Sweden is something of a fintech Mecca, having spawned the likes of Klarna, Tink and iZettle. And now, the country is lining up a new generation of fintech stars.

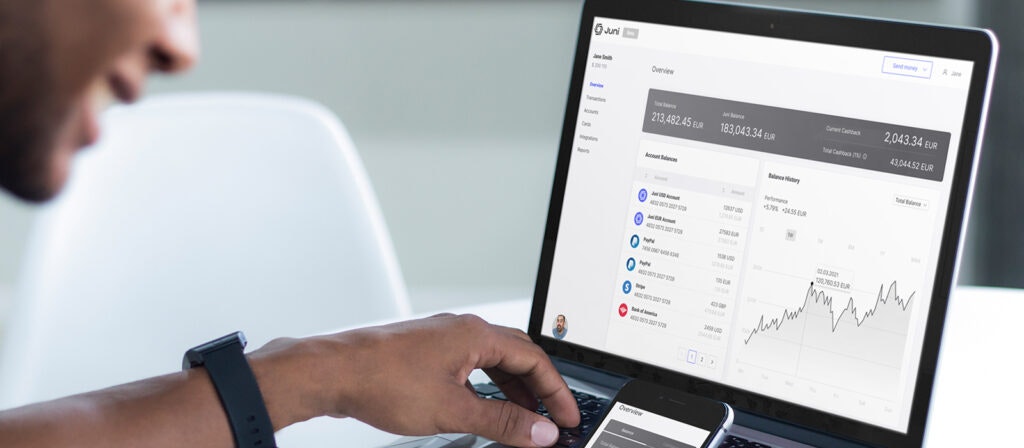

Among them is Juni, the neobank built for ecommerce merchants, which has today announced a $52m Series A extension from EQT Ventures.

Founded in June 2020, Juni wants to be the financial companion to the thousands of ecommerce businesses who sell via Shopify and Amazon. The startup has quickly expanded into the Netherlands and the UK, which is its biggest market, offering a suite of products from lending to return-on-investment tracking features.

Juni forms part of a new wave of so-called vertical neobanks geared towards a specific demographic. In August XPO, a neobank for influencers, launched in the UK and on Monday Cure, a German neobank for doctors and dentists, tapped $1.4m in funding.

That makes Juni a critical addition to the market, says its cofounder and CEO Samir El-Sabini.

“What's missing today is a vertical solution that goes in-depth into solving [ecommerce businesses’] pain points,” he tells Sifted. “In the long term, [we hope to] create a solution where we could help ecommerce entrepreneurs to survive, grow and win, and be an amplifier in their success.”

The new funding will be used to triple the size of Juni’s team from 75 to 225 by the end of next year and also to launch its own credit product for internet-first small businesses.

This follows its initial $21.5m Series A in July, backed by DST Global, Felix Capital, Cherry Ventures and others. Sifted nominated the startup as one of the breakout fintechs of 2021.

All eyes on Sweden

Juni’s funding round tops off a banner year for Swedish fintechs. So far this year, the country’s financial startups have raised a record €1.8bn, as well as scoring high-profile exits by the likes of Tink.

Stockholm is now ranked second only to Silicon Valley for the number of unicorns per capita, a recent study by Atomico showed. More could be on the way, with fast-growing fintechs like Dreams, Willa and Hedvig soaring in valuations.

It might seem an unlikely destination given the country has a population of just over 10m.

Yet being small has been key to Sweden’s conveyor belt of high-growth startups, explains Mikael Hussain, the founder of debt refinancing startup Anyfin. Hussain, who has raised from top investors like Accel, argues Sweden’s size has made startups think internationally from day one.

“We’re a fairly small domestic market. So that makes your plans more grandiose, and that gets recognised by investors,” he tells Sifted, following Anyfin’s recent entry into Germany.

For many companies, the market size and opportunity exists elsewhere. You think about things differently from day one.

“For many companies, us included, the market size and opportunity exists elsewhere. You think about things differently from day one. Whereas if you’re in France, you create a product for quite a [large] bespoke market. That makes internationalisation trickier.”

He’s right — Juni’s new credit product will be initially rolled out in the UK, not Sweden. Equally, SME-lending startup Qred, backed by Nordic Capital, is active elsewhere in the Nordics and in the Netherlands — testament to the export power of Swedish B2B fintechs.

“There are no serious fintech companies that are starting up, aiming only for the Swedish market,” Qred CEO Emil Sunvisson tells Sifted.

The maturity of Sweden’s fintech sector also has political roots, including two decades of pro-tech governments. In the 90s, a pioneering state policy made computers available in every home — a policy that Klarna founder Sebastian Siemiatkowski recently told Reuters sparked his own success.

The neolender army

Juni is among a league of neolenders that have historically mopped up the bulk of Sweden’s VC funding. In 2020, Lendify, Klarna and Anyfin scored the country's largest funding rounds, besides Tink.

Magda Lukaszewicz, who oversees Nordic investment for Balderton Capital, tells Sifted that Sweden offers several advantages in the lending realm.

“I don’t think it was random that Klarna was founded in Sweden,” says Lukaszewicz. “There's a public consumer data and tech infrastructure, a relatively straightforward enforcement process, ecommerce penetration [is] high... Those factors combined allowed fintechs like Klarna to get more creative.”

Lending and ecommerce startups continue to catch the attention of investors, following in Klarna’s footsteps.

Among them is Zaver — a P2P payment solution that raised €5m earlier this year — and Briqpay, a B2B payments firm set up by Klarna alumni. Another one to watch is Minna Technologies, a subscription management solution for retail banks that has charmed investors such as Visa to the tune of €15m.

“It definitely feels like there’s a new generation of Klarnas,” Tink founder Daniel Kjellén tells Sifted.

A bright future?

Whilst Sweden may be enjoying its fintech primacy, it’ll need to watch its back.

France recently overtook Sweden as the third most favoured destination for fintech investors. The French government is also aggressively trying to make Paris a fintech hub by offering a giant funding pool, something that Sweden's government have failed to do.

Lukaszewicz also admitted that funding is “very skewed” towards Klarna: “There is more capital but it’s not necessarily going into more companies.”

Dream’s founder Henrik Rosvall agreed. “Our VCs are really careful and we don’t have the huge funds here... I absolutely feel it would be easier [to be a founder] in London,” he told Sifted.

Moreover, despite the country’s reputation for gender equality, Swedish tech lags far behind. Only 1% of capital went to Nordic female-founded startups in 2020.

Still, Sweden has a strong pipeline of entrepreneurial talent — trained at Europe’s biggest fintechs. Case in point is the wave of ex-Klarna employees becoming founders themselves. That makes Stockholm an obvious destination for overseas investors, they tell Sifted.

"Sweden is definitely on the map for fintech investment in Europe... there's a very strong fintech talent pool available there,” says Julia Andre of Index Ventures, noting the country’s “headstart” in this sector.

“Even if you look at the new B2B payment wave, there's now a number of emerging players out of the region, no doubt we'll see large companies in the coming years.”

Juni’s El-Sabini adds that the upcoming exits — both Klarna and Trustly are rumoured to be planning public offerings in the near future — could also trigger a new era for Swedish fintech.

“I think it's very hard to come to a critical level of capital, talent and support structure to really be an engine of new great companies,” says El-Sabini. “But I would certainly say that Sweden has come to that place.”

Isabel Woodford is Sifted’s fintech correspondent. She tweets from @i_woodford and coauthors our new fintech-focused newsletter. Sign up here.

Tom Matsuda is an editorial intern at Sifted. He tweets from @_tommatsuda.