B2B SaaS startups have been a money-making bonanza for many VCs over the years. Now many of them are eyeing up quantum computing-as-a-service to get into this still-developing deep tech sector.

Quantum computing is still riddled with unanswered questions — starting from which type of underlying physics will ultimately dominate. But the beauty of quantum-as-a-service is that users don't have to make any of those decisions, nor wait for the industry to create a perfectly-performing qubit. Quantum-as-a-service companies will take those headaches on for you.

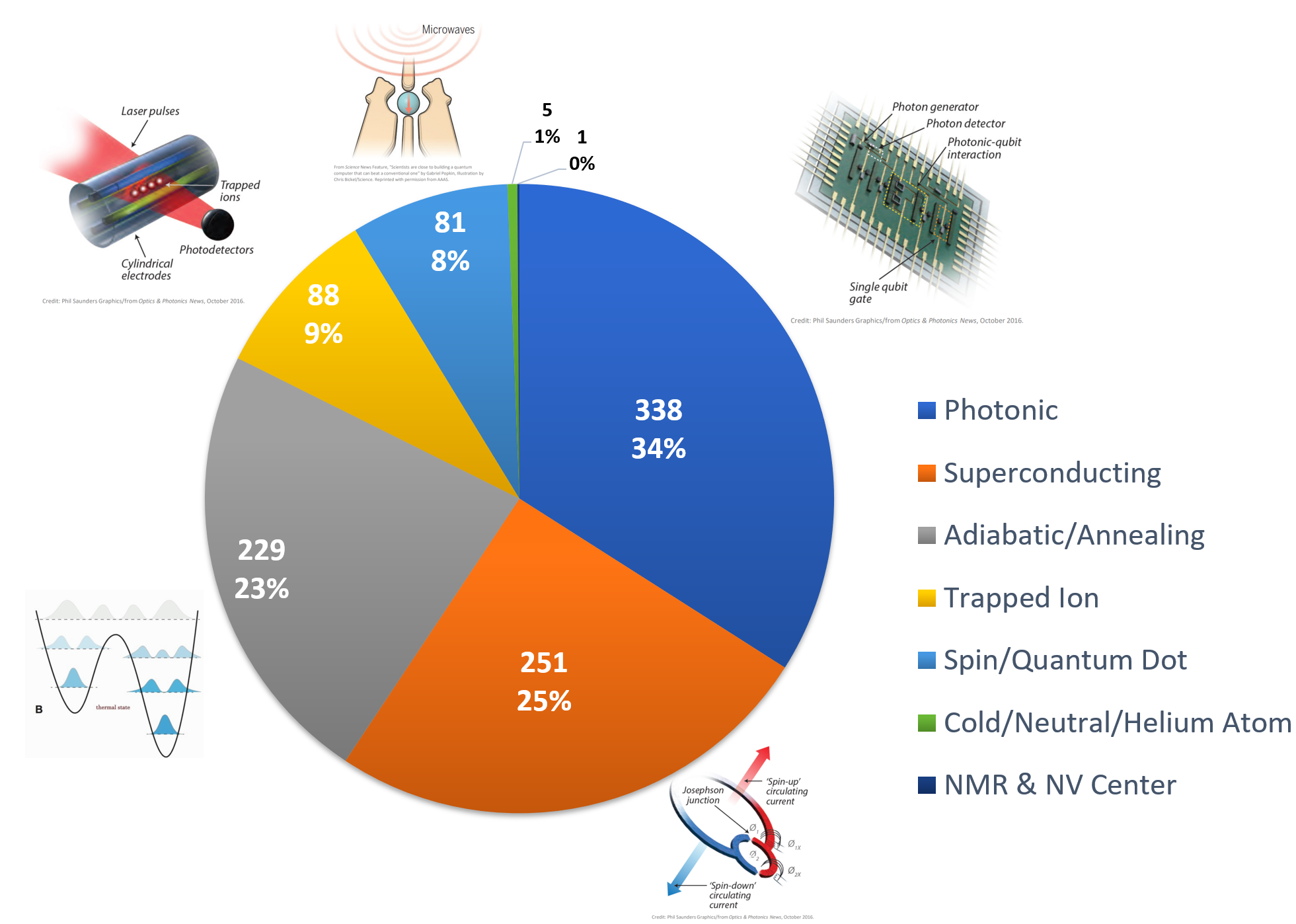

Breakdown of the investment into the different types of quantum computer

IBM’s fleet of 18 quantum computers is available to access through the cloud: some reserved for members of the IBM Network of more than 100 research institutions and large corporates, and some for anyone to use. Microsoft Azur Quantum and Amazon AWS Braket offer the same kinds of services.

A user of IBM’s Q network can run quantum software on IBM’s superconducting quantum computers or on the trapped ions of its partner, Austrian quantum computer maker AQT. Similarly, Pasqal, a French startup developing a cold atom-based quantum processor, is collaborating with Google to provide access to its technology through Cirq, the open-source framework Google uses to access its own superconducting quantum computers.

Last year, Cambridge Quantum Computing, which works closely with IBM, launched a series of quantum software services, such as random number generation and quantum-proof cryptography keys. Quantum software like Riverlane’s Deltaflow operating system is portable across at least four of the major types of quantum hardware.

The big breakthrough was realising that although the underlying physics might be different, the hardware operates the same way.

“The big breakthrough for us was realising that although the underlying physics might be different, the hardware tends to operate the same way,” says Steve Brierley, Riverlane's founder and CEO. “The system sends in a signal to the qubits, something quantum happens, and then you need to get the signal out. The computer is actually a control system.”

Realising this meant that Riverlane could develop an operating system that would work across the board with all this hardware.

Companies like Terra Quantum are working to make it easy for corporations to use quantum computing — or a simulated version of it — right now. The company is developing its own silicon-based quantum platform but is also offering quantum-as-a-service for companies.

They are specialising in taking client problems and finding the quantum algorithms that will work in solving them. As quantum computing develops these solutions will become better and faster, but companies can start getting the benefits of quantum computing straight away, without having to wait several more years for the industry to reach quantum advantage. Terra Quantum, too, can make real money.

“We can talk to corporates now, and will generate relevant revenues this year,” says Markus Pflitsch, Terra Quantum founder and chief executive.

The money pours in

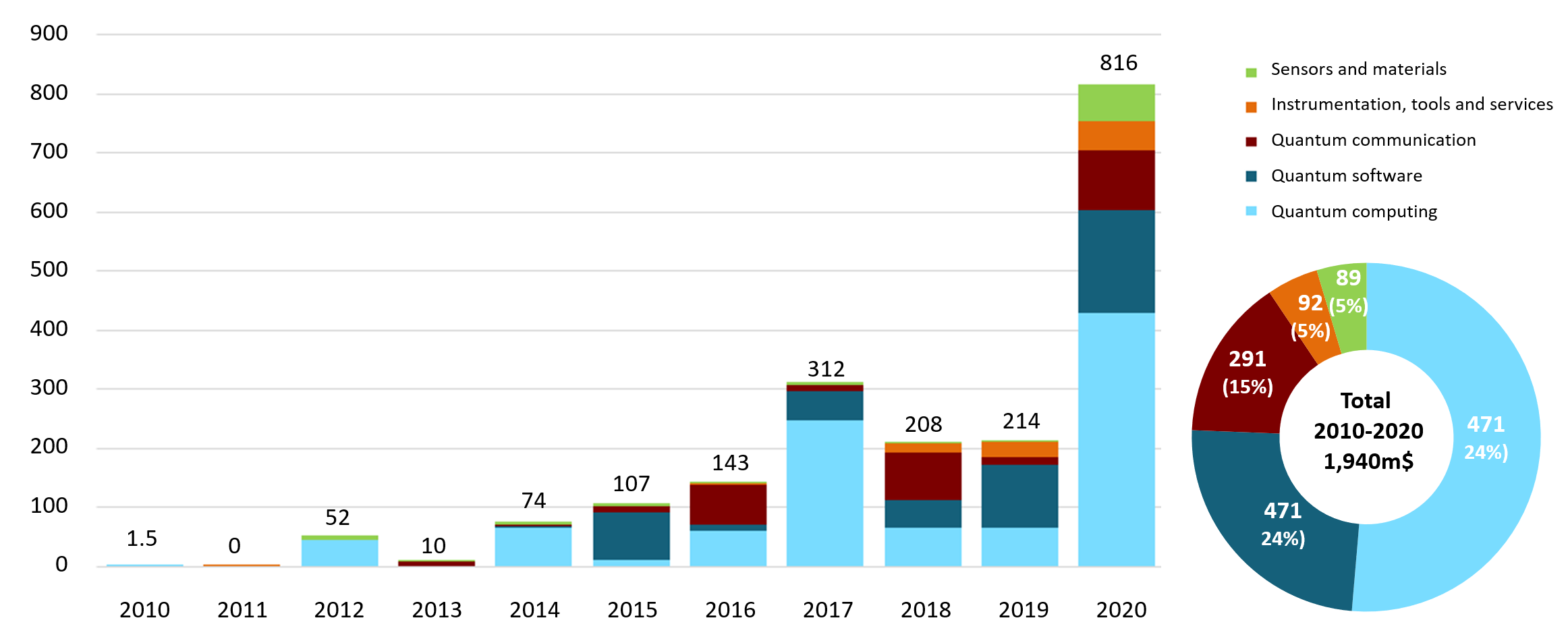

Since 2012, more than $1.9bn has been invested in quantum tech startups, according to Le Lab Quantique, the French quantum think tank and accelerator.

Spending on quantum technologies nearly quadrupled last year

The time is starting to be right to invest in quantum computing, says Stuart Chapman, partner at Draper Esprit, which led the recent Series A into Riverlane.

“VCs rarely lose money because the technology doesn’t work. They lose money because they get the timing wrong by five years,” says Chapman. Now, however, there is demand from both quantum users and quantum hardware manufacturers for software like Riverlane that makes the technology easy to use.

When Pflitsch at Terra Quantum talks about being able to start generating revenue this year, quantum investments start feeling like less of a long shot and investors’ ears prick up.

We may also be about to see a first stock market listing, with Bloomberg reporting that US-based quantum computing company IonQ is planning to list via a SPAC, with a valuation of around $300m.

European governments, too, have started putting serious money into quantum. Last month the French government recently unveiled a national quantum strategy that will see €1.8bn invested in the sector over the next 4 years.

[Read the full assessment of the French strategy by Christophe Jurczak, founder of quantum-focused VC Quantonation]

The French strategy follows a pledge last July by the German government to spend €2bn on quantum and EU plans for €1bn in investment by the end of 2028. The UK has spent more than €1bn on quantum tech since establishing the National Quantum Technologies Programme in 2014.

Jurczak says countries like the Netherlands, Spain and Italy could also use their post-Covid-19 economic recovery plans to boost national quantum industries.

It’s not just the money — government endorsement also helps elevate the status of the industry, says Jurczak.

“When I started evangelising about the topic back in 2015, I felt sometimes that people thought quantum computing was a scam,” he says.

Can Europe keep up?

One worry is that the new national strategies might be too slow, says Terra Quantum’s Pflitsch. Breakthroughs are happening so fast in the industry at the moment that the time to solidify a position in the industry is now.

A month is a long time in the industry right now.

“When we file patents I am sweating over the weekend worried that I will hear about a similar patent being filed in China before we can manage to get ours in,” he says. “A month is a long time in the industry right now. Talking about getting a lab running in three to five years, is just too slow.”

But many people in the sector believe it is still a level playing field for quantum globally. Indeed, some hope that Europe could take a lead in quantum in a way that it failed to in classic computing.

“Europe has watched the US cloud hyperscalers take over the internet for quite a while. Now the time has come when a disruptive technology from Europe changes the rules of the game: The Quantum Cloud,” says George Gesek — CEO and founder of Novarion Systems, the high performance computing company.

We haven’t got to the point where you can’t catch the big tech companies.

Some of the biggest quantum computers are still in the US. Google and IBM have machines with 50 or so qubits, and IBM has a roadmap to get to 1000 by 2023 — while in contrast machines from IQM have just 5 qubits. But IQ Capital’s Carew advises against simply counting qubits. The whole industry is still searching for qubits that are more reliable and easy to scale. A company that discovers that can move rapidly from 5 qubits to 50 and beyond.

“If you come up with a scalable system, moving from 5 to 50 isn’t a big deal. We haven’t got to the point where you can’t catch the big tech companies,” says Carew.

Investors like Chapman at Draper Esprit and Jurczak at Quontonation are, overall, bullish on European quantum.

“Europe has finally realised that, although historically it was a heavyweight of quantum R&D, there was a risk that it could be left behind in the quantum race. The cumulated budgets of the EU and national plans are very substantial, and quantum is clearly identified as a priority now,” says Jurczak. “It’s hard to compare for lack of publications, but I’d put the US, China and Europe more or less at the same level.”

This is the third in our series of articles about quantum computing. Read the previous two articles:

Why now is the right time to invest in European quantum computing.

Can France’s quantum plan deliver? An interview with Quantonation