In a post-Covid-19 world, many companies will have less money dedicated for their non-core business investments due to their urgent and imperative need to relaunch their business — particularly in areas like aerospace, airlines, events and the automotive industry.

Innovation teams will be under pressure to do more with less, to spend less and execute better, to reach valuable quick wins and, most importantly, demonstrate that they have created value for the business.

This is the end of “innovation theatre”. Companies will have to get rid of pointless marketing events and realise that taking part in a big event like VivaTech is not the panacea that will make them a leader in their value chain.

Companies we work with such as Schneider Electric or Michelin understand the situation. They launch initiatives to break into areas where they have yet to be visible. Creating ventures from scratch in early-stage markets allows them to capture the maximum value, without paying the high valuation of a Series C deal later on.

Not all corporations are good at launching something new, however. We see many groups willing to launch their own startup studio — in other words, an entity to industrialise the venture creation process — when they have never done it once. Don’t try to do everything in-house!

Realise your limitations

Incumbents are ideally placed to make the big changes that are needed in the post-Covid world. They have the cash and assets to make changes much more quickly, and, more importantly, they are experts at industrialising, scaling and globalising. They have proven their ability to create and scale-up new markets. And they have valuable assets and cash to bring to the table.

But to do this they have to come to terms with the limitations they have. Clearly, very few companies have had tangible success with innovation — Google, Apple, Amazon and Facebook, as native digital companies, and Tesla (itself a relatively new company) are some of very few to show real value from innovation in a well-established industry.

Why are corporations bad at innovating?

Corporations have to understand the roots of this problem. It comes down to 4 issues:

- Research and development is still dominant in many traditional companies while innovation should be equally important. Incremental innovation is well managed by companies, but they need to become ambidextrous, and able to also handle disruptive innovation. The pharmaceutical industry, for instance, is realising that if they focus just on R&D excellence they could miss the opportunities presented by the huge changes in clients' and patients' behaviour, including trends such as wellness coaching, customisation, and preventative medicine.

- There is no real and formal alignment between innovation and strategy. In other words, companies don’t always understand why they are innovating, which leads them to do what is modish and visible rather than bold, focused and under-the-radar. Strategy is often clearly defined by the company, but innovation relies on key people: if these people change, innovation is at risk.

- They don’t put in place the right KPIs for their innovation efforts thus struggle to show clients, partners, employees and shareholders the value they got from the investment. Innovation is about speed, learnings and competitivity (whether the impact is visible on the top or bottom line) and that’s where the focus should be.

- A lack of courage at executive and board level. It is a huge challenge to manage on one hand the continuous improvement of the core business and on the other hand to invent a new set of businesses. You have to be schizophrenic to manage it.

The solution: venture building at arm’s length

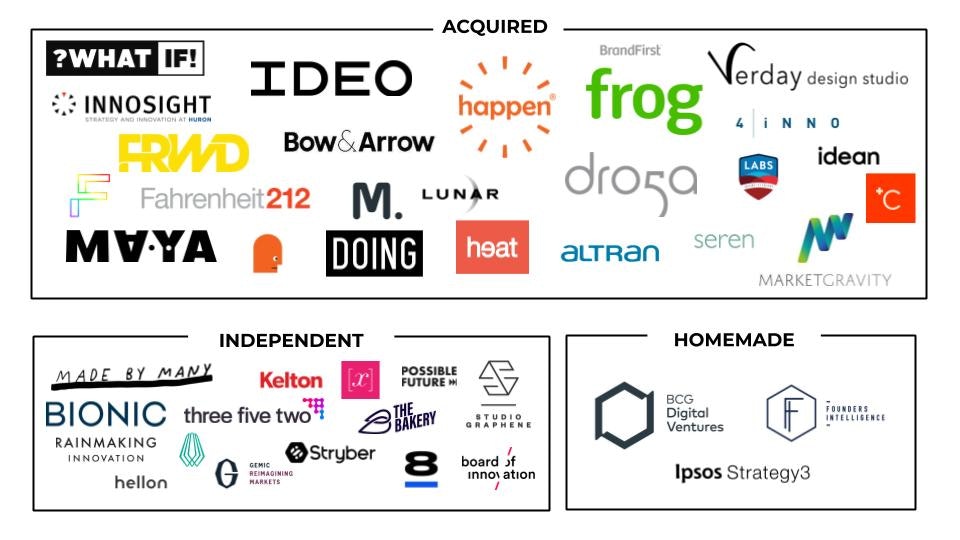

Building ventures is an effective option but it is faster and cheaper to outsource the work to an experienced startup builder.

Creating a startup requires two things: a tested customer pain point, and corporate assets to be leveraged to accelerate the execution. Indeed, the venture building process requires an ability to take risk and execute fast.

An external team freed from any corporate constraints is often more efficient — unless the group has secured a large investment that will allow them to launch at least five ventures each year for five years minimum.