Corporations are under extra pressure to innovate faster with tighter budgets. An opportunity or resource today may be gone in 30 days. Global market volatility has intensified between two to six times in past months, according to proxies such as the CBOE Volatility Index. Companies are also struggling to beat more competitors hunting the same top-tier entrepreneurs: the number of firms collaborating with startups (so-called corporate venturing) has increased fourfold since 2013.

What can we learn from companies such as Volvo, Samsung or BNP Paribas to make corporate innovation efforts less risky, faster and more cost-effective? Based on almost 100 interviews with chief innovation officers —and those in related roles— located in Asia, America, and Europe — our recent study found three takeaways addressing this question.

Team up with others. Yes, also with other corporates

One way is building a ‘corporate venturing squad’, a small group of corporations joining forces to collaborate with one or more startups. Volvo did this in Sweden's Lindholmen Science Park.

Volvo has teamed up with CEVT, Veoneer, and Ericsson at Lindholmen Science Park.

In the same value chain, it banded together with the automobile companies CEVT and Veoneer, and the telecommunications company Ericsson. This squad, called mobilityXlab, offers entrepreneurs the acceleration support of the squad by receiving mentorship, access to professional networks, industry insights, and workspace.

On the one hand, it improves the corporate value proposition offered to the entrepreneur, thereby aggregating value (e.g. providing complementary expertise across the value chain). On the other hand, it shares the risk and cost of the proof of concept among the squad’s members, while strengthening the corporate access to startups by leveraging the scouting capabilities of each corporation.

Look beyond consulting firms for enablers

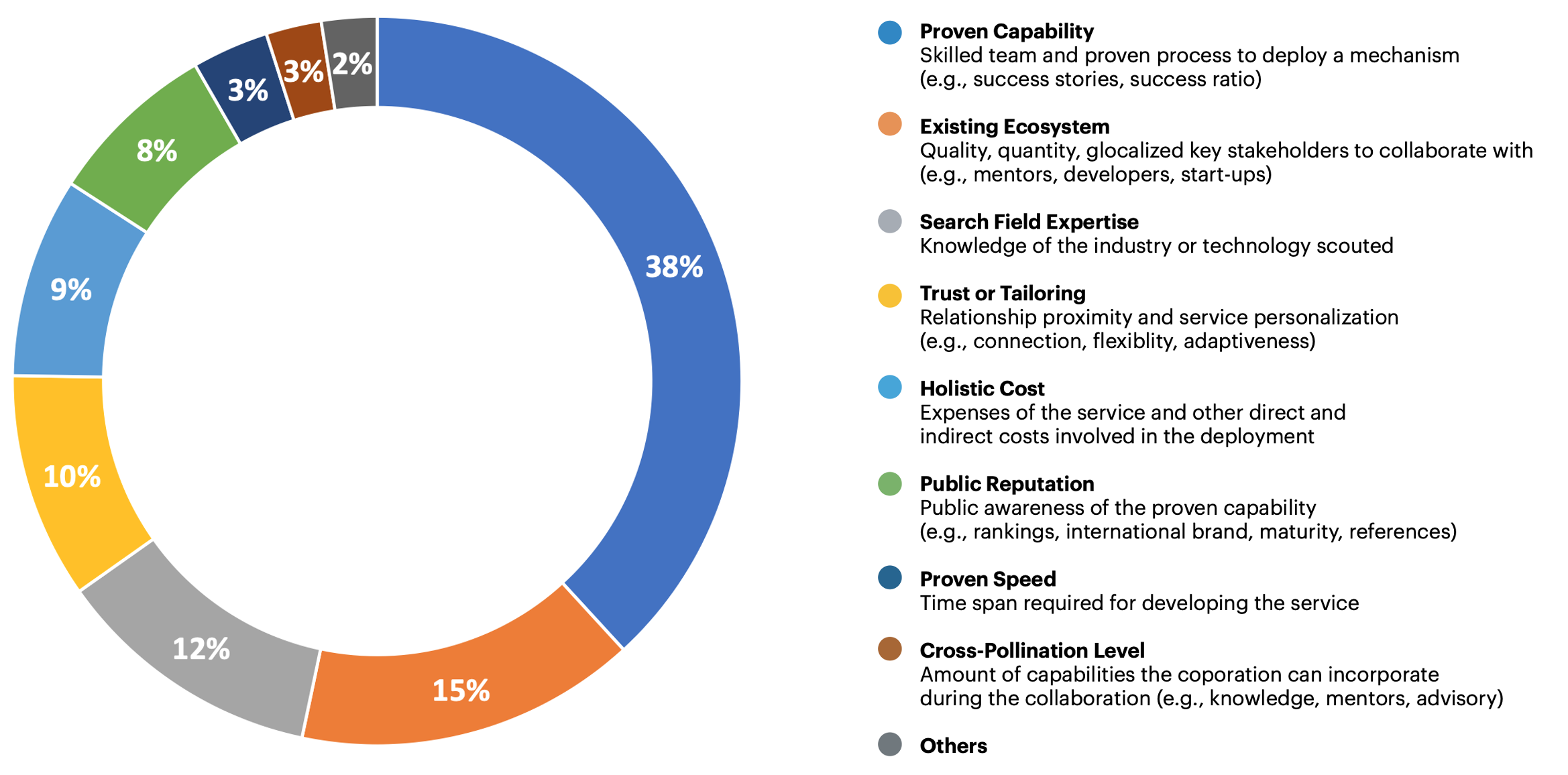

When companies search for an enabler to facilitate the collaboration with a startup, they usually think first about turning to a professional services firm. However, reality is far richer. Other types of institutions have developed some of the corporate venturing aspects most frequently evaluated by companies when choosing an enabler: capabilities to work with entrepreneurs (in 38% of the cases), existing ecosystem of curated stakeholders (15%), knowledge of the industry or the scouted technology (12%), and more.

Enablers can take many other forms such as private accelerators and incubators, research centres, universities, venture capital firms, business angel investors, private equity firms, governments, embassies, chambers of commerce, and think tanks. Weighing all the options can reveal less intuitive ways to complement the corporate efforts and to access these resources and activities faster.

Samsung Electronics has used a fund-of-funds strategy when scouting in the Israeli market.

One example is the South Korean Samsung Electronics, which invests $200m a year in about 60 startups. Among other mechanisms, the company has used a fund-of-funds strategy when scouting in the Israeli market by participating in private venture capital funds. This not only speeded up its connectivity to regional deal flow but also reinforced its due diligence capability with regard to local startups and enablers.

Tap into a hidden new revenue stream

The line of who does what in the corporate venturing field is getting blurry. Corporations are starting to offer innovation services to other firms, since they have developed certain venturing resources and activities that, in some cases, can be stronger than those of other enablers (e.g., access to innovation ecosystem, distribution channel). Commercializing them is generating a new revenue stream for corporate venturing teams, following a business-to-business model: licensing processes, sharing acceleration teams, providing segmented deal flow, complementing expertise in a search field, to name a few.

BNP Paribas started an innovation hub in Brussels six years ago and now has replicated it in multiple cities and verticals.

Just reflect on the evolution experienced by Co.Station, the coworking space of the financial company BNP Paribas. Starting six years ago, in the city of Brussels, as a workspace for startups, it later became a hub of innovation where startup solutions and corporate needs meet. Nowadays, it is a multi-company initiative that has been replicated in multiple cities and verticals, which include not only financial services but also industries such as communications, health and energy — producing new income opportunities to the bank.

In short, corporations have the chance to innovate faster at a lower risk and cost, teaming up with others and keeping in mind the whole spectrum of enablers, including other corporations. If you know more examples of corporate venturing squads, please let us know.

Josemaria Siota is Executive Director at IESE Business School.

Mª Julia Prats is Head of Entrepreneurship at IESE Business School.

Note: On 2 July 2020, Veoneer finalized the split of mobilityXlab’s cofounder partner Zenuity, its joint venture with Volvo Cars.