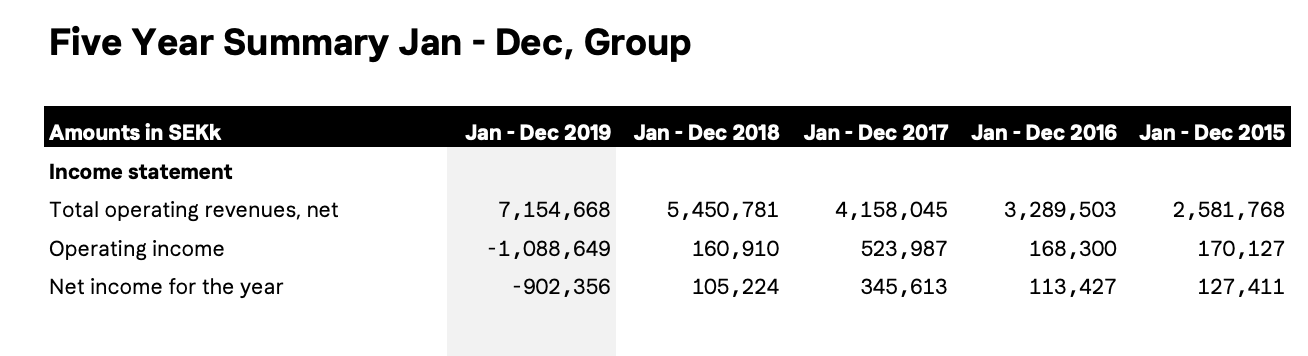

Klarna's push for hyper-growth landed it in the red for the first time in its history, according to the company's 2019 annual report, which was published on Wednesday.

The Swedish “buy now-pay later” lender noted a drop in over $100m since the previous year — from a profit of $10m in 2018 to a loss of $93m this year. It's the first time the company has been in the red since launching in 2005, having delivered an unusual "profitable-on-day-one" commission model with thousands of retail partners, including ASOS and H&M.

Klarna, which joins Revolut as Europe's most highly-valued fintech, beat its peers to the mark in expanding into the US, a destination that continues to hold unparalleled glamour for European startups. Klarna began its launch stateside in 2015 but took time in securing the necessary licenses, finally ramping up its efforts to accumulate customers early last year after a mammoth $460m fundraise.

The company reported it had surpassed 2m US downloads by December 2019, but growth there has been financially gruelling. Indeed, the company recorded a 69m SEK ($7m) loss under a mixed regional category that included the US and the UK. The company also invested heavily in marketing across these areas and it's set to do the same in Australia where it launched in January this year, ahead of a rumoured flotation.

Overall, Klarna's general expenses also rose by $177m between 2018 and 2019. This may well grow again as the company prepares to expand into four to five new markets this year.

Risky customers?

Notably, the new geographies seem to have made the business more problematic. It has attracted more customers who aren't paying back; Klarna recorded that customers defaulting on payments doubled from 2018, reaching SKr1.86bn (nearly $200m) in credit losses last year.

The company says they use a unique credit scoring system to vet users but acknowledged that first-time customers in new markets paid back less reliably.

Last year, Klarna was embroiled in a public spat with Swedish politician Per Bolund, who said customers should not be fooled into “payment paths that cost more”, promising to give companies like Klarna a “hard time”.

Klarna hit back, arguing that lending credit to retail customers was nothing new. The company’s basic ‘pay later’ option does not cost customers more in itself, assuming they pay back on time.

Elsewhere, investors have also flagged the difficulties of cracking the US market, despite the country's affinity to credit.

“What I tell companies when they want to go to the US is ‘think of it like China’. The cultural gap between the US and Europe is as big as Europe and China,” Yann Ranchere, a partner at early-stage venture capital fund Anthemis, told Sifted last year.

Revenue push

Nonetheless, Klarna has a solid revenue stream; it recorded revenues of over $740m in its latest report; up from $561m in 2018.

Interestingly, it brought twice in as much from partner commissions (who incorporate Klarna as a payment option) than it did from customers themselves (made up of late-payment fees and interest fees for premium users).

Klarna has sold itself to online retailers with the promise of a 20% increase in the frequency of purchases.

It's unclear how much Klarna increased its customer base globally, but it has doubled its UK users in the last year after a slow start. Meanwhile, Sweden, Germany, Austria, Switzerland and Norway were all profit-making.

Despite sharing the same valuation as Revolut as of yesterday, Klarna brought in four times as much in revenue last year, based on Revolut's projected income for 2019 (yet to be finalised).