Fintechs are nothing if not ambitious; whether it's the neobanks taking on Barclays, or insurtechs taking on the global insurance giants.

Now, startups are taking on the debit card operators: Visa and Mastercard. The idea is to build out a new checkout infrastructure that allows shoppers to pay instantly via bank transfer, instead of using cards.

It's ambitious but these efforts are not in vain — the space is attracting fresh funds across Europe. London's Volt is the latest to catch the investors' eye, having raised a $23.5m Series A, led by EQT Ventures, with the aim of aggregating this new payment method into one global network. It's the largest European Series A round in open banking to date.

Other London-based companies to raise in the space are fellow newcomer Trilo, which just raised a £1m pre-seed round, and Banked, which has raised $12m to date and is currently raising again (largely from US investors) to build out its 'Pay by Bank' facility.

Each of them lets users make account-to-account (A2A) payments at the checkout using open banking, following in the footsteps of localised initiatives like Sweden's Trustly (now a multibillion-dollar frontrunner) and Ireland's Nuapay.

These newcomers are betting that cards have had their heyday, arguing that they are expensive, clunky, and also risky (card fraud in Europe hit $1.55bn last year).

"I tell my friends that I'm building a network to compete with Visa," says Banked founder Brad Goodall.

Goodall isn't exaggerating. If A2A payments go mainstream (as seen in Sweden, the Netherlands, India, and Germany), these startups could take a lucrative cut of the billions of transactions completed every day, currently dominated by Visa and Mastercard.

"This is an alternative payment method, like PayPal...[Even getting] 10% of checkout is still a massive business," says Goodall, who previously cofounded fintech 10x alongside Anthony Jenkins.

Changing customer behaviour won't be easy. Four out of five transactions in Europe currently rely on Mastercard and Visa. It also won't be quick, relying heavily on regulatory support.

But VCs are itching to get in early, particularly if they missed out on the first generation of open banking players.

"[Investors] are a little confused. There's a lot of players out there. They're looking at the valuations [of the first lot] and asking how they managed to creep up on them like that," Goodall tells Sifted.

Acquisition prospects also look promising. Visa has already tried (and failed) to buy Plaid, while Tink has also been on a spending spree, giving startups in the space a viable exit path.

"If I'm enough of a pain [for Visa and Mastercard], they'll probably buy us at some point, which is fine by me," Volt founder Tom Greenwood jokes.

A race to launch

These newcomers are at the forefront of A2A payments, but they have a race on their hands. Mastercard and Visa have their own open banking strategies in the works, and could "flick the switch" at any time, admits Greenwood.

"Their balance sheets are way too powerful for them to lose...it would naive to say otherwise," he tells Sifted.

Still, while Mastercard and Visa are card experts, A2A is a new game to them.

"They'll be fighting us in the field...shaking their reputation as card player will be difficult...it's an open market," Greenwood says, adding that "no payments team [in the space] comes anywhere nears ours in terms of experience," having hired from Adyen and FIS.

Competition is heating up elsewhere too. The early open banking players like Tink, Plaid, Bankin' and TrueLayer — who all began by offering data connectivity — have now begun branching into the payments space.

"They realised data is such a commoditised product. The unit economics really don't work," Banked's Goodall says. (Note: the likes of Banked have built their services on top of these infrastructure players. They're therefore partners and potential competitors at the same time.)

Veteran fintech GoCardless has also recently launched an open banking product.

That could make it a frenzy to win over merchants, says Goodall, whose plan is to focus solely on the US.

"[This] needs a very big brand to drop [open banking] into their checkout. Whoever gets those metrics first will be able to sell to everyone," he adds.

Slowly does it

It will take time before you see the likes of Volt or Trilo at a checkout.

Between the UK main players, there are still no more than 200 merchants signed up, meaning they're very early on in their journey.

"2021 is not going to be the year where your friends say they have done account to account payments [at a checkout]," Goodall says.

Plaid's Keith Grose, however, is more optimistic, betting that 10m UK citizens will make an open banking payment in the next year.

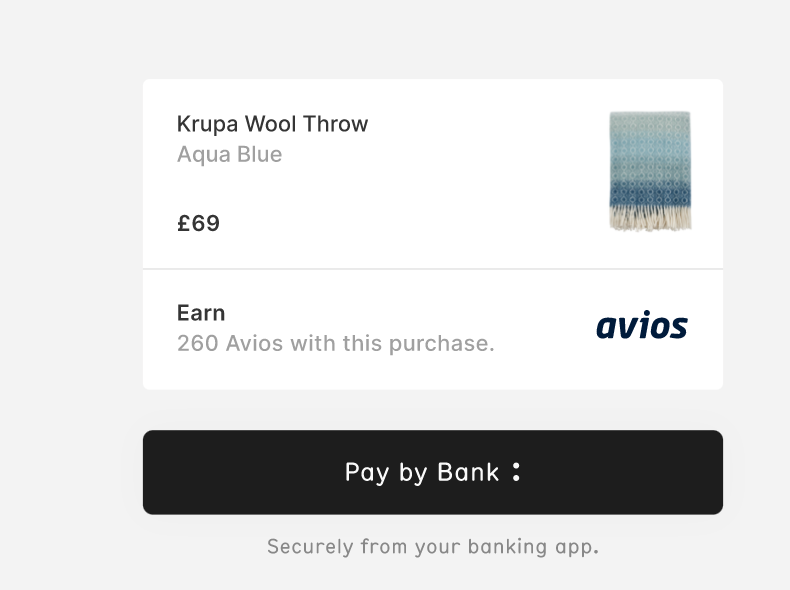

The challenge here is changing customer behaviour, as cards are still the default in places like the UK. To do that, startups are rolling out a range of incentives: Banked has partnered with British Airways to give users Avios points when they pay, while Trilo wants to offer cashback.

Inherent benefits like instant refunds and up to 90% shorter checkout times may also sway people, as they have in the Netherlands, argues Volt's Greenwood.

While A2A doesn't offer chargeback protection, Greenwood argues that "95% of transactions" like groceries and Ubers don't require protection.

Collectively, that makes open banking infrastructure a serious contender to cards — and Mastercard and Visa know it.