Businesses have gone truly global, and so have the people behind it. But as more and more companies launch entities overseas, they face a huge challenge: how can they quickly and legally pay workers in different locations?

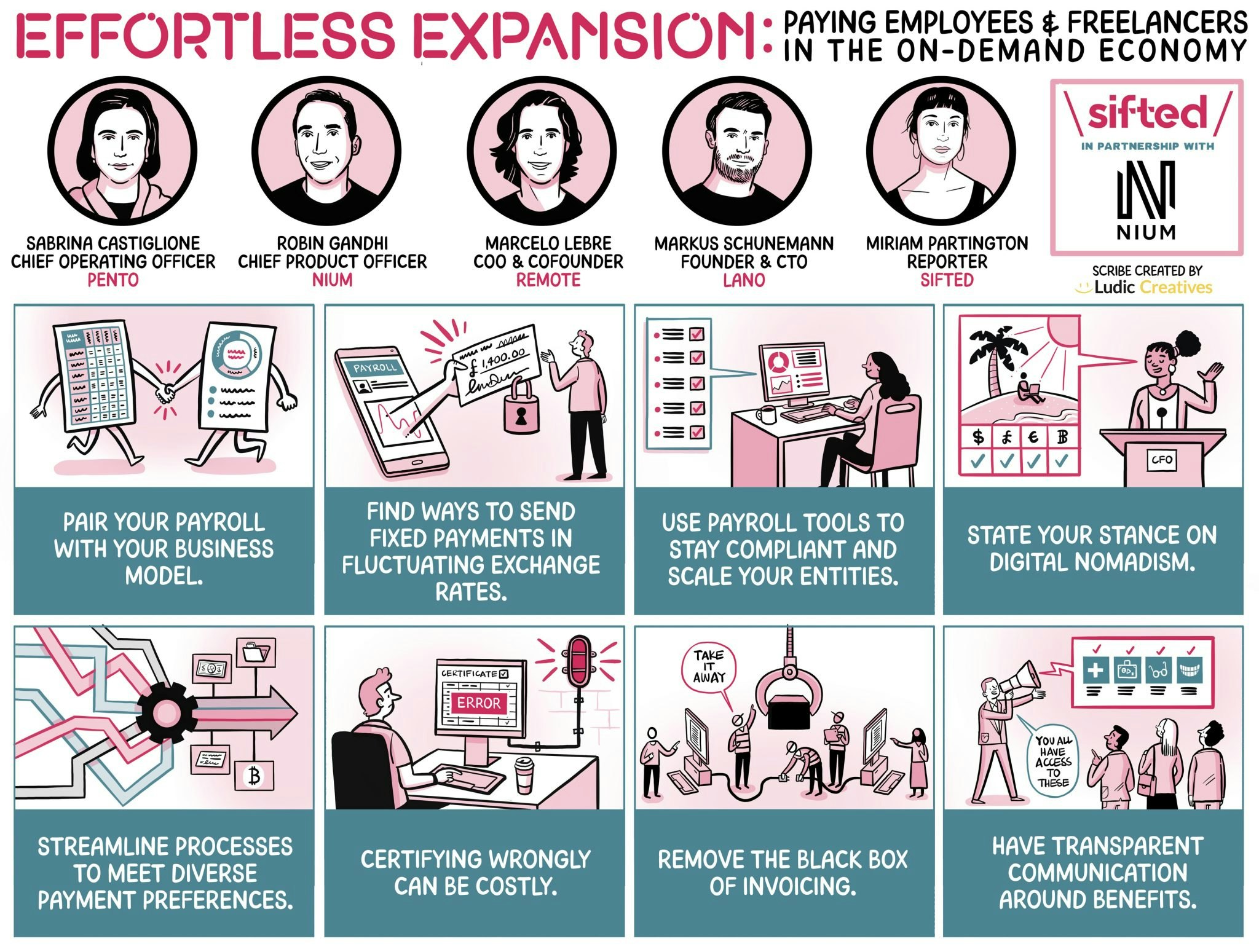

In the latest session of Sifted Talks, we asked the experts how to successfully navigate payroll in the on-demand economy, where consumers are digitally connected to products and services.

Our panel included:

- Robin Gandhi, chief product officer of payments platform Nium

- Sabrina Castiglione, chief operating officer at automated payroll solution Pento

- Markus Schünemann, founder of onboarding and payments platform Lano

- Marcelo Lebre, cofounder of Remote, an employment platform that covers global payroll, and compliance for remote teams

These were the key takeaways:

1/ Pair your payroll with your business model

Up until recently, there’s been a perception that payroll is similar everywhere and just a payment you do at the end of the month. But Lebre said that’s not true: “Payroll is not just a number at the back of an envelope.”

He added that every country has a different set of rules for payroll — and that employers have a responsibility to know and respect those rules.

Schünemann said that payroll encompasses how companies employ people and pay them. He warned against assuming that adjacent countries share labour laws — what a freelance contract is, or what salary requirements are, can vary hugely between neighbouring nations.

For Castiglione, these nuances should be factored into the type of experience startups want to give employees when it comes to payroll. She recommended thinking about whether the business operates with a fully distributed (where a majority, or all employees, are distributed across different locations) or hub model (where a business has a main “hub” that it operates from), and how legislation in the targeted locations aligns with that structure.

For example, establishing an entity to conduct payroll could make sense for hub models that want to invest in local expertise. But remote models may take a more agnostic approach to the geography they’re in and prefer to eliminate payroll administration where possible.

“International payroll depends on the country, the employment type and how you ship funds through your entity” — Markus Schünemann, Lano

2/ Find ways to send fixed payments in fluctuating exchange rates

Currency is a hurdle for expanding startups — especially with volatile exchange rates and inflation. But companies can’t afford to pay remote employees incorrectly, Lebre said. “Even one cent wrong is a trigger for employees to think the whole process is wrong. It’s a breach of trust.”

Gandhi added that companies have to know foreign exchange rates before putting money into accounting systems, as it’s up to them to ensure that employees get the entire amount they’ve been promised.

Schünemann advised creating contracts in dollars and providing remote workers with a digital wallet so they can decide for themselves when, and if, they want to convert that money into the local currency.

“You can take payment at a certain date with a locked foreign exchange rate... when money is going out you know exactly how much and how much underlying customers need to put into the system so there’s no discrepancy” — Robin Gandhi, Nium

3/ Use payroll tools to stay compliant and scale your entities

With many countries setting their own parameters for payroll, startups should initially aim to maintain compliance across all their areas of operation with the lowest possible overhead (ongoing business expenses not directly linked to creating a product or service), Castiglione explained.

She said that once businesses reached a certain critical mass, they could start taking more control of specific entities and how they interacted with the relevant tax and labour authorities. At this stage, startups don’t just have to deal with the risk of mitigating compliance, they can take advantage of tax schemes in countries too.

Along the way, startups should leverage modern tools that facilitate both compliance and scaling. While not having an entity in a place or not knowing how to onboard someone abroad used to prevent startups from hiring and paying remote teams, nowadays these resources open doors to international talent and cover compliance.

“The world has changed in terms of how we think about workers, and that’s why we’ve seen such a massive uptick with companies that are helping others get into markets they previously couldn't” — Gandhi

4/ State your stance on digital nomadism

Digital nomads now make up a significant chunk of the workforce, but according to Castiglione regulation has not caught up with them yet. That’s why companies need to set clear expectations with this group of employees. “Be upfront with contractors,” she suggested.

Lebre emphasised that employers can’t assume employees understand their payslips in different countries, especially as digital nomads who move around regularly. “In many countries, there’s a vast majority of people working remotely who may be looking at a payslip there for the first time. They may ask, is this legal?”

Companies therefore have to provide a breakdown of payments, taxes and other included costs for freelancers, and explain how they pertain to the location.

“If you have remote people and support digital nomads, be open about limitations — for example, if you restrict travel to 60 or 90 days per year. On top of that, specify what the obligation is for the employee to communicate their travel to the employer” — Sabrina Castiglione, Pento

5/ Streamline processes to meet diverse payment preferences

“The way we want to pay people, and the way people want to be paid, is intrinsically different” Gandhi highlighted. Employees may want biweekly or monthly payments, they may want money credited into a bank account or a digital wallet, they may want cryptocurrency or they may want stocks. Whatever the needs are, companies must be transparent about how they can accommodate the demands and deliver payments. The two most important factors are that the payment is timely and that the complete amount agreed upon is paid.

Gandhi also offered insight around payment speed: “Where payments tend to get stuck is at the end when companies are doing a sanctions check. But you can verify people before you send the payment” so that there are no bottlenecks once the work has already been submitted and employees are waiting for the payment.

Lebre says that meeting more complex demands like payment in cryptocurrency requires relying on strong partners on the ground in different locations.

The remote revolution has forced organisations to digitise what has traditionally been an analogue payroll journey. And while companies have to stay on top of legal compliance and employee expectations, they are also positioned to influence these spaces down the line. The startups that use savvy tools for payroll and fine-tune their communication around payroll will be the ones to eventually construct a more equitable, efficient on-demand economy.

“There’s no magic sauce, but [providing preferred payments] is possible” — Marcelo Lebre, Remote

Like this and want more? Watch the full Sifted Talks here: