UK digital health startup Huma is today announcing an $80m Series D round, following a period of “restructuring” at the company that’s seen it lay off some 100 employees in the past year.

The round featured existing investors AstraZeneca, Hitachi Ventures and Leaps by Bayer. New investors also participated — but are undisclosed. The Series D takes Huma’s total funding to around $300m.

The fresh funds were picked up over several smaller injections of capital in the last year, Sifted understands, but cumulatively the total makes up Europe’s largest digital health funding round since the start of 2023.

It follows what Huma founder and CEO Dan Vahdat describes as a number of “efficiency” savings made at the startup in the past 12 months as it has looked to slash its cash burn and move towards profitability.

“Shopify for digital health”

Founded in 2011, Huma builds remote patient monitoring (RPM) solutions for pharmaceutical companies and healthcare providers — for use cases like decentralised clinical trials and “virtual wards” (a system for tracking patients’ treatment and recovery at home).

It’s partnered with health providers like the NHS and Johns Hopkins University, pharma companies like Bayer and Smith+Nephew, and Chinese tech behemoth Tencent in the past. Huma’s platform is an authorised medical device by regulators in the US, EU and Saudi Arabia.

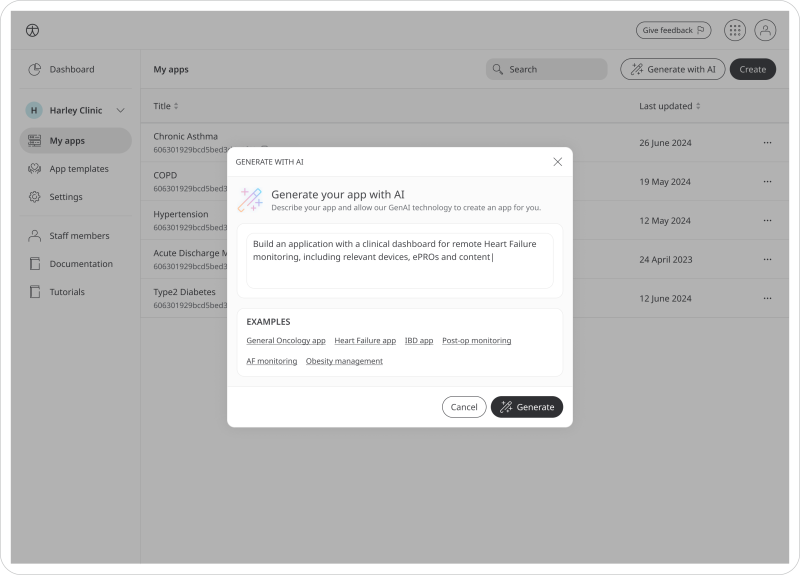

Previously Huma has worked directly with its customers to build monitoring tools, but in the second half of 2024 it will launch Huma Cloud — a self-service style app builder. Customers will be able to build their own RPM apps, using a prompt inputted into a generative AI-powered search bar or from a template on the platform.

Those apps could focus on RPM for anything from asthma, cancer to diabetes, or data collection for clinical trials, says Vahdat.

“It’s Shopify for digital health. So many companies are built on top of Salesforce or Palantir, and we want to become that type of enabler.”

Vahdat also sees potential for healthtech startup customers. The young companies, he says, often have fewer resources to build out their tech than typical startups, due to the extra costs involved in complying with stringent healthcare regulations.

The big idea is that, because Huma has already built the individual tools that make up an app and gained regulatory approval for its system, startups can build a digital health product for less money on its platform. While pricing is still being finalised, Vahdat says that it will be “consumption-based” and “similar to Shopify”.

Because, theoretically, it will take less Huma person-power to build a health app using the Huma Cloud platform, it will also be more scalable and the margins will be higher for the company, says Vahdat. The product will launch in beta this week, before rolling out more widely towards the end of 2024.

Restructuring

As Huma has looked to improve its margins, the startup has also cut costs over the past year. Part of that has been reducing headcount.

“When you have a platform with regulatory approval, you don’t need a big team to maintain it,” says Vahdat — adding that the costs associated with getting that regulatory approval and building a product from scratch now don’t apply.

He’s also replaced some hires with cheaper alternatives. “We had certain talent that we hired during 2021 and 2022, at the peak of the market, the cost was expensive,” Vahdat says. “We’ve replaced some of this talent with more cost effective options.”

Huma’s headcount has dropped from around 500 when Sifted reported that the company planned to make around 45 layoffs at the end of August 2023 to 400 today. The layoffs come during a difficult time for digital health startups across Europe.

They raised just $1.2bn across 2023 — less than half the $3.1bn picked up during 2021 and the lowest amount since 2018. If H1 numbers are anything to go by, 2024 isn’t looking much brighter.

The harsh funding environment has pulled the path to profitability into sharp focus for many in the sector — and Huma’s no different.

The startup made a loss of £31m in 2022, according to its latest Companies House filings. Numbers for 2023, although not publicly released, were similar, says Vahdat.

However the company is targeting break-even across the year by the end of 2024.

As it moves towards that goal, Vahdat did not rule out further layoffs at the company. “Every company does ‘optimisation’, we’re not going to do anything big,” he tells Sifted.

Huma’s also got one eye on the M&A market.

It has acquired three companies in the past two years — including digital clinical trials startup Alcedis and patient engagement platform iPlato, and one further unannounced company.

The tricky funding environment has “created opportunities” for startups like Huma that do have existing investors with deep pockets, Vahdat says.

“If the funding world had been better, maybe we would have had to pay more or it would have been harder [to make those acquisitions],” he tells Sifted. “If we come across [a business] with a use case or in a geography that makes sense, we’ll look at it.”