John Martinis, the lead scientist who built Google’s first computer to achieve quantum supremacy, recently left the tech giant to join Silicon Quantum Computing, a 2017-founded startup based in Sydney.

Meanwhile Terra Quantum, a Swiss-based quantum computing startup, has celebrated another big hire with high-profile physicist Valerii Vinokur from the Argonne National Laboratory in the US.

There is a trend for academics going to startups now, and it is a good sign when the seasoned professionals start joining.

Both moves are a sign that smaller startups are able to compete with the big players in the brewing war for talent in the quantum sector, as the industry begins to get out of the lab towards commercial applications.

Markus Pflitsch, cofounder Terra Quantum, says that big shot professors joining startups is a sign that smaller quantum companies are being taken increasingly seriously. He adds that the field is so new that new companies may well be just as successful as the likes of IBM, Google and Microsoft.

“There is a trend for academics going to startups now, and it is a good sign when the seasoned professionals start joining,” says Pflitsch.

Competition is fierce though.

European governments’ recent moves to pour funding into quantum projects (France recently pledged to spend €1.8bn in the sector and Germany €2bn) is partly motivated by a desire to avoid leading academics from the region, says Christophe Jurczak, founder of Quantonation.

“The French government feels very strongly that the country is suffering from a brain drain in the field of AI, and they don’t want that to happen with quantum while there is more time to prepare,” says Jurczak, who was instrumental in helping formulate the French plan.

Quantum computing companies are raising ever-larger funding rounds and using the money for hiring.

Riverlane, a Cambridge-based startup which raised a £14.6m last month, is looking to double its team of 26 this year. Cambridge Quantum Computing, which raised a $45m early VC round in December, has gone from 37 employees in 2018 to close to 90 now and is hiring for 30+ more roles. Finnish superconducting quantum computer maker IQM, which raised a €39m Series A round in November, has more than doubled its headcount in the last year.

Brains not money

“The shortage in the industry is no longer the money, it is the brainpower,” says Pflitsch, who now has a staff of around 80 at Terra Quantum. “The talent is so important, we can’t do it without these guys. If you have those brains at Google or Terra Quantum it doesn’t matter, it is a fair battle.

Big advances are still happening at relatively unknown teams at labs all around the world. In December a group based at the University of Science and Technology of China demonstrated quantum superiority — the Holy Grail of the sector — by getting a photon-based quantum system to do in 20 seconds what would take a supercomputer 600m years. The demonstration outdid Google’s 2018 demonstration of quantum superiority by several orders of magnitude.

Small companies can compete in quantum if they have a breakthrough.

“If a lab can do that it shows that small companies can compete in quantum if they have a breakthrough,” says Daniel Carew, principal at IQ Capital.

French photonics-based quantum company Pasqal is thought to have achieved a record in the simulation of quantum systems with 196 qubits in the lab. If confirmed, this would give Europe a “quantum advantage”.

The "homebrew" stage

With so much still undeveloped, the quantum computing world still has an amateur enthusiast flavour to it with big developments able to come from unexpected places, much like the early days of the personal computer in the 1970s.

“It’s a bit like the homebrew computer club,” says Steve Brierley, chief executive of Riverlane, referencing the early hobbyist computer club that ran in a garage in California’s Menlo Park between 1975 and 1986, and which became the training ground for tech entrepreneurs like Steve Jobs and Steve Wozniak.

“There’s a lot of tinkering. It’s happening over the cloud rather than in someone’s shed, but there is that same excitement.”

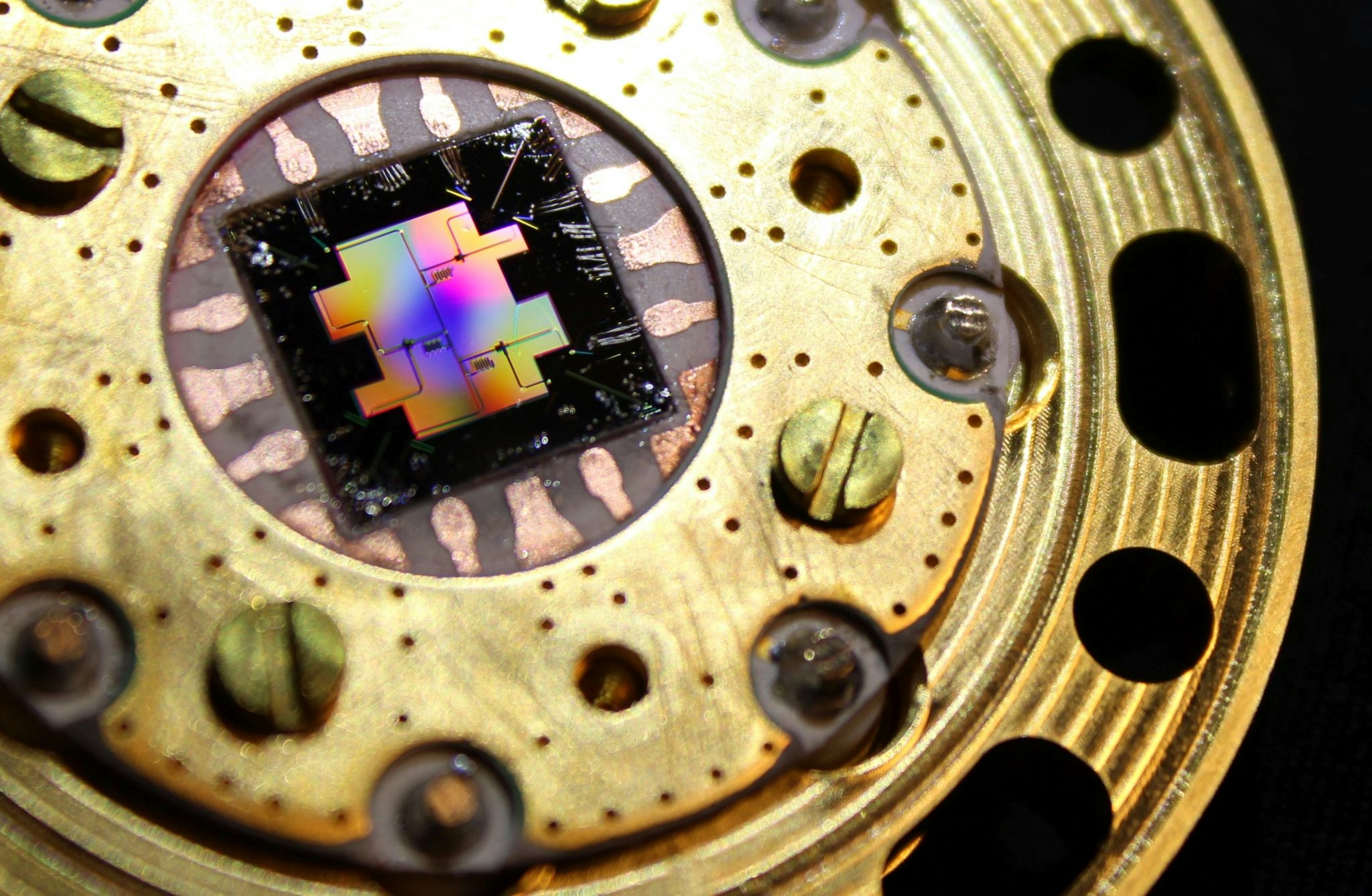

It is still not clear which kind of quantum computing will be the dominant technology. Many of the big bets are on superconducting quantum computers, which operate at temperatures close to absolute zero, but there is investment going into photon-based systems, where photons are “bounced” into a quantum state by a series of mirrors, systems using trapped ions and silicon-based systems which don’t have to operate at quite the super-low temperatures of the superconducting systems.

Researchers from Microsoft and the University of Sydney recently announced they had developed a quantum computing system that uses the same kind of complementary metal-oxide-semiconductor (CMOS) chips already used in classic computing.

If they have baked the wrong technology, some companies may disappear overnight.

“It is still early days of knowing which style of quantum will prevail,” says Pflitsch. If they have baked the wrong technology, he says, “some companies may disappear overnight”

Much of the big investment so far has gone into superconducting qubits, in part because the refrigeration technology needed for this is more established and available. But if there are big breakthroughs in one of the other areas — which would make the qubits more reliable or scalable — this could become the dominant technology.

“I think atoms and ions will be dominant first, they have many advantages as for scalability (atoms) and fidelity (ions). In the longer term, solid-state approaches (superconducting qubits, spins, photons) should catch up,” says Christophe Jurczak, founder of Quantonation, the quantum-focused VC fund.

It is also entirely possible that we could end up with multiple types of quantum computer co-existing, each with a particular niche it is best suited for.

“The big dream of a general quantum computer may not be what happens,’ says IQ Capital’s Carew. “It may be more like the early days of microprocessors where you had a lot of different types each with a specific function.”

This is part one of a series of four articles we are running this week on Europe's quantum computing industry. Part two, on France's quantum strategy, will be published tomorrow.