The UK is Europe’s most mature startup ecosystem, with a vibrant tech community, a web of funding options and — until now — strong government support, thanks to tax relief schemes for investors like EIS and SEIS, and access to innovative financing such as UKRI grants, R&D tax credits and focused regional support from the British Business Bank.

But incoming changes to regulation around who can invest in startups threaten to set us back and seriously compromise the UK’s growing pool of diverse angels.

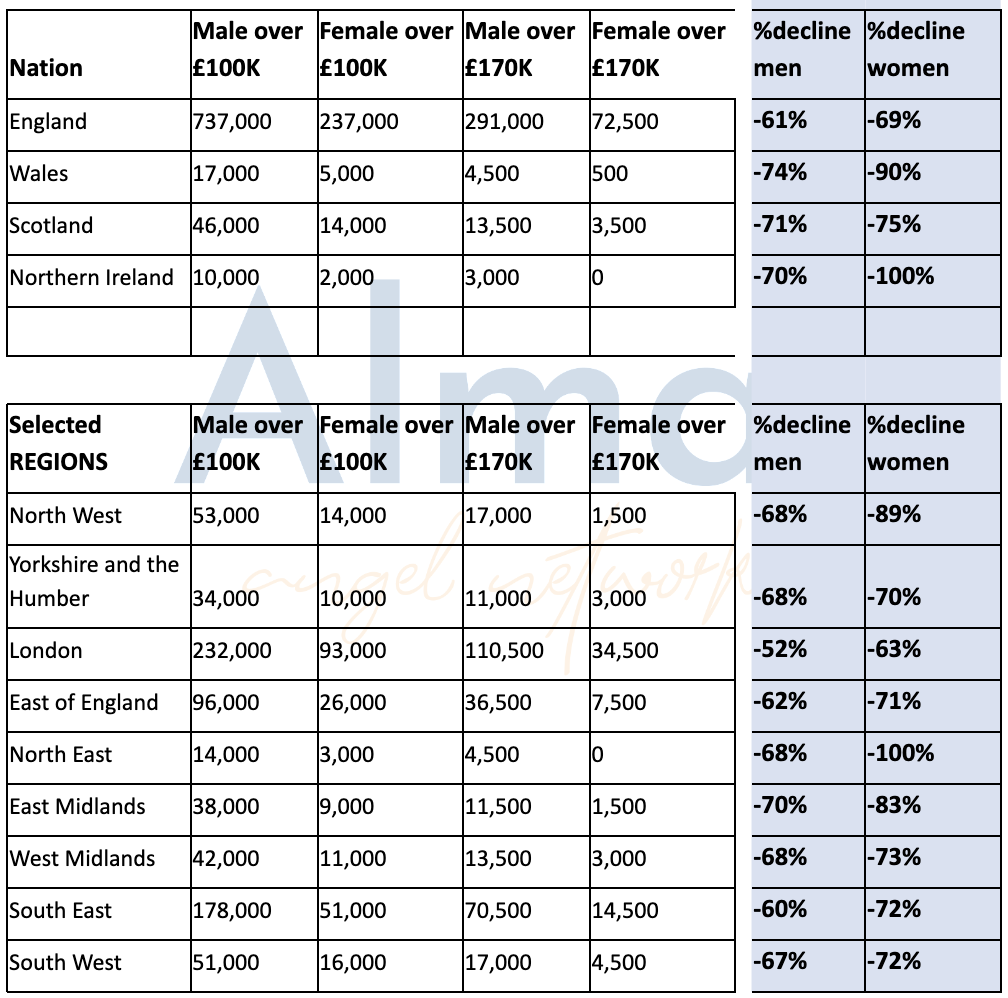

As of January 31, we’ll see a huge reduction in the number of women able to invest in startups on the basis of income — with an estimated 90 to 100% fall in some regions, down to zero in Northern Ireland and the North East of England. What’s more, some of the best qualified people to invest in startups — operators in high-growth private companies — may no longer make the cut.

If the government is concerned about fostering a more diverse tech sector, allocating more capital to women-led businesses and ensuring white, London-based men aren’t the main demographic reaping the rewards of startup success, it needs to amend this regulation — ASAP.

The Financial Promotions act

The regulation we’re talking about — the Financial Promotions act, which was last updated in 2005 — governs who can be approached for investment opportunities. It essentially enables a business or individual (a startup or syndicate lead) to share an investment opportunity (a fundraising deck) directly with a potential investor.

Angel investors, syndicates and groups rely on these exemptions to share deals. Failing to comply could result in harsh penalties, including a two-year jail sentence or an unlimited fine, imposed by the UK’s Financial Conduct Authority.

The regulation exists to ensure that investors comprehend the risks associated with early-stage ventures and don't overcommit their capital to highly risky and illiquid businesses. (Crowdfunding platforms like Seedrs and Crowdcube are regulated entities and target retail investors, which are subject to a different set of rules.)

But we’re not sure the Treasury’s update is relevant to the investing landscape as it stands today.

The new criteria for assessing one's ability to gauge risk now hinge on wealth thresholds, which have been raised significantly, and specific job qualifications, which have been narrowed down. Actual investing experience no longer carries any weight in the assessment.

Breaking down the new rules

Let’s dissect the new rules:

Higher wealth thresholds. You qualify if your annual income is above £170k (up from £100k previously) or your net assets are above £430k (up from £250k, excluding your home or any equity released from it or your pension). As intended, and as seen in the table above, the number of people who could qualify as angel investors declines dramatically; however it affects every region and nation of the UK outside of London the most. And the decline is disproportionately greater for women everywhere.

We’ll witness a 90% decline in women who could angel invest in Wales on the basis of income, and a 100% fall in the North East of England and Northern Ireland, meaning women no longer qualify at all. It’s also fair to assume that people who qualify will be more likely to be White rather than Asian (other than Indian) or Black.

Work versus investing experience. You no longer qualify if you have experience investing in unlisted companies, but you do qualify if you work in private equity or SME financing. But is a junior working in private equity more qualified to invest in an early-stage startup than a startup executive who has previously made 10 angel investments?

Directorship. You can also qualify if you are a director of a company with at least £1.6m turnover (up from £1m), which generally excludes a lot of self-employed people and anyone taking a board seat in a pre-seed company. We also know that women are underrepresented on boards.

Active member of an angel group. One silver lining is that anyone who has been an active member of an angel group for over six months will be considered a sophisticated investor — and allowed to receive financial promotions as before. However, under this rule you cannot invest for the first six months and legal experts are still not certain whether you’re allowed to see any startup decks shared within the group during that time.

What’s more risky?

To illustrate the impact the new rules will have, ask yourself which of the following individuals better understands the risks associated with investing in startups?

- A 21-year-old man starting as a junior in private equity with an annual income of £35k qualifies under the rules and can invest £50k (or more!) in a startup.

- A 31-year-old woman with £200k in savings and a decade of experience working in startups, with an annual salary of £130k and three investments under her belt doesn't qualify to invest £5k in a startup.

The Treasury’s new approach prioritises wealth and a very narrow work qualification as the key factors in assessing one's ability to invest. It will, inevitably, result in making early-stage investors in the UK more white, more male and more London-centric.

So what?

Now, if you’re wondering why it all matters: growing the number of diverse angels directly increases the level of investment in diverse entrepreneurs. If the government cares about allocating more capital to women-led businesses and capturing diverse voices across the UK to fund the companies of the future, it must encourage the participation of diverse angels rather than hinder it.

And the benefits of investing in diverse teams is proven. Put simply, we see higher returns. Companies with a female founder generate more revenue; a BCG study from 2018 found that per $1 of capital invested, female-founded or female-cofounded startups generate 78 cents while male-founded startups generate just 31 cents.

Rushing to update legislation which is already nearly 20 years out of date could harm the UK’s startup ecosystem far more than it helps it, so we advocate for a 6- to 12-month extension of the current framework to allow for further consultation on the topic, actively involving women and underrepresented investing groups. Could different inflation metrics be applied based on the region or nation rather than a blanket rate across the UK? Can newbie angels be allowed to see decks if they refrain from writing cheques for six months?

If you want to get involved, sign this open letter to the Chancellor for him to act on this before it’s too late.