More and more companies are realising that investing in environmental, social and governance (ESG) initiatives matter. From investor relationships to employee retention, these initiatives and policies can have a huge impact on the overall health of your business.

Last year at Back Market, a marketplace for refurbished technology, we translated and delivered our first non-financial performance declaration to investors outside of France. It focused on our environmental impact, the wellbeing of our team and how we're supporting the wider community. It was also audited just as our financial reports are.

Now, for the first time, we’re about to start integrating non-financial performance data into our monthly financial investor reports. We've had to adopt new approaches and scrutinise detail with a new level of granularity, discovering some key principles for this style of reporting. Here’s what we’ve learnt, and the lessons you can take into your own startup.

Get clear on why ESG matters to your business

One of the key reasons greenwashing exists is because, traditionally, many businesses haven’t grasped the value of investing in sustainability initiatives or changing fundamental business practices to become more sustainable. Instead, they’ve opted for deceptive marketing techniques. With new European legislation, and more scrutiny from investors, this tactic won’t wash for much longer.

The key to reporting on ESG metrics is to clearly understand and show how sustainability initiatives impact your business overall. That ensures these reports are authentic, are given the same weight as financial KPIs and help you achieve buy-in from different stakeholders.

To get a clear view on why ESG matters to your business, it’s vital to ask employees: "What impact do you want us as a company to have?" Opening this line of questioning will reveal the stark number of employees who are motivated by purpose, not just profit. It will also allow your startup to become intentional about ESG, aligning objectives to the desires of employees.

Fundamentally, it’s in the interest of every business to report on financial and non-financial data in tandem, and start understanding how they’re interconnected. In the majority of cases reducing environmental impact can also drive financial efficiencies. For instance, if manufacturers use water recycling systems, they’ll use and pay for less water. This principle is especially true in the tech space. If you aren’t storing your data effectively, for example, your carbon footprint increases as more electricity is being used to power servers and you’re being charged for the additional electricity.

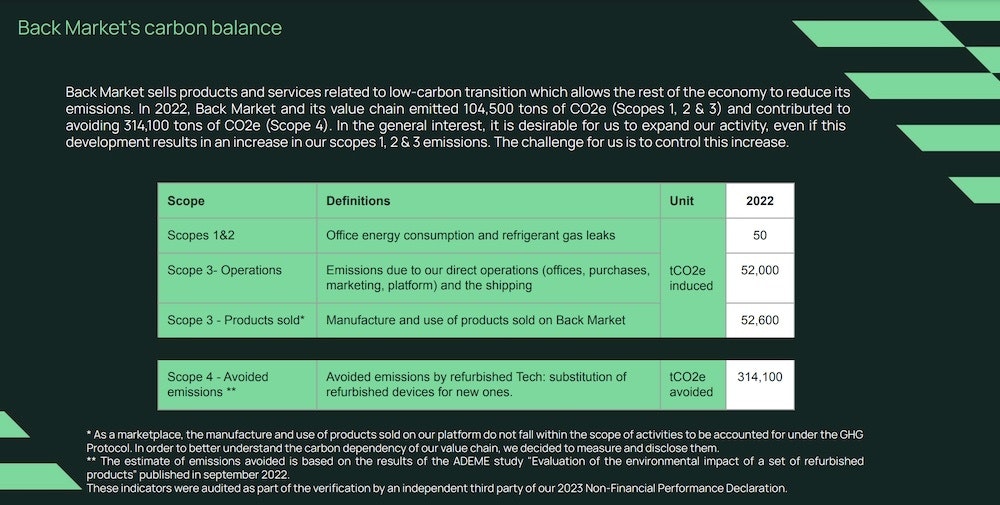

As an example, here’s how we’ve reported on our carbon emissions:

Don’t forget about the S and G

Measuring the success of environmental initiatives is key. But looking at environmental, social and governance policies holistically, and giving them equal weight, unlocks insight into the overall health of your business.

When we started thinking about these reports, the first question we asked was: what's our responsibility as a business to the society we live in? From here, we then settled on three main areas of responsibility:

- Our planet

- Our team

- Our wider community.

Then, it was about setting measurable, realistic and relevant KPIs — just as financial KPIs are set. One of the key mistakes companies make when devising ESG policies is using vague KPIs, which can’t be measured or don’t reflect the operationality of the day-to-day business.

Here’s a few of the metrics we’re currently measuring:

- CO2 emissions per item sold (emissions due to direct operations, eg. offices, purchases, marketing, platform and shipping) — measuring the culmination of different environmental policies.

- Staff satisfaction rate — asking employees to rate their satisfaction on a scale of one to ten, helping us to understand if perks, progression opportunities, pay and requirements of the role align with the expectations of our employees.

- Percentage of managers identifying as a woman — looking at this data provides us with key insight into the success of hiring policies and progression plans aimed at improving equality of opportunity.

- Churn rate of partners — this indicates if our partners are engaged and satisfied with our offering to them.

- Number of critical security risks — showing how our governance policies are protecting our data, staff and the overall business.

Use ESG KPIs to prevent weak signals turning into red flags

ESG KPIs illuminate the factors influencing financial performance. Through monitoring ESG initiatives, it becomes easier to identify signals that could impact your company’s finances.

If there’s been a drop in staff satisfaction, for example, rather than risk staff leaving, businesses can start having conversations about improving working conditions. The same applies to the churn rate of partners. If you notice partners are churning, it opens up the opportunity to address your partner offerings before it becomes an issue.

Once measuring and reporting in this way starts, it also enables you to understand how your business can differentiate itself among competitors. It highlights areas where you excel, and the areas that might require improvement. Then, it becomes a question of putting new practices and policies in place that prevent these weak signals from escalating.

Measuring and reporting on ESG initiatives in the right way can have a transformational effect on your startup. It doesn’t just unlock visibility into the overall health of a business, it enables you to start having a real impact on communities, employees and the planet.