America may have just gained a new president, but London fintech Monzo has lost theirs.

Monzo founder-turned-president Tom Blomfield is leaving the UK challenger bank at the end of January, marking the end of an era for a company that he took from a little startup back in 2015 to one of the most valuable fintechs in Europe with 5m users.

In an interview with Techcrunch, Monzo's Blomfield said that he had stopped enjoying his role a long time ago, as the company moved from startup to scaleup and the pandemic added extra strain on his mental state.

“I stopped enjoying my role probably about two years ago… as we grew from a scrappy startup that was iterating and building stuff people really love, into a really important UK bank," he said.

"I’m not saying that one is better than the other, just that the things I enjoy in life is working with small groups of passionate people to start and grow stuff from scratch, and create something customers love.

"And I think that’s a really valuable skill but also taking on a bank that’s three, four, five million customers and turning it into a ten or twenty million customer bank and getting to profitability and IPOing it, I think those are huge exciting challenges, just honestly not ones that I found that I was interested in or particularly good at.”

He also credited Monzo's team and investors for responding to his call for "help".

The move comes at the end of a rough patch for Monzo, which saw Blomfield step down as CEO last May to take up the newly created title of president.

Three months later, the bank announced it had more than doubled its pre-tax losses in the year 2019–2020, with losses growing to £115.4m.

The report also flagged concerns about the bank’s future in light of the pandemic: “There are material uncertainties that cast significant doubt upon the Group’s ability to continue as a going concern,” it stated.

The company's results also followed its much-awaited £60m raise but at a £1.25bn valuation — a 40% drop from its previous round.

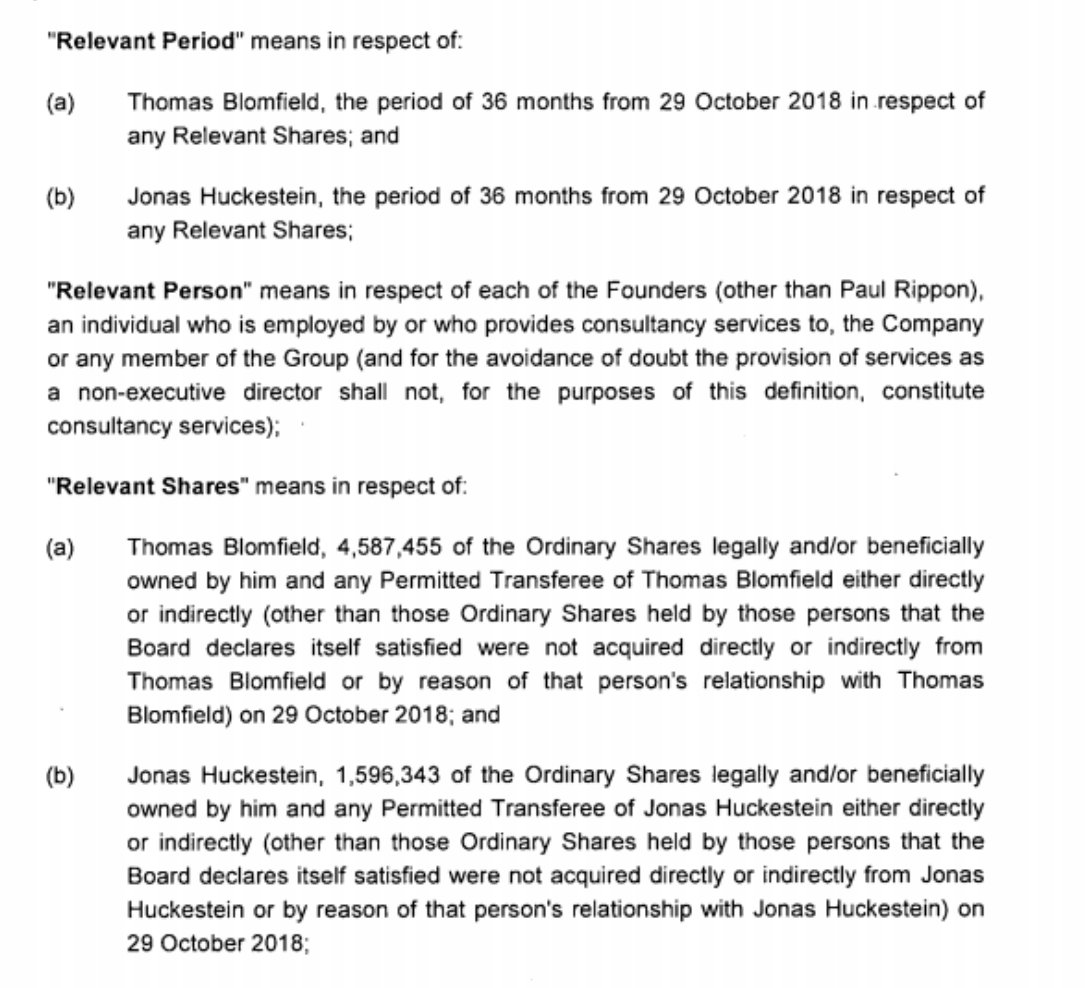

In officially ending his employment at Monzo, Blomfield may be walking away from a sizeable chunk of equity, which past filings show don't vest fully until October this year.

Up to 4m of his shares appear to be unvested, unless there has been a renegotiation since the last articles of agreement were outlined on Companies House.

Blomfield had already hinted he was starting to work on new "side projects", recently posting on Twitter that he was looking for developers.

However, he told Techcrunch this was a short-term project and was now looking to “chill out”, as well as working as a volunteer vaccinator to help with the national COVID-19 response.

In a statement to Sifted, a Monzo spokesperson said:

“Tom is an incredible entrepreneur who, with his cofounders, built Monzo from the ground up with a determination to be transparent, put customers first and make money work for everyone. Monzo is where it is today because of Tom and his vision to transform banking - he leaves us with the foundations and inspiration to win under TS Anil’s leadership. We’ll miss him very much!”