Lendable, the London-based digital lender backed by Goldman Sachs, has quietly become Europe's latest unicorn.

The fintech was valued at over £1bn earlier this year following a secondary sale, inside sources told Sifted.

The internal transaction saw unnamed early investors and employees cash in around ~£30m in shares, while Lendable’s existing institutional backers increased their stake, Sifted understands.

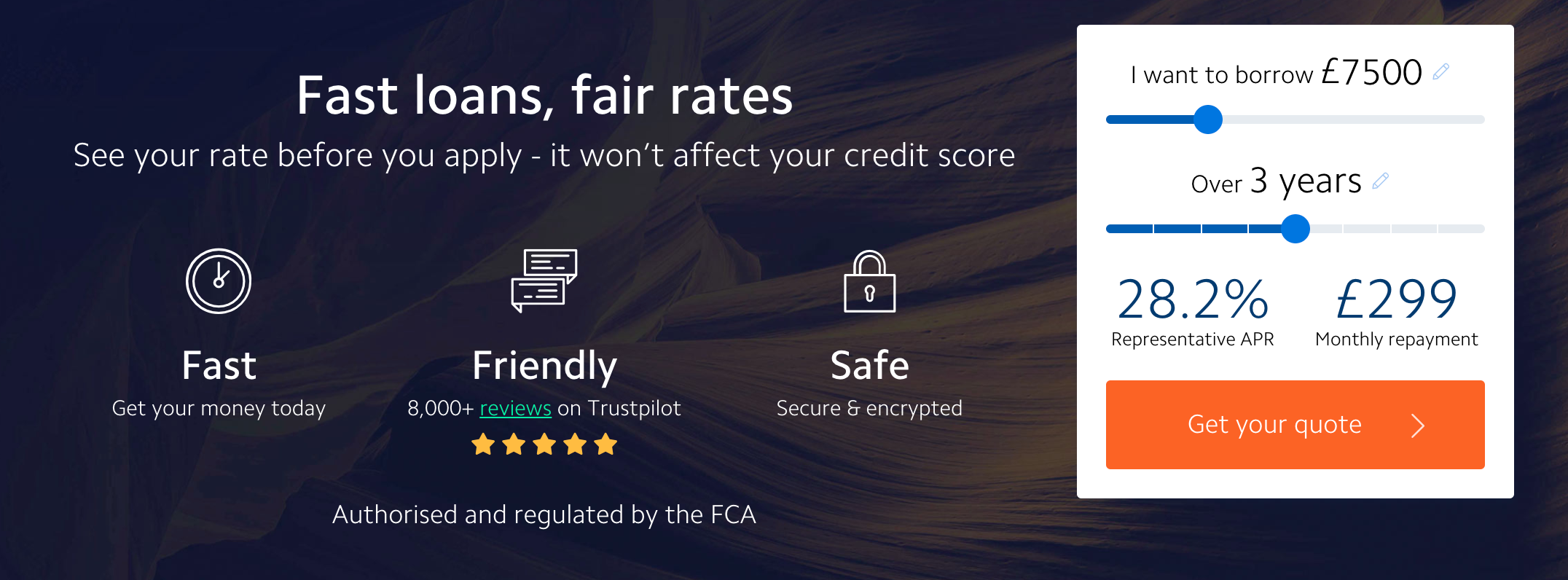

Founded in 2014, Lendable has become a standout UK digital lender, allowing customers to instantly borrow up to £20k.

The company's £1bn+ valuation is a big jump from the £500m it was last rumoured to be priced at when Balderton led a secondary sale in 2018.

Notably, Lendable has raised just £4m in equity to date, making its unicorn status all the more impressive. It's also unusually discreet, with Lendable's young founders having avoided a formal press interview in three years.

Still, becoming a unicorn has arguably been a long time coming.

In 2019, Lendable recorded £15m in profit on £32.1m in revenue, putting it in the shallow ranks of European fintechs that are actually generating money. Its earnings were also well ahead of most European unicorns — with Monzo, Revolut, N26 and Klarna operating at a loss.

Today, Lendable approves a new loan every 30 seconds, and recently appeared in the Sunday Times Top 10 in Tech alongside Revolut, ranked by fastest-growing sales. Its ability to fast-track applications and to offer competitive rates has won it tens of thousands of customers, using institutional capital to fund the loans (it's not a bank itself).

The company is now also rumoured to be expanding into the US, as well as recently launching a credit card product.

Lendable could not be reached for comment.

Happy investors

Despite being under-the-radar, Lendable has not escaped the attention of top investors.

Its backers include Goldman Sachs and Passion Capital’s top partners — Stefan Glänzer and Eileen Burbidge — who both invested in Lendable's seed round in a personal capacity.

Lendable's new valuation means its early angel investors — including those who have just cashed in — have secured healthy returns of up to 250x, one investor told Sifted.

The latest public filings suggest the following*:

- Glänzer's stake in Lendable is today worth an estimated £23m.

- Meanwhile, fellow Passion Capital partner Eileen Burbidge partially liquidated her shares in previous sales, leaving a stake worth ~£355.5k at the last count.

- Lendable's cofounder Martin Kissinger owns around 15% of the company, according to company filings.

Unsurprisingly then, new investors are now circling trying to get a piece of the pie.

Lendable’s new valuation has caught the attention of several SPAC sponsors, who have been scouting out Lendable's appetite for an exit, insiders say.

The secondaries trailblazers

Lendable is unusual in its embrace of the secondary markets.

Secondary sales lie outside the main private capital markets, and exist to allow startup shareholders to cash in their holdings.

It's still seen by some as a taboo exit route, not least because they can also affect valuations negatively. Few startups disclose their participation in secondary markets, and it's particularly rare outside an equity raise, with the exceptions of firms like Wise (formerly TransferWise) and Darktrace.

Still, Jeff Lynn, the chairman of crowdfunding and secondary-sale platform Seedrs, says there is growing momentum in this space.

“It’s now pretty commonplace for unicorn-level businesses [to do employee secondaries]… Lower down the chain... I’m hearing [it] talked about far more than it was a few years ago,” he told Sifted.

Isabel Woodford is Sifted’s fintech correspondent. She tweets from @i_woodford

****

* A note on calculations

The worth of each shareholders' stakes are estimated using the 2019 filings, and based off a £1bn valuation.

Stefan Glänzer owns 153,771 of 6,670,834 total shares, equating to 2.31% of the company. 2.31% of £1bn would make £23m.

Equally, Kissinger is shown to hold over 1m (vested) shares in total, giving him at least 15% in shares.