Computing’s $215m Series B.

This was due in part to technological breakthroughs in the field, particularly in error correction. With current quantum computers still heavily prone to errors, these developments are expected to be key to scaling the devices’ capabilities.

Error correction will be a focus of the new fund. “There are new architectures that optimise error correction from the start, thanks to attributes within the hardware,” says managing partner Christophe Jurczak. “We’re interested to look into the question of: ‘What’s an ideal architecture to do error correction at scale?’”

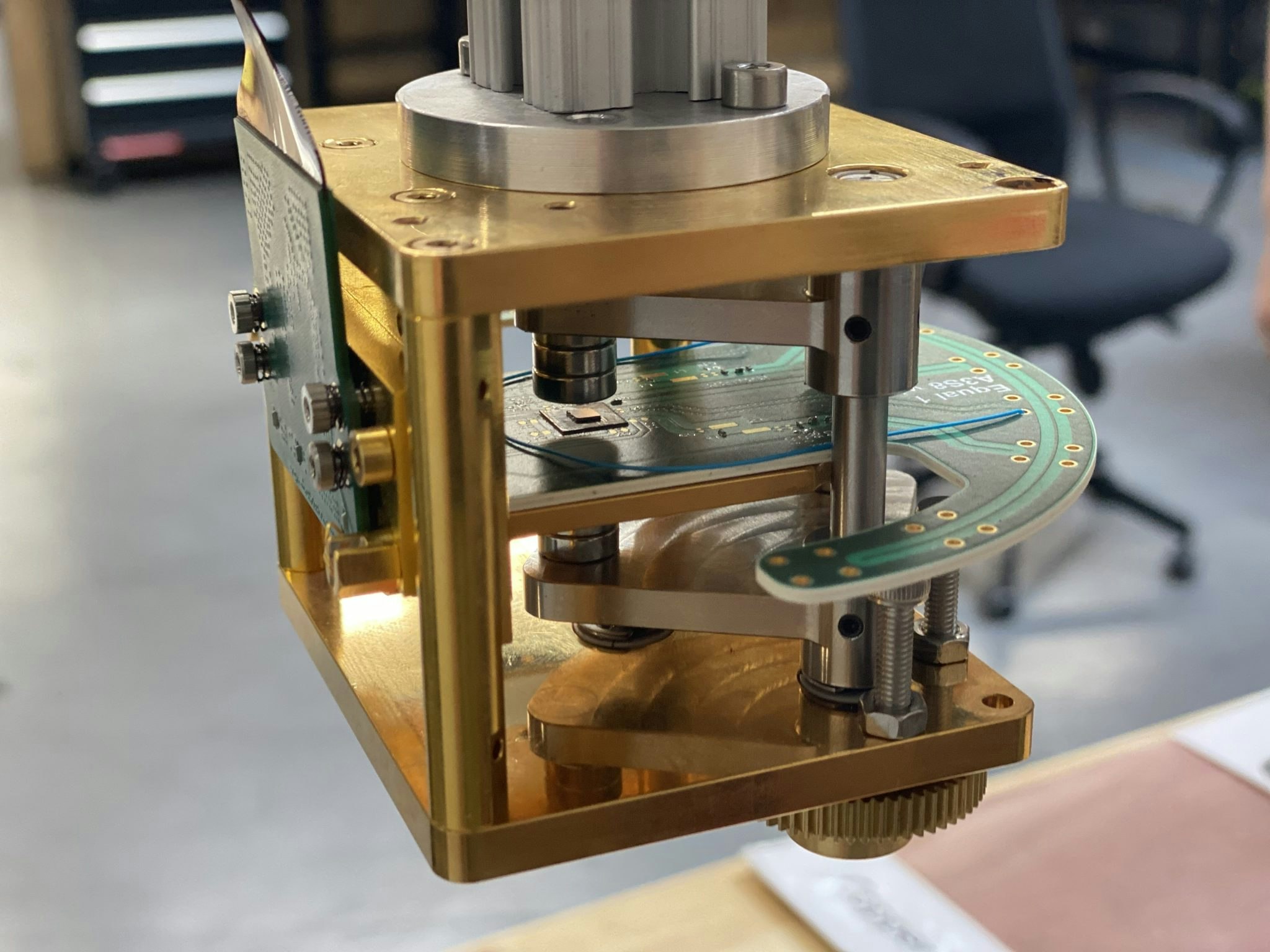

Quantonation will also invest in “enabling technologies”, a growing segment of quantum computing that refers to startups building parts of the stack that are needed to scale the devices, such as networking solutions and control systems. Enabling technologies are expected to grow in the next few years as quantum computers move into production.

The scope of the latest fund has also expanded to include physics-based technologies which are not strictly related to quantum computing, such as advanced materials and photonics.

The fund has already backed 12 companies including Australian startup Diraq, which builds quantum computing chips, and Swiss nanomaterials startup Chiral.

With the new fund Quantonation plans to back 25 startups with tickets ranging from €200k to “a dozen million euros,” says Tonneau, with capacity to invest up to €20m in total for top companies over several rounds.